How Does a DUI Affect Your Auto Insurance Rates?

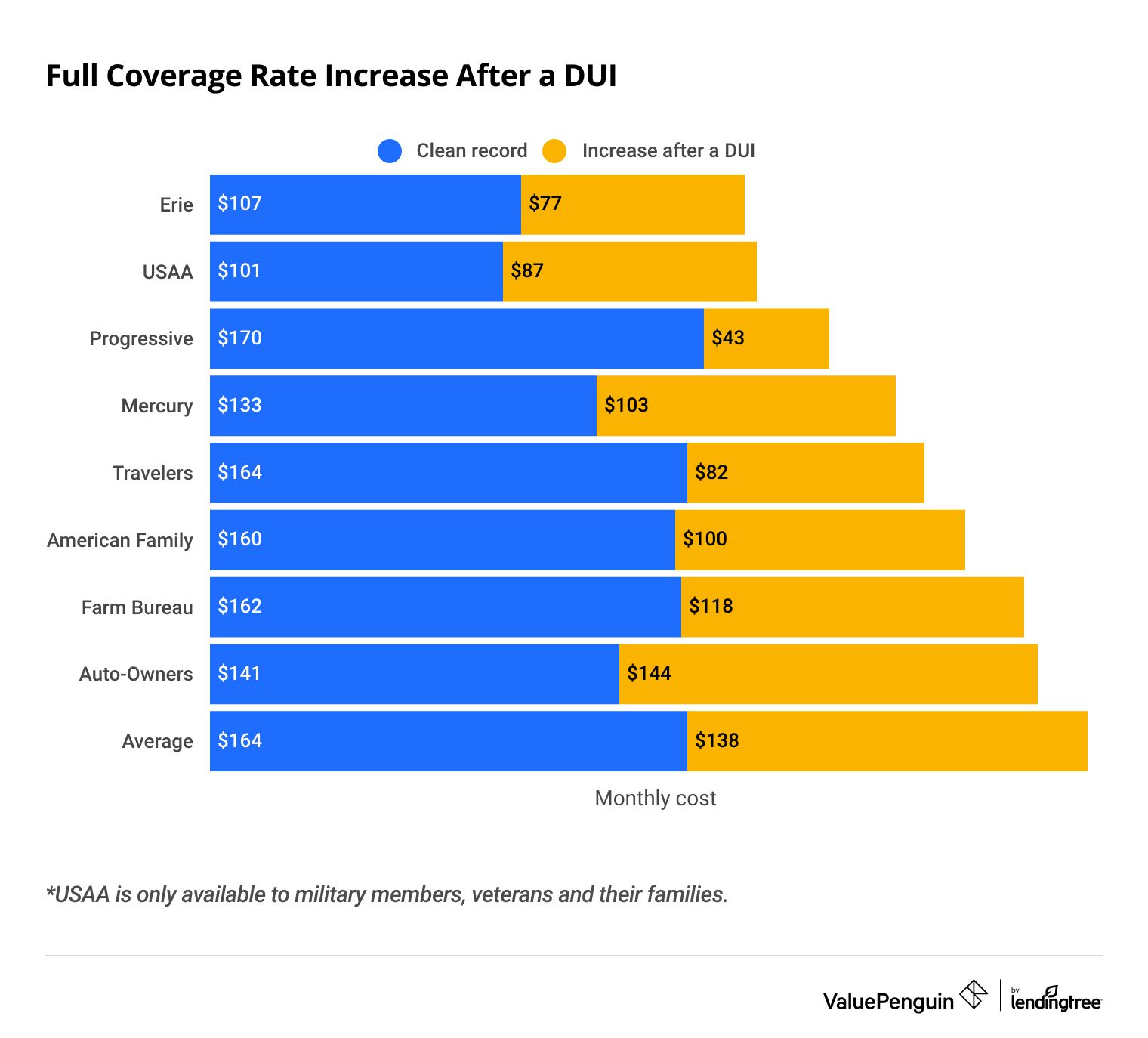

A DUI will raise your car insurance rates by around 84%. That's an average increase of $138 per month for full coverage insurance.

Drunk driving can affect your rates for several years, up to five in some states. Car insurance is more expensive after a DUI because insurance companies believe you're more likely to file a claim in the future.

Your state's DMV will tell your insurance company when you get a DUI, DWI or DWAI. So, it's a good idea to contact your insurance company in advance so you can file an SR-22 form and get back to driving.

Find Cheap Auto Insurance Quotes after a DUI

How much does insurance go up after a DUI?

A DUI increases the price of full coverage car insurance by $138 per month, on average.

The average cost of DUI insurance is $302 per month for a full coverage policy. That's 84% more than drivers with a clean record pay for the same coverage.

Some companies increase rates after a DUI more than others. Progressive's rates only increase by $43 per month, while State Farm's rise by $243, on average.

Find Cheap Auto Insurance Quotes after a DUI

The cheapest company nationwide may not have the best DUI insurance in your area. For example, Travelers is cheaper than Progressive in six states.

And smaller regional companies, like Erie, Mercury and Auto-Owners, tend to have more affordable rates.

DUI car insurance rates by state

How long does a DUI stay on your record?

A drunk driving ticket can stay on your driving record for five to 10 years, and in some cases longer. But it likely won't impact your rates for that long.

A DUI typically affects your insurance for three to five years, depending on the state you live in.

And you may need to keep an SR-22 form on file for three to five years.

Three years after the DUI, your rates may return to their normal levels, depending on your insurance company. It's a good idea to shop for new rates at this point.

Which states have the highest DUI car insurance rates?

Michigan already has the highest car insurance rates in the country. So, it's no surprise that Michigan has the most expensive rates after a DUI, at $727 per month for full coverage. That's nearly double the cost of insurance for Michigan drivers with a clean record.

North Carolina car insurance rates are nearly four times higher after one DUI. That's the largest increase in the country.

In six states and the Washington, DC, a single DUI more than doubles the price of car insurance. In North Carolina and Hawaii, a drunk driving ticket triples insurance rates.

Full coverage DUI insurance rates by state

State | Clean record | DUI rate | Increase |

|---|---|---|---|

| Alabama | $165 | $261 | 58% |

| Alaska | $136 | $228 | 68% |

| Arizona | $224 | $359 | 60% |

| Arkansas | $157 | $264 | 68% |

| California | $156 | $428 | 174% |

Other factors that affect your auto insurance after a DUI

A wide range of factors affects your rates after a DUI. Where you live plays a big part, as do age, gender, insurance company and how recently you got a ticket.

Age: Car insurance companies generally consider younger drivers riskier to insure. That's because they have less experience behind the wheel. So, age plays a big role in how much your rates increase after a DUI. For example, insurance for an 18-year-old with a DUI costs an average of 47% more than coverage for an older driver.

Time since conviction: The amount of time since your most recent DUI also affects your rates. Insurance companies generally consider the past three to five years of driving history to calculate your DUI insurance quote.

Number of DUIs: The number of DUIs you've had in the past three years also affects your rates. A 30-year-old with four DUIs can expect full coverage rates to be 52% more expensive than rates for someone with one DUI.

Companies: Every insurance company considers different factors when setting rates. For that reason, the cheapest company after a DUI may not be the same for every driver. Comparing quotes from multiple companies can help ensure you get the cheapest car insurance rates after a DUI.

How do insurance companies find out about a DUI?

Insurance companies typically check your driving record when you renew your policy. They do this to decide what your new quote will be. Your record will show any recent DUIs.

Your DMV may also tell your insurance company about your DUI before your next renewal.

The best thing you can do is be honest with your insurance company. You may also need to ask your company to file an SR-22 or FR-44 form.

This form is required in 42 states and the Washington, DC. It proves to the DMV that your insurance limits are high enough to meet the state requirement. You'll need it to keep your license after a major traffic incident like a DUI.

When you ask your insurance company to file an SR-22 or FR-44 form, you will need to pay a fee of around $15 to $50. You may need to keep the form on file for three to five years, depending on your state.

Some insurance companies won't file an SR-22 or FR-44 for you. And if you have a lot of tickets or accidents on your record, your insurance company may cancel your policy. If that happens, you might need to turn to a high-risk car insurance company. You can expect to pay even higher car insurance rates with these providers.

Not telling your insurance company about a DUI will not prevent your rate from going up. And your insurance company may drop your policy entirely.

Frequently asked questions

How much does a DUI raise insurance?

Insurance rates go up by an average of 84% after a DUI. However, that percentage varies widely by company and by state. In North Carolina, a DUI more than triples the price of insurance. On the other hand, a DUI in Pennsylvania causes an increase of only 45% .

How much is DUI insurance per month?

A full coverage policy after a DUI costs $302 per month, on average. Your rate may be different depending on where you live, your driving history, the coverage you choose and other factors.

How long does a DUI affect your insurance?

A DUI will typically affect your insurance rates for three to five years. However, the length of time varies by state and insurance company.

In California, a DUI stays on your record for 10 years. And you aren't eligible for a good driver discount throughout that time period.

Methodology

To find average insurance rates after a DUI, ValuePenguin gathered millions of quotes from every ZIP code in the United States. Quotes are for a 30-year-old man with a 2015 Honda Civic and good credit, one DUI and no other tickets or accidents on his record.

Rates are for a full coverage policy with higher liability limits than required in each state, along with comprehensive and collision coverage.

- Bodily injury liability:$50,000 per person; $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person; $100,000 per accident

- Comprehensive and collision: $500 deductible

Rates for 18-year-olds and multiple DUIs were from the five largest states in the country.

Quadrant Information Services was used to compile the insurance rate data for the analysis. The data is publicly sourced from insurance company filings. Rates should be used for comparative purposes only. Your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.