Cheap Car Insurance Quotes in Kentucky (2025)

Kentucky Farm Bureau has the best cheap car insurance in Kentucky, at $141 per month for full coverage.

Find Cheap Auto Insurance Quotes in Kentucky

Best cheap auto insurance in KY

How we chose the top companies

Best and cheapest car insurance in Kentucky

- Cheapest full coverage: Farm Bureau, $141/mo

- Cheapest minimum liability: Farm Bureau, $42/mo

- Cheapest for young drivers: Farm Bureau, $117/mo

- Cheapest after a ticket: Farm Bureau, $141/mo

- Cheapest after an accident: Farm Bureau, $141/mo

- Cheapest for teens after a ticket: State Farm, $64/mo Farm Bureau, $117/mo

- Cheapest after a DUI: Travelers, $225/mo

- Cheapest for poor credit: Travelers, $298/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Farm Bureau, State Farm and Auto-Owners all have reliable customer service and cheaper-than-average rates.

State Farm is the best choice for Kentucky drivers looking to get a quick online quote. Neither Farm Bureau nor Auto-Owners offers online quotes, so you'll need to work with a local agent to compare rates.

Travelers also has affordable rates, but its customer service is lacking. That means Travelers may take longer to get your life back to normal after a crash.

Cheapest auto insurance in Kentucky: Farm Bureau

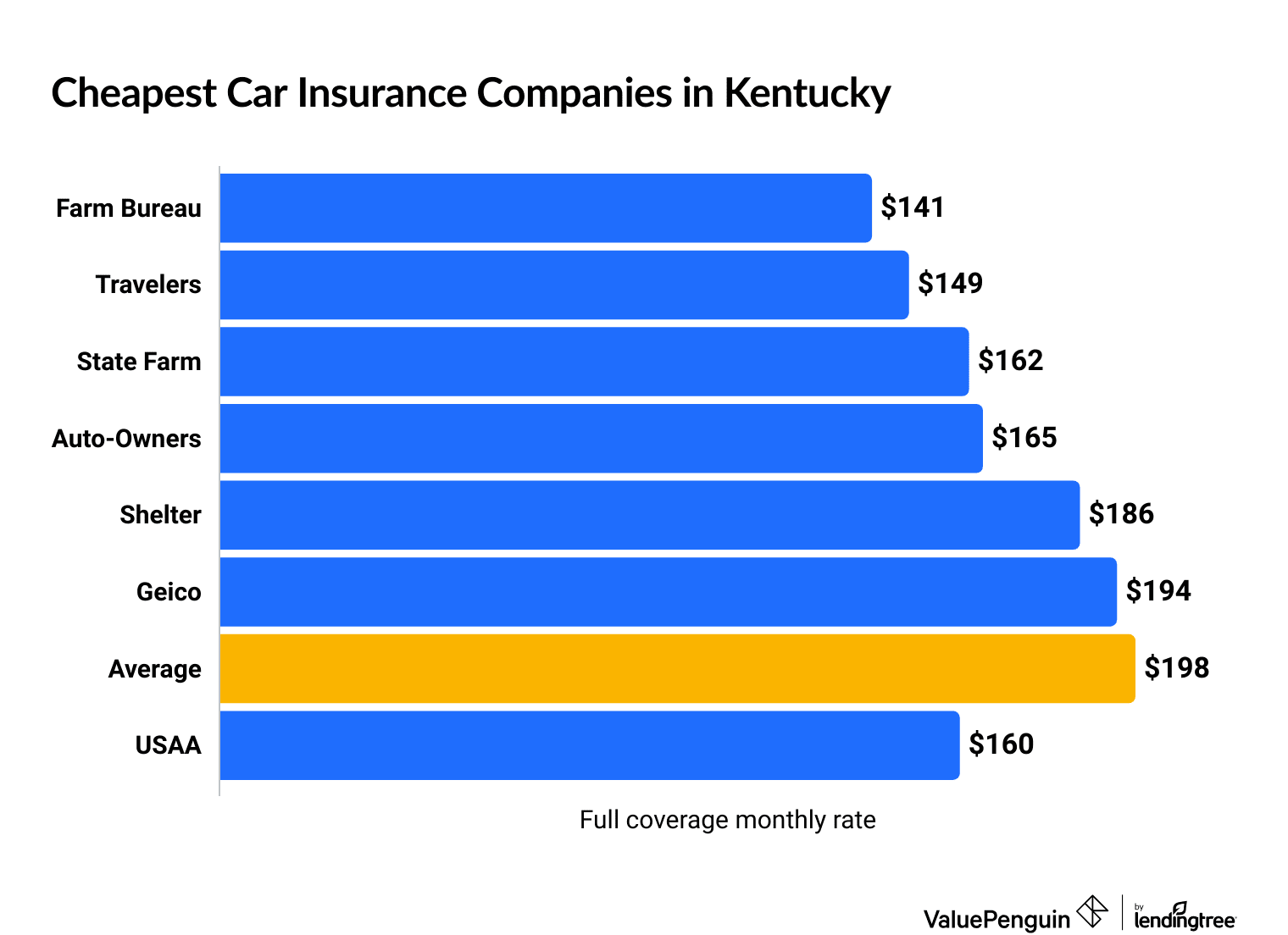

Kentucky Farm Bureau offers the cheapest full coverage auto insurance in the state.

At $141 per month, Farm Bureau's price is $57 per month less than the Kentucky average.

Find Cheap Auto Insurance Quotes in Kentucky

The average cost of car insurance in Kentucky is $198 per month for full coverage. That's $23 per month more expensive than the national average.

This is partially because Kentucky is a no-fault state, and those tend to have more expensive rates. Kentucky also has more car accidents than many other states.

Cheapest full coverage car insurance in Kentucky

Company | Monthly rate | |

|---|---|---|

| Farm Bureau | $141 | |

| Travelers | $149 | |

| State Farm | $162 | |

| Auto-Owners | $165 | |

| Shelter | $186 |

*USAA is only available to current and former military members and their families.

Cheapest KY liability insurance quotes: Farm Bureau

Kentucky Farm Bureau car insurance is the cheapest option for liability-only insurance, at $42 per month.

That's nearly half the state average of $82 per month. However, you can't compare quotes from Farm Bureau online. You'll have to contact an agent to get a quote.

State Farm has the most affordable online quotes. A minimum liability policy from State Farm costs $57 per month.

Cheapest KY state minimum auto insurance

Company | Monthly rate |

|---|---|

| Farm Bureau | $42 |

| State Farm | $57 |

| Travelers | $67 |

| Auto-Owners | $75 |

| Geico | $80 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Kentucky

Cheapest KY auto insurance for young drivers: Farm Bureau

Farm Bureau has the most affordable car insurance rates for young drivers in Kentucky.

Minimum liability car insurance from Farm Bureau costs around $117 per month for an 18-year-old driver. That's less than half the state average.

Farm Bureau also has the most affordable full coverage insurance quotes for teens. At $377 per month, it costs $253 per month less than the Kentucky average.

Teens with military ties can get even cheaper rates from USAA. However, only military members, veterans and some of their family members can buy USAA insurance.

Best car insurance in KY for teen drivers

Company | Liability only | Full coverage |

|---|---|---|

| Farm Bureau | $117 | $377 |

| Travelers | $173 | $383 |

| State Farm | $188 | $455 |

| Shelter | $215 | $460 |

| Auto-Owners | $257 | $500 |

*USAA is only available to current and former military members and their families.

Younger drivers pay much more than older drivers for car insurance because they are more likely to get in an accident. In Kentucky, an 18-year-old driver with a clean record pays three times more for car insurance than a 30-year-old driver.

Young drivers can get a cheaper rate on their insurance by sharing a policy with a parent or relative. Typically, the cost of sharing a policy is much cheaper than buying separate policies.

Cheap insurance in KY after a speeding ticket: Farm Bureau

KY Farm Bureau insurance has the cheapest quotes for Kentucky drivers with a speeding ticket. A full coverage policy from Farm Bureau costs around $141 per month, which is $94 per month less than the Kentucky average. In addition, some drivers may not see a rate increase from the company after one ticket.

Cheap Kentucky car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| Farm Bureau | $141 |

| Auto-Owners | $168 |

| State Farm | $172 |

| Travelers | $194 |

| Shelter | $212 |

*USAA is only available to current and former military members and their families.

The cost of Kentucky car insurance goes up by an average of 18% after a single speeding ticket. That's an average increase of $36 per month for a full coverage policy.

Best auto insurance quotes in KY after an accident: Farm Bureau

Kentucky Farm Bureau has the cheapest quotes for after an accident. The company's average rate of $141 per month for full coverage insurance is less than half the Kentucky average for those with a recent accident. In addition, Farm Bureau may not raise rates for some drivers after their first accident.

Cheap KY car insurance after an accident

Company | Monthly rate |

|---|---|

| Farm Bureau | $141 |

| State Farm | $184 |

| Travelers | $212 |

| Auto-Owners | $227 |

| Shelter | $236 |

*USAA is only available to current and former military members and their families.

Kentucky drivers with a recent accident will see their rates increase by 59%, on average.

Don't rush to switch auto insurance companies right after an accident. Your rates won't go up until your current policy renews. But any quotes you get will include your accident, so they'll probably be more expensive.

Instead, wait until your current company sends your new rates with your renewal paperwork. Then, you should get quotes from multiple companies to find the cheapest price.

Cheapest in KY for teens with a ticket or accident: Farm Bureau

Farm Bureau has the best rates for younger drivers with a recent speeding ticket or an at-fault accident. A minimum liability policy from Farm Bureau costs $117 per month after a ticket and $141 per month after an accident. That's around three times cheaper than the state average.

Cheap quotes in KY for teens with a bad driving record

Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $117 | $141 |

| State Farm | $205 | $226 |

| Travelers | $221 | $250 |

| Shelter | $254 | $290 |

| Auto-Owners | $257 | $368 |

*USAA is only available to current and former military members and their families.

On average, insurance rates increase by 17% for an 18-year-old driver with a speeding ticket in Kentucky, while rates increase by 50% after an accident.

Young drivers who want to save on car insurance rates should consider a driver training course. Insurance companies often give discounts to teens who complete training beyond what's required to get their license.

You may also be able to save on car insurance if you have good grades.

Cheap Kentucky auto insurance quotes after a DUI: Travelers

Travelers has the cheapest car insurance in Kentucky for drivers with a recent DUI. At $225 per month, a full coverage policy from Travelers costs $132 per month less than the average cost statewide.

Drivers with a recent DUI should also consider Shelter, which costs $271 per month. Although it's more expensive than Travelers, Shelter's excellent customer service may be worth the extra cost.

Affordable car insurance after a DUI in Kentucky

Company | Monthly rate |

|---|---|

| Travelers | $225 |

| Shelter | $271 |

| Progressive | $279 |

| Farm Bureau | $329 |

| State Farm | $337 |

*USAA is only available to current and former military members and their families.

A DUI can double your car insurance rates in Kentucky. You may be able to lower your insurance bill by taking a safe driver training course if your insurance company offers a discount.

Cheapest KY car insurance for drivers with poor credit: Travelers

Travelers has the most affordable car insurance quotes for drivers with bad credit in Kentucky, at $298 per month for full coverage. That's $179 per month less than the Kentucky average.

Best Kentucky car insurance quotes for drivers with poor credit

Company | Monthly rate |

|---|---|

| Travelers | $298 |

| Progressive | $350 |

| Geico | $358 |

| Farm Bureau | $431 |

| Auto-Owners | $478 |

*USAA is only available to current and former military members and their families.

Drivers with low credit scores pay nearly two and a half times more for coverage in Kentucky than drivers with good scores. That's because insurance companies believe that people with lower credit scores are more likely to make a claim.

Best car insurance in KY

USAA is the best-rated insurance company in Kentucky, based on its excellent customer service and affordable rates.

However, USAA is only available to military members, veterans and some of their family members.

Farm Bureau and State Farm are the best choices for drivers who aren't eligible for USAA. Both companies offer great customer service and cheaper-than-average quotes.

Top Kentucky auto insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| State Farm | 657 | A++ | |

| Farm Bureau | 673 | A | |

| Shelter | 678 | A | |

| Auto-Owners | 654 | A++ |

Average car insurance rates in Kentucky by city

Fort Thomas, a city on the Ohio River, has the cheapest car insurance in the state.

The average cost of car insurance in Fort Thomas is $151 per month for full coverage.

Goose Rock, a small community in southeastern Kentucky, has the most expensive rates in the state, at $288 per month.

Car insurance quotes in KY by city

City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $188 | -8% |

| Adairville | $157 | -23% |

| Adams | $226 | 11% |

| Adolphus | $165 | -19% |

| Ages Brookside | $244 | 20% |

Where you live can impact your auto insurance rates as much as your driving history. Car insurance companies consider the number of accidents in your area, car theft rates, and even whether the roads are well maintained. That's because all of these things could lead to future claims.

KY state minimum auto insurance requirements

Kentucky requires drivers to have a minimum amount of liability insurance, often written as 25/50/25, along with $10,000 in personal injury protection.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $10,000

Drivers may opt for combined liability coverage of $60,000 per accident instead of separate bodily injury and property damage limits.

Kentucky is a no-fault insurance state.

That means that you need to have personal injury protection (PIP) insurance. It covers the medical costs of you and your passengers, regardless of who caused an accident. It also means that you cannot sue other drivers for medical expenses, lost wages or other related costs if the total is under $10,000.

Drivers have the option to reject the limitation on filing a lawsuit, and to reject PIP coverage, by filing a form with the Kentucky Department of Insurance. However, you still need to have guest PIP coverage to protect passengers and pedestrians. The cost of keeping PIP coverage on your policy is usually low, so it's a good idea for most drivers.

What's the best car insurance coverage for Kentucky drivers?

Full coverage is the best coverage for most Kentucky drivers.

After a crash, full coverage pays for your car repairs and medical bills, and covers the other driver's costs if you caused the crash.

Minimum liability auto insurance is the cheapest option, but it only pays a limited amount for damage to the other driver's vehicle and their injuries. It doesn't include comprehensive and collision coverages, which protect your own vehicle from damage.

In addition, a minimum liability policy might not have enough coverage if you're in a major accident. If another driver's brand new car is totaled in a crash that you cause, $25,000 probably won't be enough to replace it.

Frequently asked questions

Who has the cheapest car insurance rates in Kentucky?

Farm Bureau has the cheapest full coverage car insurance in Kentucky, at $141 per month. It's also the cheapest option if you want liability-only coverage or have a bad driving record.

How much is car insurance in Kentucky?

The average cost of a full coverage policy in Kentucky is $198 per month. Minimum liability coverage costs $82 per month, on average.

What is the minimum car insurance you must have in KY?

Kentucky state law requires at least $25,000 per person and $50,000 per accident in bodily injury liability and $25,000 in property damage liability. You can choose to get $60,000 in combined liability coverage instead of separate bodily injury and property damage coverage. You must also have at least $10,000 in personal injury protection.

Is car insurance expensive in Kentucky?

Car insurance in Kentucky is expensive compared to the rest of the country. It ranks as the 11th most expensive state for full coverage and the 15th most expensive for minimum coverage. One reason car insurance in Kentucky is so expensive is that it is a no-fault state.

How much does car insurance cost in Louisville vs. Lexington?

Car insurance in Lexington, KY, is much cheaper than in Louisville. Full coverage auto insurance in Lexington costs an average of $165 per month. That's 19% cheaper than the Kentucky state average. On the other hand, car insurance in Louisville is 8% above the state average, at $220 per month.

Methodology

To find the best cheap Kentucky insurance, ValuePenguin collected thousands of rates from ZIP codes across KY for the state's largest insurance companies. Rates are for a 30-year-old man who owns a 2015 Honda Civic EX and has good credit.

Most rates are based on a full coverage policy with the following coverage limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection (PIP): $10,000

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.