Minnesota SR-22 Insurance: What Is It and How Much Does It Cost?

Minnesota does not require SR-22 insurance. Instead, drivers need to file an insurance certification with the Minnesota Driver and Vehicle Services (DVS).

The insurance certification is required for people with serious driving violations on their record, like a DUI or DWI. These drivers will need to have their insurance company submit the insurance certification as proof that they have the minimum amount of coverage to drive legally in Minnesota.

Cost of SR-22 insurance in MN

There's no cost to file an insurance certification in Minnesota, and insurance companies may not charge you extra for having to submit proof of insurance.

However, your insurance rates will usually go up based on the violation that caused you to need to file an insurance certification.

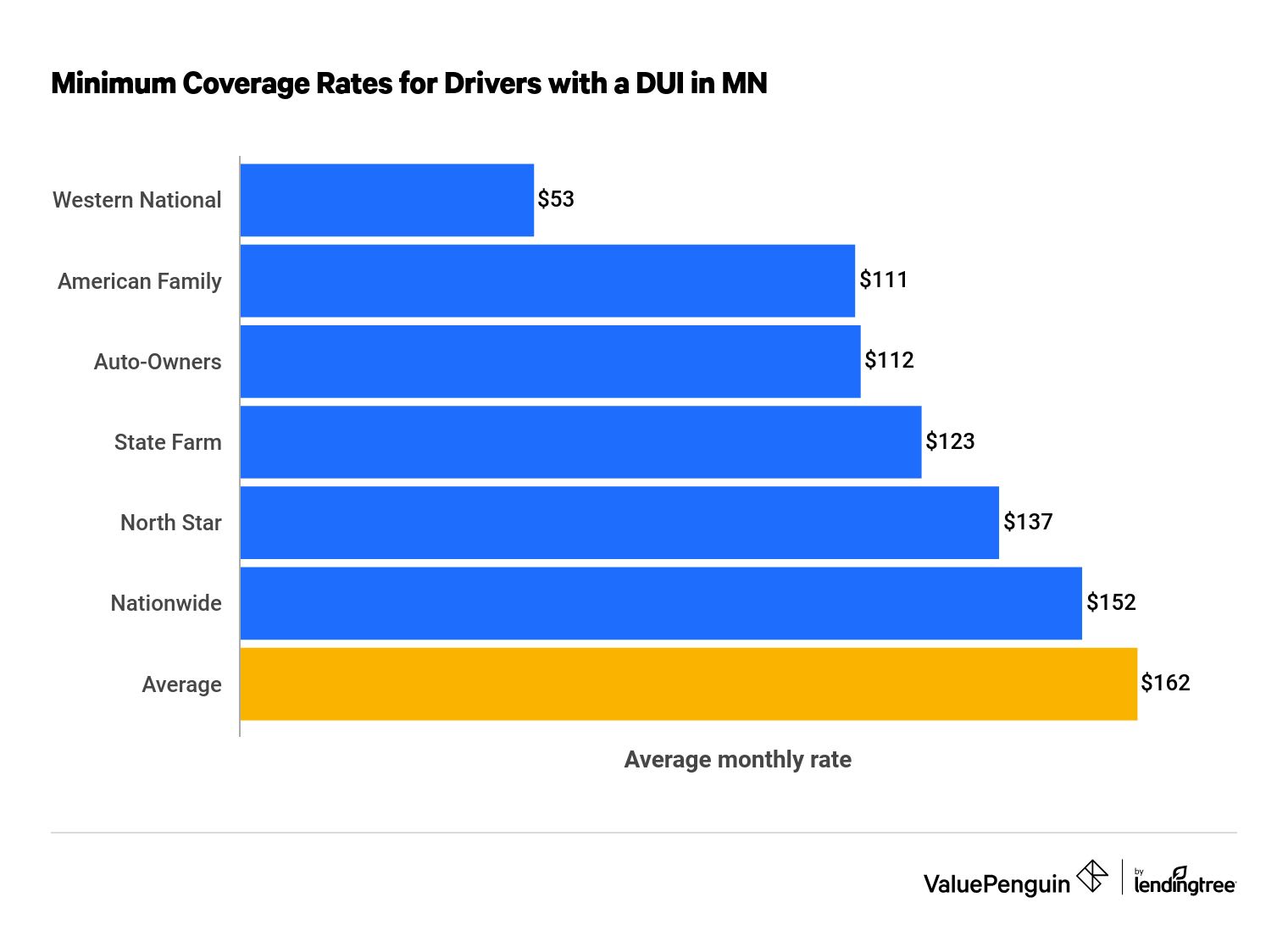

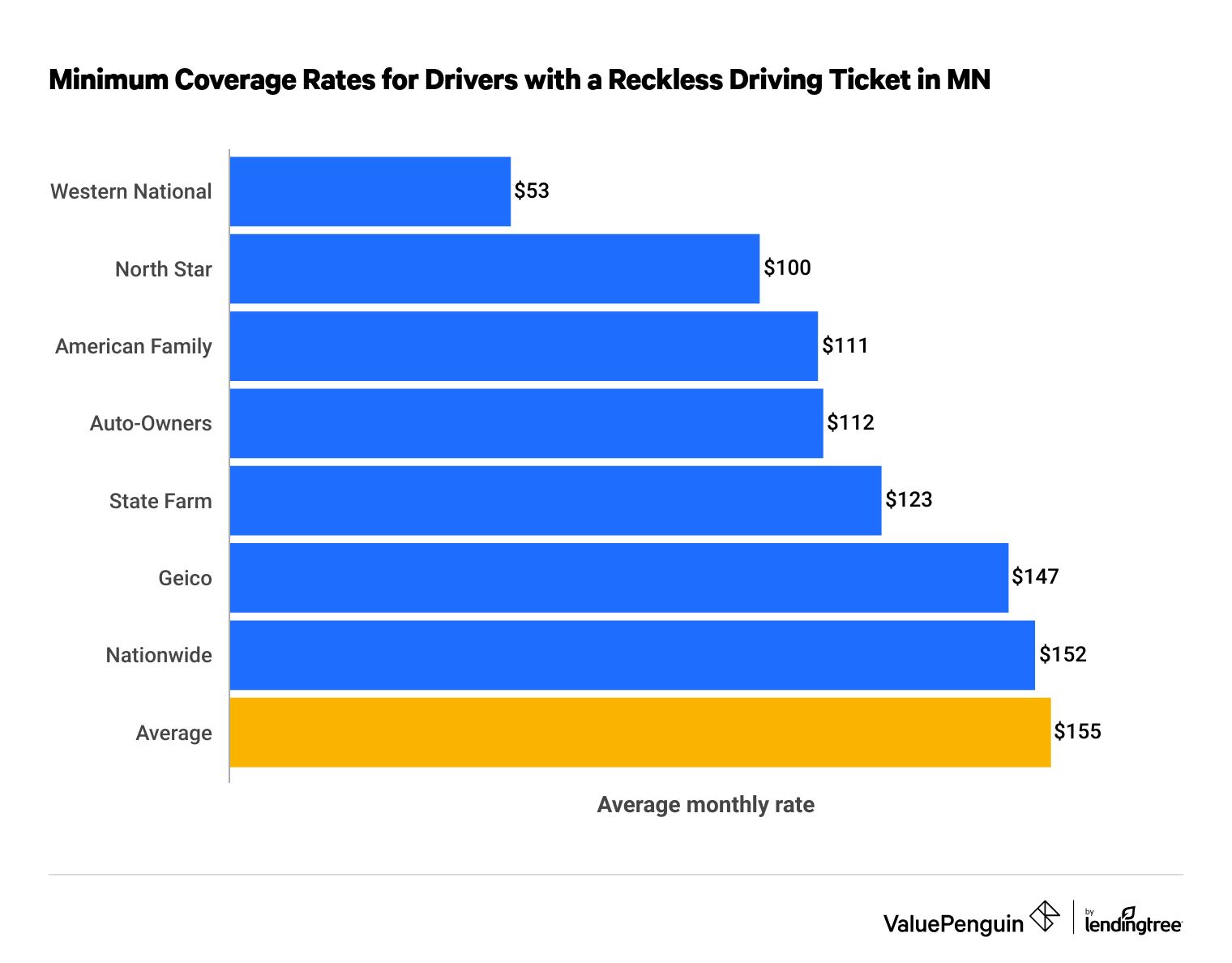

Western National has the cheapest minimum coverage rates for drivers who have to file proof of insurance after a DUI or reckless driving conviction. These violations both require an insurance certification and have a big impact on your rates. A minimum coverage policy from Western National costs $53 per month, which is three times cheaper than average in Minnesota.

Monthly insurance certification rates in Minnesota

DUI/DWI

Reckless driving

Find Cheap SR-22 Auto Insurance Quotes in MN

Minnesota drivers with a DUI can also find affordable rates with American Family, Auto-Owners and State Farm. A minimum coverage policy from these companies is 24% to 31% cheaper than average.

Cheapest SR-22 rates after DUI

Company | Monthly rate | |

|---|---|---|

| Western National | $53 |

| American Family | $111 | |

| Auto-Owners | $112 | |

| State Farm | $123 | |

| North Star | $137 |

*USAA auto insurance is only available to military members, veterans and their families.

DUI/DWI

Find Cheap SR-22 Auto Insurance Quotes in MN

Minnesota drivers with a DUI can also find affordable rates with American Family, Auto-Owners and State Farm. A minimum coverage policy from these companies is 24% to 31% cheaper than average.

Cheapest SR-22 rates after DUI

Company | Monthly rate | |

|---|---|---|

| Western National | $53 |

| American Family | $111 | |

| Auto-Owners | $112 | |

| State Farm | $123 | |

| North Star | $137 |

*USAA auto insurance is only available to military members, veterans and their families.

Reckless driving

Find Cheap SR-22 Auto Insurance Quotes in MN

Western National offers the cheapest minimum coverage rates after a reckless driving conviction, at $53 per month. Rates from USAA are even more affordable at $47 per month, but only military members, veterans and their families can buy USAA insurance.

Cheapest SR-22 rates after reckless driving

Company | Monthly rate | |

|---|---|---|

| Western National | $53 |

| North Star | $100 |

| American Family | $111 | |

| Auto-Owners | $112 | |

| State Farm | $123 |

*USAA car insurance is only available to members of the military, veterans and their families.

Each car insurance company calculates rates differently. It's important to compare car insurance quotes from multiple companies to find the best Minnesota car insurance for you.

Do I need SR-22 insurance in Minnesota?

Minnesota requires drivers with serious violations to submit an insurance certification, which is similar to an SR-22 filing in other states.

Drivers may be required to file the certification for a range of incidents behind the wheel.

If you don't own a car, you're still required to file a certificate of insurance to have your license reinstated. This means you'll need to purchase a non-owner insurance policy, which protects you if you get in an accident while driving a car you don't own.

How long do I need SR-22 insurance in MN?

Minnesota only requires drivers to have an insurance certification on file for one year after having a license reinstated, or getting a citation for driving without insurance.

After one year, you can contact your insurance company and ask them to remove the filing.

However, most insurance companies raise rates for three to five years after a DUI or reckless driving conviction, so you might not see your rates go down just because you no longer need an insurance certification.

How to get an SR-22 insurance certification in Minnesota

If you're required to have proof of insurance on file with the Minnesota DVS, you'll need to ask your insurance company to fill out the Minnesota insurance certification form and submit it to the Commissioner of Public Safety. Once the form has been processed, your license can be reinstated.

Before you can drive legally, you'll usually have to pay a license reinstatement fee, which varies depending on your violation.

Drivers who lose their license after a DUI or DWI can expect to pay $680 to have a license reinstated. Minnesota only charges between $20 to $30 to reinstate your license after other offenses.

What is Minnesota SR-22 insurance?

Minnesota's version of SR-22 insurance is called a certificate of insurance. The certification is a form filed by your insurance company that confirms your policy meets the minimum coverage required by law in Minnesota.

The minimum liability coverage requirements in Minnesota are:

- Bodily injury liability: $30,000 per person and $60,000 per accident

- Property damage liabilit:y $10,000 per accident

- Personal injury protection (PIP): $40,000 per accident

- Uninsured/underinsured motorist coverage: $25,000 per person/$50,000 per accident

Frequently asked questions

Is SR-22 required in Minnesota?

Minnesota doesn't require SR-22 insurance, but drivers with serious violations on their records may need to file an insurance certification. This form is submitted by your insurance company, and acts as proof that you have the minimum amount of coverage required by law in Minnesota.

How do I get my SR-22 removed in Minnesota?

After you've had a certificate of insurance (Minnesota's version of an SR-22) for one year, you can call your car insurance company and ask them to remove it.

Who has the cheapest SR-22 insurance in Minnesota?

Western National has the cheapest rates for drivers that need to file an insurance certification after a DUI or reckless driving conviction. A minimum coverage policy from Western National costs $53 per month, which is three times cheaper than average.

How can I get a proof of insurance certificate in MN?

The Minnesota insurance certification form can be found online. This form will need to be filled out by your insurance company and mailed or faxed to the Minnesota Department of Public Safety Driver and Vehicle Services.

Methodology

To find the best rates for Minnesota drivers with a certificate of insurance, we compared quotes from the largest insurance companies in the state across every residential ZIP code. Rates are for a 30-year-old-man with good credit who drives a 2015 Honda Civic EX.

Quotes are based on a policy with the minimum liability limits required in Minnesota.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.