Wellcare Medicare Advantage Review (2024)

Compare Medicare Plans in Your Area

Wellcare has cheap Medicare Advantage and Part D plans. It also offers extra benefits like $0 prescription copays, Medicare Part B monthly giveback and a preloaded debit card that can be used for healthy food, medications and more.

However, most Wellcare customers are not satisfied with their Medicare Advantage plans. Wellcare gets significantly more customer complaints compared to an average insurance company of the same size.

Cost of Wellcare Medicare Advantage

Wellcare Medicare Advantage plans cost $8 per month on average.

You can save roughly $15 per month, compared to the national average, by getting a Wellcare Medicare Advantage plan. In addition, Wellcare offers a large number of $0 Medicare Advantage plans. Keep in mind that you still have to pay for Medicare Part B, which costs $174.70 per month, even if you have a $0-per-month plan.

However, Wellcare will pay for some or all of your Medicare Part B monthly rate if you choose a plan with a Part B give-back benefit. This makes WellCare one of the more affordable Medicare Advantage options available.

However, Wellcare has low levels of customer satisfaction and poor quality care. Aetna also offers low-cost Medicare Advantage plans, but at a much higher level of quality.

Plans and coverage

Wellcare offers HMO, PPO, HMO-POS and PFFS Medicare Advantage plans. However, most people will choose between a HMO and a PPO plan.

HMO (health maintenance organization) plans require you to have a primary doctor. Typically, you'll need a referral to visit a specialist, and you can't go outside your plan's network of doctors unless it's an emergency.

In contrast, PPO (preferred provider organization) plans usually cost a little more than HMOs, but you don't need to have a primary care doctor, and you don't need to get a referral to see a specialist. You can also see doctors outside of your network, although you'll pay more when you do.

Plans to avoid

Among Wellcare's cheap Medicare Advantage plans are options that don't include prescription drug coverage. These $0 plans may seem like a good deal, but you won't have coverage for any medications. And in nearly all cases, you won't be able to add on stand-alone prescription coverage with a Medicare Part D plan.

An HMO-POS plan lets you see an out-of-network doctor at a higher cost. However, you still need a primary care doctor, and your plan may require you to get a referral to see a specialist.

A PFFS (Medicare Private Fee-For-Service) plan pays a set amount for each individual medical service you use. PFFS plans tend to be expensive and unpopular.

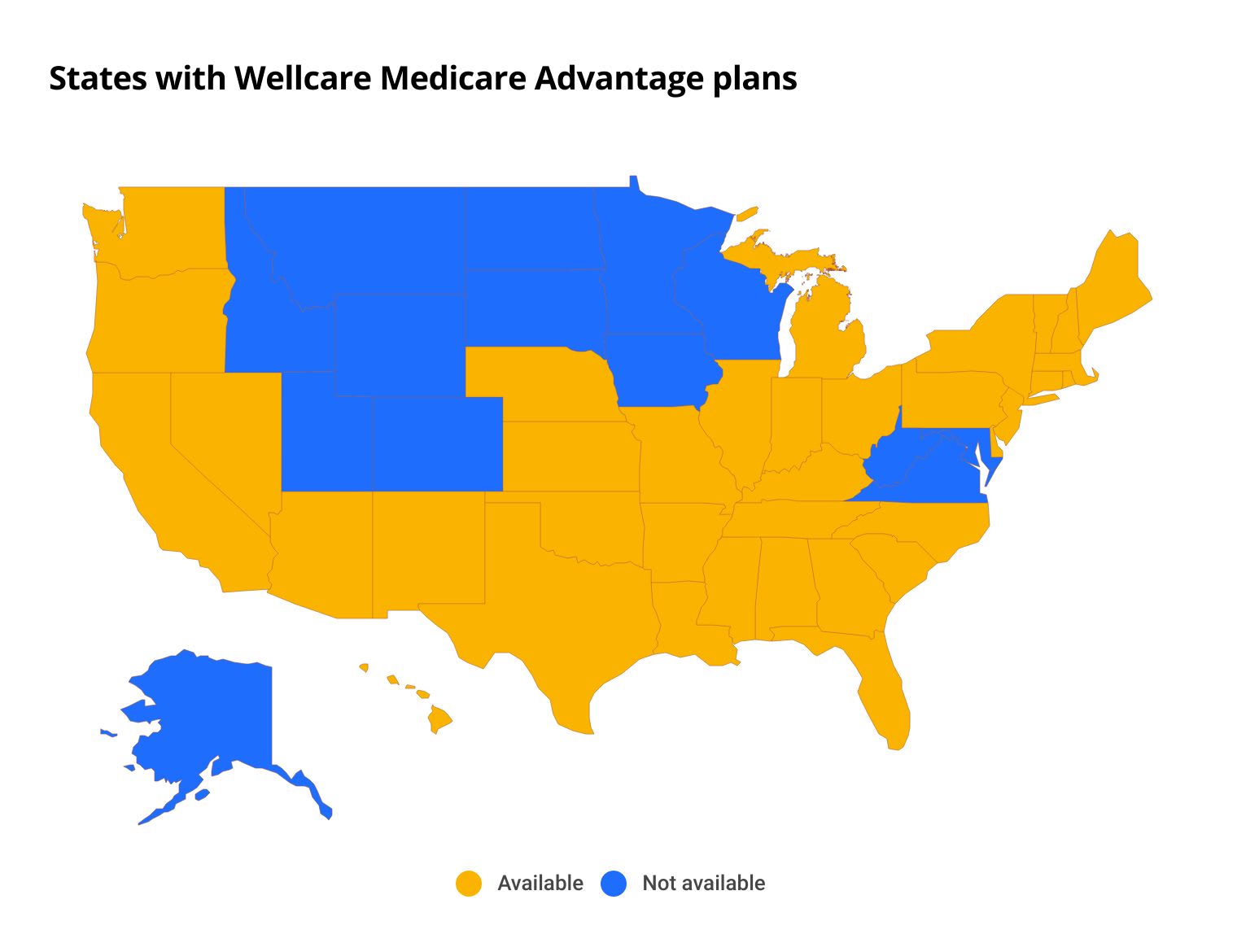

Wellcare Medicare Advantage plan availability

Wellcare sells Medicare Advantage plans in 36 states. This includes most of the country outside the upper Midwest, parts of the Mountain West and the mid-Atlantic.

Compare Medicare Plans in Your Area

States with Wellcare Medicare Advantage plans

- Alabama

- Arizona

- Arkansas

- California

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Maine

- Massachusetts

- Michigan

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Vermont

- Washington

Wellcare Part D plans

Wellcare Part D plans offer good quality at an affordable price.

Wellcare Part D plans cost $39 per month, on average, which is $20 per month cheaper than the national average. In addition, Wellcare Part D plans have an average rating of 3.5 stars from CMS. That's comfortably above the industry average of 2.8 stars.

That makes Wellcare Part D plans a good choice for people who want good coverage at low monthly rates.

Medicare Part D is a prescription drug plan that's only available to people who have Original Medicare. You cannot buy Medicare Part D if you have Medicare Advantage.

Wellcare Classic has the best overall Medicare Part D plan for 2024 because of its low costs, good plan quality and zero-dollar generic drug deductible . In addition, Wellcare has two other plan choices: the Wellcare Value Script and Wellcare Medicare Rx Value Plus.

Wellcare Value Script has an average monthly rate of just $1. In some states, it costs $0 per month making Wellcare Value Script the only free Medicare Part D plan in the country.

Wellcare Part D plans are available in all 50 states and Washington D.C.

Wellcare Medicare Rx Value Plus is expensive with an average monthly cost of $80. However, it has a $0 deductible for both prescription and generic drugs. You might also save money on your copay depending on which types of drugs you take.

Medicare Part D | Average monthly cost | Average deductible |

|---|---|---|

| Wellcare Value Script | $1 | $536 |

| Wellcare Classic | $37 | $545 |

| Wellcare Medicare Rx Value Plus | $80 | $0 |

After you've met the plan's deductible, most Wellcare Part D plans have free preferred generic medications. The cheaper Value Script plan will have the best coverage if you expect to take generic medications. However, if you expect to need brand-name medications, the Classic plan has better coverage while still having a low monthly cost.

The primary benefit of the Medicare Rx Value Plus plan is its no deductible, but plans are typically not the best financial deal. The copayments are similar to the Value Script plan. This means an Rx Value Plus plan makes sense if you think you'll meet your deductible, but otherwise, you're better off financially with the Value Script plan.

Other WellCare plans

Wellcare's Medicare options go beyond Medicare Advantage and Part D plans. Wellcare's parent company, Centene, sells Medigap plans through a subsidiary, Health Net.

The company is particularly focused on its Dual Medicare Special Needs Plans (D-SNPs). These plans help coordinate the benefits you get if you dual-qualify for Medicare and Medicaid.

Member resources and unique features

Wellcare's member benefits vary between plans, states and brands. However, there is usually a large list of benefits, and most plans include:

- Dental care

- Hearing care

- Vision care

- Fitness services

- My Wellcare rewards

- Telehealth

- $0 Rx Copays & Healthy Foods Card

- Over-the-counter (OTC) benefit: A set allowance, which can be used to purchase items at CVS pharmacies

- Spendable card: A prepaid debit card to pay for nearly anything, including gas and groceries

Wellcare Spendable cards are prepaid debit cards that some plans offer. Depending on your plan, you'll get between $144 and $2,880 per year. However, you won't get the full sum all at once. Instead, Wellcare will give you monthly or quarterly installments.

Wellcare Spendable cards used to be called flex cards.

If you have a non-Special Needs Plan, Wellcare restricts your spending to over-the-counter items, dental, vision and hearing care at certain stores and hospitals. However, customers with Dual Special Needs Plans can also use their Spendable card on groceries, gas, rent and utilities.

Customer reviews and complaints

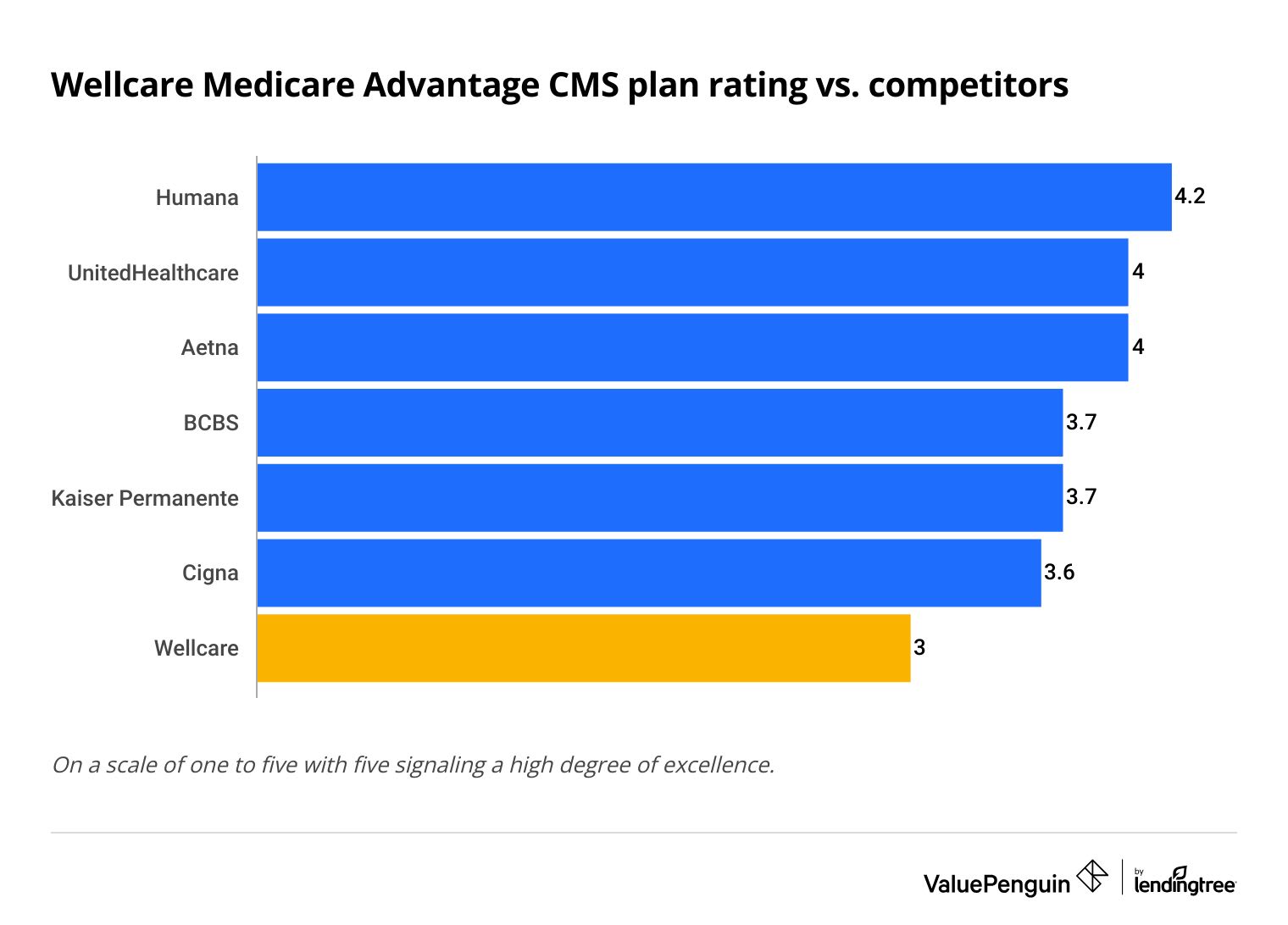

Wellcare has one of the lowest ratings among major Medicare Advantage companies, averaging 3 stars overall.

By comparison, the national average is 3.9 stars. Top competitors like Humana, UnitedHealthcare and Blue Cross Blue Shield (BCBS) all have star ratings of four or better.

Wellcare only has four plans with a star rating of 4 all of which are PFFS plans. Its highest-rated HMO plan has 3.5 stars and its highest-rated PPO plan has 3 stars.

Star ratings come from the Centers for Medicare and Medicaid (CMS). Medicare Advantage customers are surveyed on a wide range of topics related to the quality of their care. Star ratings are the average score of these responses.

In four states , Wellcare's parent company Centene ranked in last place for Medicare Advantage customer satisfaction according to a recent J.D. Power survey.

Frequently asked questions

Does Wellcare have good Medicare plans?

Wellcare Medicare Advantage plans cost significantly less than the national average. However, Wellcare's overall customer satisfaction is worse than other major companies like AARP/UnitedHealthcare.

What is WellCare?

Wellcare is a health insurance company that sells Medicare Advantage, Medicare Part D and D-SNP plans. Wellcare is owned by Centene, which is also the parent company of Ambetter.

What is the difference between Medicare and Wellcare?

Wellcare is a company that sells health insurance plans. Medicare is a type of government-run insurance. However, the government lets certain companies sell Medicare plans. Wellcare is just one of the companies you can get Medicare benefits from.

Methodology and sources

Medicare Advantage data on cost and star ratings is from Centers for Medicare & Medicaid Services (CMS). Rates listed only include Medicare Advantage plans with prescription drug coverage. PACE plans, special needs plans, Part B-only plans, employer-sponsored plans, Medicare-Medicaid plans and sanctioned plans are excluded. Each instance of a plan is considered individually when it has different monthly costs or coverages. Star ratings are averaged based on individual contracts.

Company information is from Centene and Wellcare. Additional rating data is from J.D. Power.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.