Cheapest Car Insurance in Arizona (Best Rates in 2025)

State Farm has the best cheap car insurance in Arizona, at $138 per month for full coverage.

Find Cheap Auto Insurance Quotes in Arizona

Best cheap car insurance companies in Arizona

How we chose the top companies

Best and cheapest car insurance in Arizona

- Cheapest full coverage: State Farm, $138/mo

- Cheapest minimum liability: State Farm, $59/mo

- Cheapest for young drivers: State Farm, $204/mo

- Cheapest after a ticket: State Farm, $147/mo

- Cheapest after an accident: State Farm, $138/mo

- Cheapest for teens after a ticket: State Farm, $64/mo State Farm, $220/mo

- Cheapest after a DUI: Progressive, $204/mo

- Cheapest for poor credit: Travelers, $255/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

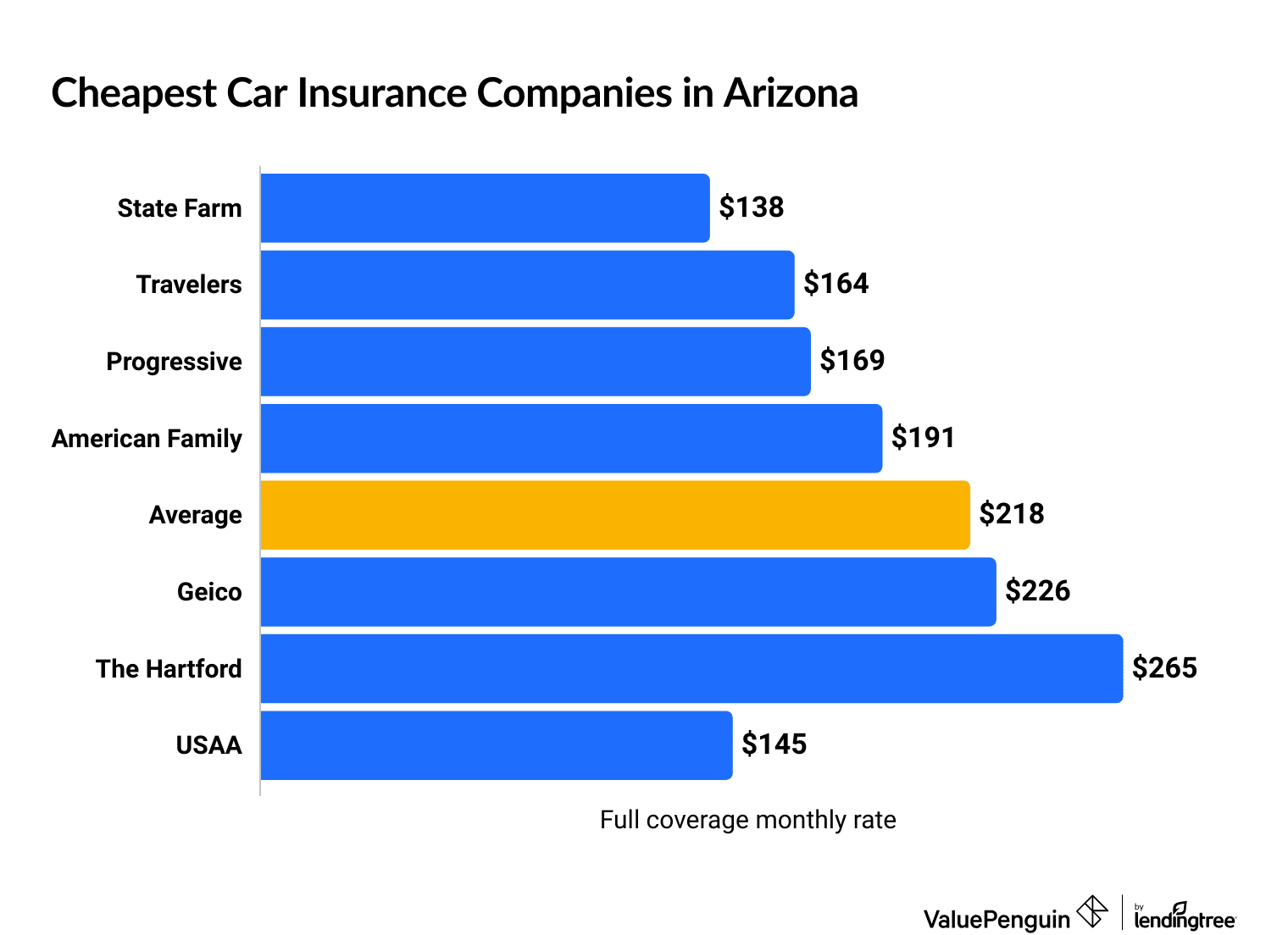

State Farm has reliable customer support, along with the lowest rates in Arizona. Travelers, Progressive and American Family also have cheaper rates than average. All four companies offer online quotes, so you can quickly find the cheapest rates for you.

Cheapest car insurance in Arizona: State Farm

State Farm has the cheapest quotes for full coverage in Arizona, at $138 per month.

That's 37% less than the average rate in Arizona, which is $218 per month.

Find Cheap Auto Insurance Quotes in Arizona

Cheapest car insurance in Arizona for full coverage

Company | Monthly rate | |

|---|---|---|

| State Farm | $138 | |

| Travelers | $164 | |

| Progressive | $169 | |

| American Family | $191 | |

| Geico | $226 |

*USAA is only available to current and former military members and their families.

Best cheap liability car insurance in AZ: State Farm

State Farm has the cheapest liability auto insurance in Arizona, at $59 per month.

That's 35% cheaper than the state average of $91 per month.

Cheapest Arizona car insurance quotes

Company | Monthly rate |

|---|---|

| State Farm | $59 |

| Travelers | $70 |

| Progressive | $78 |

| American Family | $80 |

| Geico | $102 |

*USAA is only available to current and former military members and their families.

Military members, veterans and their families can get even cheaper rates from USAA. At $49 per month, a policy from USAA costs $10 per month less than State Farm.

Find Cheap Auto Insurance Quotes in Arizona

Cheapest AZ auto insurance for young drivers: State Farm

State Farm has the most affordable minimum coverage insurance for 18-year-olds, at $204 per month.

State Farm also has the best full coverage prices for young drivers. Full coverage from Travelers costs around $418 per month.

Lowest young driver car insurance prices in Arizona

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $204 | $418 |

| Travelers | $205 | $443 |

| The Hartford | $249 | $757 |

| Geico | $254 | $495 |

| Progressive | $308 | $779 |

*USAA is only available to current and former military members and their families.

The cheapest way for young drivers to get coverage is by sharing a policy with their parents.

Young drivers pay much more for car insurance than older adults. An 18-year-old driver can expect to pay more than triple what a 30-year-old driver pays for auto insurance in AZ.

Best cheap insurance in AZ after a speeding ticket: State Farm

State Farm has the cheapest car insurance quotes for Arizona drivers with a speeding ticket on their record. Its average rate is $147 per month for full coverage insurance, which is about half the Arizona state average.

Best prices for car insurance after a speeding ticket in Arizona

Company | Monthly rate |

|---|---|

| State Farm | $147 |

| Travelers | $208 |

| Progressive | $227 |

| American Family | $231 |

| Geico | $303 |

*USAA is only available to current and former military members and their families.

In Arizona, one speeding ticket will raise your insurance rates by around 33%.

Cheapest AZ car insurance after an accident: State Farm

State Farm has the most affordable car insurance in AZ after an accident. Full coverage insurance from State Farm costs only $138 per month after an accident, which is less than half the state average.

The average cost of car insurance after an at-fault accident is $314 per month in Arizona.

Most affordable car insurance in Arizona after a crash

Company | Monthly rate |

|---|---|

| State Farm | $138 |

| Travelers | $230 |

| Geico | $246 |

| Progressive | $257 |

| American Family | $343 |

*USAA is only available to current and former military members and their families.

Car insurance quotes in Arizona go up by an average of 44% after an at-fault accident. That's $96 per month more than drivers with a clean record pay for auto insurance.

If you can't afford insurance after an accident, there are a few ways to lower your car insurance bill.

- If you have comprehensive and collision coverage, you can typically lower your payments by choosing a higher deductible.

- You may be able to save money by signing up for automatic payments or paying your six-month or annual bill up front.

- Many major companies offer safe driving programs. By practicing safe driving habits, like sticking to the speed limit, you could earn a large discount.

- If you own your car outright, you could consider canceling your comprehensive and collision coverage. These coverages may not be worth it if your car is more than 8 years old or worth less than $5,000.

Cheap car insurance in AZ for young drivers after a ticket or accident: State Farm

State Farm has the cheapest car insurance quotes for teen drivers with a recent speeding ticket or accident. With that company, you'll find an average price of $220 per month for minimum coverage after a ticket or $204 after a crash. Those are both about 40% cheaper than the state average.

Best insurance quotes in AZ for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| State Farm | $220 | $204 |

| Travelers | $257 | $293 |

| Progressive | $320 | $327 |

| Geico | $332 | $263 |

| The Hartford | $344 | $442 |

*USAA is only available to current and former military members and their families.

If you're 18 years old in Arizona, a ticket will raise your rate by an average of 22%. An at-fault accident raises rates by 32%. Teens usually see smaller increases after an incident than adults since they're already considered high-risk drivers.

Cheapest Arizona auto insurance after a DUI: Travelers

Travelers has the cheapest rates for Arizona drivers after a DUI, averaging $255 per month. That's $158 per month cheaper than the Arizona average.

Company | Monthly rate |

|---|---|

| Travelers | $255 |

| Progressive | $269 |

| American Family | $285 |

| Geico | $344 |

| Allstate | $454 |

*USAA is only available to current and former military members and their families.

Drivers in Arizona with a DUI pay an average of 660% more for full coverage than drivers with no prior incidents.

Driving under the influence (DUI) causes car insurance rates to go up more than any other offense. That's because insurance companies believe drivers with a DUI are very likely to file a claim in the future.

Cheapest car insurance in AZ for drivers with poor credit: Travelers

Travelers has the cheapest car insurance quotes in Arizona for drivers with a low credit score. The average rate for full coverage from Travelers is $255 per month for these drivers. That's $158 less expensive than the state average of $413 per month.

Affordable bad credit car insurance in Arizona

Company | Monthly rate |

|---|---|

| Travelers | $255 |

| Progressive | $269 |

| American Family | $285 |

| Geico | $344 |

| Allstate | $454 |

*USAA is only available to current and former military members and their families.

Your credit score doesn't have anything to do with your ability to drive safely, but it can impact how much you pay for insurance.

Arizona drivers with poor credit pay 80% more for insurance than drivers with good credit. That's because insurance companies believe people with poor credit are more likely to file a claim, which makes them more expensive to insure.

Best car insurance companies in Arizona

State Farm has the best car insurance in Arizona for most drivers.

It earned excellent customer service scores from J.D. Power and ValuePenguin editors. State Farm also has the highest rating for financial strength. That means customers don't have to worry about State Farm's ability to pay out claims.

Drivers with military connections can find excellent service from USAA, too. However, only military members, veterans and their families can buy car insurance from USAA.

Best auto insurance in AZ

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| State Farm | 657 | A++ | |

| AAA | 658 | NR | |

| Geico | 637 | A++ | |

| Travelers | 616 | A++ |

Average car insurance cost in Arizona by city

Drivers in Desert Hills pay the cheapest car insurance rates in Arizona, while those in Phoenix have the most expensive quotes.

Auto insurance in Phoenix, the state's largest city, costs an average of $254 per month for full coverage. People who live in Desert Hills can expect to pay around $152 per month.

Full coverage auto insurance quotes by AZ city

City | Monthly Rate | % from average |

|---|---|---|

| Aguila | $209 | 13% |

| Ajo | $182 | -1% |

| Ak-Chin Village | $200 | 9% |

| Alpine | $169 | -8% |

| Amado | $170 | -8% |

Minimum auto insurance requirements in Arizona

Minimum coverage insurance pays for damage you cause to others, including medical bills and the cost to repair their car. You're required to carry bodily injury liability coverage and property damage liability coverage. The state's limits are often written as 25/50/15.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $15,000 per accident

What's the best car insurance coverage for Arizona drivers?

Full coverage car insurance is the best choice for most drivers in Arizona.

Full coverage quotes include not only liability coverage, but also comprehensive and collision coverages.

- Comprehensive coverage pays for damage from incidents beyond your control, such as hail or theft.

- Collision coverage pays for damage to your car if you crash into another car or stationary object, regardless of fault.

Getting minimum liability insurance is the cheapest way to make sure you can drive legally. On average, minimum coverage costs $127 per month less than full coverage in Arizona.

However, minimum liability insurance in Arizona only pays for injuries to others or damage to another person's car or property. It doesn't include protection for your own car, and it doesn't pay for injuries to you and your passengers.

You should consider full coverage auto insurance instead of minimum coverage to ensure you have enough protection if you're in a major car accident.

Frequently asked questions

Who has the cheapest auto insurance in Arizona?

State Farm has the cheapest minimum coverage insurance in Arizona, at around $59 per month. Drivers shopping for full coverage insurance can also find the best rates at State Farm, where a policy costs $138 per month, on average.

What is the average cost of car insurance in Arizona?

Minimum coverage car insurance costs $91 per month in Arizona, on average. The average cost of full coverage insurance in Arizona is $218 per month. However, every company offers different prices, and what you'll pay depends on your age, driving history, location and credit score.

What is AZ state minimum auto insurance?

Drivers in Arizona must have a car insurance policy with a minimum of $25,000 of bodily injury liability coverage per person and $50,000 per accident, in addition to $15,000 of property damage liability.

How much does car insurance cost in Phoenix vs. Tucson?

Phoenix has the most expensive car insurance of any city in Arizona, while Tucson is closer to average. In Phoenix, drivers pay around $254 per month for a full coverage policy, which is 38% more than the statewide average. In Tucson, the average price is $209 per month, which is 13% higher than the state average.

Methodology

ValuePenguin collected thousands of quotes from ZIP codes across Arizona for some of the largest insurers in the state. Rates are for a 30-year-old man with a 2015 Honda Civic EX who has good credit and a clean driving record, unless otherwise noted.

Full coverage auto insurance quotes include comprehensive and collision coverage, and higher liability coverage limits than the legally required minimums.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Rate data was collected using Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.