Compare FAIR Plans for High-Risk Home Insurance

FAIR plans are homeowners insurance plans that help provide coverage to high-risk homes.

FAIR insurance coverage is different for each state. Most plans offer a maximum of $500,000 to $600,000 of protection for the structure of your home. Some states allow you to add extra coverage, like protection for your personal property.

Most people are better off with homeowners insurance from a private company. You should try to find private coverage before settling for FAIR plan insurance.

Find Cheap Homeowners Insurance Quotes in Your Area

What is FAIR plan insurance?

Fair Access to Insurance Requirements (FAIR) programs were created by states to help people with high-risk homes find insurance.

FAIR plans are considered a last resort for coverage. You may only be able to buy FAIR insurance after you have been denied coverage by several private home insurance companies.

Both taxpayers and private insurance companies pay for FAIR insurance. Instead of just a single insurance company taking on the risk of protecting your home, multiple companies share the risk. Participating companies share the cost if you have a FAIR plan and your home is damaged.

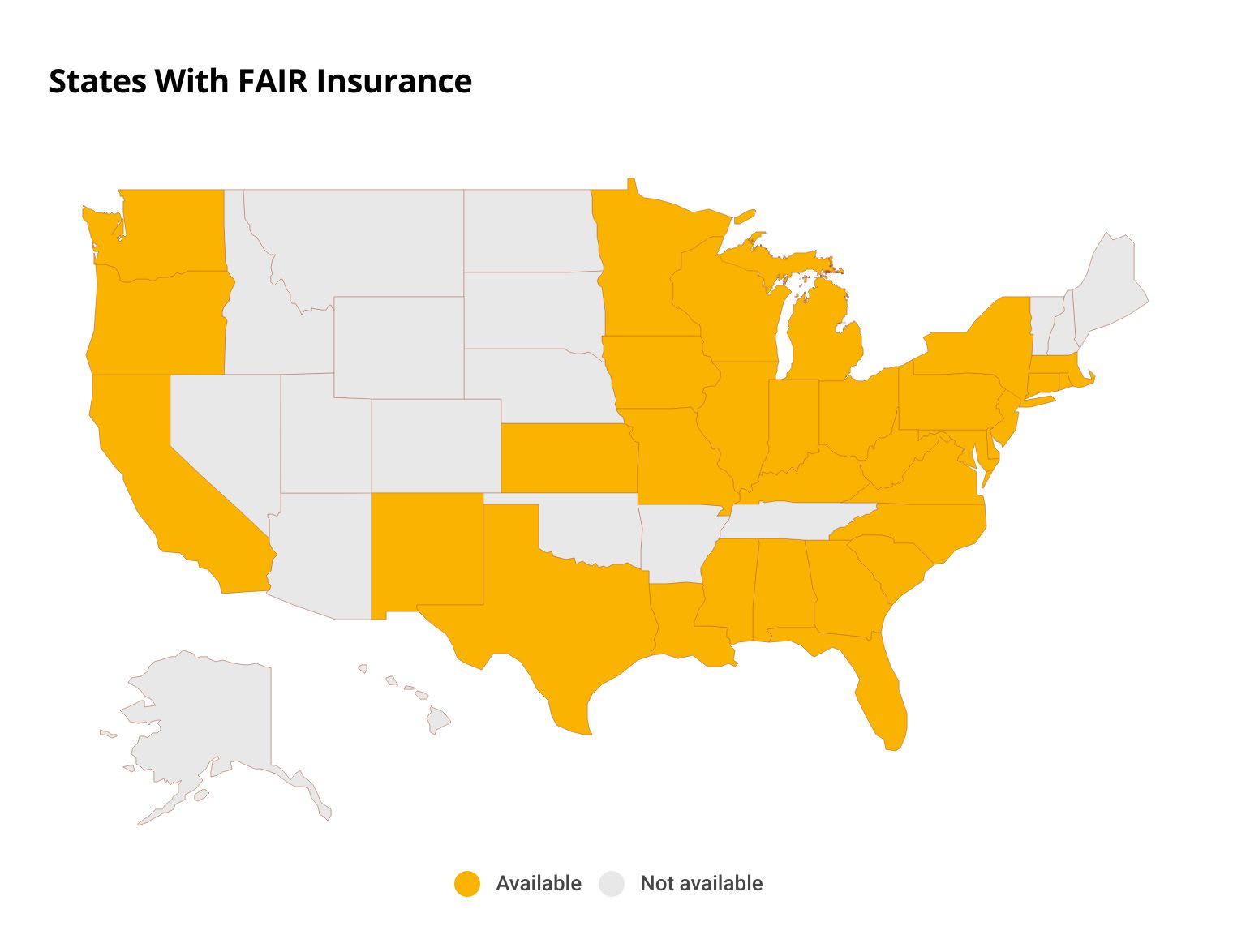

Which states offer FAIR plan homeowners insurance?

FAIR insurance is offered in 33 states and Washington, D.C. Most states with FAIR programs have frequent natural disasters or severe weather events.

- Alabama

- California

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- New Jersey

- New Mexico

- New York

-

North Carolina

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Texas

- Virginia

- Washington

- Washington, D.C.

- West Virginia

- Wisconsin

How to get FAIR plan insurance

If you can't find a private homeowners insurance policy, start with a call to your state insurance agency.

Your home will typically need to meet the following conditions to get a FAIR policy.

FAIR program requirements

- Compliance with local building codes

- Someone occupying the house

- No open claims against the house

- No restricted dog breeds like pit bulls and rottweilers

- No unsecured pools

Each state's plan has different rules and restrictions. There is no guarantee that your state's program will cover your home.

Check with your state agency to know what else may disqualify you from getting a FAIR plan.

Most states' programs require you to apply through an insurance agent.

You'll usually be able to request an agent through the FAIR plan and have them fill out your application. You may also need to prove that you have been denied coverage by several home insurance companies.

State FAIR plan contact info

State plan | Phone number |

|---|---|

| Alabama FAIR Plan | 334-943-4029 |

| California FAIR Plan | 213-487-0111 |

| Connecticut FAIR Plan | 860-528-9546 |

| Delaware FAIR Plan | 215-629-8800 |

| Florida Citizens Insurance | 850-513-3700 |

What does FAIR plan insurance cover?

FAIR plan coverage varies depending on your state.

Most FAIR plans offer a maximum of around $500,000 to $600,000 of protection for your home's structure. This is called dwelling coverage. You should choose a dwelling coverage amount that will cover the cost to rebuild your home if a disaster destroys it, like a fire.

Some states like New Jersey also offer coverage for personal property. Other states, like Ohio, provide two types of coverage — a basic fire policy and a more comprehensive homeowners policy that also protects your belongings.

You'll need to contact your state's agency to find out what type of coverage it offers.

What if you can't get a FAIR plan?

If you can't find private home insurance and don't qualify for a FAIR plan, you may have to make major improvements, decide not to buy the home or not have insurance.

If you already live in the home or don't want to back out of the purchase, you'll probably need to make improvements. Major improvements can cost a lot of money. But if they make your home insurable, that may be the best option.

Just be sure to check with multiple insurance companies to make sure that the changes will get them to insure the home. Sometimes if the area is too risky, even the best repairs won't convince the company.

If you have a mortgage on your home, you won't have the option to live in the home without insurance. That's because mortgage companies require home insurance to help protect their investment in your home.

Even if you don't have a loan, it's dangerous to forgo homeowners insurance. This is especially true in a high-risk area, where you will likely have future damage.

What makes a home high-risk?

There are several factors that may make insurance companies consider your home high-risk.

For example, your home may be high-risk if you live in a storm-prone or crime-heavy area. Older homes that need renovations may also be considered high-risk.

Some high-risk areas include:

- California, due to wildfires and earthquakes

- Tornado Alley in the Midwest

- The Gulf Coast, due to frequent flooding

- Florida and the coastal Southeast, due to hurricanes

- Urban centers with high crime rates

Your home also could be considered high-risk because of past insurance claims. If your home has lots of past claims on file, it will be harder to find insurance.

In addition, insurance companies may decide you're a high-risk customer if you've filed multiple claims from multiple homes.

In this case, you may need to find other options for insuring your home. Even a FAIR plan may not take you if you are considered a high-risk homeowner.

You should work with an independent agent to find a specialty company willing to insure you.

How to find high-risk home insurance

Buying FAIR plan insurance should be your last resort.

That's because a FAIR plan doesn't typically offer as much protection as home insurance from a private company. A standard home insurance policy covers most damage to your home's structure and personal property. It also provides liability coverage if you accidentally hurt someone or damage their property.

A FAIR plan usually limits the types of damage it will pay for. It may not protect your belongings or cover personal liability.

For that reason, there are a few other options you should try before applying to your state's FAIR plan.

Find an insurance agent

A good bet for finding private home insurance for a risky home is to work with an independent insurance agent.

Independent insurance agents understand your local market, so they'll be familiar with risks specific to your area. These agents typically work with local or specialty companies willing to take on more risk than national companies.

Talk to your neighbors

It's also a good idea to introduce yourself to your neighbors and ask what company they use for home insurance. An insurance company willing to protect another home in your neighborhood may also consider selling you a policy.

A neighborhood or community association might be a good resource for finding insurance companies that do business in your area.

Negotiate with a home insurance company

There are a few ways to negotiate with a homeowners insurance company that can make your home more insurable.

Frequently asked questions

What is a FAIR insurance policy?

A FAIR, or Fair Access to Insurance Requirements, plan is a state-run homeowners insurance program that helps provide insurance for high-risk homes. You may be eligible for a FAIR plan if you've been denied coverage by multiple private insurance companies.

What types of coverage are available through a FAIR plan?

Most FAIR plans only offer protection for the structure of your home, known as dwelling coverage. In addition, FAIR plans typically limit coverage to only damage from a limited set of events, like fire and windstorms. Some states offer extra protection you can add on, like protection for your personal belongings.

But FAIR insurance doesn't usually include personal liability coverage, which comes with most standard home insurance policies.

Does Ohio have a FAIR plan?

Yes, Ohio has a FAIR homeowners insurance plan. You can visit the Ohio FAIR plan website to find an agent who can help you get coverage.

How much does a FAIR plan cost?

The cost of a FAIR plan varies from state to state, but you should not expect a major discount from private home insurance rates. The FAIR program is not meant to help you find affordable insurance, so the pricing will generally reflect the coverage you get.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.