AARP Medicare Supplement Review 2025: Cheap Rates, Great Perks

AARP/UnitedHealthcare Medigap costs an average of $158 per month for Plan G and comes with impressive benefits.

Compare Medicare Plans in Your Area

AARP Medicare Supplement plans are a good option if you want extra perks. The company's rates are usually a bit cheaper than average, too. However, your rate may go up quickly as you get older because the company's unique enrollment discount falls off your plan.

You have to join AARP to buy a plan. A membership costs $16 per year and comes with extra benefits like discounts on travel and hotels.

Pros and cons

Pros

Low rates

Added benefits like fitness discounts

Unique enrollment discount

Cons

AARP membership required

Mediocre customer satisfaction

AARP/UnitedHealthcare (UHC) Medigap rates

Plan G from AARP/UnitedHealthcare costs $158 per month, on average.

Plan G is the best Medicare Supplement plan if you are newly eligible for Medicare. It has the best coverage of any current Medigap plan. Plan F is the only plan with more coverage, but you can only get it if you were eligible for Medicare before Jan. 1, 2020.

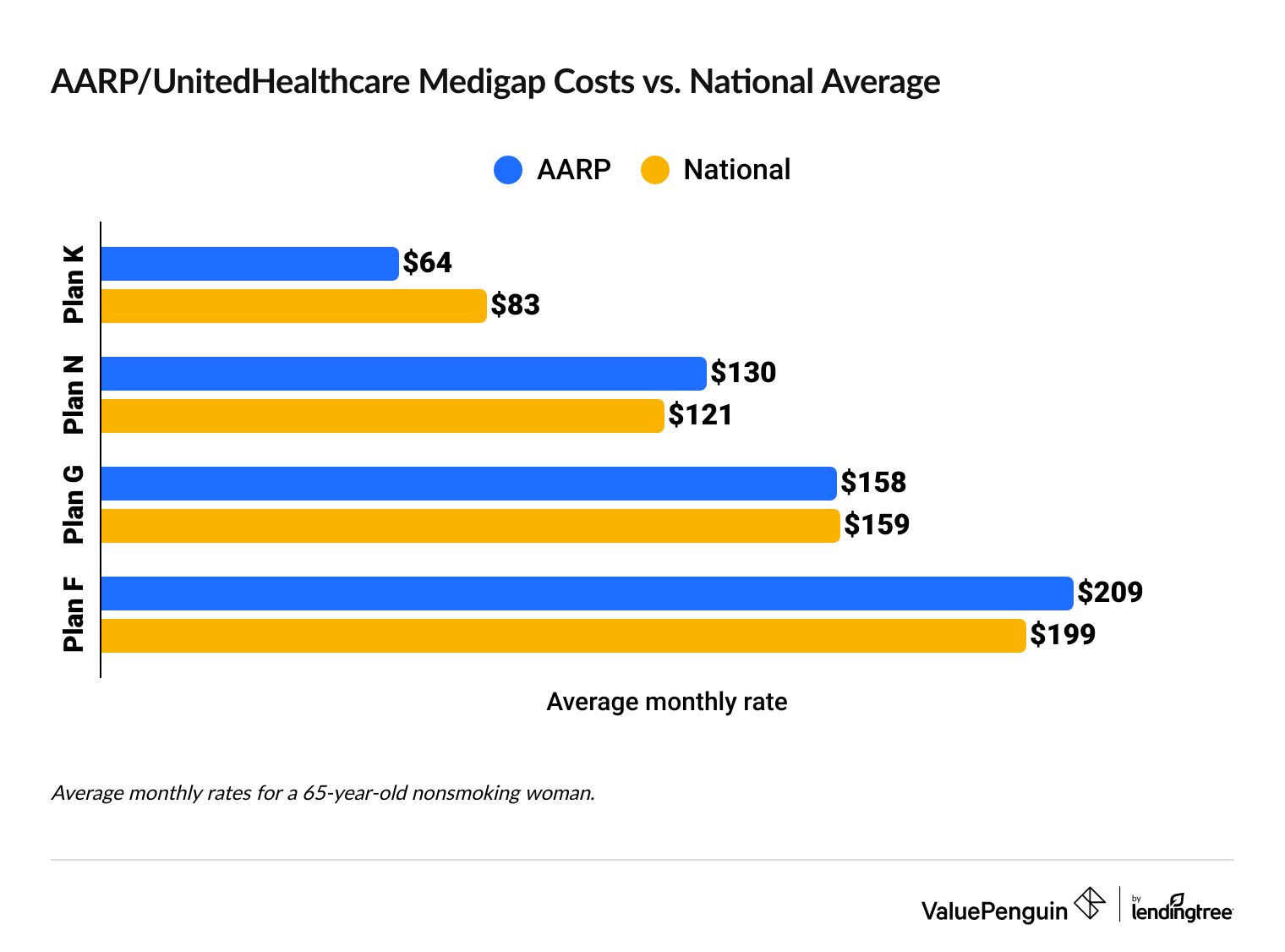

AARP Medigap costs vs. the national average

AARP's rates for Medigap coverage are average compared to national rates. But when you look at rates on a state level, AARP is often a cheap option.

But if you are interested in Plan N or Plan F, you can expect to pay more with AARP than other companies.

Compare Medicare Plans in Your Area

AARP/UHC offers 10 Medicare Supplement plans, and six of those plans have cheaper rates than the national average.

AARP vs. national average Medigap costs

Plan | AARP monthly rate | National monthly rate |

|---|---|---|

| High-deductible G | $48 | $49 |

| K | $64 | $83 |

| L | $116 | $126 |

| N | $130 | $121 |

| A | $145 | $151 |

Average monthly cost for a 65-year-old woman who does not smoke.

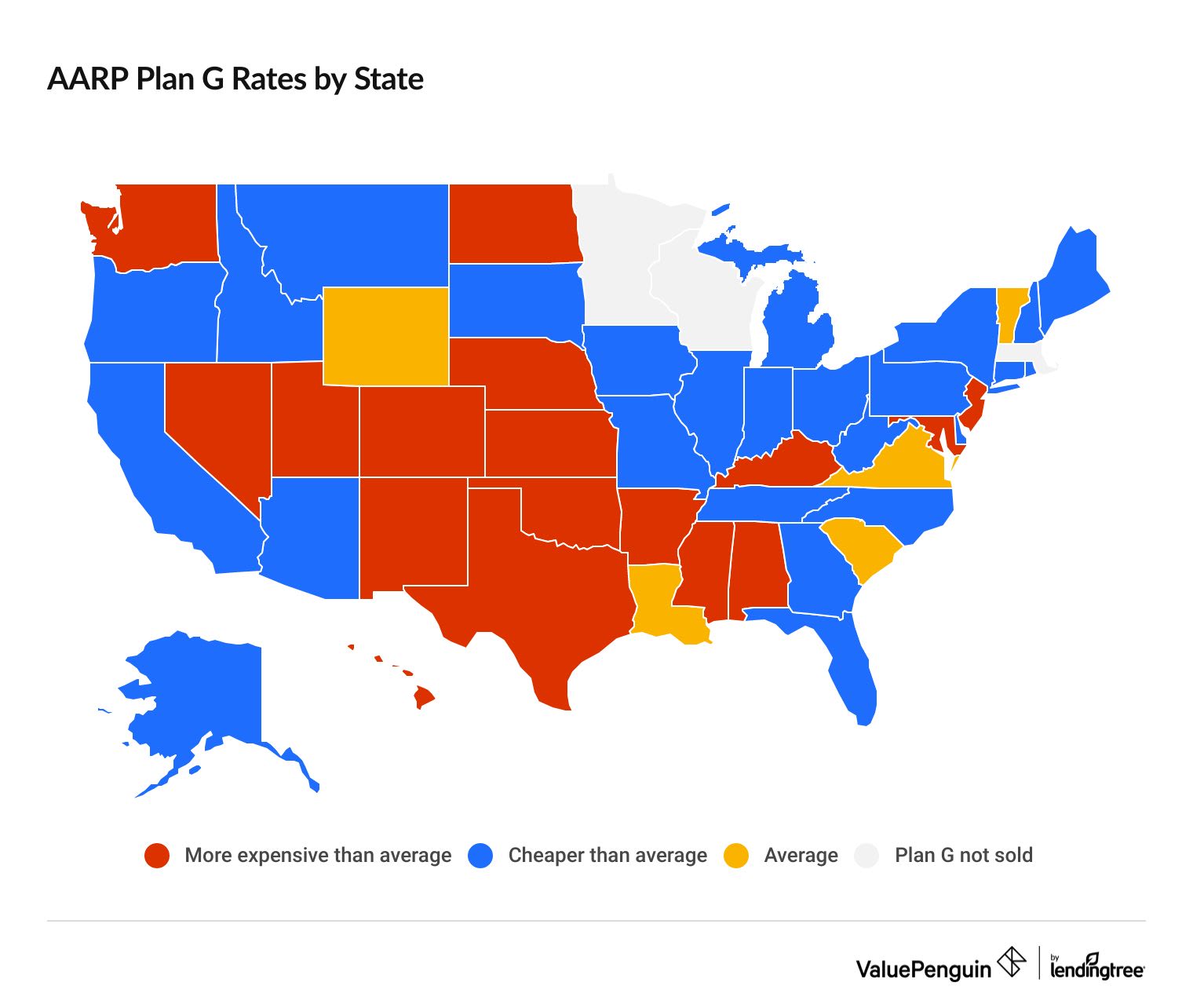

AARP Plan G rates by state

What you pay for a Medigap plan from AARP/UnitedHealthcare depends on where you live. The company's Plan G is just $1 per month cheaper than the national average. However, AARP's Plan G is cheaper than the state average in about half the country.

Cost of AARP Plan G by state

State | AARP Plan G rate | State average Plan G rate | Difference |

|---|---|---|---|

| Alabama | $144 | $142 | 1% |

| Alaska | $140 | $158 | -11% |

| Arizona | $145 | $154 | -6% |

| Arkansas | $181 | $172 | 5% |

| California | $165 | $182 | -9% |

Average monthly cost for a 65-year-old woman who does not smoke.

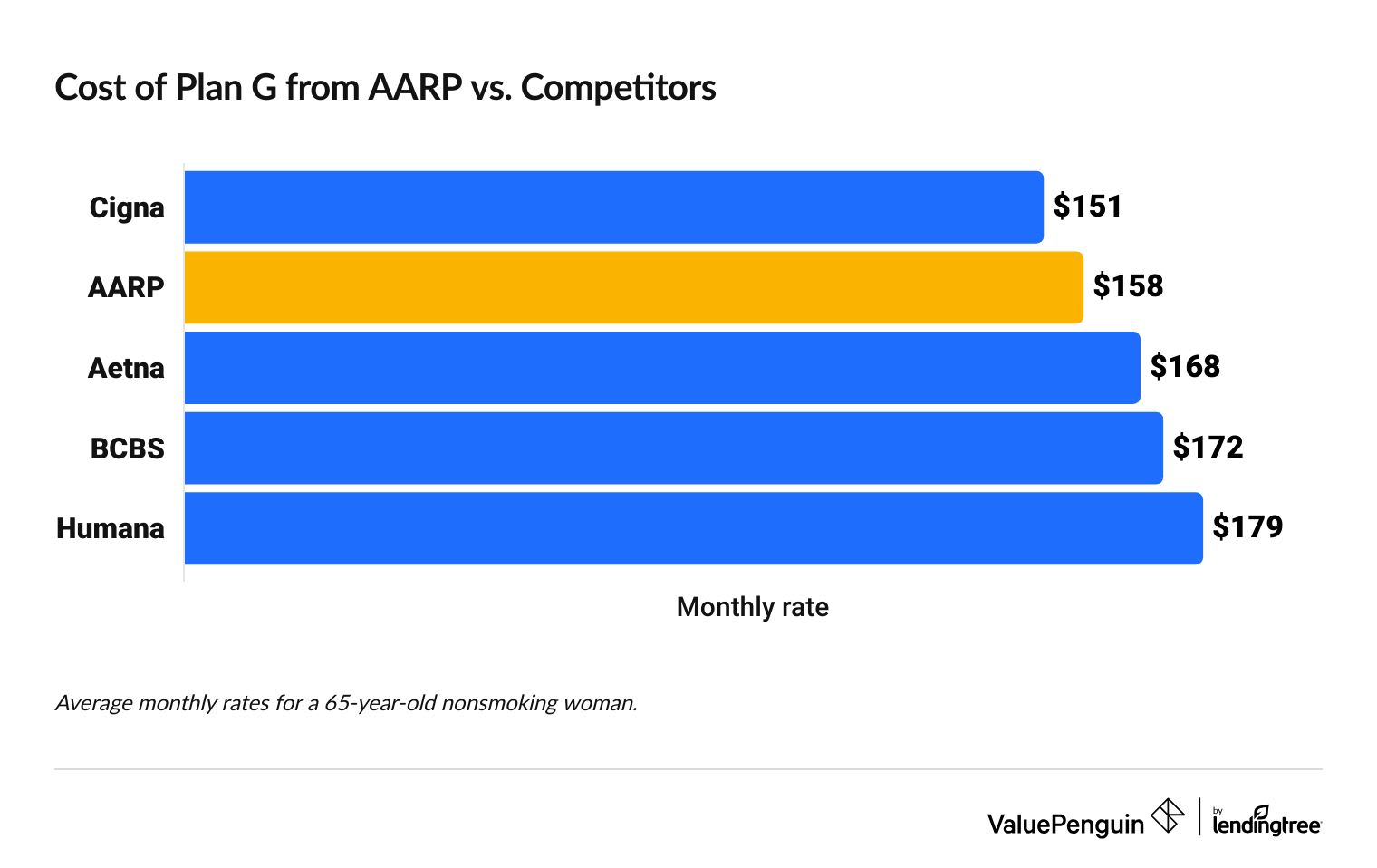

AARP Medigap rates vs. other insurance companies

AARP/UnitedHealthcare has some of the cheapest rates for Medigap plans compared to other large insurance companies.

Compare Medicare Plans in Your Area

But your rate will depend on things like where you live, your gender, whether you smoke and if your state allows age to be used in your rates.

Medicare Supplement coverage is the same across companies. The only thing that sets your coverage is the plan letter you buy. That means Plan G from one company covers the same things as Plan G from another company. You should compare average rates, extra benefits and customer satisfaction to choose the best company.

AARP Medicare Supplement Plan G rates vs. competitors

AARP Medigap prices by age

In most states, your age will affect how much you pay for Medigap coverage. For states where age is factored into your rate, the average monthly cost for AARP Medigap Plan G is $150 per month for a 65-year-old woman who doesn't smoke. At age 75, the average monthly rate is $204, and it's $254 at age 85.

If you want a cheaper plan, consider Plan N, which has coverage that is almost as good as Plan G, but a lower monthly rate. In states where age impacts rates, AARP's Plan N costs an average of $124 per month at age 65 and $208 per month at age 85.

AARP/UnitedHealthcare price increases are based on what it calls an enrollment discount.

- From ages 65 to 67, customers are given a 45% discount.

- The discount is reduced by two percentage points each year between ages 68 and 79.

- Between ages 80 and 85, the discount goes down by three percentage points each year.

- At age 86, the discount is completely gone and you pay a standard rate.

Only AARP sets rates this way. Nationally, rates change between about 2% and 3% each year as you age.

The AARP Medigap enrollment discount might help you get a lower rate at first, but customers complain about their rates increasing as the discount gradually disappears.

To make sure an AARP plan is right for you, it might help to get quotes at different ages. You can do this by adjusting your birth year on the quotes. The numbers you get might not be exactly what you'll pay as you age, but they can help you get a sense of what you'll pay as you get older. That way you know if you can still afford the plan you want.

Cost of AARP Medigap plans by age

Age 65

Age 75

Age 85

Plan | AARP monthly rate |

|---|---|

| High-deductible G | $48 |

| Plan K | $61 |

| Plan L | $110 |

| Plan N | $124 |

| Plan A | $141 |

Average monthly cost for a 65-year-old woman who does not smoke.

Age 65

Plan | AARP monthly rate |

|---|---|

| High-deductible G | $48 |

| Plan K | $61 |

| Plan L | $110 |

| Plan N | $124 |

| Plan A | $141 |

Average monthly cost for a 65-year-old woman who does not smoke.

Age 75

Plan | AARP monthly rate |

|---|---|

| Plan K | $84 |

| High-deductible G | $106 |

| Plan L | $152 |

| Plan N | $169 |

| Plan A | $190 |

Average monthly cost for a 65-year-old woman who does not smoke.

Age 85

Plan | AARP monthly rate |

|---|---|

| Plan K | $100 |

| High-deductible G | $149 |

| Plan L | $180 |

| Plan N | $208 |

| Plan A | $237 |

Average monthly cost for a 65-year-old woman who does not smoke.

Most states are allowed to increase monthly costs as you get older. Eight states ban cost increases based on age or health condition.

States where companies can't use age in pricing

- Arkansas

- Connecticut

- Maine

- Massachusetts

- Minnesota

- New York

- Vermont

- Washington

Also, Massachusetts, Minnesota and Wisconsin don't follow the standard Medigap plan letters. These states have their own plan types and prices.

AARP Medigap costs in states with different plans

- Massachusetts: $163-$228

- Minnesota: $236-$315

- Wisconsin: $145

Massachusetts, Minnesota and Wisconsin use alternative plan names with different structures and benefits compared to the other states.

Minnesota and Massachusetts don’t allow price increases by age, but Wisconsin does.

How do AARP Medicare Supplement plans work?

Medigap policies from AARP or any other company pay for many costs that Original Medicare doesn't.

These plans can reduce the part of your medical bill that you're responsible for paying. The level of coverage depends on the plan you select.

For example, if the cost of a doctor's visit is $200, Medicare Part B would pay $160 of the bill, assuming you've already met your small Part B deductible. Your Medigap plan could pay the leftover $40, depending on the plan you choose and how much coverage it offers.

When you buy an AARP Medicare Supplement insurance plan, you’re actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for certain UnitedHealthcare plans. In turn, AARP gets a percentage of each Medicare Supplement plan sold.

What do Medigap plans cover?

- What Medigap covers: All Medigap plans cover some of the Medicare costs you're responsible for, like deductibles and coinsurance, for Medicare Part A and Medicare Part B.

- What Medigap doesn’t cover: A Medicare Supplement plan will not cover your prescription drugs. For that, you’ll need a separate Medicare Part D plan.

What extra features do AARP Medigap plans have?

AARP Medigap plans come with impressive extra benefits like discounts on vision and dental care, plus a free gym membership.

You have to join AARP to buy one of the company's Medicare Supplement plans. Membership costs $16 per year. Your Medigap plan comes with extra benefits and coverage options. AARP membership gives you access to AARP discounts, like savings on hotels and rental cars.

- Vision: AARP offers discounted glasses and contacts through EyeMed.

- Dental: You can get discounts on dental care through Dentegra.

- Hearing: AARP Hearing Solutions gives you a free hearing test and discounts on hearing aids.

- 24/7 nurse line: If you have questions about your health, medications, treatment plan or more, you can call a nurse any time of day for help.

- Fitness: AARP has several fitness benefits, including an online fitness center and customized workouts. UnitedHealthcare offers a free gym membership through its fitness program, Renew Active.

- Mental sharpness: AARP Staying Sharp has brain health games and activities to help with your mental fitness.

- Driver safety: This is a safe driving course, which could help you reduce your car insurance rates.

Remember, though, that the primary coverage of AARP Medicare Supplement plans will be the same as plans offered by other insurance companies. You should buy the plan that works best for you, and treat perks as extra. Don't buy a plan just because of the company's extra benefits.

Customer reviews and satisfaction

AARP/UnitedHealthcare has average customer satisfaction.

The largest company within the UnitedHealthcare group gets 16% more complaints for Medigap plans than expected for a company its size, but the second largest company gets 11% fewer complaints.

The Better Business Bureau (BBB) gives AARP an A+ rating. This means the company responds to customer issues and attempts to solve problems.

However, the online customer reviews on BBB are low. Common complaints about AARP include junk mail, poor customer service and aggressive marketing.

Frequently asked questions

How much does AARP supplemental insurance cost per month?

Plan G from AARP costs $158 per month, on average. In about half the country, AARP is a cheaper-than-average choice for Plan G, although its other plans can be expensive. The price you pay for a Medigap plan will depend on what plan you choose and when you buy a policy. In most states, your age will also affect your rate.

Is AARP Plan N good?

AARP's Plan N rates are usually expensive compared to other companies. You'd get the same coverage from another company and you might be able to get a cheaper rate, too. However, AARP's perks might make up for the higher Plan N rate for some people.

What is the difference between AARP UnitedHealthcare and UnitedHealthcare?

AARP and UnitedHealthcare are different companies. But AARP and UnitedHealthcare work together to sell Medicare Supplement plans. The coverage on your AARP Medigap plan comes from UnitedHealthcare. AARP gets a fee for helping market the plans.

Methodology and sources

Medicare Supplement rates for 2025 are based on actuarial data for private insurance companies. Average rates are for a 65-year-old nonsmoking woman unless a different age or gender is specifically mentioned. The rates on this page are the cost for coverage when a person initially becomes eligible for Medicare. Average rates are for preferred pricing when health conditions are not factored into monthly costs.

Other sources include AARP, A.M. Best, Better Business Bureau (BBB), J.D. Power, KFF, Medicare.gov, the National Association of Insurance Commissioners (NAIC) and UnitedHealthcare.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.