10 Largest Auto Insurance Companies (April 2025)

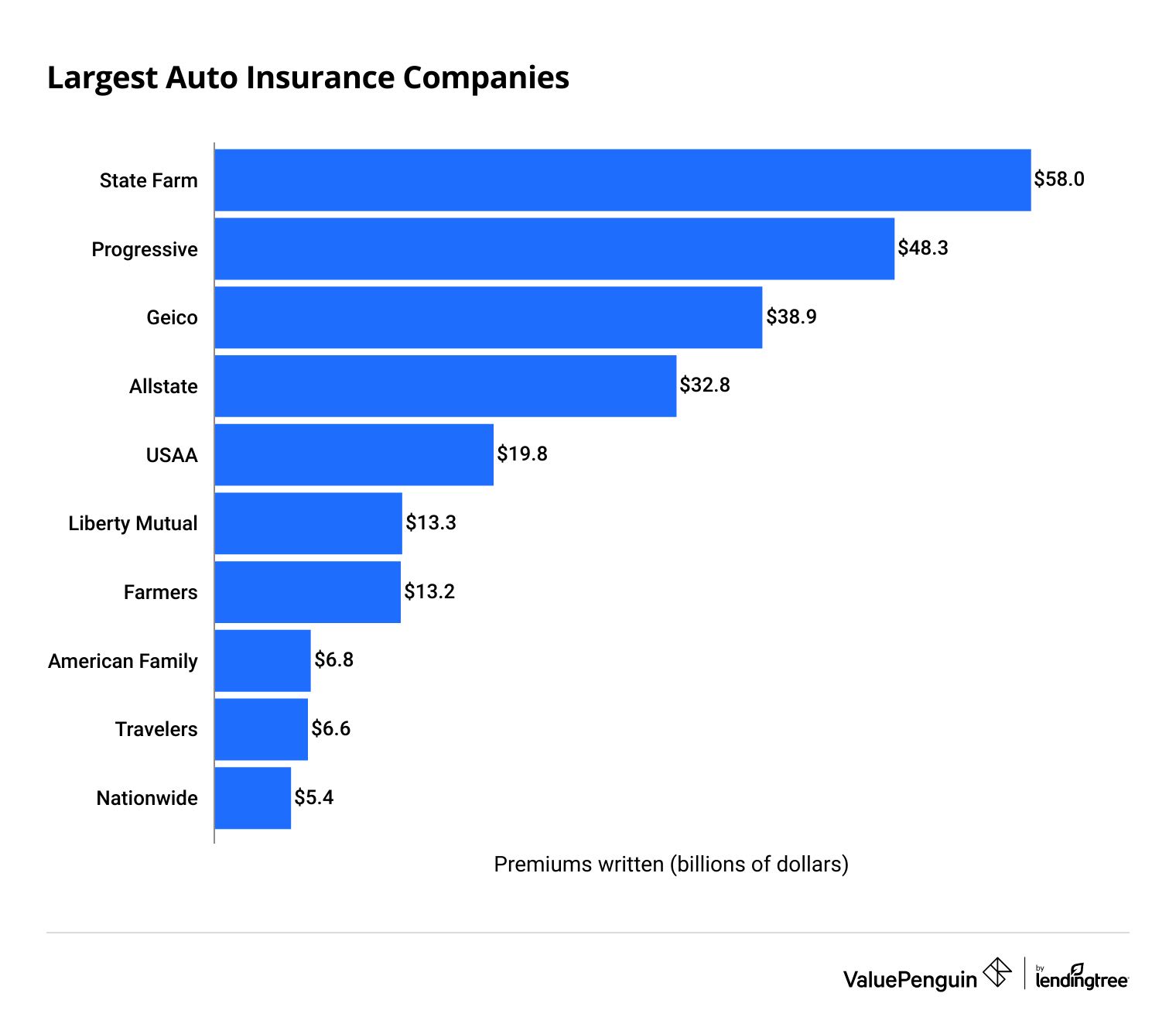

State Farm is the largest auto insurance company in the U.S., with 18% of the market.

Find Cheap Auto Insurance Quotes in Your Area

What are the largest auto insurance companies in the US?

State Farm is the biggest auto insurance company in the country by market share.

Progressive, Geico and Allstate are the next three largest. Most of the largest companies in the country are familiar because of national advertising campaigns.

Find Cheap Auto Insurance Quotes in Your Area

In recent years, State Farm has overtaken Progressive as the largest car insurance company. Even though both companies are popular, State Farm's cheap rates and good customer reviews have helped it grow.

Biggest car insurance companies by market share

Company | Market share | Premiums in billions |

|---|---|---|

| State Farm | 18.3% | $58.0 |

| Progressive | 15.3% | $48.3 |

| Geico | 12.3% | $38.9 |

| Allstate | 10.4% | $32.8 |

| USAA | 6.3% | $19.8 |

1. State Farm

State Farm is a great choice for anyone who wants a local agent, a personalized experience and cheap rates.

-

Editor's rating

- Market share 18% ?

- Monthly cost $134 ?

- J.D. Power Good ?

State Farm is the largest auto insurance company in the U.S. It earns about 18% of the money people spend on personal car insurance policies.

The company has about 58,000 employees and 19,000 agents. State Farm is a mutual insurance company, meaning that its customers own it.

Among the largest car insurance companies, State Farm offers the cheapest car insurance rates in most of the U.S.

2. Progressive

Progressive offers lots of discounts and coverage options. But its rates are just average and customers aren't happy with the claims process.

-

Editor's rating

- Market share 15% ?

- Monthly cost $173 ?

- J.D. Power Poor ?

Progressive is the second-largest car insurance company in the country and was established in 1937. You can buy its auto insurance in person, online, by phone or through independent insurance agents.

Progressive isn't typically the cheapest option for most people. However, its discounts can make it more affordable. Options like accident forgiveness can protect you from price increases.

The company has about 43,000 employees and has offices across the country. Progressive is a publicly traded company.

3. Geico

Geico is available in every state and it offers an easy shopping experience.

-

Editor's rating

- Market share 12% ?

- Monthly cost $176 ?

- J.D. Power Poor ?

Geico, known for its advertisements with an animated gecko, insures more than 30 million cars across 18 million policies. It also employs more than 40,000 people.

Geico started by insuring U.S. government employees and military members. Today, the company sells insurance to everyone.

Plus, Geico has the best car insurance for college students.

4. Allstate

Allstate insurance is expensive, and customers often aren't happy with its claims process. However, it's cheap for new drivers.

-

Editor's rating

- Market share 10% ?

- Monthly cost $247 ?

- J.D. Power Poor ?

Established in 1931, Allstate is one of the largest publicly traded property and casualty insurance companies in America. Like State Farm, Allstate has local agents who sell policies. The company currently employs about 46,000 people.

Allstate stands out for its many discounts and features like vanishing deductibles. But its home insurance tends to be a better deal than its car insurance.

5. USAA

USAA is one of the best companies in the country because of its cheap rates and great customer service. But only military members and their families can get a policy.

-

Editor's rating

- Market share 6% ?

- Monthly cost $110 ?

- J.D. Power Good ?

USAA was founded in San Antonio in 1922 by 25 army officers who decided to insure each other's vehicles. Today, the company provides insurance to millions of people with ties to the U.S. military.

You can get coverage from USAA if you have served in the U.S. armed forces. This includes current service members and veterans. Families of military members are also eligible if a spouse or parent had USAA insurance at some point.

USAA is our pick for the best and cheapest car insurance for veterans and military service members.

6. Liberty Mutual

Liberty Mutual's rates vary more than most other insurance companies. But customers are typically happy with its claims process.

-

Editor's rating

- Market share 4% ?

- Monthly cost N/A ?

- J.D. Power Good ?

Liberty Mutual is one of the largest insurance companies in the U.S. and has been around for more than 100 years. It also has a large international presence, with operations in 29 countries. The company sells other types of insurance, including property and casualty, health, and life insurance policies.

You can get Liberty Mutual auto insurance online, by phone or through a local Liberty Mutual agent or broker. Liberty Mutual also owns Safeco, a company with cheaper rates but worse customer service.

7. Farmers

Farmers has good discounts and coverage options, plus highly rated customer service. But it's typically expensive.

-

Editor's rating

- Market share 4% ?

- Monthly cost $289 ?

- J.D. Power Good ?

Farmers began as an insurance company providing coverage to farmers' vehicles. Since then, it has evolved to become the seventh-largest insurance company in the country.

It’s hard to find an insurance company that offers more products than Farmers. It offers auto insurance, pet insurance and even investment products, among other insurance products. Farmers employs nearly 21,000 people, underwriting more than 19 million policies across all 50 states.

8. American Family

American Family is a good choice for auto insurance. It has decent rates and lots of discounts to help lower your bill.

-

Editor's rating

- Market share 2% ?

- Monthly cost $168 ?

- J.D. Power Average ?

American Family was originally established to insure farmers' crops. In the 1930s, the company expanded and began offering insurance to nonfarmers. Today, it's one of the biggest insurance companies in the U.S. It's especially popular in Midwestern states like Wisconsin, Kansas and Minnesota.

American Family is known for its many discounts that can make it more affordable for customers. It's also the cheapest major company for drivers with poor credit. American Family sells insurance in 44 states, though some states are only eligible for Connect by American Family.

9. Travelers

Travelers has lots of coverage options and discounts. However, customers aren't happy with its claims process after an accident.

-

Editor's rating

- Market share 2% ?

- Monthly cost $151 ?

- J.D. Power Poor ?

Travelers is more than 160 years old, making it one of the oldest insurance companies operating today. In fact, Travelers issued its first auto insurance policy in 1897, before the invention of the Ford Model T.

The company has more than 30,000 employees and 13,500 independent agents and brokers in the United States, the United Kingdom, Canada and Ireland.

You may be able to get cheap rates on car insurance if you qualify for some of Travelers' many discounts. You could save for being a safe driver, owning an electric or hybrid car, paying on time and more.

10. Nationwide

Nationwide's car insurance rates aren't the cheapest. But it has great customer service and lots of discounts.

-

Editor's rating

- Market share 2% ?

- Monthly cost $200 ?

- J.D. Power Good ?

Nationwide sells insurance and financial products in all 50 states. But its auto insurance is not available in Alaska, Hawaii, Louisiana or Massachusetts.

Nationwide offers standard coverages and discounts you’d expect from a major insurance company. Plus, programs like SmartMiles and SmartRide give you discounts based on how you drive.

List of car insurance companies in the US

Large insurance companies may have names you recognize. But getting quotes from both large and small companies will tell you which companies have the best rates for you.

Company | Rating | Total premiums (billions) |

|---|---|---|

| NJM | $1.3 | |

| State Farm | $58.0 | |

| USAA | $19.8 | |

| Erie | $4.2 | |

| Farm Bureau | $5.8 |

- AIG

- American Integrity

- American National

- Andover Cos.

- AssuranceAmerica

- California Casualty

- Central Insurance Cos.

- Clear Blue Insurance

- Donegal

- Florida Peninsula

- Frontline (First Protective)

- Germania

- Grinnell Mutual

- HCI Group

- Home State

- Homeowners of America

- Horace Mann

- IAT

- Munich RE

- Mutual of Enumclaw

- North Star Mutual

- Ocean Harbor

- Old American

- Olympus

- Pekin Insurance

- Pemco

- Penn National

- QBE

- Redpoint

- Sentry

- Slide

- Spinnaker

- Sure

- Tokio Marine

- United Farm Family

- Universal Insurance Holdings

- Utica National

- Vermont Mutual

- West Bend Mutual

- Westfield

- WT Holdings

Largest car insurance companies by state

State Farm is the most popular insurance company nationwide, It's also the most popular company in 19 states.

Progressive is the largest insurance company in 21 states. This includes many New England states, some states in the Midwest, Florida and Texas. Geico has the largest market share in California, Arizona and some of the Mid-Atlantic states.

Popular auto insurance companies in each state

State | Largest insurance company |

|---|---|

| Alabama | State Farm |

| Alaska | State Farm |

| Arizona | Geico |

| Arkansas | State Farm |

| California | Geico |

Benefits of big vs. small insurance companies

You can find cheap rates at both big car insurance companies and smaller local ones.

Large companies often have more online and mobile options and are normally more stable financially. On the other hand, small companies often have a better customer experience, as they can have a more personal relationship with their customers.

Pros and cons of big companies

-

Typically have more coverage options and discounts

-

Usually offer 24/7 claims and customer service

-

More likely to easily pay out claims after a large scale disaster

-

Better online and mobile experience

-

Less personal touch and interaction

-

Often won't have the absolute lowest rates

-

Slower to address complaints

Pros and cons of small companies

-

More personalized experience

-

Will likely work closely with an agent

-

May be cheaper than major companies

-

Sometimes won't have 24/7 service

-

Often more vulnerable to regional disasters

-

May have fewer coverage options and discounts

How to find the right insurance company for you

There are many large auto insurance companies out there, so you’ll want to shop around to make sure you’re picking the best company for your unique situation. Always compare quotes from multiple companies to find the cheapest company that meets your needs.

The type of auto insurance policy you choose — whether minimum or full coverage — will affect your quote. So it helps to have a general idea of which coverages you'd like before getting one.

- Liability-only car insurance gives you the minimum auto insurance required by your state. These policies are cheap, but they usually don't pay for all of the costs after an accident.

- Full coverage car insurance is the best policy for most drivers who have a car worth more than $5,000. Full coverage car insurance adds comprehensive and collision coverage to your policy to pay for damage to your car.

Expert insights to help you make smarter financial decisions

ValuePenguin has curated an exclusive panel of professionals, spanning various areas of expertise, to help dissect complex subjects and empower you to make smarter financial decisions.

- Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

- How does market share ownership impact a customer's perception of quality of service?

- Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

- Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

- Deanne Butchey, Ph.D.

- Teaching Professor, Finance

- Read answer

- Craig Seidelson, Ph.D.

- Assistant Professor Operations and Supply Chain Management

- Read answer

- Christopher J. Marquette, Ph.D.

- Assistant Professor of Finance

- Read answer

- Marc Kalan

- Assistant Professor of Professional Practice

- Read answer

- David C. Marlett, Ph.D., CPCU

- Managing Director, Brantley Risk and Insurance Center

- Read answer

- Dena H. Hale, Ph.D.

- Assistant Professor of Sales and Marketing

- Read answer

- Steven L. Savino

- Assistant Dean of Lehigh Business Graduate Programs

- Read answer

- Prachi Gala

- Assistant Professor of Marketing

- Read answer

- Jaclyn Stevenson

- Director of Marketing and Communications

- Read answer

- Rutgers Insurance Club

- Led by Sameer Bhuyan

- Read answer

Deanne Butchey, Ph.D.

Teaching Professor, Finance; Faculty Advisor, Phoenician Investment Fund (PIF); Financial Management Association (FMA) @ FIU

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

It depends on the industry. In financial services, trust and the ability to connect with the company is critical in instilling confidence in the minds of the consumers. Smaller companies that do not have an easily identifiable spokesperson may not enjoy as widespread acceptance or trust. Eventually, word of mouth and personalized experiences with the smaller company may ease these concerns.

How does market share ownership impact a customer's perception of quality of service?

In scientific research, it is a known fact that a small percentage of influencers who may be viewed as "informed individuals" have the potential to lead others down a specific path. Many times when a company has a significant market share, consumers believe that existing clientele have superior information about the quality of the good or service. It is for this reason that positive online reviews are highly sought after.

Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

It depends how effectively the integration or consolidation takes place. If it is seamless and customers view the expansion of services offered as being beneficial to them, they will be highly satisfied. On the other hand, if there are hiccups or disruptions in service in the early stages of integration, the acquired or consolidated company will lose its original customers.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

I don’t believe it is necessary to maintain local agents, but it is important that the person on the other line or on the chat is culturally sensitive. Seemingly personalized experiences, whether it is through a live agent or artificial intelligence, is invaluable.

Craig Seidelson, Ph.D.

Assistant Professor Operations and Supply Chain Management, University of Indianapolis

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

Companies in the U.S. spent nearly $250 billion on ads in 2020. When it comes to financing national marketing campaigns, large companies have a distinct advantage over their smaller counterparts. This spending advantage becomes a business advantage when ads create sufficient brand loyalty that consumers are willing to pay a price premium for more recognizable products and services.

How should drivers balance risk management and affordability when it comes to car insurance?

It's widely accepted among consumers that market share is a key indicator of competitiveness. It follows that companies with a commanding market share are perceived as offering superior products or services. Consumers are willing to pay more for perceived value. With higher profits comes opportunities to further expand market share. As the cycle repeats, the connection between market share and perceived quality is reinforced.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

In our digital world, U.S. consumers spent a whopping $860 billion online in 2020. Is it still necessary for companies to offer personalized sales staff? On the one hand, consumers clearly value the safety, convenience, low prices and wide selection available online. This is particularly true when amounts being spent are well within one's discretionary budget. On the other hand, over half of online shoppers spend less than 15 seconds on a website. When purchases are for substantial amounts of money, selling requires much more engagement than a typical website can offer. Salespeople have the skills necessary to help would-be buyers with their purchase decisions.

Christopher J. Marquette, Ph.D.

Assistant Professor of Finance, Tabor School of Finance, Millikin University; Managing Editor, Journal for Business Advancement

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

The insurance industry is naturally a very segmented one. There are approximately 6,000 firms active in the industry, but the largest 10 firms command over 50% of the premium revenue. So we have an industry that has a few very large firms, such as Progressive and State Farm, and numerous small firms. The objective for success for the smaller companies should be not to compete with the large firms but rather to find a niche market and develop superior expertise in that market.

The insurance industry is bifurcated into two segments. There are several names used to describe these two segments: standard/specialty, admitted/nonadmitted, standard/excess and surplus. I will use the terms standard and specialty. The standard market is characterized by large masses of insureds who have risks that are very similar in nature. This market includes the personal lines of homeowners, automobile, life and health insurance. These are the insurance companies that the public is familiar with because they advertise to the public heavily with catchy slogans and endearing spokespeople and mascots.

The standard market comprises approximately 90% of the total market’s premiums. The specialty market takes the remaining 10% but is vastly more diverse. Examples of risks insured in the specialty market include commercial property, trucking, shipping, product liability, worker’s compensation and professional liability (e.g., doctors, lawyers, building contractors). This is only a small sample of the types of risks insured in this market that offer ample opportunities for profitability for smaller companies.

Even homeowners insurance, for example, provides niche opportunities. Standard market insurers like Progressive and State Farm will only insure single-family residences (up to four units) where the owner/insured lives year-round. They will not insure a vacant house, a seasonal residence or a rental property. Individuals seeking insurance in these situations must go to a specialty insurer.

The specialty market includes a large subdivision where companies don’t even exist. The Lloyd’s insurance marketplace is characterized by syndicates that are just loose affiliations of investors looking to insure risks. Although companies can participate in these syndicates along with individuals, the syndicate itself has a lifespan of only three years before it disbands. The risks insured in this market tend to be very distinct and diverse. Lloyd’s syndicates have, in the past, insured risks as unique and divergent as Bruce Springsteen’s voice, Tina Turner’s legs and the Loch Ness Monster.

There are also opportunities in reinsurance — insuring the insurers! So we can see that the insurance industry is a vast, diverse world with a wide variety of opportunities and markets. The strength of one company’s advertising campaign should not adversely affect a smaller player’s profitability if that player is smart and nimble.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

I would say that insurance companies could reduce their offering of localized agents, but not eliminate them altogether. There is still a large swath of the population that doesn’t have good, reliable internet service. In addition, there are numerous individuals who have good internet service but still are not comfortable with e-commerce.

Insurance is complicated and sometimes confusing, and quite often, potential customers will want to speak directly to a person to explain policies before they are confident it is the right thing for them. Personal service is also an important feature for some customers as they build a relationship with a particular insurer, and somebody the customer has met and knows can attain greater trust than an anonymous call center person.

I don’t see the personal touch in insurance contracting going away soon and think localized offices will continue to be an important, if diminished, facet of policy distribution and service for the foreseeable future.

David C. Marlett, Ph.D., CPCU

Managing Director, Brantley Risk and Insurance Center

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

Larger auto insurers spend enormous sums on advertising to create a positive image and encourage applications. Smaller insurers are unable to match the advertising but offer a similar product and often at competitive prices. Consumers should feel comfortable buying from less well-known auto insurers because they are regulated by the state Department of Insurance.

Their finances are in order, forms and rates approved, in compliance with licensing requirements and backed by the state guaranty fund just like the larger insurers. Just to be on the safe side, visit your state's Department of Insurance website or call if you have questions about a particular insurer. The regulator can confirm whether the insurer is licensed in the state and may provide information on the number of complaints they have received (a complaint ratio provides the number of complaints divided by premium volume).

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

Having a local agent to offer a personalized experience is certainly helpful for Gen Xers and baby boomers, but likely less so for the younger consumers who are more comfortable in the digital space. This last year has pushed many of the traditional local agents to improve their virtual interactions, but many consumers still prefer to visit or call with questions.

Marc Kalan

Assistant Professor of Professional Practice, Department of Marketing

Flo from Progressive and Jake from State Farm are household names by now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

Many consumers feel comfort from dealing with a "perceived familiar" expert or, in this circumstance, the familiar personality (albeit a "company-created expert"). This is a perceived strength that larger companies with high levels of awareness carry as an advantage that smaller entities in the same industry rarely can match. In categories where there is a constant flow of potential new users, this is a clear competitive advantage.

How does market share ownership impact a customer's perception of quality of service?

As members of a consumer-driven population, we are drawn to those already perceived as "winners." In today's competitive environment, success on any parameter — and "quality of service" is certainly one of those parameters — is a key consumer desire. Therefore, the higher the market share, the higher the impression of the "better" competitor as measured by the size of its customer base in comparison with the rest of the market, and this is measured by its share of the market.

Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

While companies desire to raise the level of consumer satisfaction, it is my understanding that cuts in budgets to create the "savings" anticipated by consolidations of functions never reach those levels, and resulting customer satisfaction tends to the opposite.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

Historically, most insurance has been sold and serviced via local agents, and those local relationships were a key component in that process. As the digital revolution continues to impact our lives, more and more "traditional" processes are being replaced with digital solutions. This is occurring across more and more industries traditionally handled via face-to-face interactions, including banking, automobile and home purchases, and virtually all consumer industries. Insurance companies, if they are to maintain and grow in the future, will most likely need to adapt to this new paradigm or [risk seeing] a revolution of new competitors as has occurred in so many consumer-focused businesses.

Dena H. Hale, Ph.D.

Assistant Professor of Sales and Marketing, Centurion Sales Program, Stetson University

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

It comes down to familiarity and branding. Insurance is a credence- or experience-attribute service. This means that it is difficult for a consumer to really know if a service provider (i.e., an insurance company) provides quality service or not. If you have an accident and you are satisfied with the way the firm handled your claim, you assume you received quality service, but you can’t really know for certain.

It is very difficult to determine prior to an experience if an insurance provider delivers value. This is where branding comes in for firms like Progressive and State Farm. We don’t see an insurance provider; we see Flo and Jake. Flo and Jake are our "friends," and we value what our friends say. We "know" the value is better because our trusted friend said so.

The use of personal branding (and integrated marketing communications) not only allows familiarity for consumers — it also creates less price sensitivity for consumers. Many consumers are able and willing to pay a slightly higher premium for the assurance of quality service delivery if and when the insurance coverage becomes needed.

How does market share ownership impact a customer's perception of quality of service?

It's about perceptions. It can be summed up in one statement: "If a firm is larger with greater market share, more people must trust the firm, so I can trust it too."

Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

Generally speaking, it can be two-fold. It may spark consumer "shopping" for other insurance options, or it could solidify satisfaction. It comes down to the reputation of the acquired/consolidated firm.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

That is a very interesting question. A balance is needed, allowing customers to interact online for basic questions and searches; however, agents are critical for establishing relationships, suggesting appropriate service offerings and speaking with clients after an accident.

Insurance literacy, or the ability to fully comprehend the insurance market, varies among customers. Currently, consumers are not as insurance-savvy as needed to have fully automated processes. Looking to the future, this could shift. The increased use of artificial intelligence (that is, avatars that interact with customers online like a real-life agent would) may change the need for localized agents in the future.

Steven L. Savino

Assistant Dean of Lehigh Business Graduate Programs, Professor of Practice, Marketing Department, Lehigh University College of Business

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

The perceived value of larger companies can have an impact on smaller companies primarily in the areas of satisfaction guarantees and customer service. In other words, larger companies who are able to invest more dollars in advertising messaging, like with Progressive and "Flo" or State Farm and "Jake," are able to reinforce their value propositions in ways that prompt consumers to perceive a higher likelihood of realizing brand satisfaction. Well-known brands become assets that achieve reliable, ongoing sales volume resulting from the perception that risk in choosing such brands is low.

How does market share ownership impact a customer's perception of quality of service?

Higher market share is the result of the combination of four factors. Stronger brand preference combined with greater resistance to compromise (more willingness to search for the brand) drives market share by creating "pull." Likewise, greater availability and in-market visibility combine to create "push." This combination of push-pull factors creates market share, and higher market share enables the firm to gain leverage over channel partners, thus resulting in even greater availability and in-market visibility.

This cycle is important in the context of understanding that a high market share means your brand has greater in-market visibility. The result is a higher likelihood that your brand will be chosen. This trial, combined with meeting or exceeding customer expectations, leads to repeat purchases and ultimately high brand loyalty rates. So, high market share triggers the notion that the brand must be of high quality, otherwise why would so many people be willing to purchase the product?

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

On the surface, it might appear that insurance company providers need localized agents less due to digital interface solutions. In other words, consumers can transact more easily and with less anxiety within digital and web-based platforms than through high-pressure sales presentations. However, with that said, consumers still need a level of customization when it comes to purchasing insurance products.

As a result, insurance providers utilizing the human touch can more readily address consumer needs and realize higher sales closing rates. Insurance is considered a high-involvement product, meaning there is greater willingness to gather information and search for alternative solutions. Localized agents and personal attention in terms of customer experience can go a long way in getting the undecided prospect off the fence and engaging them in the transaction.

Prachi Gala

Assistant Professor of Marketing, Kennesaw State University

Q: Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

The characters and the perceived value play two different roles.

I will try to address the perceived value. Larger companies will have higher value. It’s a no-brainer. So the problem for smaller companies here is that the larger companies are always top-of-mind for the consumer and hold a bigger market share. So it has a huge negative impact on the smaller startups. But, at the same time, these new entrants have multiple benefits: federally supported funds, getting something new to the market, flexibility in adapting to customer needs as they are not yet fully grown, freshly done market research, etc.

These benefits can be fully supportive of new entrants to increase their perceived value as they can serve the customer in the best way possible while making their entry. A recent example of a new entrant is an app called Avail, which rents out your car while you’re out of town. The app provides customers with free car washes and free parking while they are traveling. Who would not see value in that?

How does market share ownership impact a customer's perception of quality of service?

The more users, the more diversified the opinions. You can’t please everyone who is your customer. Opinions about market share ownership, like monopolies, are usually diversified.

For example:

- Facebook — everyone is on it. And three people may criticize the company and its usage of data and leakage when they are on it. But do they have a choice? All the customers are still on Facebook, despite their dislike of the platform’s market share.

- Apple — most Americans own at least one Apple device. They are all very happy with their products. When Apple started selling AirPods and different charging cords, they were certainly criticized for it, but do the customers have a choice? They can switch to Android. But will they?

These two examples explain the fact that market share ownership does get love and hatred together, but due to the huge market share, customers don’t have a choice and are wary of switching to new products, regardless of a high dislike sometimes.

Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

The customers most times are not aware of the acquisitions taking place between companies. For example, last week, Redbox merged with Seaport Global. It’s not very attention-seeking. Certainly if there are bigger acquisitions, covered well by the media, like the merging of WarnerMedia and Discovery, then there is awareness. But impact? Not so much.

Would you stop watching Discovery because the company merged with WarnerMedia? If this merger had an impact on subscription rates, then it may be a different story. Some merger decisions may eventually impact consumers, but it is those decisions — and not the news of the mergers themselves — that impact customer satisfaction.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

The question here should be "how" not "if." Because there is no other way but to have that personalized experience. Digitizing means people are naturally getting isolated and working in their own dens, and thus, loneliness is kicking in. In such circumstances, having the best digital service is great. The customer will certainly like it, regardless of digital service. But if there is a live agent, unconsciously, they will feel more welcomed, more engaged and part of the company community.

Today, giving a personalized experience is what can differentiate you from the competition. It is a must. Simple example: If you are moving to Michigan and an assistant from a mortgage company is talking to you online but you don’t know their whereabouts, your confidence with the company may not be the same as if the same agent told you they are a local of the area you are moving to. That gives you the personalized feeling — a bond — and a feeling of belongingness to the community.

Jaclyn Stevenson

Director of Marketing and Communications, Columbia-Greene Community College, the State University of New York

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

In my opinion the marketing personas, so to speak, that brands create are a move toward making the company seem more approachable, relatable and down to earth — all qualities that small and successful companies possess inherently. Flo, Jake and other spokes-characters have proven to be effective tools to promote products and services and to bring in new customers.

That said, retention is key. If the service provided once a new customer signs on is not up to their standards, many consumers will pivot — almost automatically — to doing business with a smaller company.

This poses a challenge, as well as an opportunity, for those smaller outfits, who must position themselves as visible to consumers with creative marketing of their own. This could include a larger-than-life character (who is also a real leader in the company, as opposed to fiction), but above all should focus on the points of service customers can expect to receive with low or no failure for an extended period of time.

How does market share ownership impact a customer's perception of quality of service?

As a small community college serving a rural area, we struggle with the balance of advertising spread. Our budget is smaller than some neighboring colleges that can pursue larger and longer campaigns, and that affects the perception of the institution — area residents sometimes assume the larger colleges are more well-heeled, accessible or program-rich.

However, wide-reaching campaigns in our region can also be read as overexposure or overspending. We pay great attention to our demographic and geographic targets to help combat this — delivering marketing materials to core audiences as often as possible — and also working with community partners to create unique, attention-getting "splashes" throughout the year that demand attention, but don’t suggest grandiosity. Some examples include "carvertising" on delivery-service cars, QR-code powered brochures to pair digital and print pieces and sponsorships of events that are reflective of our community’s flair, such as art festivals, agricultural fairs and theater productions.

Generally speaking, what is the impact on customer satisfaction after an acquisition and/or consolidation?

Name changes or announcements of company changes of any kind often foster anxiety among consumers, who may adopt a newly cynical view of the company in question or worry their service will change or decline in quality. The impetus is on the company to double down on its customer service and pay attention to any developing trends of dissatisfaction among its customer base.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

While it’s not intrinsically necessary, local access to service is always a plus and an important aspect of service to promote. Personalized experiences should always be part of marketing and customer outreach, whether delivered from afar or from across the street. This digital world, especially post-pandemic, is one that has created a need among many consumers for real, human experiences. The good news is digital resources make personalization easier than ever before — but sometimes, all that’s needed is a personal phone call, too.

Rutgers Insurance Club

Led by Sameer Bhuyan

Flo from Progressive and Jake from State Farm are household names now. How does the perceived value of larger companies impact the smaller, yet potentially just as competitive, ones?

Customers recognize familiar faces and companies. Flo and Jake are two of many recognized faces in the country. When Progressive and State Farm create ads with these icons, they also create a customer base of "satisfied customers." Since their ads portray satisfied customers, potential customers are more inspired and persuaded to switch from their current insurance and become a customer of Progressive and/or State Farm.

The assumed "100% guarantee" builds a 100% "satisfactory" value that smaller, competitive companies are challenged to match. Customers are so used to watching persuasive ads and promotions that they disregard smaller companies and assume that smaller companies do not provide the same level of satisfaction. In turn, smaller insurance companies struggle to gain new customers and subscribers. Smaller companies seem to be already labeled as "unsatisfactory" without being given a chance.

This marketing strategy is one that is being employed in almost all industries and institutions. At Rutgers Business School, we have our own Flo and Jake to compete with. Renowned clubs like LIBOR (Little Investment Bankers of Rutgers), QFC (Quantitative Finance Club) and many others dominate in attracting new members and provide a perception of "Join us and you will be guaranteed a successful future."

A new and much smaller club like Rutgers Insurance Club needs to show it provides just as much value as the big shots, if not more. To do that, a new club needs to attract members and strategize how to retain its members. To reach the same playing field, smaller companies need to seize each and every opportunity they get to increase their value and customer base.

Living in this digital revolution, is it necessary for companies, like insurance providers, to maintain localized agents and personalized experiences?

The digital revolution has been a blessing and curse for almost all industries, including insurance. Technological advances have allowed companies to reach out globally without leaving a desk. While technology allows insurance companies to build their organization in new ways, it is just as important to maintain positive relationships with localized customers and stakeholders.

As for localized agents, it is important for companies to employ individuals who can assist customers on the spot. Personalized experiences allow customers and people to interact with agents and have more liberty to know the company. An agent represents their company and, therefore, illustrates the values and morals a company has. Someone over the phone or on a video call will not be able to portray company standards the same way.

At the end of the day, customers are people, and people need to interact with other people. Insurance agents, or any agents for that matter, need to exist as long as a company wants a future.

Frequently asked questions

What are the largest auto insurance companies?

The 10 largest auto insurers in the United States are State Farm, Progressive, Geico, Allstate, USAA, Liberty Mutual, Farmers, American Family, Travelers and Nationwide. Together, they collect 77% of what people spend on car insurance in the U.S.

Do larger insurance companies have better rates?

There's no guarantee that a bigger insurance company will have a better price than a smaller company. Each company uses a different formula for setting rates. The only way to find the best rate for you is to get quotes from multiple insurance companies.

Should I go with a big or small auto insurance company?

There are affordable, good insurance companies of all sizes. But larger, national insurance companies usually have more coverage options, discounts and digital tools like mobile apps. In contrast, a smaller insurance company may have more personalized service and local expertise.

Methodology

The largest auto insurance companies are based on data for direct written premiums and market share percentages from the National Association of Insurance Commissioners (NAIC) and S&P Global, a financial data resource for the insurance industry.

Full-coverage auto insurance quotes are national averages using quotes in ZIP codes across the country. Rates are for a 30-year-old man with good credit and a clean driving history, driving a 2015 Honda Civic EX.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.