The Best and Cheapest Home Insurance Companies in New York for 2024

NYCM Insurance has the cheapest home insurance in New York at around $503 per year.

Find Cheap Home Insurance Quotes in New York

Best cheap home insurance in New York

ValuePenguin editors studied thousands of New York home insurance quotes spanning every ZIP code in the state and the state's largest companies.

Those rates are used along with coverage options, discounts offered and customer satisfaction metrics to pick the best and cheapest home insurance options in New York.

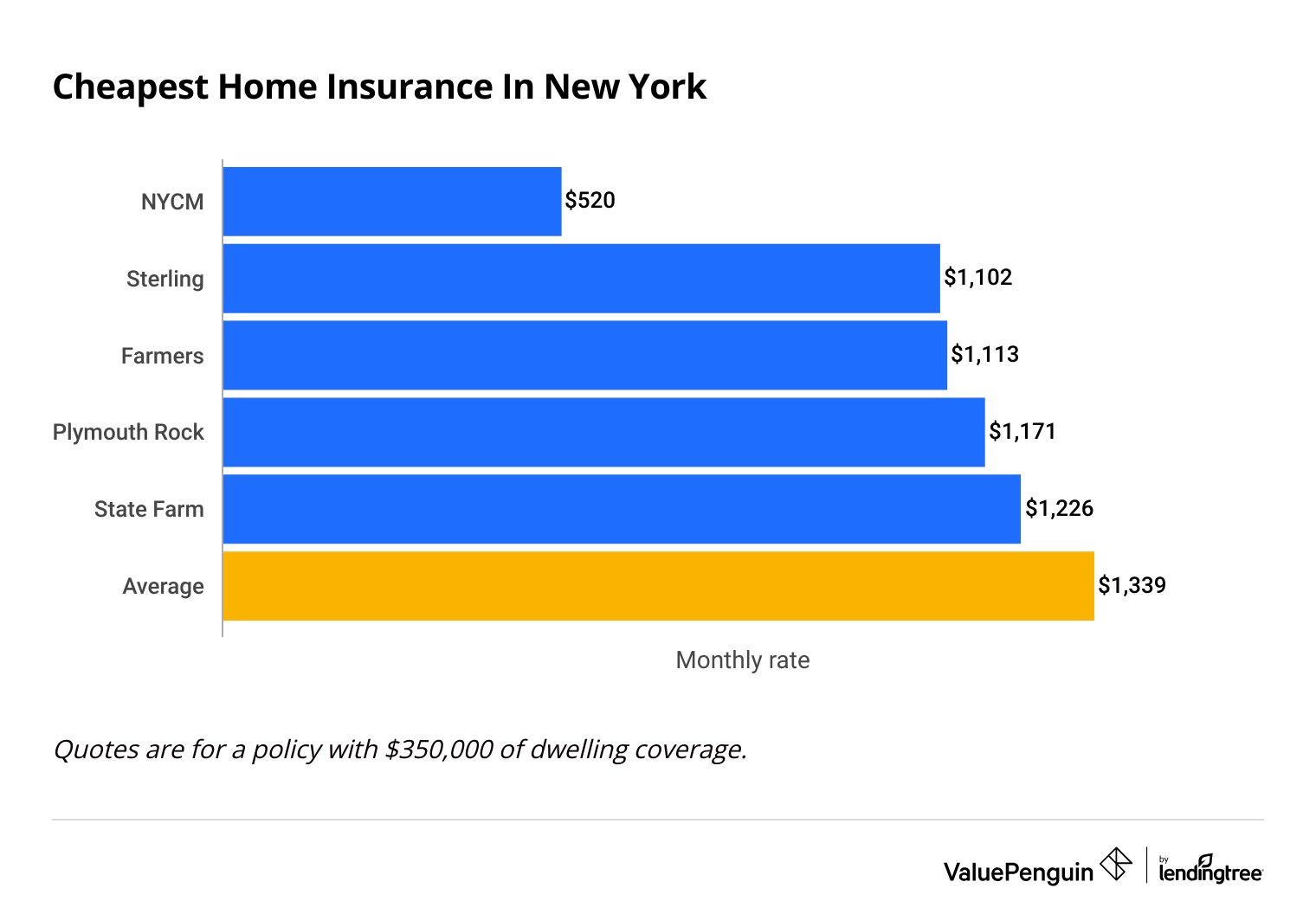

The cheapest homeowners insurance companies in New York

NYCM has the best home insurance rates in New York.

A policy from NYCM costs $520 per year for $350,000 of dwelling coverage You can save $818 per year which is 61% less than the NY state average.

Find Cheap Home Insurance Quotes in New York

NYCM also has the lowest rates for higher coverage levels. An NYCM home policy costs $677 per year for $500,000 of coverage which is 63% below the state average. A $1 million NYCM homeowners policy costs $1,461 per year or 60% less than the NY state average for this coverage level.

New York homeowners who prefer the stability and name recognition of working with a national home insurance company should consider Farmers. You can save $225 per year compared to the New York state average, and the company has strong customer service.

Cheap annual home insurance quotes in New York

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| NYCM | $418 | ||

| State Farm | $698 | ||

| Farmers | $715 | ||

| Sterling | $781 | ||

| Nationwide | $862 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| NYCM | $418 | ||

| State Farm | $698 | ||

| Farmers | $715 | ||

| Sterling | $781 | ||

| Nationwide | $862 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| NYCM | $520 | ||

| Sterling | $1,102 | ||

| Farmers | $1,113 | ||

| Plymouth Rock | $1,171 | ||

| State Farm | $1,226 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| NYCM | $677 | ||

| Plymouth Rock | $1,452 | ||

| Sterling | $1,536 | ||

| Farmers | $1,640 | ||

| Kingstone | $1,693 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| NYCM | $1,461 | ||

| Plymouth Rock | $2,465 | ||

| Sterling | $2,883 | ||

| Nationwide | $3,463 | ||

| Kingstone | $3,534 | ||

Common natural disasters in NY

Powerful storms and Nor'easters impact many homeowners who live in the coastal regions of New York state and, to a lesser extent, some inland areas such as the lower Hudson River Valley. Some of the most vulnerable parts of the state include the New York City metropolitan area and Long Island.

Homeowners policies typically cover damage caused by storms. However, you'll have to buy a separate insurance policy to protect against flooding.

Best NY home insurance company for most people: NYCM Insurance

-

Editor's rating

- Cost: $$520/yr

NYCM Insurance has the cheapest rates in New York.

Pros:

-

Cheapest coverage in New York

-

Many discounts available

-

Good customer service

-

Strong network of local agents

Cons:

-

No online quotes

NYCM has the lowest rates in the state. $350,000 of coverage to repair or rebuild your home, called dwelling coverage costs an average of $520 per year. That's $818 less expensive than the average home insurance cost in New York.

NYCM also has the cheapest rates for more expensive homes. An NYCM homeowners policy with $500,000 of dwelling coverage costs $677 per year, which is 63% below the state average. On average, $1 million of dwelling coverage with NYCM costs $1,461 per year. That's a savings of $2,174 over the NY state average.

NYCM gets significantly fewer complaints compared to other insurance companies of the same size according to the National Association of Insurance Commissioners (NAIC), an industry group. It's a good idea to choose a homeowners insurance company that doesn't get many customer complaints because a high number of complaints could mean you'll have a difficult time with the claims process.

The company also offers an array of discounts. For example, combining your auto and home insurance policies results can earn you a 25% discount from your total insurance bill. Adding an umbrella policy increases the savings to 35%.

NYCM also offers a few unique discount options including those for retirees, people who work from home and green-certified buildings.

Unlike many major home insurance companies, NYCM doesn't offer online quotes. That means you'll have to pick up the phone and speak to a local agent to get a quote.

Best house and car insurance in NY: State Farm

-

Editor's rating

- Cost: $1,226/yr

State Farm has the best home and auto bundling discounts in New York.

Pros:

-

Affordable rates

-

Good for bundling home and auto policies

-

Lots of cheap coverage options for condo owners

Cons:

-

Few coverage options and discounts for homeowners

In New York, a homeowners policy from State Farm costs $1,226 per year for $350,000 of dwelling coverage. That's roughly 8% cheaper than the state average.

You'll save less with State Farm if you have a more expensive home. A State Farm policy costs $1,841 per year for $500,000 in dwelling coverage which is slightly above the NY state average.

A State Farm homeowners insurance policy with $1 million in coverage costs $3,941 per year. That's $306 per year more expensive than the New York state average for that coverage level.

You can lower your rate even further by bundling your home and auto coverage. On average, you can save $1,008 per year by bundling your home and auto policies with State Farm.

State Farm multipolicy discounts

- Life and auto

- Home and auto

- Condo and auto

- Renters and auto

- Multiple auto policies

Outside of its multipolicy discounts, State Farm offers fewer ways to save compared to many of its competitors. If you don't already have an auto policy with State Farm, you may be better off with a company that has more discounts.

State Farm gets a fairly average amount of customer complaints. Consider NYCM if customer satisfaction is a high priority for you.

Best for extra home insurance coverage in NY: Farmers

-

Editor's rating

- Cost: $1,113/yr

Farmers has the best coverage options for homeowners insurance in New York.

Pros:

-

Lots of useful coverage options

-

Many discounts available

-

Cheap rates

Cons:

-

Low customer satisfaction levels

You should consider Farmers if you need more coverage than what a standard homeowners insurance offers. Farmers lets you choose from six different coverage options. In addition, Farmers sells separate flood, earthquake and personal liability umbrella policies.

Farmers homeowners extra coverage options

- Extended replacement cost covers repair costs up to 25% above your coverage limits.

- Guaranteed replacement cost guarantees coverage for the full cost to repair your home regardless of your policy limits.

- Building ordinance or law will pay for upgrades to your home required by law after a covered loss.

- Sewer and drain water damage coverage will pay for water damage caused by a backed up drain or sewer.

- Scheduled personal articles coverage will pay to replace or repair expensive personal property such as a necklace or painting.

- Identity shield protects against identity theft

In addition to its many coverage add-ons, Farmers has some of the cheapest homeowner insurance rates in New York. A Farmers policy costs just $1,113 per year which is 17% below the state average. You can lower your rate even further by taking advantage of one or more of Farmer's many discount options.

Keep in mind that Farmers ranked below average in the latest J.D. Power homeowners insurance overall customer satisfaction survey. That means you may have a more difficult time when you file a claim.

How much does home insurance cost in New York?

Homeowners insurance in New York costs $812 per year less than the national average.

The Northeast has cheaper homeowners rates compared to the U.S. as a whole. That's because this region gets few natural disasters. In contrast, places in the west, like Colorado and California, have high rates partly because they experience frequent and destructive wildfires.

You'll pay about the same for homeowners insurance in New York as you would in neighboring states like New Jersey and Connecticut. Higher labor and materials costs may partially explain why homeowners insurance in New York costs more than in nearby Pennsylvania.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $969 |

| $350,000 | $1,339 |

| $500,000 | $1,837 |

| $1,000,000 | $3,635 |

Cost of homeowners insurance in New York by city

The most expensive city for home insurance in New York is North Greece, while Springs has the cheapest rates.

Home insurance rates differ by up to $2,019, depending on the city in which you live. Homes located along the coast tend to have higher home insurance rates due to damage from coastal storms.

City | Annual rate | % from avg |

|---|---|---|

| Accord | $1,188 | -11% |

| Acra | $1,181 | -12% |

| Adams | $1,131 | -16% |

| Adams Basin | $974 | -27% |

| Adams Center | $1,128 | -16% |

Rates are for a policy with $350,000 of dwelling coverage.

Best homeowners insurance companies in New York

NYCM offers the best customer service for New York homeowners.

NYCM gets significantly fewer complaints compared to an average insurance company of the same size. State Farm has above average customer satisfaction ratings according to a recent J.D. Power survey, but it's about average when it comes to complaints.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| NYCM | Low | |

| Sterling | Low | |

| Kingstone | Low | |

| AIG | Low |

Natural disasters to watch out for in New York

As a coastal state on the Eastern Seaboard, New York is subject to hurricanes, nor'easters and other large storms that can cause damage to your home. This is especially true if you live on Long Island, in New York City or the Lower Hudson Valley.

The two primary sources of damage from these major storms are winds and flooding from rain or storm surges.

Homeowners insurance almost always covers wind damage.

However, your home insurance policy won't cover flood damage. If you live in a coastal zone or an area with a high risk of flooding, you'll need to buy a separate flood insurance policy.

Tips for buying the best home insurance in New York

To save money on your New York home insurance policy, it's a good idea to shop around. If you live in New York City, Buffalo, Rochester or another densely populated part of the state, you should have access to multiple options including large national companies like State Farm and Farmers as well as regional companies like NYCM.

Choose a company that offers a multipolicy discount, so you can save on different types of insurance. For example, if you have a high net worth, you may consider getting an umbrella policy on top of your homeowners insurance.

Finally, it's important to choose a company with a strong reputation for customer satisfaction. Companies that get many complaints often have a difficult or inefficient claims process.

Frequently asked questions

How much is homeowners insurance in New York?

The average cost of home insurance in New York is $1,339 per year, or $112 per month for $350,000 of dwelling coverage.

Who has the cheapest homeowners insurance in New York?

NYCM, New York Central Mutual Insurance Company, offers the best home insurance rates in the state. A typical policy costs $520 per year, which is 61% cheaper than the statewide average.

How much is homeowners insurance in NYC?

Home insurance in New York City costs $1,986 per year on average for a single-family home with $350,000 of dwelling coverage. You may find cheaper rates if you live in a co-op, condo or apartment.

Full Methodology

ValuePenguin collected homeowners insurance quotes from 12 of the largest insurance companies in New York across more than 150,000 separate addresses. Rates are for a 45-year-old married man with no prior insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's homeowners insurance analysis used insurance rate data from Quadrant Information Services. These rates came from insurance company filings and should be used for comparative purposes only. Your quotes may differ.

We determined customer service ratings by comparing National Association of Insurance Commissioners (NAIC) complaint index scores, J.D. Power's 2023 home insurance customer satisfaction study rankings and our own ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.