Highmark Medicare Advantage Review: Good Coverage but High Rates

Highmark Medicare Advantage plans have good coverage. They can be expensive, but cheap options are available.

Compare Medicare Plans in Your Area

Highmark, which is part of Blue Cross Blue Shield, is a good option for high-quality Medicare Advantage plans. Its plans are expensive, on average, but it has at least one $0 per month plan everywhere it sells coverage. Highmark Medicare Advantage plans are available in Delaware, New York, Pennsylvania and West Virginia.

Pros and cons

Pros

Good quality coverage

High customer satisfaction

Sells some cheap and $0 per month plans

Cons

High average rates

High out-of-pocket costs

Only available in four states

Is Highmark good insurance?

Highmark Medicare Advantage plans are a good choice for coverage and customer service.

The company's average rates are high, but it also has cheap and no-cost plans available. And Medicare.gov gives Highmark an overall quality rating of 4.23 out of 5 stars. The company is particularly well-rated for customer satisfaction, where it earns a Medicare.gov rating of 4.28 out of 5.

Cost of Highmark Medicare Advantage

Highmark has at least one $0 option everywhere it sells plans.

And most of those counties have access to two or three $0 per month plans from Highmark.

Overall, Highmark has high rates for Medicare Advantage, at an average of $71 per month. But Highmark's average rates are only high because it offers some higher-cost plans that offset its cheap and no-cost plans. Highmark is still a good option if you are on a budget.

Compare Medicare Plans in Your Area

You can still get good cheap or no-cost plans from Highmark. It's worth it for most people to get quotes from Highmark and compare them to other companies.

Highmark Medicare Advantage rates by state

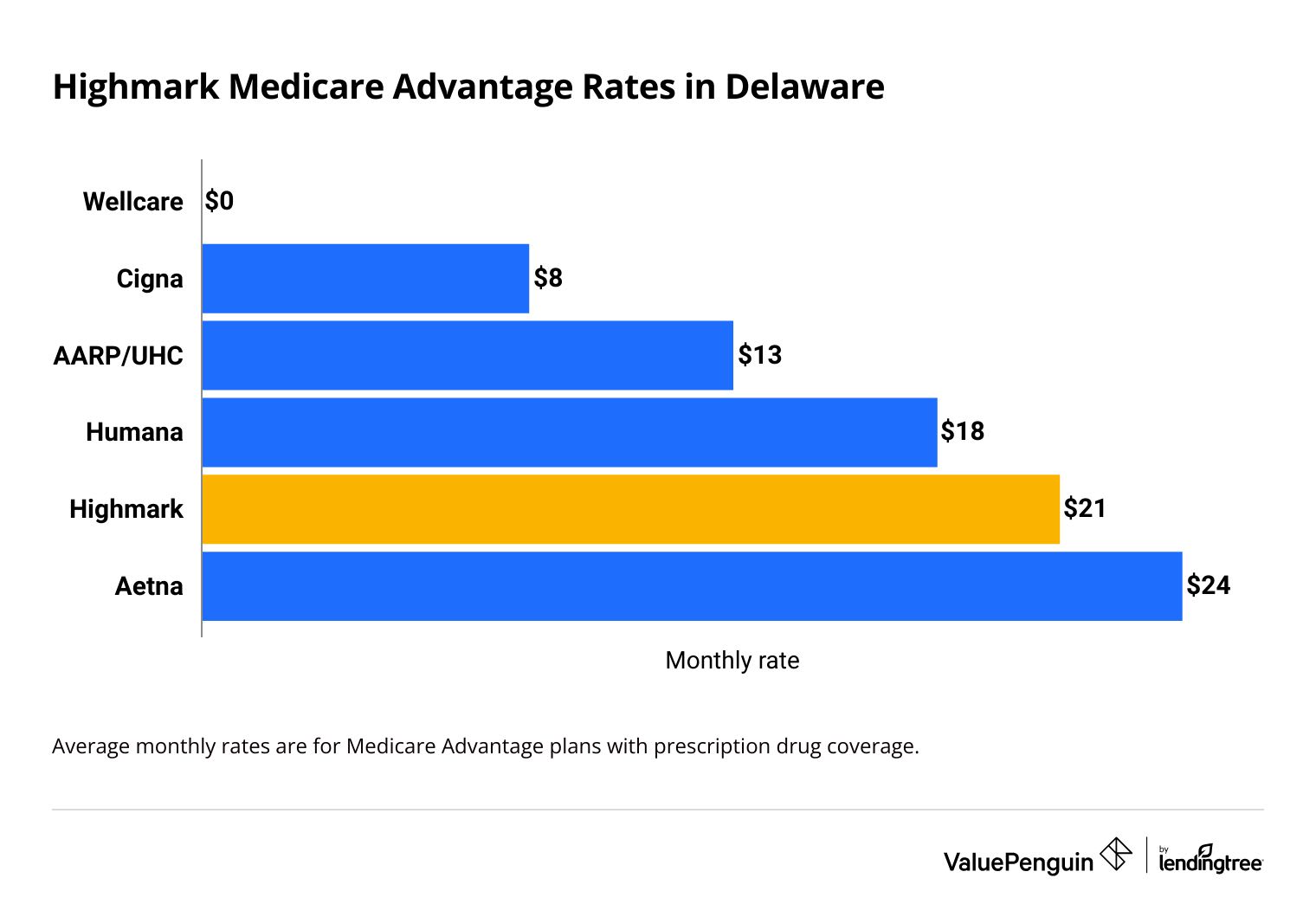

Delaware

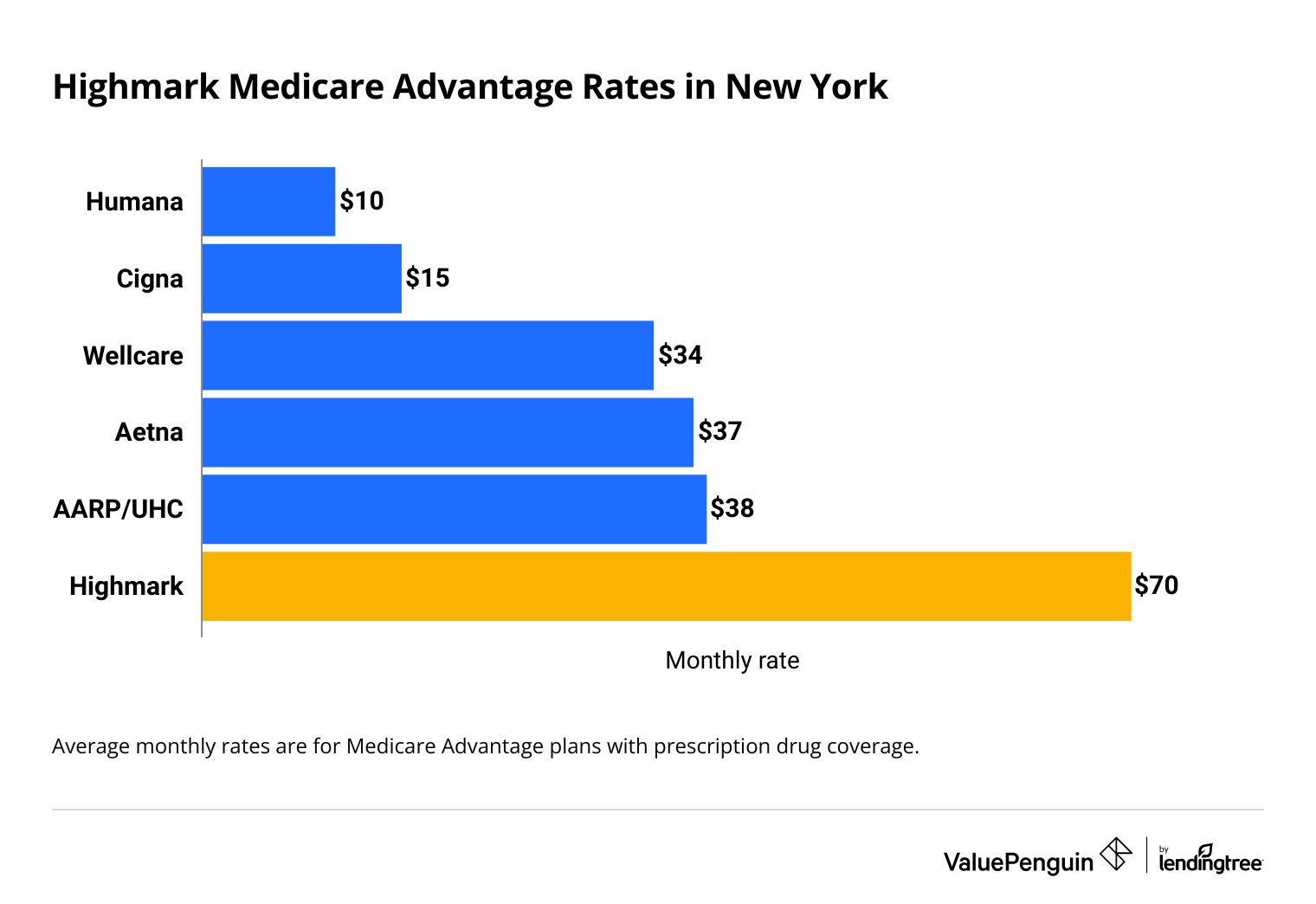

New York

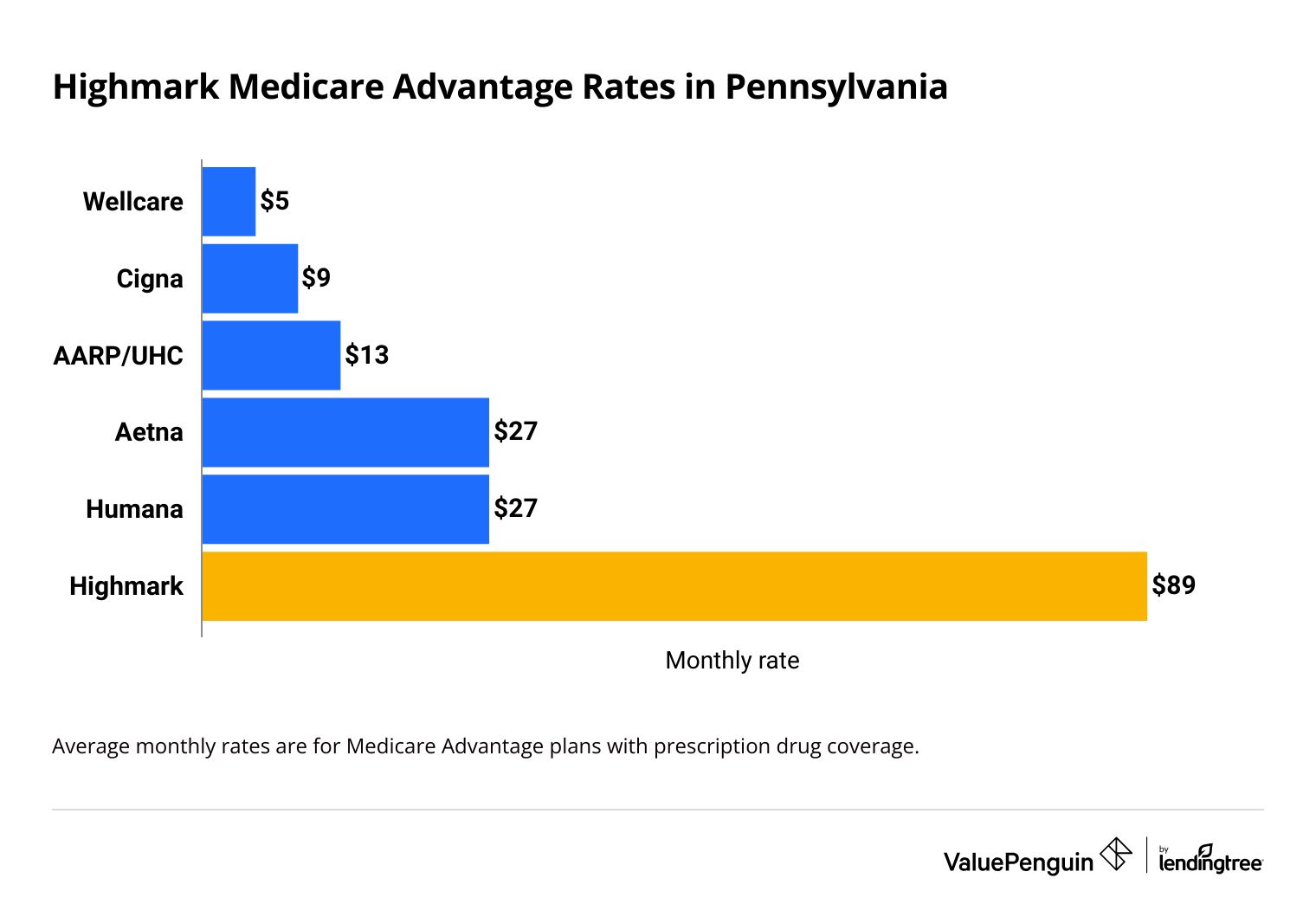

Pennsylvania

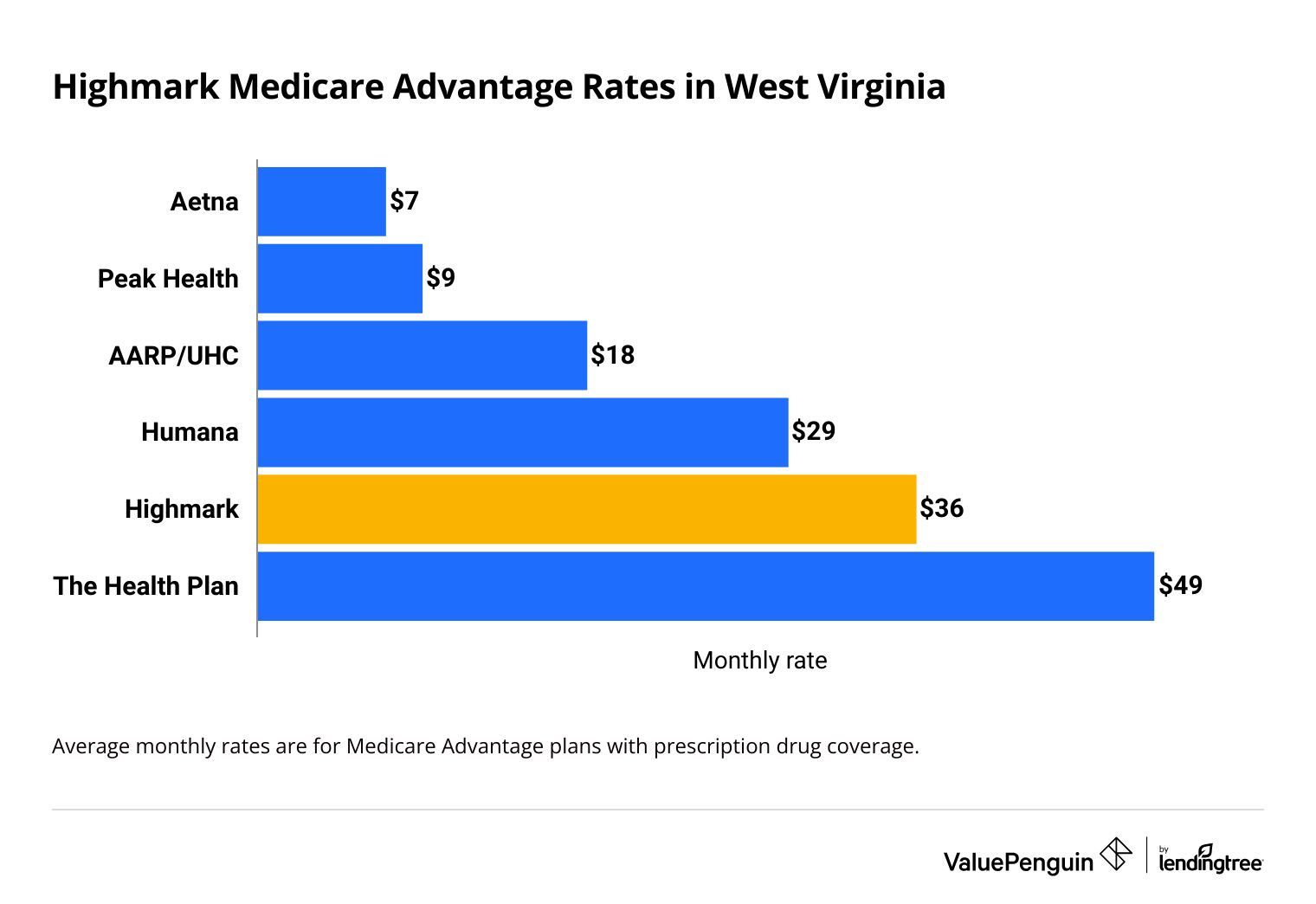

Are Highmark's Medicare Advantage plans a good value?

Highmark's cheap or $0-per-month plans can be good if you don't need much medical care.

The Freedom Blue PPO Signature plan, for example, has no monthly cost. It also doesn't have a deductible for medical care and prescription drugs, which means your coverage starts right away. You won't usually pay for primary care doctor visits, and you'll only pay between $25 and $30 to see a specialist.

But you could pay up to $10,000 for medical care if you need expensive treatment that's out of the plan's network. Even if you stay inside the network, you could pay between $6,700 and $7,550 before your plan starts to pay for all your covered medical care. That's because Highmark's cheap or free plans have high out-of-pocket maximum limits.

Highmark isn't a good choice if you need expensive or frequent medical care.

If you buy one of the company's free or cheap plans, you could end up paying a large portion of your medical bills.

You could buy one of Highmark's more expensive plans, like the Freedom Blue PPO Deluxe, which costs $278 per month, on average. Highmark's higher-cost plans usually have lower out-of-pocket maximums, which means you won't pay for as much of your medical care. With the Freedom Blue PPO Deluxe plan, the most you would pay for medical care in any year is $4,500.

But you can get a cheaper plan from another company that has a similar out-of-pocket limit. For example, the Aetna Medicare Essentials Plan, which is available in many of the same areas as Highmark's Freedom Blue PPO Deluxe, has a $0 monthly rate and a $4,850 out-of-pocket maximum. You might pay a bit more yearly for medical care, but you'd ultimately save money since the plan has no monthly rate.

Highmark Medicare Advantage plan options

You'll usually have seven plans to choose between, if you live in a county where Highmark sells Medicare Advantage.

This includes a mix of HMO plans, which limit coverage to in-network medical providers, HMO-POS plans, which provide the flexibility to go out of network for some services and PPO plans, which cover both in-network and out-of-network medical care. Benefits can include:

- Accepted by most doctors: Highmark is part of Blue Cross Blue Shield (BCBS). More than 90% of doctors and hospitals in the country take BCBS coverage. And even though the list of doctors varies by plan, there are options like the $0 Freedom Basic plan, which can give you in-network coverage even when you're not near home.

- Prescription drugs: In general, Highmark plans have good coverage and affordable copays for prescription drugs, and there are discounts if you use a preferred pharmacy. However, some plans, particularly the plans in New York, have a prescription drug deductible of a few hundred dollars. This means you could have to fully pay for some prescriptions out of pocket before the benefits kick in.

- Dental: Plans usually cover preventive dental care, like cleanings, and some non-routine dental care services. However, your costs for advanced dental care can be high, 50% of the bill, and advanced plan approval is usually required.

- Hearing: Most plans provide low-cost hearing exams and coverage for hearing aids. You could pay $699 to $999 per hearing aid, making Highmark one of the best Medicare Advantage providers for hearing aids.

- Vision: Most plans cover eye exams, lenses, contacts and frames.

- Over-the-counter (OTC) allowance: Some plans offer an allowance of $100 to $140 per year to buy pharmacy items at the Highmark OTC store.

- Telehealth: Depending on your plan, you might have access to virtual appointments through either the Doctor On Demand app, the Blues On Call program or a virtual appointment with your local doctors.

- Worldwide emergency coverage: Many plans will cover emergency or urgent care, even if you're traveling abroad.

In Pennsylvania, Highmark also sells plans that help you coordinate your health care if you have both Medicare and Medicaid. These are called Dual-Eligible Special Needs Plans (D-SNPs).

Compare Medicare Plans in Your Area

Highmark Medicare Advantage perks and extra benefits

Highmark plans often come with a few perks that give you extra coverage.

The extra benefits will depend on where you live and what plan you buy.

- Companionship and non-medical support: Some plans offer the PALS program, which provides at-home help with chores, a sense of community and non-medical support such as help shopping. Keep in mind that those participating in these programs may be encouraged to get wellness exams.

- Wellness debit card: You might be able to get rewards for things like wellness exams and cancer screenings.

- Fitness: Plans include the SilverSneakers fitness program.

While perks can be nice, you shouldn't choose your Medicare Advantage plan just based on the extra coverage. Make sure that Highmark is a good fit for your budget and health needs first. Then, if you're still comparing plans, you can use the extra benefits to make a final decision.

Customer reviews and complaints

Highmark Medicare Advantage plans have excellent customer service ratings from Medicare.gov

The plans have an average quality rating of 4.23 out of 5 stars from Medicare.gov, and an average customer satisfaction rating of 4.28 out of 5 stars. This means that Highmark plans have good coverage and its customers are generally happy with their experiences.

Highmark also offers six 5-star plans in Pennsylvania. Highmark has some of the most highly-rated Medicare Advantage plans in Pennsylvania.

Highmark placed second overall in the 2023 J.D. Power U.S. Medicare Advantage Study in Pennsylvania. Only UPMC for Life ranked higher. The study looks at the level of trust that people have in their plans, the ability to get medical care, average rates, coverage offerings, customer service and digital tools.

But satisfaction varies depending on the plan you buy and the state you live in. In Delaware, for example, Highmark only gets 2 out of 5 stars for customer service. If you know someone with a Highmark Medicare Advantage plan, ask about their experience with the company to get a better sense of service in your area.

State | Overall rating | Customer service |

|---|---|---|

| Delaware | ||

| New York | ||

| Pennsylvania | ||

| West Virginia |

The National Association of Insurance Commissioners (NAIC) also shows that Highmark typically has good service. Most of the companies under the Highmark brand have very low levels of complaints, which likely means they have good service.

But the Highmark company in New York has 17% more complaints than an average company its size. These complaints aren't specifically about Medicare Advantage plans, but they can be used to get a sense of the company's service overall.

And customer reviews on the Better Business Bureau (BBB) website about Highmark tend to be negative. Highmark has a customer rating of 1.11 out of 5 from BBB. These reviews aren't purely about Medicare Advantage plans, but they do offer insight into the company's service as a whole. Many customers complain about phone calls dropping or being transferred, difficulty reaching the right person to discuss a problem and billing issues. However, most BBB reviews are negative. Only you can decide how much value to place on these reviews.

Frequently asked questions

Is Highmark the same as Blue Cross Blue Shield?

Highmark is an independent company that is a part of the Blue Cross Blue Shield Association. So even though plans are affiliated with Blue Cross Blue Shield, the company is locally owned and operated.

Is Highmark a good Medicare Advantage plan?

Yes, Highmark is usually a good choice for Medicare Advantage plans. Some of its plans are expensive, but you can get cheap or $0-per-month plans in every county where Highmark sells coverage. Highmark typically has good customer service and useful perks, too.

Does Highmark have a Medicare Supplement plan?

Highmark sells Medicare Advantage plans in Pennsylvania and West Virginia. Highmark's Plan G, which is the best Medigap plan if you're new to Medicare, costs $131 in Pennsylvania and $128 in West Virginia. That's lower than the state average in each state, making Highmark Medicare Supplement a good value.

Methodology and sources

Medicare Advantage rate data is from Centers for Medicare & Medicaid Services (CMS) public use files. Average rates are only for Medicare Advantage plans that include prescription drug coverage. Program of All-Inclusive Care for the Elderly (PACE) plans, Special Needs Plans (SNPs), Part B-only plans, employer-sponsored plans, Medicare-Medicaid plans (MMPs) and sanctioned plans were excluded from rates. Medicare star ratings are averaged based on individual contracts.

Other sources include the J.D. Power, the National Association of Insurance Commissioners (NAIC), Highmark and Blue Cross Blue Shield.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.