State Farm Insurance Review: Auto, Home and Renters

State Farm is a good insurance company with cheap rates and reliable customer service.

Find Cheap Auto Insurance Quotes in Your Area

Is State Farm a good insurance company?

State Farm is a good insurance company if you're looking for low rates and dependable customer service.

It sells many insurance products at affordable rates, including auto, home, renters, condo and life insurance.

State Farm has a large network of local agents which may be able to provide better customer service than someone in a call center. It also has a highly-rated mobile app, so it's a good choice if you prefer to manage your insurance policies online.

Editor's rating | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value |

State Farm pros and cons

Pros

Affordable rates

Good customer service

Offers many different types of insurance

Lots of local agents if you value personalized service

Cons

Extra coverage options

While you can get a quote online, you may have to buy your policy over the phone

State Farm car insurance review

State Farm has some of the cheapest car insurance quotes in the country.

It also offers helpful auto insurance discounts and practical coverage add-ons.

State Farm auto insurance quotes

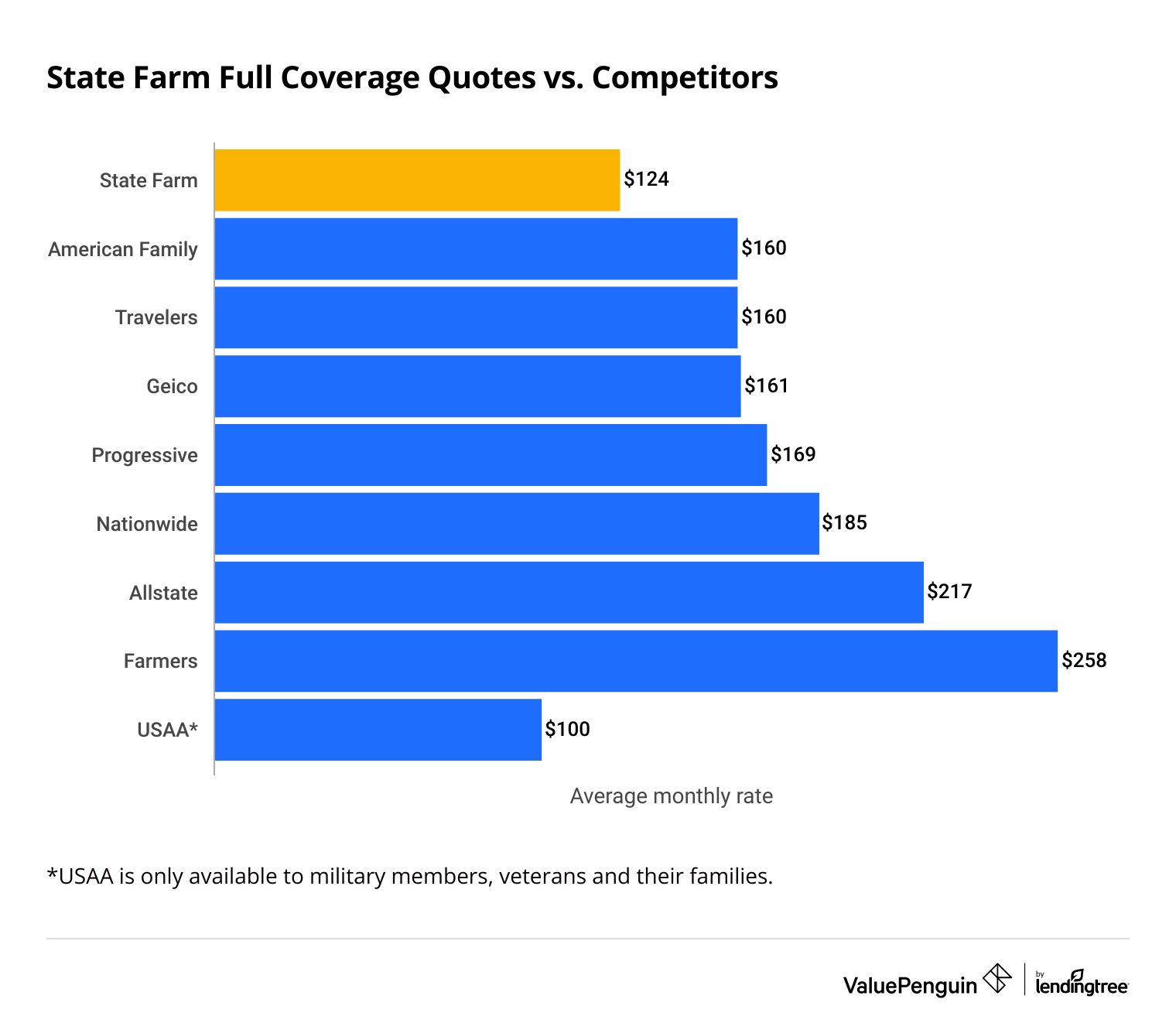

Car insurance quotes from State Farm are 37% cheaper than other major car insurance companies, on average.

Full coverage insurance from State Farm costs an average of $124 per month. That's $36 per month less expensive than the second cheapest major company, American Family.

Find Cheap Auto Insurance Quotes in Your Area

State Farm also has the cheapest minimum coverage rates for drivers who don't need comprehensive and collision coverage. State Farm insurance quotes for a liability-only policy average $50 per month. That's $11 per month less than the next-cheapest option, American Family.

State Farm auto quotes vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

*USAA is only available to military members, veterans and their families.

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

*USAA is only available to military members, veterans and their families.

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $50 | ||

| American Family | $61 | ||

| Geico | $61 | ||

| Progressive | $66 | ||

| Travelers | $70 | ||

*USAA is only available to military members, veterans and their families.

State Farm also has excellent rates for young drivers and those with a bad driving record.

Rates for teens

$344/mo

$485/mo

Rates after a ticket

$135/mo

$202/mo

Rates after an accident

$154/mo

$244/mo

State Farm auto insurance discounts

State Farm has similar car insurance discounts to most other major companies, including two discounts for safe drivers that offer major benefits.

Have your car insured with State Farm for at least three years without causing a crash.

Drivers under the age of 21 may complete an approved driver's education course

Have a vehicle built before 1993 that has air bags or other passive restraint equipment

Go three years or more without an at-fault accident or ticket

Have a student driver on your policy who lives away from home and only uses the car when they're visiting home

Get home, renters, condo or life insurance from State Farm along with your auto policy

Install an anti-theft device in your car, like LoJack

Have a student on your policy with a GPA of 3.0 or higher

Have a car built before 1994

Insure multiple cars with State Farm

Take a driver safety course

Steer Clear driver program

State Farm offers a discount to drivers under 25 years old who complete its Steer Clear program.

Steer Clear is a driver education program that includes course training, practice driving and mentorship. Your State Farm agent can help you navigate the program, which is available online or on your mobile app.

Steer Clear is available in all states except California, Hawaii, Massachusetts, North Carolina and Rhode Island.

Drive Safe & Save

State Farm customers can earn a discount for practicing safe driving habits with the Drive Safe & Save program.

Drive Safe & Save uses a mobile app to track your driving habits, like speeding and sharp turns. State Farm uses this info to determine how much you can save, which could be up to 30%.

State Farm car insurance coverages

State Farm offers standard car insurance coverage along with a few other valuable policy add-ons.

Roadside assistance

State Farm roadside assistance pays for towing, delivery of gas or oil, a new battery or a tire change if your car breaks down on the side of the road. It also covers the cost of a locksmith if you get locked out of your car.

Rideshare insurance

Rideshare driver insurance provides coverage while you drive for a rideshare app.

If you drive for Uber or Lyft, you need to buy a separate rideshare insurance policy. Your rideshare company typically offers liability coverage while you have a passenger or delivery in your car. However, it doesn't usually cover damage to your vehicle. It also doesn't offer liability coverage when you are available for hire but haven't picked up a customer.

State Farm's coverage helps bridge the gap so you have protection at all times. Adding rideshare coverage to your insurance policy typically raises your rates by 15% to 20%.

Rental car coverage

Rental car reimbursement and travel expenses coverage pays for a rental car while your car is in the shop after an accident.

It also covers certain expenses if your car breaks down while traveling. State Farm pays up to $500 for a hotel, transportation and meals if your car breaks down while you're away from home.

To use travel expenses coverage, your car has to be undrivable and covered by comprehensive or collision insurance.

Classic car coverage

State Farm partners with Hagerty to offer State Farm Classic+.

Classic car coverage typically insures your car based on a value that you and the insurance company agree on in advance. This is usually called agreed value insurance.

State Farm considers a car classic if it's between 10 and 24 years old and has a historical interest, like a hot rod or muscle car.

State Farm auto insurance reviews and ratings

State Farm has a reputation for great customer service.

It gets 25% fewer complaints than an average insurance company its size, according to the National Association of Insurance Commissioners (NAIC).

State Farm also earned an excellent score on J.D. Power's auto insurance claims satisfaction survey.

You can typically count on State Farm to get you back on the road quickly after an accident.

In addition, State Farm has the highest possible financial strength rating from AM Best — A++ or Superior. That means State Farm should be able to pay claims even during difficult economic times.

How to file a car insurance claim with State Farm

There are multiple ways to file an auto insurance claim with State Farm. You can file a claim on the company's website, via its app or by phone.

The online claims process should take about 10 minutes to complete, after which you can easily keep track of your claim.

If you prefer to file a claim over the phone, call your agent during business hours. You can call State Farm customer service if you're in an accident outside regular business hours.

- State Farm auto claims phone number: 800-732-5246

- Auto glass claims: 888-624-4410

- Emergency roadside assistance: 877-627-5757

State Farm home insurance review

State Farm has affordable home insurance rates, especially if you don't need a lot of coverage.

However, it only offers a few discounts and extra protections for your home.

California home insurance from State Farm

State Farm has stopped offering home insurance in California as of May 2023.

State Farm home insurance quotes

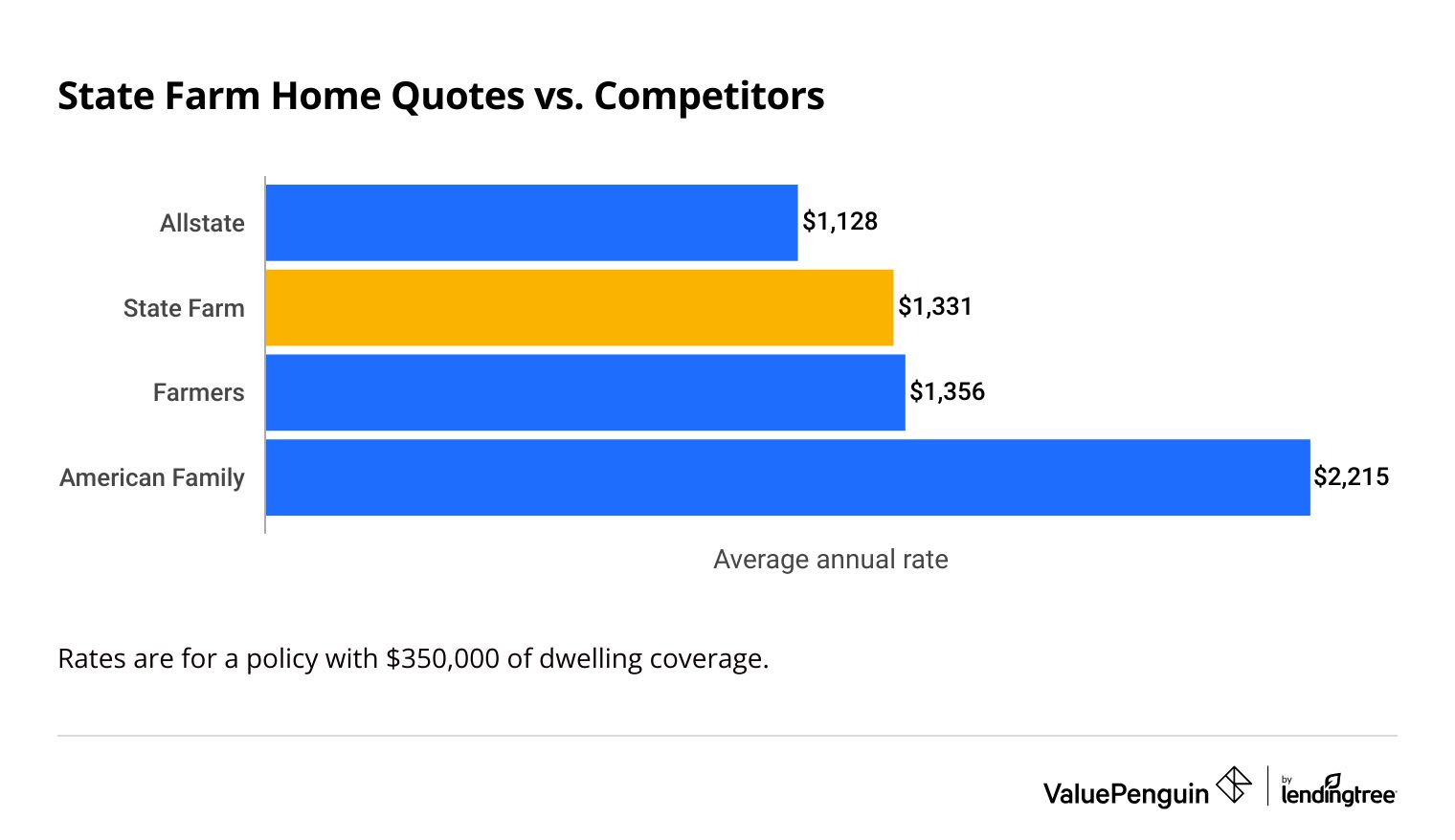

State Farm's homeowners insurance quotes are very affordable, but it's not always the cheapest option. On average, State Farm house insurance costs 16% less than other major companies.

People with inexpensive homes will find the best rates at State Farm. Homeowners insurance from State Farm costs around $800 per year for a policy with $150,000 of dwelling coverage. That's $43 per year less than the second cheapest company, Allstate.

Find Cheap Homeowners Insurance Quotes in Your Area

However, there are cheaper options than State Farm for people with more expensive homes. People who need $350,000 or more of dwelling coverage may find better rates with Allstate.

Home insurance quotes by dwelling coverage amount

$150,000

$350,000

$550,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $800 | ||

| Allstate | $843 | ||

| Farmers | $879 | ||

| American Family | $1,307 | ||

$150,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $800 | ||

| Allstate | $843 | ||

| Farmers | $879 | ||

| American Family | $1,307 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,128 | ||

| State Farm | $1,331 | ||

| Farmers | $1,356 | ||

| American Family | $2,215 | ||

$550,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,547 | ||

| State Farm | $1,982 | ||

| Farmers | $2,106 | ||

| American Family | $3,218 | ||

State Farm home insurance coverage

State Farm offers typical homeowners insurance coverages. It also offers a few ways to upgrade your policy with coverage add-ons.

State Farm Home Systems Protection pays to repair or replace home equipment damaged by an accidental mechanical or electrical breakdown. This can include things like your AC unit or fridge.

If someone steals your identity, State Farm assigns you a case manager to work with your bank, creditors and credit bureaus.

In addition, this coverage helps pay for:

- Data recovery after a cyber attack

- Identity restoration after theft

- Professional help and reimbursement if you're a victim of cyber extortion

Service line coverage pays to repair or replace exterior underground water and sewer piping, electrical service lines and data lines that you own if they fail or break.

Water backup coverage pays for water damage due to a sewer, drain or sump pump backup.

In addition, a policy from State Farm includes standard home insurance coverage. This includes protection for the structure of your home and belongings. It also includes personal liability and medical payments coverage if a guest is hurt in your home or you damage someone else's property.

State Farm also offers customers access to its Premier Service Program.

This optional service connects you with contractors who can fix or replace your roof and floor, offer water removal services, and more.

The Premier Service Program can be beneficial because it guarantees repairs up to five years after a covered loss. However, it's not yet available in all locations.

State Farm home insurance discounts

State Farm offers a few common ways to save on homeowners insurance costs.

- Home security discount

- Multipolicy bundling discount

- Damage-resistant roofing material discount

State Farm home and renters insurance ratings and reviews

Homeowners and renters are typically happy with the service they get from State Farm.

It gets 5% fewer complaints than other major insurance companies, according to the National Association of Insurance Commissioners (NAIC).

State Farm also earned an above-average score on J.D. Power's home insurance customer satisfaction survey. That means you can expect State Farm to provide a quick and easy claims process after an emergency.

State Farm has an A++, or Superior, financial rating from AM Best. This is the highest possible rating an insurance company can earn. A high financial strength rating means that State Farm should have no problem paying customer claims, even during a major disaster.

How to file a home or renters insurance claim with State Farm

You can file an insurance claim with State Farm in three ways:

- Over the phone

- On the company's website

- Via the State Farm app

If you have an emergency during regular business hours, the best way to file a claim is to call your local State Farm agent. If you need to file a claim after hours, call the State Farm home claims phone number at 800-732-5246.

State Farm renters insurance review

State Farm has low renters insurance rates and enough coverage for most renters.However, it may not offer enough protection if you have valuable items, like expensive jewelry, sports equipment or firearms.

State Farm renters insurance quotes

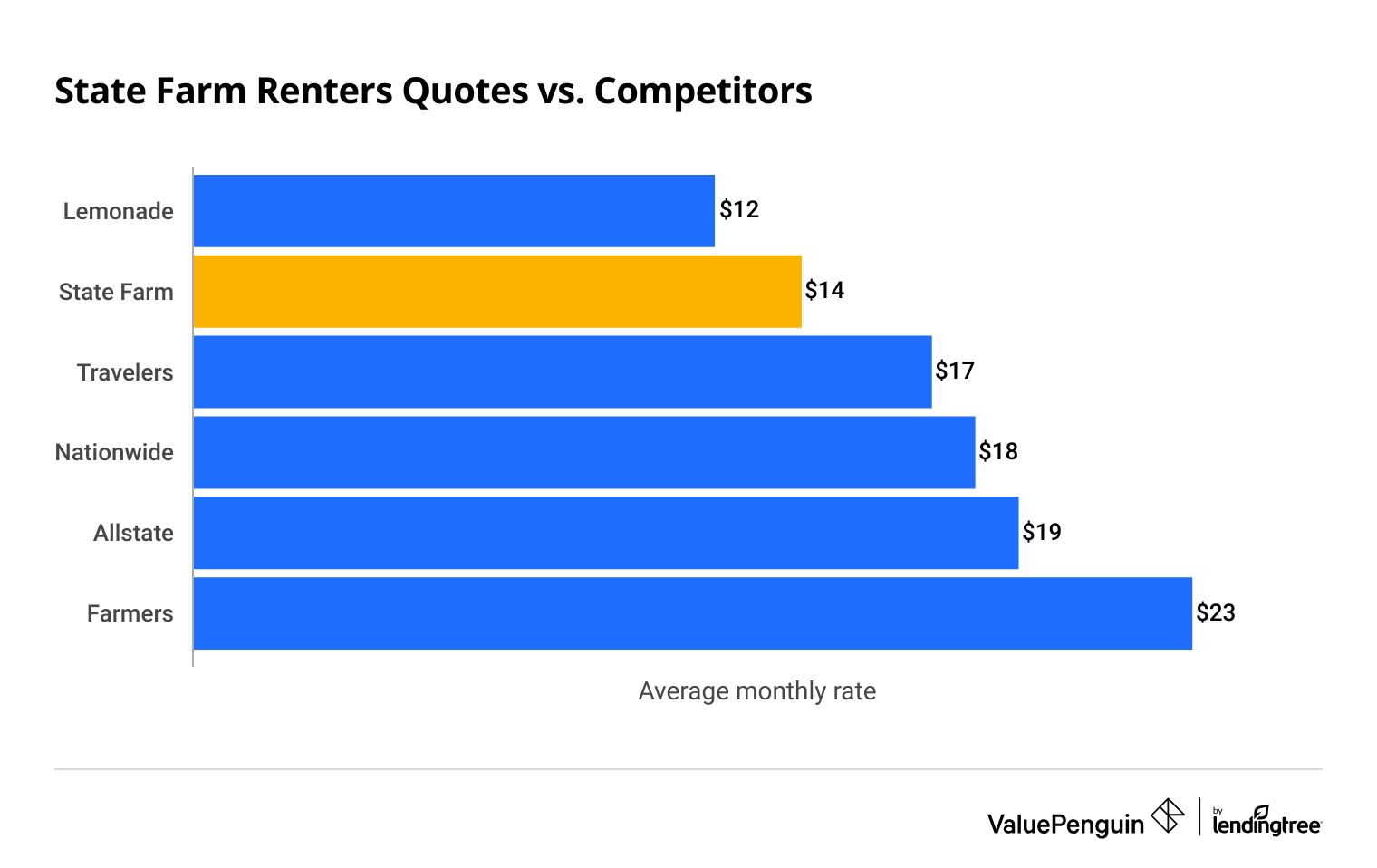

State Farm has very affordable renters insurance rates. The average cost of a renters insurance policy from State Farm is $14 per month. That's $3 per month less than the national average.

Find Cheap Renters Insurance Quotes in Your Area

However, State Farm typically isn't the absolute cheapest option. Most renters can find cheaper rates with Lemonade. But it may be worth spending a little more for a policy with State Farm due to its proven customer service track record.

Average monthly renters insurance rates

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $14 | ||

| Travelers | $17 | ||

| Nationwide | $18 | ||

| Allstate | $19 | ||

| Farmers | $23 | ||

State Farm renters insurance coverage

State Farm renters insurance only provides a few extra options to customize your policy: identity theft protection and earthquake coverage. It also comes with the standard coverage you would expect from renters insurance.

Identity restoration coverage protects you after identity theft or cyber extortion.

For $25 per year, State Farm offers case management and expense reimbursement after someone steals your personal info. You'll also get credit monitoring to reduce the chances of someone stealing your identity.

If someone steals your identity, State Farm will assign you a case manager to work with your credit card company, bank and credit bureaus to help restore it.

State Farm will reimburse you up to $25,000 to recover your identity and settle any lawsuits. State Farm will also pay up to $15,000 if you're a victim of ransomware.

Earthquake coverage pays to repair or replace any belongings damaged by earth movement. For example, earthquake coverage will pay to replace your TV if tremors cause it to fall off the wall and break.

Frequently asked questions

How much is State Farm car insurance?

The average cost of State Farm vehicle insurance is $124 per month for full coverage. That's 24% cheaper than the national average. Minimum coverage from State Farm costs around $50 per month, which is 22% less than the national average.

Is State Farm insurance good?

State Farm is a good insurance company. The company has cheap auto, home and renters insurance rates.

It also has a reputation for dependable customer service and financial stability. That's important if you must use your insurance and file a claim.

What is the AM Best rating for State Farm Insurance Co.?

State Farm has an A++, or Superior, financial strength rating from AM Best. That's the highest rating an insurance company can get. This means State Farm should be able to pay out customer claims easily, even after a serious emergency.

What is full coverage at State Farm?

Full coverage auto insurance at State Farm includes collision and comprehensive coverage. These coverages help pay for damage to your car after an accident. It also has the minimum liability coverage required by your state.

Full coverage insurance often has higher liability limits than your state requires, along with uninsured and underinsured motorist coverage.

Methodology

To compare the cost of State Farm's auto, homeowners and renters insurance, ValuePenguin used sample profiles based on typical customers.

Auto insurance methodology

To find the average cost of State Farm car insurance, ValuePenguin compiled quotes from all 50 states across the U.S. Rates are for a 30-year-old single man with a clean driving record and good credit score who owns a 2015 Honda Civic EX.

Full coverage quotes include higher liability limits than required in each state, along with collision and comprehensive coverage.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Comprehensive deductible: $500

- Collision deductible: $500

Home insurance methodology

ValuePenguin collected quotes for $150,000, $350,000 and $550,000 of dwelling coverage to find the average cost of State Farm homeowners insurance. Quotes are for a married man living in an Illinois house built in 1977. He has been claim-free for five years and has an average credit score.

Renters insurance methodology

ValuePenguin compiled quotes from the largest insurance companies in each state to find the average cost of State Farm renters insurance, where the data was available. Rates are for an unmarried 30-year-old man with no pets or roommates living in a multiunit building with the following limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Deductible: $500

Home and auto insurance quotes used insurance rate data from Quadrant Information Services. These rates are publicly sourced from insurance company filings; you should use them only for comparative purposes. Your quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.