Branch Auto and Home Insurance Review

Branch insurance offers slightly cheaper-than-average rates on home and auto insurance, but it is not widely available.

Find Cheap Auto Insurance Quotes in Your Area

Branch is a young company that offers good rates for home and auto insurance. It offers both homeshare and rideshare coverages, but it does not have a particularly broad range of coverage options.

Branch makes a point of advertising itself as a "community" organization, with price breaks for customers who invite friends to get quotes and policies. Branch is available in about half the US, although another insurer, General Security National, underwrites policies in five of them.

Pros and cons

Pros

Offers rideshare and homeshare coverage

Large discount for bundling policies

Cons

Only available in about half of the U.S.

Not the cheapest option

Unproven customer service

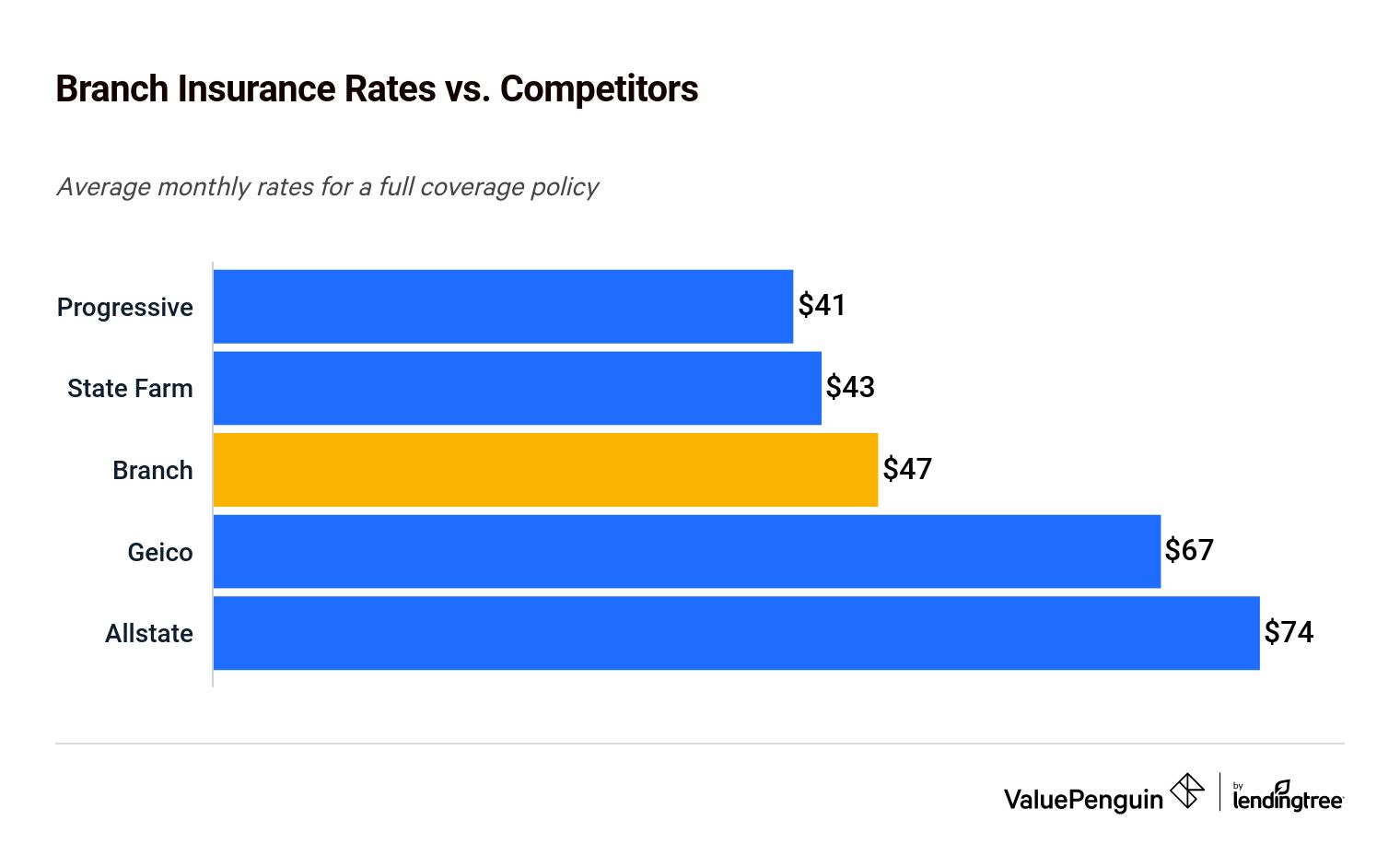

Branch car insurance quotes

Branch's auto insurance rates are a bit cheaper than average, based on ValuePenguin analysis, which included quotes from some of the largest insurers in the country. That makes Branch a competitive option in terms of price, but not the cheapest option.

We found a sample driver would pay $568 a year for a full-coverage policy for an 2008 car in Ohio. That’s cheaper than Geico and Allstate, but more expensive than State Farm and Progressive.

Find Cheap Auto Insurance Quotes in Your Area

Branch car insurance annual cost vs. competitors

Company | Annual rate |

|---|---|

| Progressive | $486 |

| State Farm | $516 |

| Branch | $568 |

| Geico | $802 |

| Allstate | $892 |

Quotes for a 2008 Chevy Malibu.

Branch will not provide an online insurance quote unless your name and address match a database the company uses. However, it can match your vehicles to your address and provide a custom quote without you having to enter much information. If your data does not match, you can reach out to the company directly by phone.

Branch car insurance coverages and discounts

Branch offers standard auto insurance coverages like liability, comprehensive and collision, plus a few other notable protections. One that stands out is rideshare coverage, something that's not usually a standard offering.

When a driver works for Uber or Lyft, the rideshare company covers them when actually giving rides to customers. Branch extends coverage to include when you are driving to make a pickup and waiting for a passenger. Other Branch coverages include:

- Roadside assistance

- Up to $60 per day for a rental car after an accident

- Gap coverage

Branch automatically applies discounts when you get a quote online. We looked at one of the company's rate filings and found the company offers a variety of discounts, including:

- Affinity discounts for members of some organizations

- Multipolicy discount

- My Community discount, for members who invite others to get a quote

- Senior citizens discount

- Smart technology discount

- Three-year safe driving discount

- Five years claims-free discount

Bundling discount with home and auto policies reduced the price of home insurance by 17%. The process of bundling policies takes only a few clicks to get a quote.

Branch also offers a telematics program called Community Drive. Drivers automatically receive a 2% discount for enrolling and can save up to 20% on their annual rates with safe driving.

Branch recently partnered with Nextbase Dash Cams to offer drivers an additional discount. Branch policyholders receive a 10% discount on new dash cam purchases from Nextbase. Once installed, drivers can save 8% on their car insurance premium.

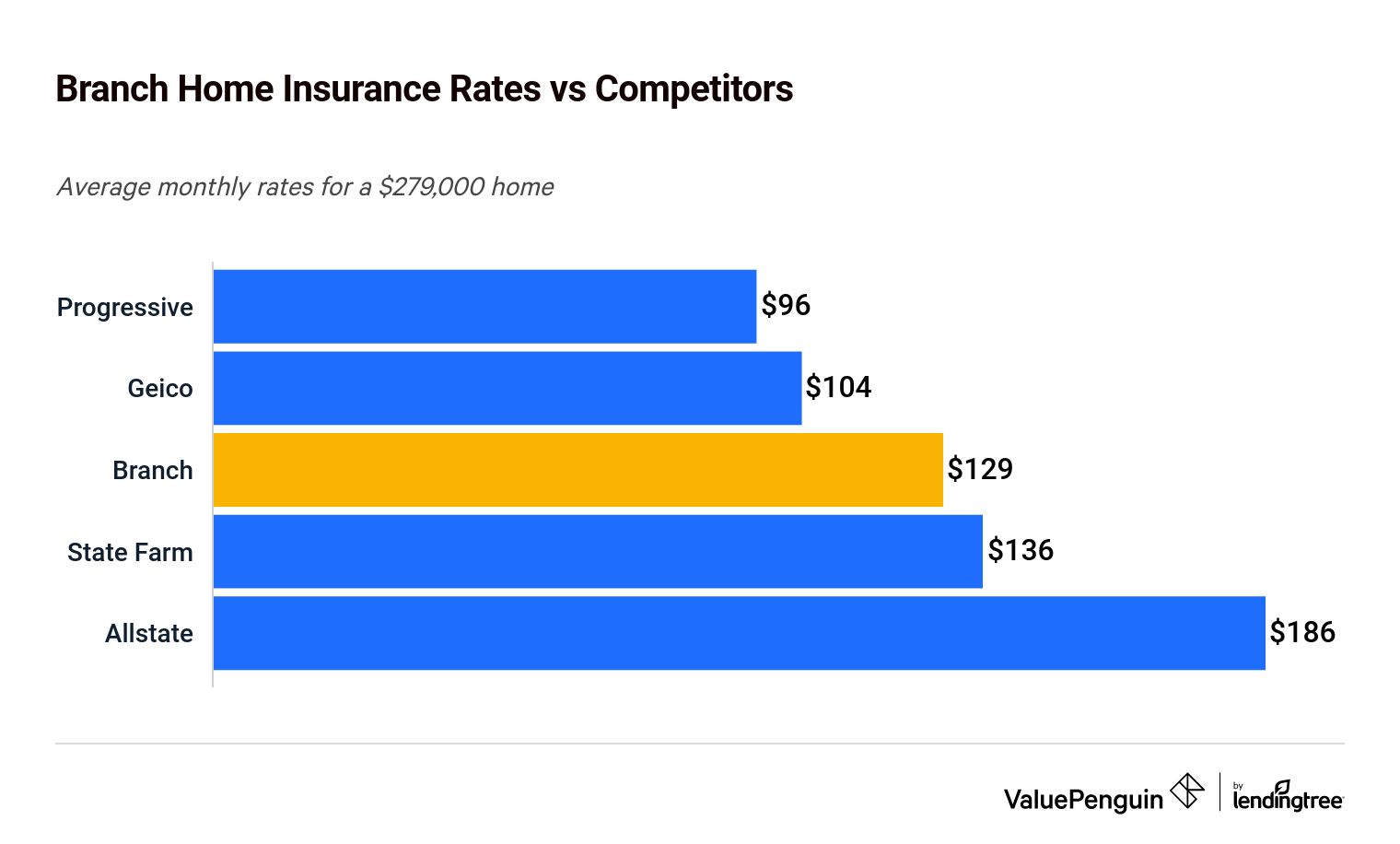

Branch home insurance rates

Branch homeowners insurance rates are competitive with some of the largest insurers in the country. The sample rates were not the lowest we found, but they were a bit cheaper than average.

The sample quote we collected from Branch came in at less than State Farm or Allstate, but more expensive than Geico or Progressive.

Find Cheap Homeowners Insurance Quotes in Your Area

Branch home insurance annual cost vs. competitors

Company | Annual rate |

|---|---|

| Progressive | $1,152 |

| Geico | $1,244 |

| Branch | $1,547 |

| State Farm | $1,627 |

| Allstate | $2,233 |

Branch home insurance coverages

Branch offers all of the basic options for home insurance coverage, plus a few extras. One standout feature is homeshare coverage, which adds more protection for those who participate in programs like Airbnb and Vrbo.

Branch also offers up to $50,000 in water backup damage coverage, although the higher limits are paired with higher deductibles. Home coverage options the company offers include:

- Liability protection

- Physical structure, with incremental coverage

- Emergency living expenses

- Personal property coverage

- Guest medical coverage

- Water backup coverage

- Building code coverage

- Roof surfaces extended coverage

- Homeshare coverage

- Extra coverage for jewelry or sports equipment

Customers can get discounts if they have a monitored home security system or if they inventory their property after getting a policy.

Other Branch insurance products

Branch offers a range of products beyond just home and auto insurance, in some cases through partner companies. These include:

- Umbrella insurance

- Renters insurance

- Boat insurance

- Condo insurance

- ATV insurance

Branch insurance customer service reviews and ratings

As a company that only started writing premiums in 2020, Branch does not have much of a history to review when it comes to customer service, but that means there are no negative marks. However, in some states, Branch sells policies from General Security National Insurance Company, which has a strong reputation.

Agency | Rating |

|---|---|

| NAIC Complaint Index | 0.00 |

| Demotech | A (Exceptional) |

| AM Best (for General Security National) | A+ (Superior) |

In 2020, Branch had a Complaint Index rating of 0.00 from the National Association of Insurance Commissioners (NAIC), meaning it received no complaints. General Security National also has not received any complaints in the past three years.

In terms of financial stability, Branch has an "A" rating from Demotech, which is considered "exceptional". This matters when it comes to the company’s ability to pay out claims after a major catastrophe.

There have also been no complaints against Branch made to the Better Business Bureau, though a few of the company's reviews mention issues with claims.

Where is Branch insurance available?

Branch sells insurance in about half the US.

Branch is a reciprocal insurance company, which means the company is technically owned by policyholders, but managed by a separate entity. This structure is similar to some other major insurers, like USAA, Farmers and AAA.

Methodology

ValuePenguin's analysis used a sample driver in a suburb of Columbus, Ohio, with a 2008 Chevy Malibu 1LT. The driver is a single 26-year-old man. Coverage limits were as follows:

Coverage | Limits |

|---|---|

| Bodily injury liability | $100,000 per person/$300,000 per accident |

| Property damage liability | $100,000 per accident |

| Uninsured/underinsured motorist bodily injury | $100,000 per person/$300,000 per accident |

| Comprehensive and collision | $500 deductible |

Homeowners quotes were for a $279,300 home in Reynoldsburg, Ohio, just outside Columbus. Policies included dwelling coverage, $100,000 in liability coverage and $200,000 in personal property coverage.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.