How Much Is Car Insurance for a 17-Year-Old?

The average cost of car insurance for a 17-year-old is $737 per month.

17-year-old drivers can save on car insurance by removing coverage you don't need, comparing quotes from multiple companies and looking for discounts for safe driving and good grades.

Find Cheap Auto Insurance Quotes in Your Area

How much does car insurance for 17-year-olds cost?

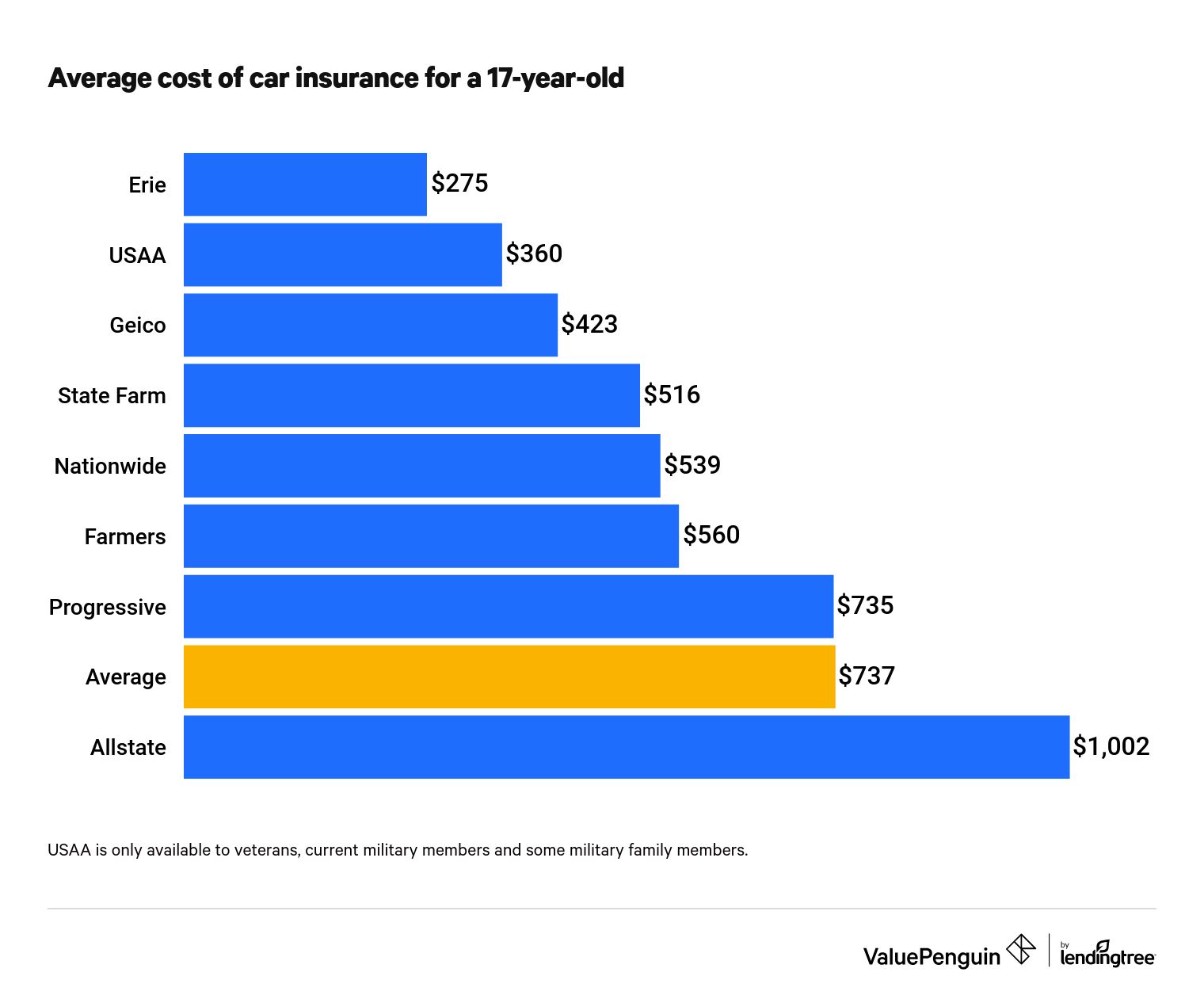

The average cost of car insurance for a 17-year-old is $737 per month. However, the cost of insuring a 17-year-old varies widely based on the insurer.

At a monthly rate of $423, Geico is the cheapest car insurance company for 17-year-olds that is widely available nationwide.

Erie, which is available in 13 states, offers the cheapest insurance quotes for 17-year-olds, at a monthly rate of $275.

USAA offers the second-cheapest rate, $360 per month. However, USAA is only available to current and former members of the military and their families.

Find the Cheapest Companies for 17-Year-Olds in Each State

Find Cheap Auto Insurance Quotes in Your Area

Average cost of car insurance for a 17-year-old

Insurer | Monthly cost | |

|---|---|---|

| Erie | $275 | |

| USAA | $360 | |

| Geico | $423 | |

| State Farm | $516 | |

| Nationwide | $539 | |

| Farmers | $560 | |

| Progressive | $735 | |

| Allstate | $1,002 | |

| Average | $737 |

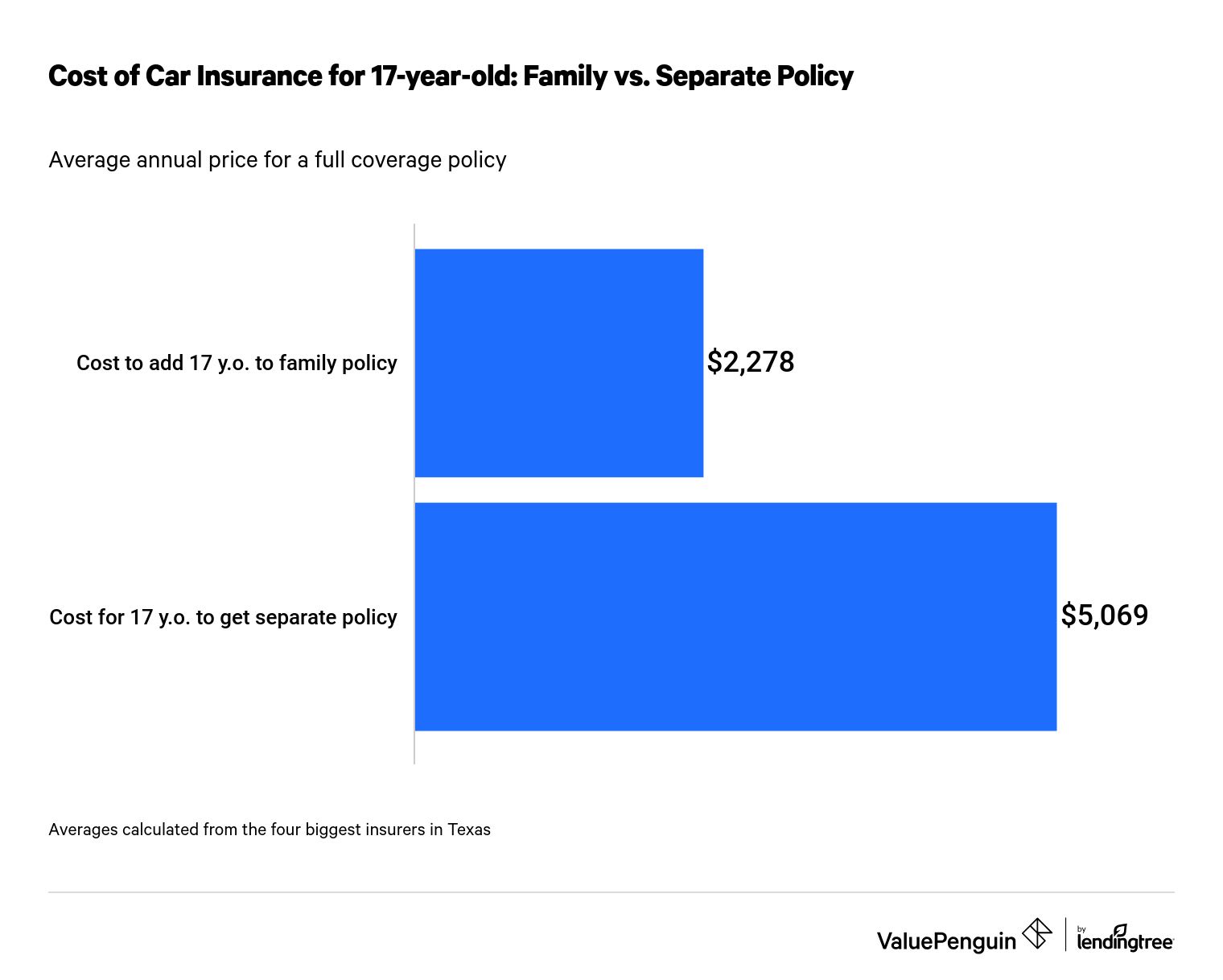

Car insurance for teens on a family policy

Adding a 17-year-old driver to a parent's car insurance plan can be 55% cheaper than getting a separate policy.

Cost of car insurance for 17-year-olds compared to other ages

The cost to insure a 17-year-old is an average $458 more expensive per month than the cost to insure a 25-year-old. A 17-year-old can expect their monthly insurance rate to decrease by $121 when they turn 18.

Why is car insurance so expensive for 17-year-olds?

Young drivers are expensive to insure because they are statistically more likely to get into car accidents and represent a greater risk for insurance companies. This may seem unfair, but 17-year-old drivers might find some solace in the fact that older, inexperienced drivers also pay higher auto insurance rates.

As drivers gain experience, they become less likely to get into accidents and see lower rates, as long as they avoid traffic accidents and tickets..

How do rates differ between 17-year-old male and female drivers?

The average cost of car insurance for 17-year-old male drivers is 9% more expensive than the average for female drivers. This is due to the fact that young male drivers tend to get into more accidents compared to young female drivers. Male drivers who are 16 and 18 years old also pay more for car insurance than their female counterparts.

Age | Monthly cost - male driver | Monthly cost - female driver |

|---|---|---|

| 16 | $845 | $782 |

| 17 | $768 | $705 |

| 18 | $647 | $586 |

How to save on auto insurance for 17-year-olds

The best way to save on auto insurance for 17-year-olds is to add them to their parents' policies, rather than getting their own car insurance. You can also find lower rates by shopping around for quotes, exploring discounts and getting less coverage.

Shop around

Insurance costs vary greatly by location. The best way to ensure you get the lowest rates is by gathering quotes from several auto insurance providers in your area. For 17-year-olds, the cost varies by as much as $8,724 per year between insurers for the same full-coverage policy. The more insurers you get quotes from, the more likely you are to get the lowest possible rate.

Find discounts for 17-year-old drivers

Most insurers offer discounts that mitigate the high cost of auto insurance for young drivers. Some insurers, such as Progressive, even offer a discount just for having a young driver — under 18 years old — on a policy. Here are some common discounts for teen drivers:

- Good student discount: Most insurers require young drivers to have at least a 3.0 GPA — or "B" average — to qualify for this discount. The amount saved varies across auto insurance companies, with some, such as State Farm, offering discounts up to 25%. Student drivers might also qualify for such a discount by placing in the upper 20% of their class, or on the dean's list or honor roll.

- Driver's education discount: A driver's education training course is one of the easiest ways to lower rates for 17-year-old drivers. Often, you get a discount upon completion of a state-approved driver's education class, though some insurers offer their own driver-education or defensive-driver courses. Discounts typically range from 5% to 15%, depending on the insurance company.

- Distant student discount: Parents whose children attend school far away and leave their cars at home can get discounts from some insurers. These discounts can be especially valuable for parents with kids in college or at boarding school. To qualify, the student typically has to be under 23 years old and attend school at least 100 miles away.

Drop comprehensive and collision coverages for cheaper cars

If you're insuring a cheaper vehicle, you can save by not getting collision and comprehensive coverages. We typically recommend dropping full coverage for vehicles that are worth less than a few thousand dollars.

Cheaper or older vehicles may not qualify for many vehicle equipment discounts, such as discounts for air bags, anti-lock brakes and anti-theft alarms. However, the amount you can save with these discounts is usually less than the savings from skipping comprehensive and collision coverages.

How to get car insurance for a 17-year-old

If you're a parent adding a 17-year-old driver to your policy, getting them covered is usually as simple as contacting your insurer or updating your policy online. This is the cheapest option for insuring these drivers, but it may still come with a major rate increase.

Can a 17-year-old get their own car insurance?

Most states allow 17-year-olds to own and insure their own vehicles. However, states often require a parent to sign a certificate of consent or otherwise grant permission before a minor can register a vehicle. Some insurers won't offer insurance to a 17-year-old without a parent’s signature.

After getting permission, the 17-year-old should learn to collect and compare quotes when they're getting an auto insurance policy. To start comparing car insurance costs in your area, use our quote tool above.

How to get insurance with a learner's permit

Teens with learner's permits are sometimes covered by their parent’s policy, and aren't required to be added as a driver. This may vary by insurer, so the best way to be sure is to contact your insurance company and let them know that a teen with a learner's permit will be driving a car covered by your policy.

If your insurer says that your policy already extends to provisional drivers, you're unlikely to see insurance rates go up.

Methodology

Our analysis gathered car insurance rates from thousands of ZIP codes across nine of the most populated states in the U.S. Our two sample drivers were a 17-year-old male and a 17-year-old female who drove a 2015 Honda Civic EX. Both drivers had clean driving records.

The full-coverage policies that we used had the following limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection (PIP) | Minimum, when required by state |

Our analysis covered 29 insurance companies, but rates from insurers were only included in our list of average prices and recommendations if their policies were available in at least three of the nine states.

ValuePenguin's analysis used data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your quotes may vary from the averages listed in this study.