Average Car Insurance Costs for 22-Year-Olds

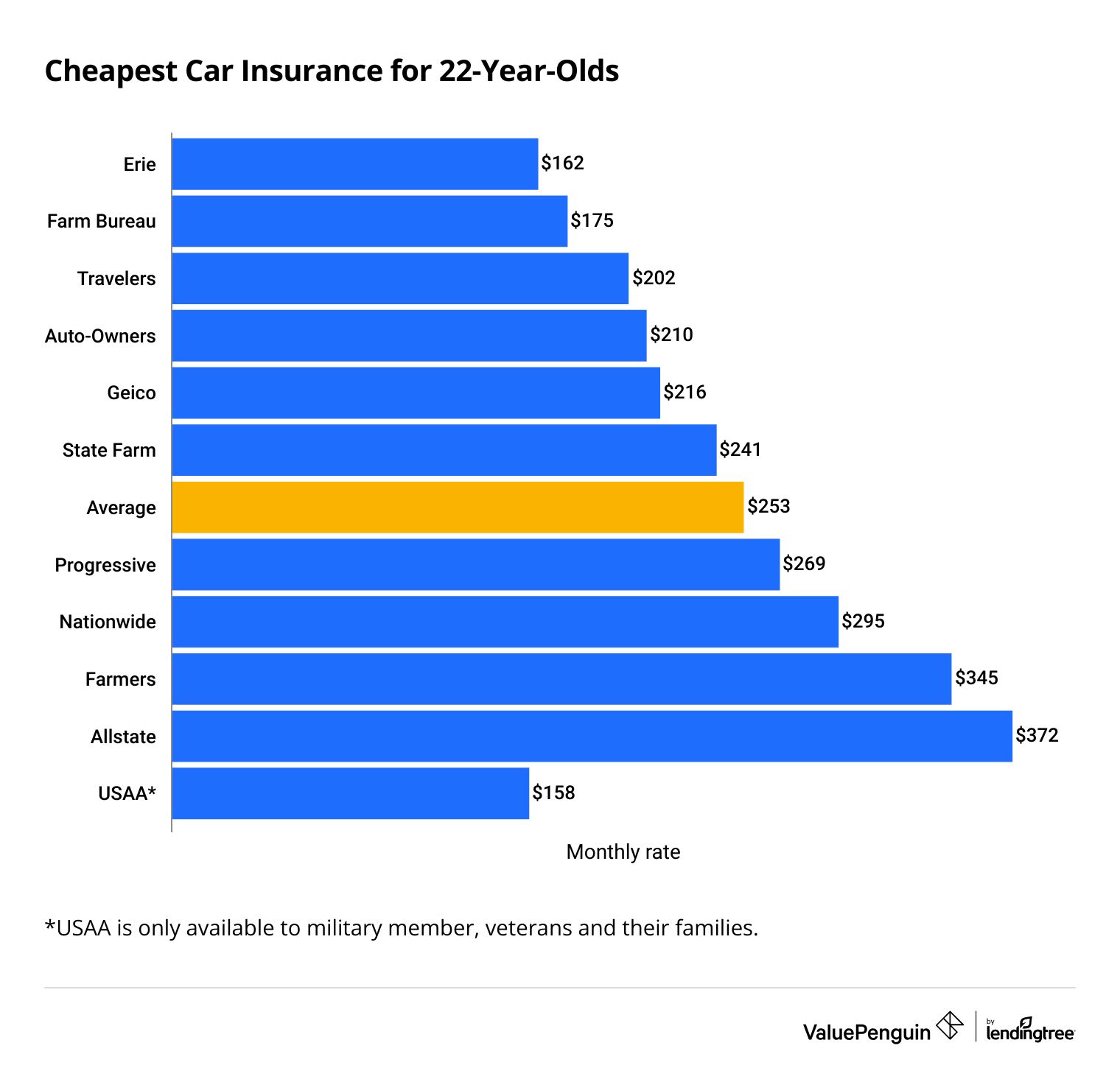

Car insurance costs an average of $253 per month for a 22-year-old.

Find Cheap 22-Year-Old Auto Insurance Quotes

Erie, Farm Bureau, Travelers and USAA have the best cheap car insurance for 22-year-old drivers. Erie offers the cheapest car insurance rates for 22-year-old drivers, with an average of $162 per month for full coverage.

How much is car insurance for a 22-year-old?

The average cost of car insurance for 22-year-olds is $253 per month for full coverage.

Erie has the cheapest rate for a 22-year-old. A full coverage policy from Erie costs $162 per month. However, the company only sells insurance in 12 states and Washington, D.C.

The second-cheapest rates are from Farm Bureau, another regional insurance company.

With a rate of $202 per month, Travelers is the cheapest major car insurance company for 22-year-olds.

Find Cheap 22-Year-Old Auto Insurance Quotes

USAA has the absolute lowest rates for 22-year-old drivers, with an average of $158 per month for a full coverage policy. However, only current and former military members and their families can buy a USAA policy.

Cheap car insurance for 22-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $162 | ||

| Farm Bureau | $175 | ||

| Travelers | $202 | ||

| Auto-Owners | $210 | ||

| Geico | $216 | ||

*USAA is only available to current and former military members and their families.

There can be major differences in the cost of insurance for 22-year-olds from one company to the next.

Full coverage from the most expensive company, Allstate, costs more than twice as much as a policy from Erie. That's why young drivers should always shop around to find the cheapest car insurance quotes.

Car insurance for 22-year-old males vs. females

The average car insurance cost for a 22-year-old male is $261 per month for full coverage. A 22-year-old woman pays around $245 per month for the same coverage.

Car insurance is typically more expensive for young men because they tend to get in more accidents.

Monthly car insurance quotes by gender

Company | Man | Woman |

|---|---|---|

| Erie | $170 | $153 |

| Farm Bureau | $187 | $162 |

| Travelers | $209 | $195 |

| Auto-Owners | $217 | $204 |

| Geico | $224 | $208 |

Several states don't allow insurance companies to use gender to determine car insurance rates. These states include:

- California

- Hawaii

- Massachusetts

- Michigan

- Montana

- North Carolina

- Pennsylvania

Men and women pay the same car insurance rates in these areas.

Average cost of car insurance by age

The average cost of full coverage car insurance for a 22-year-old is $253 per month.

However, just a few years of age difference can have a big impact on rates. As a 22-year-old driver, you will see your rates drop by around 6% when you turn 23. And you'll pay 29% less for car insurance by the time you turn 25 years old.

Insurance companies consider drivers under 25 more risky, so rates are typically expensive for this age group. Their lack of experience behind the wheel makes them more likely to cause an accident.

Cost of car insurance for 22-year-olds by state

The average cost of car insurance varies by up to $256 per month, depending on where you live.

For example, the cheapest car insurance for 22-year-olds in North Carolina comes from Erie. Its full coverage policy costs $78 per month. However, State Farm offers the most affordable coverage in Florida, at $219 per month. That's a difference of $141 per month.

Monthly car insurance rates for 22-year-olds by state

State | State average | Cheapest rate | |

|---|---|---|---|

| California | $210 | Geico | $133 |

| Florida | $392 | State Farm | $219 |

| Georgia | $258 | Farm Bureau | $188 |

| Illinois | $231 | Country Financial | $128 |

| Michigan | $294 | Geico | $127 |

USAA was excluded because its policies are only available for current or former military members and their families.

Find the cheapest insurers for young drivers in your state

How to shop for cheap car insurance as a 22-year-old

There are four main ways for 22-year-olds to find cheap car insurance.

Sharing a car insurance policy with your parents is usually the cheapest option if you're a 22-year-old.

A family policy may be more expensive for your parents, but the total cost tends to be much cheaper than buying two different policies. You can stay on your parent's auto insurance if you live in the same house or go to school full-time.

Comparing quotes from multiple companies is important when shopping for the cheapest rates.

Insurance companies use many variables to determine car insurance rates, like your age, driving record, claims history, where you live and the type of car you drive. That's why the cheapest insurance company for you may differ from the cheapest one for your family members or friends.

Car insurance companies typically offer lots of discounts that 22-year-old drivers qualify for to lower their rates. Common car insurance discounts for 22-year-old drivers include:

- Good student discount if you have a B average or better

- Defensive driving course for completing driver training

- Safe driver discount for avoiding accidents and tickets

- Online purchase discount for buying your policy online

- Automatic payment discount for having payments automatically sent from your bank account

- Paperless discount for receiving statements and bills via email

The type and amount of a discount you get can vary across companies and locations, which is another reason to shop around for multiple quotes.

As a 22-year-old, you can save money by adjusting your car insurance coverage. When you're comparing quotes, make sure that you're only paying for the coverage options you actually need.

For example, it may not make sense to pay extra for comprehensive and collision coverage if you drive a car that's more than 10 years old or worth less than $5,000.

You can also consider raising your deductible. A higher deductible typically means lower car insurance rates because the insurance company will pay you less if you're in an accident. However, make sure you choose a deductible you can afford if you're in a crash.

Frequently asked questions

How much is car insurance for a 22-year-old in California?

The average cost of car insurance for a 22-year-old in California is $210 per month for a full coverage policy. But 22-year-olds can find cheaper rates from Geico, where a policy costs around $133.

How much is insurance for a 22-year-old in Texas?

A 22-year-old driver in Texas can expect to pay around $315 per month for full coverage insurance. Farm Bureau has the cheapest rates for 22-year-olds in Texas, with an average of $153 per month.

Why is my insurance so high at 22?

Car insurance can be expensive for 22-year-olds because they lack experience behind the wheel. Insurance companies believe this leads to more accidents, which makes young drivers more expensive to insure. However, 22-year-old drivers can find cheap rates by comparing quotes from multiple insurance companies.

What is the best car insurance for 22-year-olds?

Regional companies like Erie and Farm Bureau have the best car insurance for 22-year-olds. These companies have affordable rates and reliable customer service if you're in an accident.

If these companies aren't available in your area, you should consider Geico. Geico's rates for 22-year-olds are cheaper than average, and you can easily get a quote and manage your policy online.

Methodology

To find the average cost of car insurance for 22-year-old drivers, ValuePenguin collected car insurance quotes from 13 top insurance companies across 10 of the most populated states in the U.S. Rates are for 22-year-old men and women who own a 2015 Honda Civic EX. Drivers have a clean driving record and a good credit score.

Quotes are for a full coverage policy with comprehensive and collision coverage and higher liability limits than required in each state.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): Minimum when required by state

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

ValuePenguin only included rates from companies if quotes were available in at least four of the 10 states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. The rates were publicly sourced from insurer filings and are for comparative purposes only. Your quotes may be different from the averages we calculated.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.