How a Traffic Violation Affects Car Insurance Premiums

Traffic violations can result in hefty fines or legal fees, but they can also cost you in the form of car insurance rate hikes.

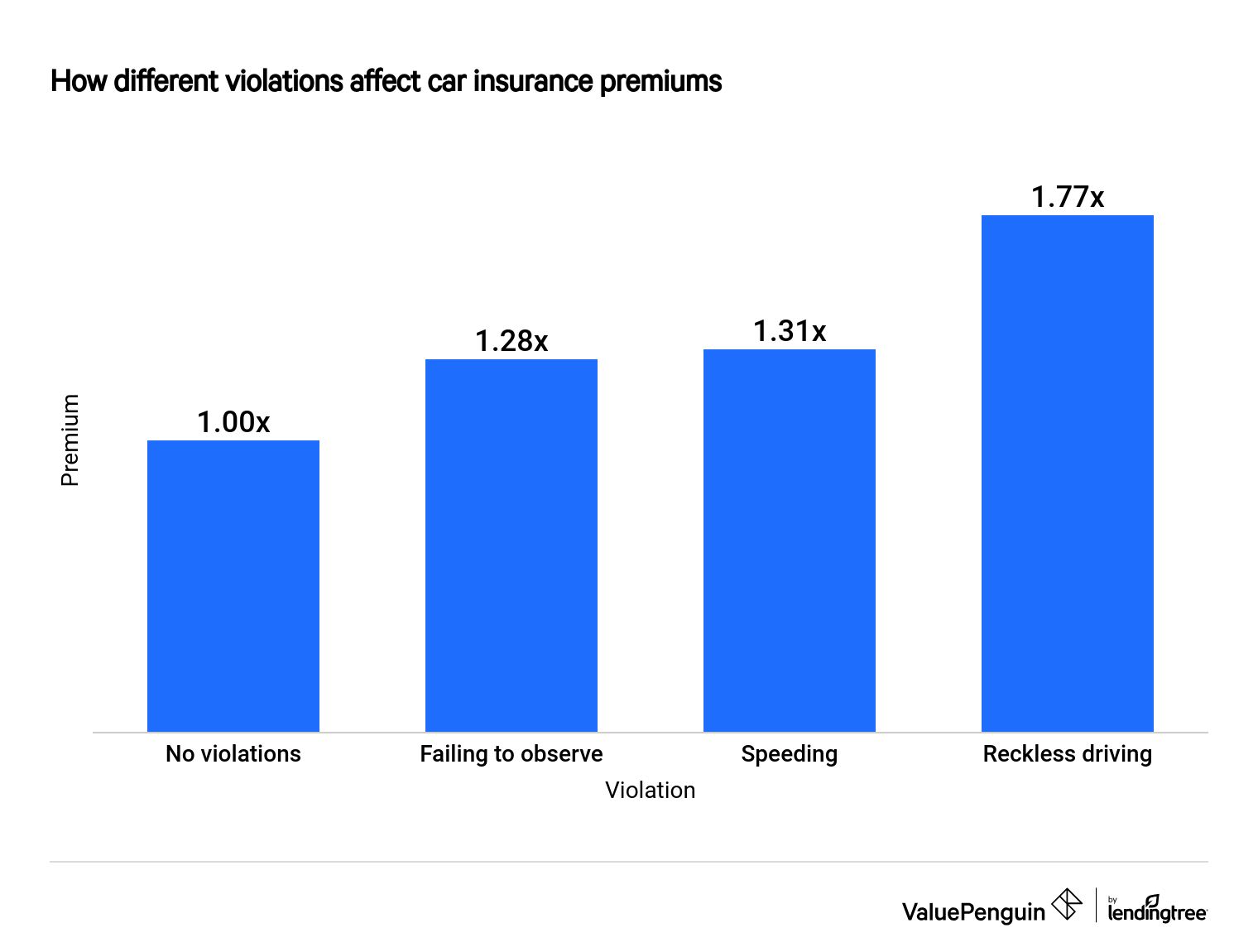

For example, a reckless driving ticket, on average, adds 77 cents per dollar to your current car insurance rates. While other common violations may not bring as much of an increase, they will influence your car insurance quotes.

Find Cheap Auto Insurance Quotes in Your Area

How much a traffic violation can affect your rates

We looked into these common traffic tickets:

- Failure to observe a sign or signal

- Speeding

- Reckless driving

Find Cheap Auto Insurance Quotes in Your Area

When analyzing a standard driver profile, we discovered an increase in their current car insurance rate of 28 cents per dollar for failing to observe a sign or signal. Speeding came in slightly higher, at 31 cents per dollar. A reckless driving ticket added 77 cents, on average.

So, if your car insurance typically costs $1,000 a year, it would increase to:

- $1,280 after a failure-to-observe violation

- $1,310 after a speeding violation

- $1,770 after a reckless driving violation

How your age and insurer can play role in your quotes after a traffic violation

Several factors influence how a traffic ticket affects your insurance quotes. For one, speeding and failure-to-observe violations are considered minor, while reckless driving is major and weighs heavier on your rates. But there are other factors.

Rates by age

Your age can influence how severely you're punished with higher insurance rates after a ticket. Older drivers get penalized the most, while younger drivers — in this example, 18-year-olds — get penalized the least. Minor tickets tend to come with smaller penalties for all age groups, while reckless driving has a heavier penalty overall.

Drivers who are 74 years old see their car insurance rates increase 1.81 times, on average, after a reckless driving ticket.

Age | Ran a light or sign | Speeding | Reckless driving |

|---|---|---|---|

| 18 | 1.09x | 1.20x | 1.34x |

| 30 | 1.16x | 1.30x | 1.73x |

| 74 | 1.20x | 1.44x | 1.81x |

Rate increases are from Geico for Alabama drivers.

Speeding and failure-to-observe violations affect car insurance rates somewhat similarly to each other, since they're considered minor. This comes out to an average of 20 cents (failing to observe) to 44 cents (speeding) extra per dollar for 74-year-olds.

When it comes to 18-year-olds, on the other hand, the change in rates is less — just 9 cents (failing to observe) to 20 cents (speeding) on average.

If you get a reckless driving ticket, you can expect your rates to rise by 34 cents per dollar, on average, if you're 18 or by 81 cents per dollar if you're 74 years old.

Rates by insurance company

Every insurance company has a different way to decide your rate. Nationwide penalized the most for both the minor and major violations. Alfa and USAA penalized the least for minor violations, and Allstate penalized the least for a major violation.

Company | Speeding or other tickets | |

|---|---|---|

| Alfa | 1.08x-1.50x | |

| Allstate | 1.13x-1.38x | |

| Nationwide | 1.15x-1.63x | |

| USAA | 1.08x-1.42x |

This isn't to say that, for example, USAA is the best auto insurance company for people with minor infractions. These are just the differences compared to the rate you were getting before a ticket.

Where it gets tricky is whether your base rate — with no tickets — is better at Alfa, Allstate, Nationwide, USAA or another insurance company. That's why it's always in your best interest to compare multiple quotes to find the most affordable rates for your coverage.

How to prevent further car insurance rate increases

If you do find yourself on the wrong end of a ticket, you'll want to try to avoid further violations by driving carefully and legally.

If you think it's likely you'll get another ticket, then shopping around for a new insurance policy could help keep expenses down. Some insurers penalize drivers less than others after a ticket. However, insurance companies are likely to offer the best rates to people who keep clean driving records, so shopping by penalty amount probably won't get you their best rate. It's more about minimizing the rate increase.

Methodology

Rates were pulled for companies in four states: Alabama, Massachusetts, Minnesota and Missouri.

Our sample driver was a single, 30-year-old man driving a 2015 Honda Civic EX. Unless noted, rates were for this driver, who had a below-average credit score and was quoted for a minimum-coverage policy. Our analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only; your own quotes may be different.

Senior Insurance Analyst

Mark is a former Senior Research Analyst for ValuePenguin focusing on the insurance industry, primarily auto insurance. He previously worked in financial risk management at State Street Corporation.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.