Cost of Medicare Part B in 2024 and How It Works

Compare Medicare Plans in Your Area

Medicare Part B costs $174.70 per month in 2024.

Medicare Parts A and B make up Original Medicare. While Part A covers health care that happens while you're in the hospital, Part B covers medical care in non-hospital settings. This includes doctor visits, tests, treatments, urgent and emergency care, and medical equipment like wheelchairs and walkers.

What does Medicare Part B cost in 2024?

In 2024, Medicare Part B costs $174.70 per month for most people.

That's an increase of $9.80 per month compared to 2023. If you get Social Security benefits, the $174.70 is deducted from your benefit payment. If you're not on Social Security, you'll get a quarterly bill for Part B.

However, the rate for Medicare Part B is higher if you earn more than $103,000 per year. This is called an income-based monthly adjustment. The adjustment changes based on your income, specifically your modified adjusted gross income (MAGI) reported on your federal income tax return. Your premium for 2024 is determined by your MAGI from the 2022 tax year.

Individual taxable income | Joint taxable income | Monthly Part B premium |

|---|---|---|

| $103,000 or less | $206,000 or less | $174.70 |

| Over $103,000 to $129,000 | Over $206,000 to $258,000 | $244.60 |

| Over $129,000 to $161,000 | Over $258,000 to $322,000 | $349.40 |

| Over $161,000 to $193,000 | Over $322,000 to $386,000 | $454.20 |

| Over $193,000 to under $500,000 | Over $386,000 to under $750,000 | $559.00 |

For example, if you filed taxes individually and reported a 2022 adjusted gross income of $110,000, then your Part B premium for 2023 would be $244.60. This includes the $174.70 base premium and an income adjustment of $69.90.

Medicare Part B rate changes

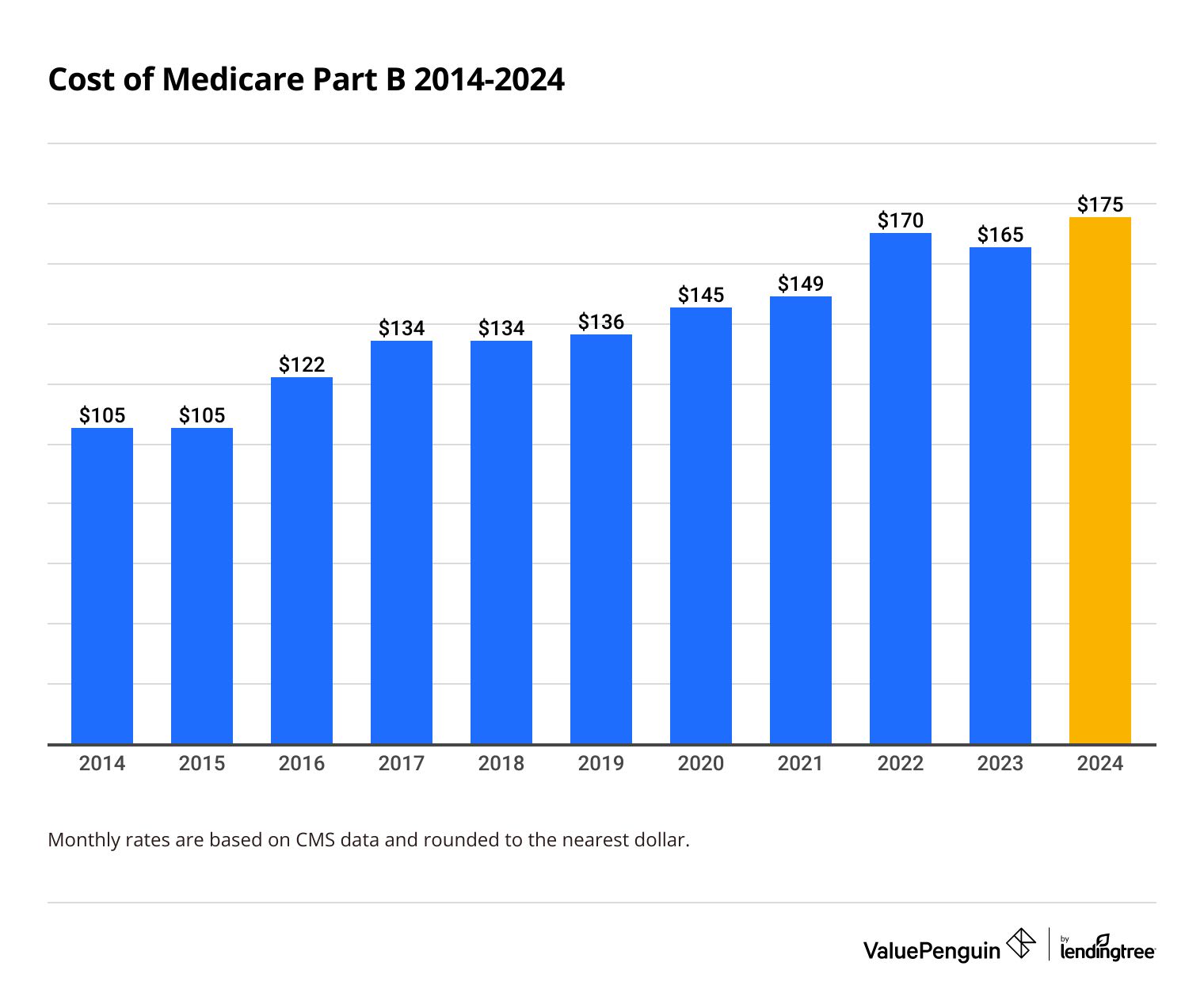

Over the past decade, Medicare Part B monthly rates have risen by almost $70, from $104.90 in 2014 to $174.70 in 2024. The Part B rate decrease in 2023 was the first price reduction in over a decade.

Compare Medicare Plans in Your Area

A key reason for rate hikes in recent years is the cost of specialty drugs covered by Part B. Many of the drugs covered by Part B are expensive, and Medicare didn't have the ability to work with drug manufacturers to lower the cost. Because Medicare hasn't previously been authorized to negotiate drug prices, the people with Medicare shouldered those costs in the form of higher monthly rates.

With the passage of the Inflation Reduction Act, Medicare is set to begin negotiating prices for 10 of the most expensive drugs. But the new prices based on the negotiations won't go into effect until 2026.

Cost of Medicare Part B from 2014 to 2024

Year | Part B cost |

|---|---|

| 2024 | $174.70 |

| 2023 | $164.90 |

| 2022 | $170.10 |

| 2021 | $148.50 |

| 2020 | $144.60 |

Monthly rates are based on CMS data.

Medicare Part B deductible

Medicare Part B comes with an annual deductible amount that must be met before Medicare starts paying for your medical care. In 2024, the Part B deductible is $240.

Typically, after you reach your $240 deductible for the year, you are required to pay 20% of Medicare Part B approved medical costs yourself while Medicare picks up the rest. This is called coinsurance.

For example, say you went to the doctor for a screening that cost you $200, then had a separate follow up visit that cost you $40. The total cost of these medical expenses adds up to $240, meaning you would have met your Medicare Part B deductible for the year. Then, say you had another screening later in the year that cost you $150. Since you already met your deductible, you would pay just 20%, or $30, while Medicare would pay the remaining $120.

Medicare Part B late enrollment fee

If you don't sign up for Medicare Part B during the initial enrollment period when you are first eligible, you may have to pay a late enrollment fee. The fee can be up to 10% for each year you were eligible but chose not to enroll. You'll pay the late enrollment fee for as long as you have Medicare Part B.

For example, say you're in line to pay the standard Part B rate of $174.70. But you signed up for Medicare Part B 12 months after your initial enrollment period. You would be required to pay an additional $17.47 each month for Medicare Part B, for a total of $192.17. If you wait two years to enroll, your rate increases by 20% based on the Part B premium in effect that year.

What is Medicare Part B and what does it cover?

Medicare Part B is part of Original Medicare, which is the federal health insurance program for people who are 65 and older, and for those who have a disability or certain medical conditions.

Part B is the medical insurance portion of Medicare, which covers preventive care and other medical services.

Some examples of care that is covered by Medicare Part B include:

- Doctor visits

- Health screenings

- Vaccinations

- Lab tests

- Therapy

- Ambulance services

- Some medical equipment

- Transplants

Medicare Part B eligibility and enrollment

Like Medicare Part A, Medicare Part B is available to people who are age 65 or older. You can qualify if you are under 65 if you have one of the following:

- A disability

- Kidney failure (ESRD)

- Lou Gehrig's disease (ALS)

If you paid into Social Security while working and are getting benefits for at least four months before you turn 65, you'll be enrolled in Medicare Part A automatically. You'll also be enrolled in Part B, but you can choose to decline it since Part B has a separate monthly cost.

If you do not get Social Security benefits, you'll need to call the Social Security office at (800) 772-1213 to enroll in Medicare Part B.

Medicare enrollment begins three months before your 65th birthday, includes your birth month and ends three months after the month you turn 65. You have a total of seven months to sign up. This is called the initial enrollment period.

During this period, you can sign up for any part of Original Medicare. When you enroll before the month you turn 65, coverage begins on the first day of the month you were born. If you sign up the month you turn 65 or in the final three months of your enrollment period, your Medicare policy will start on the first day of the following month.

If your birthday falls on the first day of the month, your seven-month enrollment period starts and ends one month sooner. It begins four months before you turn 65, includes your birth month and ends two months after your birth month. If you enroll during the four months before your 65th birthday, your Medicare policy begins a month earlier, as well. For example, Medicare would start on June 1 for a person whose birthday falls on July 1.

If you don't enroll in Medicare during your initial enrollment period, you may have to wait for a general enrollment period (GEP) to apply. which runs from Jan. 1 to March 31 each year. You may have to pay a late fee if you sign up during this time. Your coverage would start the month after you enroll.

Should I enroll in Medicare Part B as soon as I'm eligible?

If you've paid into Social Security, you are typically enrolled in Medicare Part B automatically at age 65.

To decide whether you should keep Part B as part of Original Medicare or enroll in it if you aren't signed up automatically, review your health insurance needs before you turn 65. This will help you determine whether Medicare Part B makes sense for you.

For example, if you're covered by a qualified employer health plan, you might decide to delay your Part B enrollment and remain on the employer plan without getting a late enrollment penalty. Before you decide to postpone Medicare Part B, confirm with your company that the health plan is what's called a qualified health insurance plan as defined by the IRS. You'll also want to be sure and sign up for Part B once your employer coverage ends to avoid potential late enrollment penalties at that time.

If you do enroll in Medicare Part B, you may want to consider a Medicare supplement policy to fill the coverage gaps. You could also consider bundling Part B with Part A and some added perks by buying a Medicare Advantage plan.

Is there an alternative to Original Medicare?

Medicare Advantage plans are an all-in-one coverage alternative to Original Medicare.

Medicare Advantage plans are sold by private health insurance companies and bundle your Medicare Part A and Part B together. They usually have prescription drug coverage, too. And they often have added benefits like dental and vision coverage.

Medicare Advantage policies can simplify your health coverage since just one plan manages everything. But they can sometimes be more expensive and less flexible compared to Original Medicare.

You should also keep some other things in mind if you consider a Medicare Advantage plan.

- You must enroll in and keep both Medicare Part A and Part B.

- If you get a Medicare Advantage when you are first eligible, the same enrollment periods apply.

Frequently asked questions

How do I reduce the Medicare Part B premium?

You may be able to get help paying your Medicare Part B premium through programs like Medicaid, Medicare savings programs (MSPs) and the Program of All-inclusive Care for the Elderly (PACE).

What if I missed my initial enrollment period for Medicare?

You probably have to wait until the general enrollment period from Jan. 1 to March 31 each year. You will usually pay a late fee. You might also be able to enroll in Part B during a special enrollment period. For example, if you postponed Medicare because you had health insurance through your job, you qualify for special enrollment. This lets you enroll in Medicare without a late penalty.

How can I avoid Part B late enrollment penalties?

You can avoid Medicare Part B late enrollment penalties by signing up for Medicare when you first become eligible. This is called your initial enrollment period. If you don't enroll because you have health insurance coverage from your job, be sure it is a qualified health plan.

Methodology

Cost information is from Medicare.gov. All information regarding eligibility and enrollment can also be found on Medicare.gov.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.