Best & Cheapest Home Insurance Companies in Nevada (2023)

Nationwide offers the cheapest home insurance in Nevada — a policy costs $591 per year, or $49 per month, on average.

Compare Home Insurance Quotes from Providers in Nevada

Choosing a homeowners insurance company means finding the company with the best rates, policy features and customer service quality. We gathered thousands of quotes from insurance providers across Nevada to determine the top home insurance for most people.

Best cheap home insurance in Nevada

Cheapest options for homeowners insurance in Nevada

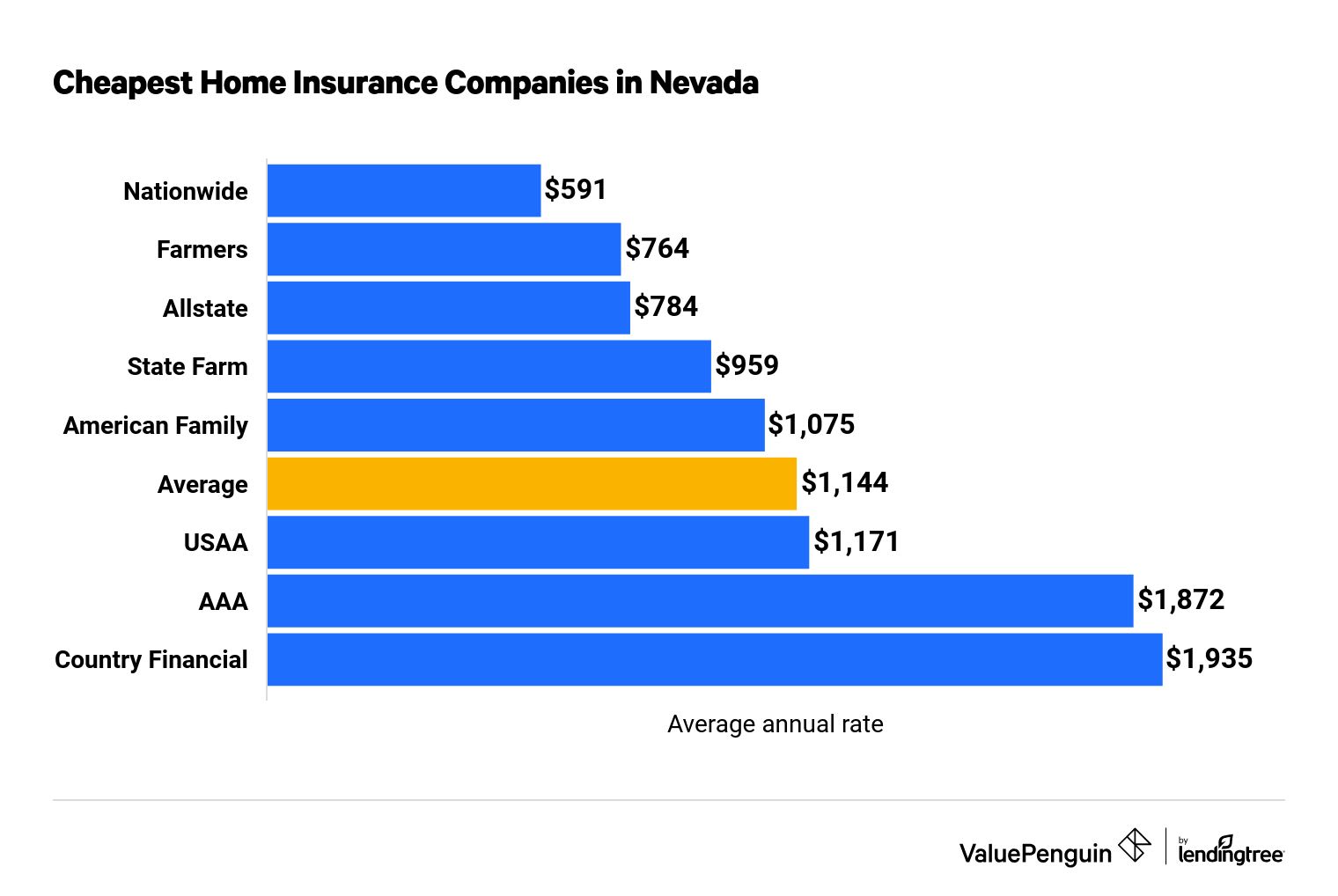

The cheapest homeowners insurance company in Nevada is Nationwide, and the most expensive is Country Financial.

In Nevada, the average cost of homeowners insurance is $1,144 per year.

That's $372 cheaper than the national average cost of $1,516. However, your rate can vary by up to $1,344 per year depending on the insurer you choose.

Compare Home Insurance Quotes from Providers in Nevada

Price alone isn't enough to judge the quality of the insurer or determine that it's the best choice for you. Although Nationwide has the best rates in Nevada, we recommend considering State Farm and American Family due to their superior customer service scores.

Cheap annual home insurance in Nevada

Company | Annual cost | |

|---|---|---|

| Nationwide | $591 | |

| Farmers | $764 | |

| Allstate | $784 | |

| State Farm | $959 | |

| American Family | $1,075 |

Best for most people: State Farm

-

Editor rating

-

Annual rate

$959 ?

Pros and cons

The best homeowners insurance for most people in Nevada comes from State Farm. The company's statewide premiums cost an average of $959 per year, which is 16% less than Nevada's average rate of $1,144 per year. State Farm also offers discounts for bundling home and auto insurance policies or installing a home security system, which can make your policy even more affordable.

Although State Farm doesn't have the cheapest rates in Nevada, its competitive prices are backed by quality coverage.

According to the National Association of Insurance Commissioners (NAIC), State Farm received zero complaints for home insurance coverage in Nevada in 2020, which is uncommon for a large insurer. Overall, policyholders are satisfied with the service they receive from State Farm, which is reflected by its above-average J.D. Power score.

Cheapest homeowners insurance: Nationwide

-

Editor rating

-

Annual rate

$591 ?

Pros and cons

The average cost of Nationwide homeowners insurance is $591 per year in Nevada, the cheapest in the state.

Although it offers the cheapest home insurance in Nevada, Nationwide's customer service is subpar. According to the NAIC, Nationwide receives more complaints than other companies of the same size. In addition, it earned a below-average customer satisfaction score from J.D. Power.

Homeowners looking for the cheapest quote can receive reduced rates if you qualify for one of Nationwide's discounts:

- Multipolicy discount

- Protective device discount

- Home renovation credit

- Home purchase discount

- Claims-free discount

- Roof rating discount

- Gated community discount

- Prior insurance discount

Best for newer homes: Farmers

-

Editor rating

-

Annual rate

$764 ?

Pros and cons

If you own a newer home in Nevada, you should consider getting a home insurance quote from Farmers. The company offers multiple discounts tailored to new construction homes, like a new home discount for homes built less than 14 years ago, and a green certification discount for Energy Star-rated homes. You could also be eligible for lower rates if your roof is constructed from impact-resistant materials or your home utilizes smart devices, such as home security systems and automatic water shutoffs.

With an average yearly price of $764, homeowners insurance from Farmers is $380 cheaper than the statewide average. However, the company has mixed customer service reviews. It receives about one third fewer complaints than a comparably sized firm, according to the NAIC. On the other hand, it earned a below-average score on J.D. Power's customer satisfaction survey. That means homeowners may have a better claims experience with another insurer.

Best for military families: USAA

-

Editor rating

-

Annual rate

1,171 ?

Pros and cons

Military families in Nevada should consider homeowners insurance from USAA. The company has the best customer service scores in the state — it received the highest score on J.D. Power's customer satisfaction survey and only receives half as many complaints as other insurers of a similar size, according to the NAIC.

USAA only offers insurance to active-duty military members, veterans and their families, so many homeowners aren't able to purchase a policy.

On average, home insurance from USAA costs $1,171 per year, which is 2% more expensive than the Nevada state average. However, its base policy includes expanded coverage that doesn't come standard from other insurers, like full replacement cost for your home and belongings.

Best home insurance in Las Vegas

The best homeowners insurance for Las Vegans depends on what they need out of a policy.

Nationwide has the cheapest rates in Las Vegas — a policy costs $644 per year, which is nearly half the average cost of home insurance citywide.

It also has the most affordable home insurance rates in most of the Las Vegas metropolitan area, including Henderson ($582 per year), North Las Vegas ($673) and Summerlin ($561).

Company | Average monthly rate | Average annual rate |

|---|---|---|

| Nationwide | $54 | $644 |

| Farmers | $65 | $785 |

| Allstate | $71 | $853 |

| American Family | $88 | $1,060 |

| State Farm | $89 | $1,068 |

| USAA | $102 | $1,222 |

| Average | $104 | $1,248 |

| AAA | $165 | $1,983 |

| Country Financial | $197 | $2,367 |

However, Nationwide received poor customer service scores on the NAIC complaint index and J.D. Power customer satisfaction survey. It's important to have an insurance company that you can count on — if you ever have to file a claim, you'll want a company that will handle it quickly and offer you a fair settlement.

For that reason, we recommend that Las Vegas homeowners compare quotes from American Family and State Farm. Both companies provide solid customer service and offer cheaper-than-average rates.

Nevada insurance rates: City-by-city breakdown

Nevadans living in Minden have the cheapest home insurance rates in the state, while those in Winchester pay the most expensive premiums.

Minden homeowners can expect to pay $976 per year on average. That's $600 cheaper than home insurance in Winchester, which costs $1,576 per year.

City | Average annual cost | Difference from state average (%) |

|---|---|---|

| Alamo | $1,071 | -6% |

| Amargosa Valley | $1,072 | -6% |

| Austin | $1,074 | -6% |

| Baker | $1,061 | -7% |

| Battle Mountain | $1,070 | -6% |

The cost of homeowners insurance also fluctuates depending on the value of your property and the risks particular to your location. For that reason, your own quotes may differ from your city's overall average.

Best-rated home insurance companies in Nevada

State Farm offers the best customer service for most Nevada homeowners.

The NAIC recorded zero complaints from State Farm customers in Nevada in 2020, which is very uncommon for an insurer of its size.

Homeowners in Nevada who are active-duty military members, veterans or their families should also consider getting a quote from USAA. The company's outstanding customer service earned USAA first place in J.D. Power's annual home insurance customer satisfaction survey.

Company |

Rating

|

|---|---|

| USAA | |

| State Farm | |

| AAA | |

| American Family | |

| Country Financial | |

| Farmers | |

| Nationwide | |

| Allstate |

To compare the customer satisfaction of homeowners insurance providers in Nevada, we collected scores from the NAIC's complaints database along with J.D. Power's customer satisfaction scores and ratings from our own editors.

Most common homeowners insurance perils in Nevada

Compared to other states, Nevada's homeowners aren't exposed to many natural perils that could threaten their properties. Nevada is the driest state in the U.S., and wildfires do pose some danger to homeowners.

Your typical homeowners insurance policy covers fires, but you should check to make sure that your dwelling coverage limit is high enough to cover the cost of rebuilding your home if it were destroyed.

Usually, an insurance policy reimburses you for the actual cash value of your home after depreciation unless you have replacement cost coverage.

Sometimes, insurers won't offer coverage in areas of the country that are particularly prone to fires. For this reason, it's important to talk to your provider to make sure that your policy would safeguard your property in the event of a destructive wildfire. If not, you might have to purchase a separate insurance policy to protect your home against only the damage from fires.

As a last resort, homeowners can purchase a Fair Access to Insurance Requirements (FAIR) policy. These policies are subsidized by taxpayers and private insurers and are available to property owners that insurers view as too risky to insure. If you've been denied fire coverage from several companies, a FAIR policy offers bare-bones coverage for a price that's not very different from a regular insurance policy. You may also be able to get a FAIR policy that covers only fire damage and pair it with a regular homeowners policy.

Frequently asked questions

How much does home insurance in Nevada cost?

The average cost of homeowners insurance in Nevada is $1,144 per year, or $95 per month. That's 24% cheaper than the national average, which is $1,516 per year.

Where can I find the cheapest home insurance in Nevada?

Nationwide offers the cheapest home insurance rate for Nevadans at $591 per year — 48% more affordable than the state average.

How much does Las Vegas home insurance cost?

Homeowners in Las Vegas can expect to pay $1,248 per year for insurance, on average — 9% more than the statewide average. In comparison, the average annual home insurance rate in Henderson is $1,129.

Methodology

We gathered quotes from eight of the largest home insurance companies in Nevada for every ZIP code in the state. Quotes are based on a sample property built in 1991 and insured to Nevada's median home cost, $267,900.

We obtained quotes for this home from the following insurance companies:

- AAA

- Allstate

- American Family

- Country Financial

- Farmers

- Nationwide

- State Farm

- USAA

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

To determine customer service ratings, we analyzed data from the National Association of Insurance Commissioners (NAIC) complaint index, the 2021 J.D. Power home insurance customer satisfaction study and our own ValuePenguin editor's ratings.