Best Cheap SR-22 Insurance Rates in South Carolina

Find Cheap SR-22 Auto Insurance Quotes in South Carolina

If you’re a driver in South Carolina and have a serious ticket (like driving under the influence) or have had your license suspended, you may be required to get SR-22 insurance. An SR-22 insurance policy is simply an auto insurance policy that meets the South Carolina minimum liability requirements. The insurer sends an SR-22 form of financial responsibility to the state on your behalf.

SR-22 insurance rates are often much higher, though this is primarily due to the conviction that required you to get an SR-22. The filing fee charged by insurers is usually less than $50.

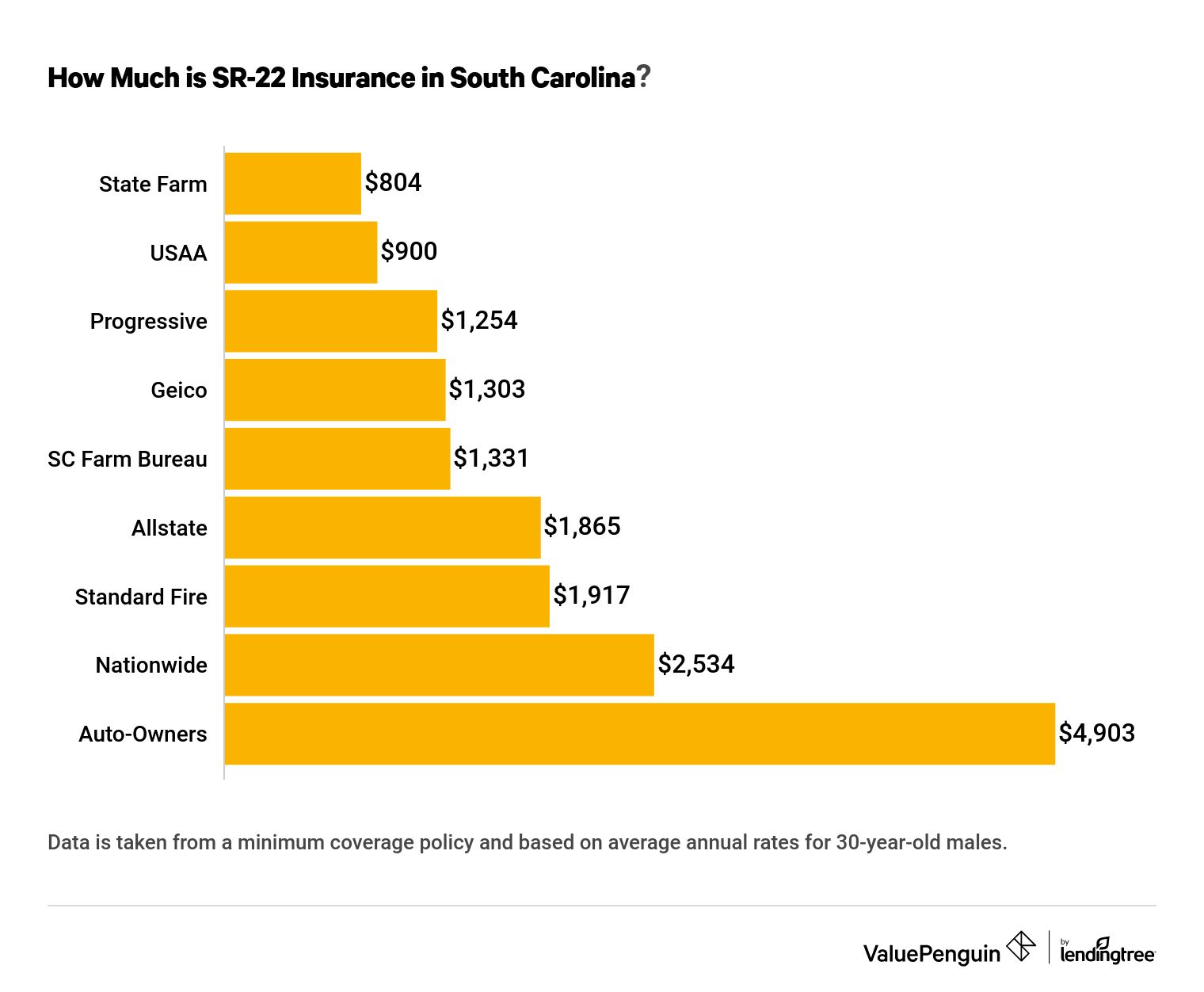

Cost of SR-22 insurance in South Carolina

The cost of SR-22 insurance in South Carolina will generally be higher than that of a standard auto insurance policy. This is primarily because the violations that lead to an SR-22 requirement also cause insurers to see you as a high-risk driver.

Among the insurers we looked at in South Carolina, USAA offered the lowest prices for SR-22 coverage, with an average of $468 per year. Travelers had the smallest percentage increase of 26% for SR-22 drivers. On the other hand, Auto-Owners' rates increased by 268% for a driver who needed SR-22 coverage.

Find Cheap SR-22 Auto Insurance Quotes in South Carolina

The table below gives a comparison of various insurer quotes for a 30-year-old male with and without an SR-22 filing. The drastic difference in percentage increase for each insurer suggests that shopping for multiple quotes will help you find the cheapest and most comprehensive option.

Average annual cost of SR-22 in South Carolina by company

Insurer | SR-22 and DUI rate | Cost increase after DUI | |

|---|---|---|---|

| State Farm | $804 | 62.42% | |

| USAA | $900 | 92.31% | |

| Progressive | $1,254 | 65.87% | |

| Geico | $1,303 | 154.99% | |

| SC Farm Bureau | $1,331 | 60.55% | |

| Allstate | $1,865 | 119.93% | |

| Standard Fire (Travelers) | $1,917 | 26.20% | |

| Nationwide | $2,534 | 77.70% | |

| Auto-Owners | $4,903 | 268.09% |

To get the cheapest SR-22 insurance in South Carolina, we recommend you compare quotes from at least three different insurers.

How to get SR-22 insurance in South Carolina

The SR-22 form acts as proof to the South Carolina Department of Motor Vehicles (DMV) that you carry the liability insurance coverage required by state law:

- $25,000 bodily injury (BI) coverage per person injured in an accident

- $50,000 BI coverage per accident

- $25,000 property damage coverage

Here are the steps you'll need to take to get SR-22 coverage in South Carolina:

Find an eligible insurer or contact your current carrier. You aren't allowed to file an SR-22 yourself, so an auto insurance company licensed to do business in South Carolina needs to do it on your behalf. Even if you move out of the state, you'll need to get coverage from an insurer that also writes policies in South Carolina to get your SR-22 filing and driving privileges.

Pay the appropriate SR-22 fee. Your insurance company will likely charge a filing fee from $15 to $50 for filing the SR-22 form on your behalf.

Have your insurer file proof of insurance. Once your insurer has submitted the SR-22 form, the DMV will send you a letter confirming it. Then you'll be able to drive legally again, assuming any other terms of your conviction have been met.

Maintain coverage. In South Carolina, drivers are usually required to have SR-22 insurance for three years, though this could be longer depending on your conviction.

Your insurer is required to submit an SR-26 form notifying the South Carolina DMV if you cancel or fail to renew your policy.

If your SR-22 insurance lapses, you’ll lose your driving privileges again. You may also have to pay a fine to regain them, and your cost of insurance will likely increase due to the lapse in coverage.

We recommend you renew your policy at least one month in advance for the period you're required to carry SR-22 insurance to avoid any gaps in coverage and the accompanying fees.

If you intend to change insurers, you should buy a policy and get confirmation that your new insurer filed an SR-22 before terminating your existing coverage.

After you've carried SR-22 insurance for at least three years, contact the South Carolina DMV or a local licensing office to confirm that the requirement is completed. Once this is confirmed, notify your insurer that the form no longer needs to be filed on your behalf.

When would you be required to get SR-22 insurance in South Carolina?

Drivers in South Carolina may be required by the court to get SR-22 insurance to reinstate their license or driving privileges if they've been revoked. This can occur for a number of reasons:

- You were convicted multiple times of driving without insurance.

- You’re required to be on mandatory insurance supervision.

- You were involved in an accident and failed to fully pay for damages for which the court determined you were responsible.

- Your license was suspended due to unsatisfied judgments.

- Your license was revoked or restricted.

- You were convicted of a DUI. If it's your first DUI offense in South Carolina, you may be required to carry a provisional license for several months, during which you'll also need to have SR-22 insurance to drive legally.

If you're uncertain about the status of your license, you can check if it has been suspended in South Carolina by going to the DMV's website. The DMV provides a driving record search, and you can determine if your license is suspended by entering your driver's license number, Social Security number and birthdate.

Non-owner SR-22 insurance in South Carolina

If you don't own a car, you'll still be required to carry SR-22 insurance in South Carolina to reinstate suspended driving privileges. But, instead of a traditional auto insurance policy, you can add an SR-22 filing to a non-owner car insurance policy.

Non-owner SR-22 insurance is generally cheaper than owner's or operator's coverage. This is because the insurer expects you'll drive less often than a vehicle owner.

Note that you won't be able to get a non-owner policy if you have regular access to a car, even if you don't own it. You'll need to get a standard SR-22 insurance policy instead.