Car Insurance Costs for 25-Year-Old Drivers

Find Cheap Auto Insurance Quotes for 25-Year-Olds

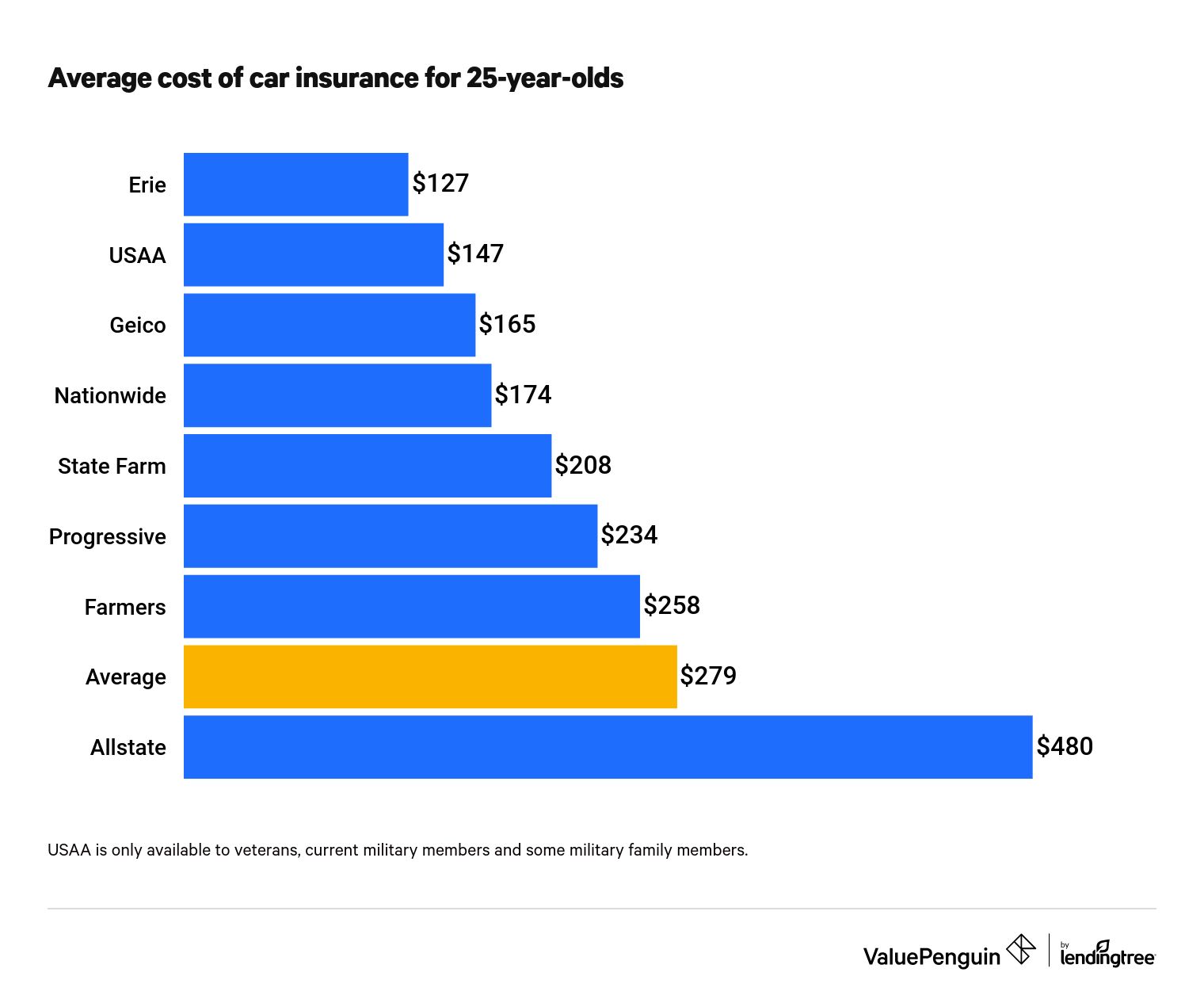

Erie offers the cheapest car insurance for 25-year-olds, but rates vary based on factors such as driving history, location and sex. Geico, Nationwide and USAA offer rates that are cheaper than average, based on this analysis of quotes for 25-year-old drivers across the country. To get the best rate, compare car insurance quotes from multiple companies.

Which companies offer 25-year-olds the cheapest car insurance?

The average cost of car insurance for 25-year-olds is $279 per month, or $3,348 per year.

Erie offers the cheapest rates for 25-year olds, at an average of $127 per month. The second cheapest is USAA, with an average rate of $147 per month.

Find Cheap Auto Insurance Quotes for 30-Year-Olds

While Erie is the cheapest option, it's only available in 13 states. And USAA is only for current or former military members and their families. Among companies with widespread availability, Geico has the most affordable rates for 25-year-olds, at an average of $165 per month.

Cheapest car insurance companies for 25-year-old drivers

Company | Monthly cost | |

|---|---|---|

| Erie | $127 | |

| USAA | $147 | |

| Geico | $165 | |

| Nationwide | $174 | |

| Progressive | $208 | |

| State Farm | $234 | |

| Farmers | $258 | |

| Allstate | $480 |

Always shop around for quotes from multiple companies, as you never know which could offer you the best rate. One could be the cheapest if you want bare-minimum coverage, while another could be the most affordable for full coverage.

How do insurance costs for 25-year-old men and women differ?

The difference in the average cost of car insurance for 25-year-old men and women was only 3%.

For younger drivers, there is a noticeable difference in the cost of car insurance between men and women, with men paying more. However, at age 25 that gap begins to narrow.

Age | Monthly rate — man | Monthly rate — woman | Difference |

|---|---|---|---|

| 23 | $344 | $326 | 6% |

| 24 | $321 | $306 | 5% |

| 25 | $283 | $275 | 3% |

Young men pay more for car insurance because they statistically get into more accidents than women.

In certain states, all things being equal, 25-year-old male and female drivers should pay the same for insurance. These states have fully or partially banned taking sex into account when setting rates:

- California

- Hawaii

- Massachusetts

- Parts of Michigan

- Montana

- North Carolina

- Pennsylvania

How much is car insurance for a 25-year-old?

The average cost of car insurance for a 25-year-old is approximately $279 per month. This is $337 less per month than an average 18-year-old pays.

Young drivers pay far more for car insurance than older drivers. However, as they gain experience, their rates begin to drop.

Average monthly cost of car insurance by age

Do car insurance rates go down at age 25?

Yes, the average cost of car insurance went down by 11% — from $314 per month to $279 — when the driver profile for this analysis turned 25. Younger drivers will see similar or even larger drops in costs each year between ages 18 and 25.

Young drivers should also note that insurance companies determine rates based on driving experience, not just age. Car insurance for a new 25-year-old driver will likely cost more than car insurance for a 25-year-old with nine years of driving experience.

Best car insurance companies for 25-year-olds by state

Geico is the cheapest option in four of nine sample states.

Although these quotes represent an average — and may not indicate the best company for you — recommendations for the cheapest insurance companies in nine sample states are compiled here.

Cheapest auto insurance companies for 25-year-old drivers by state

State | Company | Average monthly rate |

|---|---|---|

| California | Geico | $133 |

| Florida | Geico | $148 |

| Georgia | Georgia Farm Bureau | $126 |

| Illinois | State Farm | $107 |

| Michigan | Progressive | $171 |

| New York | Progressive | $205 |

| North Carolina | Geico | $86 |

| Ohio | Geico | $105 |

| Texas | Fred Loya Insurance | $119 |

USAA was not included in these recommendations, as its only available to current or former military members and their families.

With an average monthly rate of $134 — less than half the overall average — North Carolina is the cheapest state for 25-year-olds.

Michigan, on the other hand, is extremely expensive for 25-year-olds (and most ages), compared with other states. Its rates are approximately three times the overall average.

Insurance is regulated at the state level, and car insurance prices vary from state to state. Below are the average costs of car insurance for 25-year-olds in nine of the most populous states.

Average car insurance rates by state for 25-year-olds

State | Average monthly rate |

|---|---|

| North Carolina | $134 |

| Ohio | $146 |

| California | $172 |

| Illinois | $203 |

| Texas | $228 |

| Georgia | $231 |

|

New York | $254 |

| Florida | $301 |

| Michigan | $819 |

| Average | $279 |

How to find cheap car insurance when you turn 25

The keys to getting cheaper car insurance as a 25-year-old include:

Shopping multiple insurance companies to get similar coverage at a lower price

As the data shows, the exact same driver profile can get a variety of rates for equivalent coverage. The savings could even be thousands of dollars. For example, there is a difference of $2,017 per month between the cheapest and most expensive insurance companies in Michigan, as the table below shows.

Company | Average monthly rate |

|---|---|

| Progressive | $171 |

| USAA | $210 |

| Auto-Owners Insurance Company | $322 |

| Frankenmuth Insurance | $337 |

| State Farm | $444 |

| AAA | $1,093 |

| Allstate | $1,784 |

| Citizens | $2,188 |

The easiest way to start your search is to shop for quotes online. When browsing, make sure you select the same coverage limits and features for each company so you know you're getting prices for comparable policies.

You can also use this car insurance estimator to get an idea of how much yours will cost.

Checking with companies to see what discounts are available

Twenty-five-year-olds have likely aged out of ways younger people can save, such as remaining on a parent's policy or getting a good student discount, but companies still offer plenty of ways to lower rates.

Always check if an insurance company offers discounts for:

- Defensive-driving classes: Companies may reward you for taking a safe- or defensive-driving course.

- Bundling: If you're also buying renters or homeowners insurance, you could bundle the two policies to save.

- Safety features: If your car has antilock brakes or anti-theft devices, you may qualify for savings.

- Full payment: You're often able to get some minor savings if you pay your policy in full up front or opt for paperless billing.

Not buying unnecessary coverage

Buy as much coverage as necessary to ensure financial protection, but not all elements of auto insurance are appropriate for every person. For example:

- Get appropriate liability coverage: Liability coverage protects you against the costs of property damage or bodily injury in a crash for which you are at fault. Make sure you have liability limits that cover your total net worth. If higher limits beyond your worth are an unreasonable expense, stick to what you can afford.

- Only buy comprehensive and collision coverage if your vehicle is worth it: Comprehensive and collision insurance can be invaluable if you have a high-value car. But if your car is worth a few thousand dollars or less, you could be paying too much to protect an asset with little value.

Methodology

Auto insurance quotes were gathered for thousands of ZIP codes across nine of the most populous states in the country. The quotes were for 25-year-old male and female drivers with a clean driving record who drive a 2015 Honda Civic EX.

Full-coverage rates had the following limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person and $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured and underinsured motorist bodily injury | $50,000 per person and $100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection (PIP) | Minimum required by state |

This analysis collected rates from 29 insurance companies, but companies were only added to the list of average prices and recommendations if their policies were available in at least three of the nine states.

Insurance rate data from Quadrant Information Services was used to calculate the average cost of insurance for a 25-year-old. These rates were publicly sourced from insurance company filings and should only be used for comparative purposes.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.