Best DUI Car Insurance

Progressive is the best major car insurance company for drivers with a DUI. Full coverage from Progressive costs around $212 per month after one DUI.

Find Cheap Auto Insurance Quotes in Your Area

Best cheap car insurance with a DUI

To help you find the best cheap auto insurance with a DUI, ValuePenguin compared quotes from top insurance companies across all 50 states and Washington, D.C.

Our experts rated the best DUI insurance companies based on customer service, cost and coverage availability.

To find the cheapest insurance after a DUI, ValuePenguin compared quotes for a full coverage policy. Quotes include higher liability limits than the state minimum plus collision and comprehensive coverage. Full methodology.

After a DUI, you should look for companies that offer the best rates or focus on insurance for high-risk drivers.

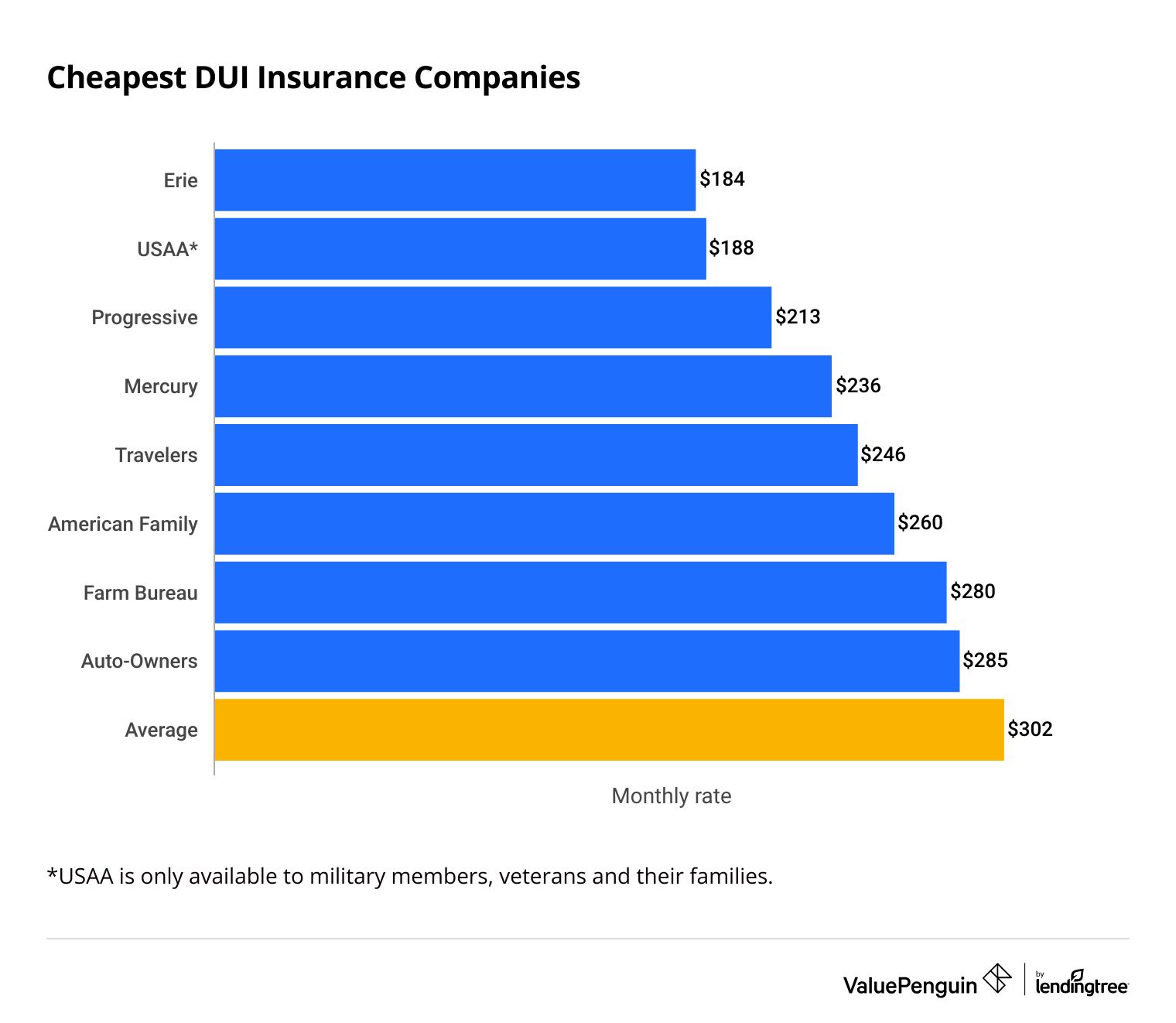

Some national companies have affordable insurance after a DUI, like Progressive, Travelers and American Family. But mid-size insurance companies, like Erie, Mercury and Auto-Owners are often cheaper.

Best insurance for DUI drivers

Progressive, Travelers and American Family are the cheapest major companies for drivers with a DUI, DWI or DWAI.

All three companies are at least 14% cheaper than the national average, which is $302 per month. However, regional insurance companies like Erie may be more affordable after a DUI.

Find Cheap Auto Insurance Quotes in Your Area

DUI and DWI car insurance rates differ a lot from one company to the next.

The most expensive major company, Geico, is nearly twice as expensive as the cheapest option, Progressive. That's why it's important to get online car insurance quotes from multiple companies.

Best full coverage DUI insurance rates

Best national DUI car insurance: Progressive

-

Editor's rating

-

Full coverage

$212/mo ?

Pros and cons

Progressive has the cheapest car insurance rates for drivers with a DUI among major insurance companies.

A full coverage policy from Progressive costs $212 per month, which is $90 less per month than the national average.

Drivers with a DUI can get even better rates by qualifying for Progressive's many discounts. You can save by getting a quote online, bundling home and auto insurance or paying your bill automatically.

In addition, drivers in most states automatically get small accident forgiveness when they switch to Progressive. That means your rate won't go up if you cause under $500 in damage in an accident. This is particularly helpful for drivers who cause a small crash while under the influence.

Drivers aren't always happy with Progressive's customer service, however. The company gets fewer complaints than an average competitor, according to the National Association of Insurance Commissioners (NAIC). However, Progressive got a low score on J.D. Power's claims satisfaction study. That means it may take longer for Progressive to get you back on the road after an accident.

Best regional DUI car insurance: Erie

-

Editor's rating

-

Full coverage

$181/mo ?

Pros and cons

Erie is a great DUI insurance company if you live in a state where it sells car insurance.

Full coverage insurance from Erie costs $181 per month after a DUI, on average. That's $121 per month cheaper than the national average.

Erie also offers outstanding customer service. It earned the third-highest score on J.D. Power's claims satisfaction survey. That means Erie customers are typically happy with their experience after an accident.

In addition, Erie customers can customize their car insurance policy with helpful coverage add-ons. This includes roadside assistance and new or better car replacement. It also offers gap insurance, which can be useful if you have a car loan or lease.

Although you can get an online quote for Erie car insurance, you'll have to call an agent to buy a policy. Speaking with an agent may be less convenient than managing your policy online. But Erie's helpful agents could be part of the reason why it gets such high customer satisfaction scores.

Best insurance for drivers with multiple DUIs: The General

Editor's rating

Pros and cons

Unlike many other auto insurance companies, The General doesn't shy away from high-risk drivers.

That includes people with multiple DUIs. In fact, The General provides relatively affordable rates to high-risk drivers. This makes it one of the better choices for DUI auto insurance.

The General even tailors its quote process to high-risk drivers. When you're getting a quote, The General asks if you need an SR-22 filing. If you need it, The General will include the form with your policy.

Some auto insurance companies that offer nonstandard insurance offer fewer coverage options and features. That isn't the case with The General. It offers a convenient mobile app, along with the option to add coverage like roadside assistance and gap insurance.

Cheapest DUI insurance rates by state

Full coverage in the most expensive state, Michigan, costs four times as much as the cheapest state, New Hampshire.

Where you live can have a major impact on your car insurance rates after a DUI. Full coverage rates can vary by over $500 from one state to the next.

In addition, the cheapest company nationally may not be the most affordable choice near you.

Although Progressive is the most affordable company in 13 states, Travelers has the cheapest quotes in six states. State Farm and Farm Bureau are each the cheapest option in five states.

Monthly full coverage DUI insurance quotes by state

State | State avg | Cheapest rate | |

|---|---|---|---|

| Alabama | $261 | Progressive | $184 |

| Alaska | $228 | Umialik | $134 |

| Arizona | $359 | Progressive | $214 |

| Arkansas | $264 | Farm Bureau | $132 |

| California | $428 | Mercury | $236 |

Find Cheap Auto Insurance Quotes in Your Area

DUI insurance in California and Florida

In California, it's against the law for your car insurance company to raise your rates or cancel your policy in the middle of your term.

For example, say you buy a six-month policy and get a DUI in the third month. Your insurance company can't raise your rates or cancel your coverage until the policy ends. However, you should still tell your company that you got a DUI and prepare to shop around for new coverage.

California removes DUIs from your public driving record after 10 years. During that 10-year span, you will not be eligible for any good driver discounts.

Florida drivers with a DUI must have higher insurance limits than drivers with a clean record.

To get your license reinstated after a DUI in Florida, you'll need to have an insurance company file an FR-44 form. This form proves that you have the right amount of coverage.

How do insurance companies find out about a DUI?

Your insurance company will most likely find out about your DUI through the DMV. Different insurance companies check these records at different times, but many check when you're renewing your policy.

Your insurance company will also find out about your DUI if you need an SR-22 filing. After a DUI or a DWI, you'll likely need to file an SR-22 form to get your license reinstated. Your auto insurance company needs to file the SR-22 with your state's DMV on your behalf.

It is highly unlikely — if not impossible — to hide a DUI from your insurance company.

Instead, you should tell your insurance company about your DUI conviction. If you don't let your insurance company know about your DUI, it could cancel your policy. That could lead to a lapse in coverage and higher rates.

Your company may still cancel your policy if you share information about your DUI. But you won't be caught off guard and will have time to shop around for coverage.

How to find cheap car insurance after a DUI

Find Cheap Auto Insurance Quotes in Your Area

800-772-1213

Getting a DUI typically causes your car insurance rates to go up. That's because insurance companies believe you're more likely to cause another accident in the future.

To find cheap DUI insurance, you should shop around, look for discounts and practice safe driving habits in the future.

Shop around: The best way to save money on car insurance is to compare quotes from multiple companies. Start by getting quotes from companies that offer the cheapest rates for high-risk drivers.

Look for discounts: Most insurance companies offer discounts that can lower your rates. Some are very easy to qualify for, like signing up for automatic payments or getting your statements via email. And you can usually save a lot by bundling your auto insurance with a home or renters policy.

Practice safe driving habits: Going forward, it's important that you have a clean driving record. This will help you avoid even higher rates.

You won’t feel the effects of safe driving right away. But over time, safe driving can lower your insurance rates after a DUI and get you discounts.

Some companies offer usage-based discounts that can save you money right away. Companies track your driving habits using your phone or a device that plugs into your car. If you're committed to driving more safely in the future, these programs can save you a lot of money.

Keep in mind that in some states, like California, you can't qualify for good driver discounts for a set period of time after a DUI.

Frequently asked questions

What is the best auto insurance with a DUI?

Progressive has the best car insurance rates for most drivers with a DUI. Full coverage from Progressive costs $212 per month after one DUI, which is 30% cheaper than average.

Erie is another great option for drivers with a DUI. Erie charges $181 per month for full coverage DUI insurance. But it's only available in 12 states in the Northeast and Midwest.

What is the cheapest insurance for a DUI?

Progressive has the cheapest DUI rates from a national insurance company. Full coverage car insurance from Progressive costs $212 per month.

Military members, veterans and their families can find even cheaper rates at USAA. Full coverage from USAA costs $188 per month after a DUI.

Is there any DUI insurance trick?

No, there is no trick to prevent your rates from going up after a DUI. Your insurance company will find out through the DMV at some point.

Rather than trying to trick your insurance company, you should shop around for the best rate. You should also try to find as many discounts as you can and drive safely in the future.

Methodology

To find the best car insurance for DUIs, ValuePenguin collected rates from ZIP codes across every state in the U.S. Quotes are for a single 30-year-old man with good credit, a 2015 Honda Civic EX and one DUI.

Rates are for a full coverage policy. It includes comprehensive and collision coverage along with higher liability limits than state minimum requirements.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Rates were provided by Quadrant Information Services and sourced from public insurance company filings. Your rates will likely be different, as these are for comparison purposes only.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.