Cost of Car Insurance for 23-Year-Olds

Find Cheap 23-Year-Old Auto Insurance Quotes

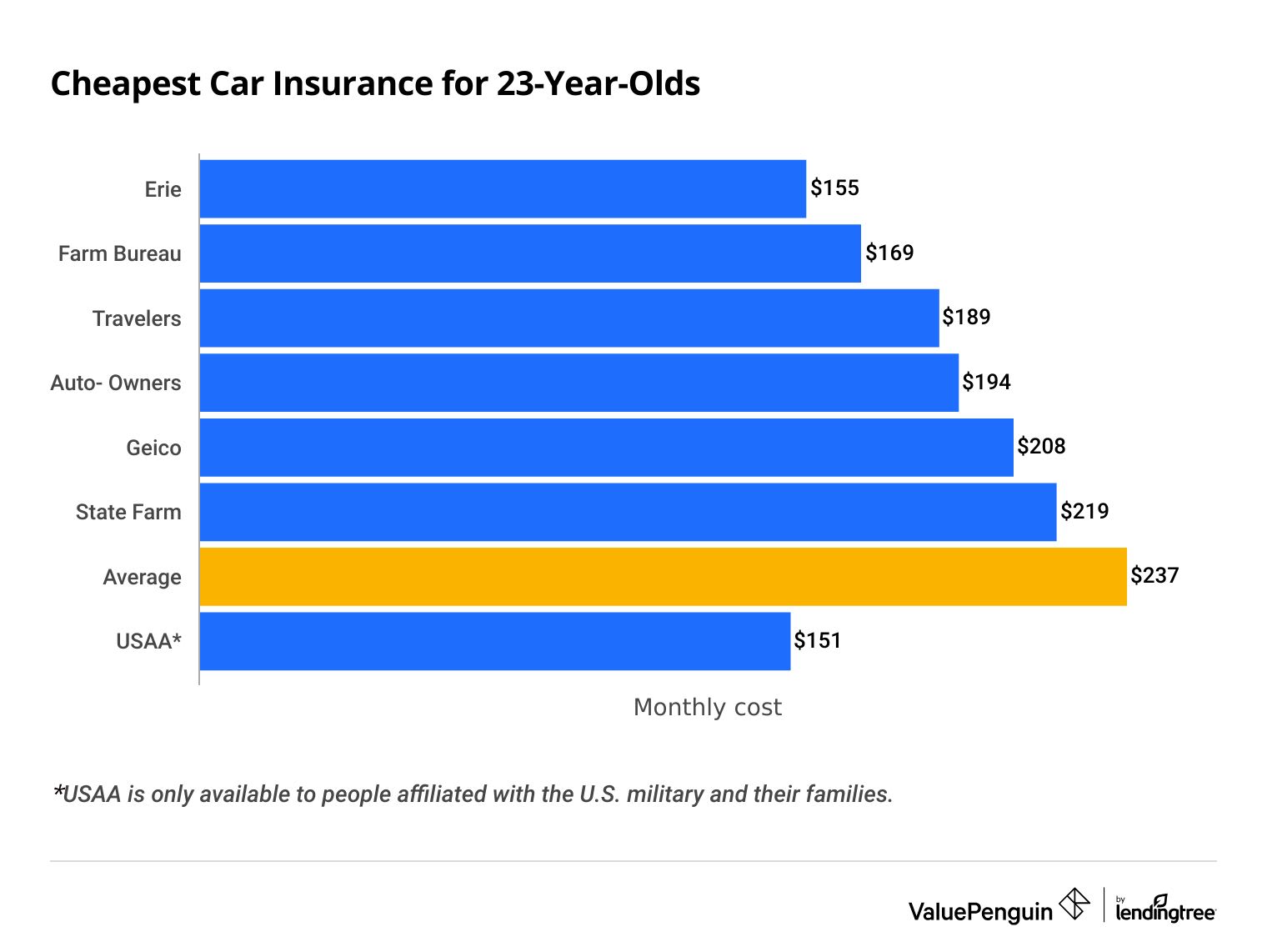

The average cost of car insurance for a 23-year-old is $237 per month for a full coverage policy.

For 23-year-olds looking for cheap car insurance, we recommend Farm Bureau, Erie and Travelers.

We collected thousands of rates across 10 of the most populated states in the country to find you the cheapest car insurance for 23-year-olds. This analysis explores how the average cost of car insurance varies for 23-year-olds by insurer, age, gender and state.

How much does car insurance cost for 23-year-olds?

The average cost of car insurance for a 23-year-old is $237 per month for full coverage.

Erie has the cheapest full coverage car insurance for 23-year-olds, at $155 per month.

Erie offers rates that are 17% cheaper than an average insurer. Geico is the cheapest car insurance company for 23-year-olds that is available nationwide, at $208 per month.

Find Cheap 23-Year-Old Auto Insurance Quotes

The widespread difference in rates from insurance companies highlights why young drivers should always compare car insurance quotes from multiple insurers before deciding on a policy.

Cheapest auto insurance for 23-year-olds

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $155 | ||

| Farm Bureau | $169 | ||

| Travelers | $189 | ||

| Auto-Owners | $194 | ||

| Geico | $208 | ||

*USAA is only available to military members, veterans and their family members.

The average cost of car insurance for 23-year-olds by state

Auto insurance costs vary substantially from state to state. For 23-year-olds, coverage is cheapest in North Carolina, where a typical driver can find full coverage for $136 per month. Florida has the most expensive car insurance policies for 23-year-olds in our sample, with an average monthly cost of $363.

Average car insurance rates for 23-year-old drivers by state

State | Monthly rate |

|---|---|

| California | $201 |

| Texas | $290 |

| New York | $250 |

| Florida | $363 |

| Illinois | $200 |

States are ordered in population rank.

How the cost of car insurance for 23-year-olds varies by gender

On average, car insurance costs $244 per month for a 23-year-old man and $230 per month for a 23-year-old woman — 6% less. Male drivers usually pay more for car insurance than female drivers, especially at younger ages. This is because young male drivers statistically get in more accidents compared to young female drivers.

Monthly cost of full coverage insurance by gender

Age | Female | Male |

|---|---|---|

| 21 | $263 | $285 |

| 22 | $245 | $261 |

| 23 | $230 | $244 |

| 24 | $218 | $228 |

| 25 | $197 | $202 |

While the average cost of car insurance tends to be cheaper for women compared to men, some states have banned insurers from using gender to determine rates.

California, Hawaii, Massachusetts, Montana, North Carolina and Pennsylvania, as well as parts of Michigan, prohibit this practice. As a result, male and female drivers of any age should pay the same amount for auto insurance in these locations, all else being equal.

Average cost of auto insurance by age

Drivers under 25 face expensive car insurance rates because of their tendency to get into more accidents than older drivers.

Even among younger drivers, rates can vary significantly. A 23-year-old will pay on average $244 less per month than an 18-year-old. On the other hand, a 23-year-old will pay on average $38 more per month than a 25-year-old.

Average car insurance rates by age

How to find the best cheap car insurance for a 23-year-old

Shopping around for quotes from several insurance companies is a great strategy to find cheap car insurance at any age. Additionally, auto insurance discounts commonly available to 23-year-olds and other young drivers include savings for being a good student, passing a defensive driving course and maintaining a clean driving record.

Every insurer offers its own set of discounts, so it's always a good idea to compare quotes from multiple insurers to see which one will give you the best rate.

Frequently asked questions

Who has the best car insurance for a 23-year-old?

Farm Bureau, Erie and Travelers have the best cheap car insurance for 23-year-old drivers. They have the most affordable rates, along with well-regarded customer service.

Does car insurance go down at 23?

Yes, a typical 23-year-old will see their rates go down by about 6% compared to a 22-year-old. Car insurance rates tend to decrease as drivers go through their mid-20s and stabilize by the time they turn 30.

How much is car insurance for a 23-year-old man?

For full coverage car insurance, 23-year-old men pay about $244 per month. That's $14 more per month than women of the same age pay.

Methodology

To find the cost of car insurance for 23-year-olds, ValuePenguin collected quotes from thousands of ZIP codes across 10 of the most populous states in the U.S. Quotes are for 23-year-old men and women with clean driving records and good credit scores who own a 2015 Honda Civic EX.

Full coverage rates include higher liability limits than the state requirements, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): Minimum, when required by state

- Medical payments: $5,000

- Comprehensive and collision: $500 deductible

This analysis included 13 insurance companies. Insurance companies were only added to the list of average prices if their policies were available in at least four of the 10 states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. The rates used to calculate the averages were sourced publicly from insurer filings. These averages should only be used for comparative purposes — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.