Guide to Providing Health Care Benefits to Employees

If your business has over 50 employees, you are legally required to provide health insurance to employees because of the Affordable Care Act (ACA).

Find Cheap Health Insurance in Your Area

If your business has fewer than 50 employees, you need to decide whether to offer your employees health care benefits.

Employee health insurance costs an average $659 per month to cover an individual. That's split between the business and the employee, with the company paying about $549 per month.

Are you legally required to provide health insurance for employees?

You are legally required to provide group health insurance to your staff if you have more than 50 full-time equivalent employees.

- Full-time employees are those who work more than 30 hours per week.

- Part-time employees can add up to the equivalent of a full-time employee based on how many hours they work.

You also need to make sure you offer coverage to at least 95% of your full-time employees and their dependents.

Do small businesses need to provide employee health insurance?

If you have fewer than 50 employees, you aren't required to provide health insurance benefits, but there are some advantages that can make it worthwhile.

A strong benefits package can help you attract and retain employees. Plus, your health insurance costs are usually tax deductible. Companies with fewer than 25 employees can get discounted rates through tax credits.

How does health insurance for employees work?

Health insurance plans for employees are commonly referred to as group insurance plans. Group health insurance is a single plan that provides coverage for employees.

Companies typically pay for insurance benefits monthly, and the employee's portion of the cost comes out of their paycheck. Costs depend on your location, the number of employees covered, the ages of your covered employees and the tax benefits you receive.

In addition, there are different types of insurance plans. The four most common types of plans are:

- Preferred Provider Organization (PPO): PPOs are the most flexible health insurance plan, but they're also the most expensive. Referrals aren't needed to see a specialist, and the plan at least partially pays for out-of-network services. They're also the most common group insurance plan.

- Health Maintenance Organization (HMO): HMOs are usually cheaper, but there are more restrictions. Employees are only covered for medical care at in-network doctors. They also need a referral from their family doctor before seeing a specialist.

- Exclusive Provider Organization (EPO): EPO plans have elements of both PPOs and HMOs. Referrals aren't needed, but the plan only covers medical care at in-network doctors.

- Point of Service (POS): POS plans also have features of both HMOs and PPOs. Referrals are needed for certain services, but a POS still pays for certain out-of-network services.

Each plan has a monthly cost, a deductible that the employee has to meet before the plan's full benefits kick in and a copay that the employee pays when they get medical care.

Watch out for very cheap group insurance plans. Many of the cheapest plans have big drawbacks, such as poor customer service, only covering medical care at a small network of doctors or denying coverage for treatment.

How much does employee health insurance cost?

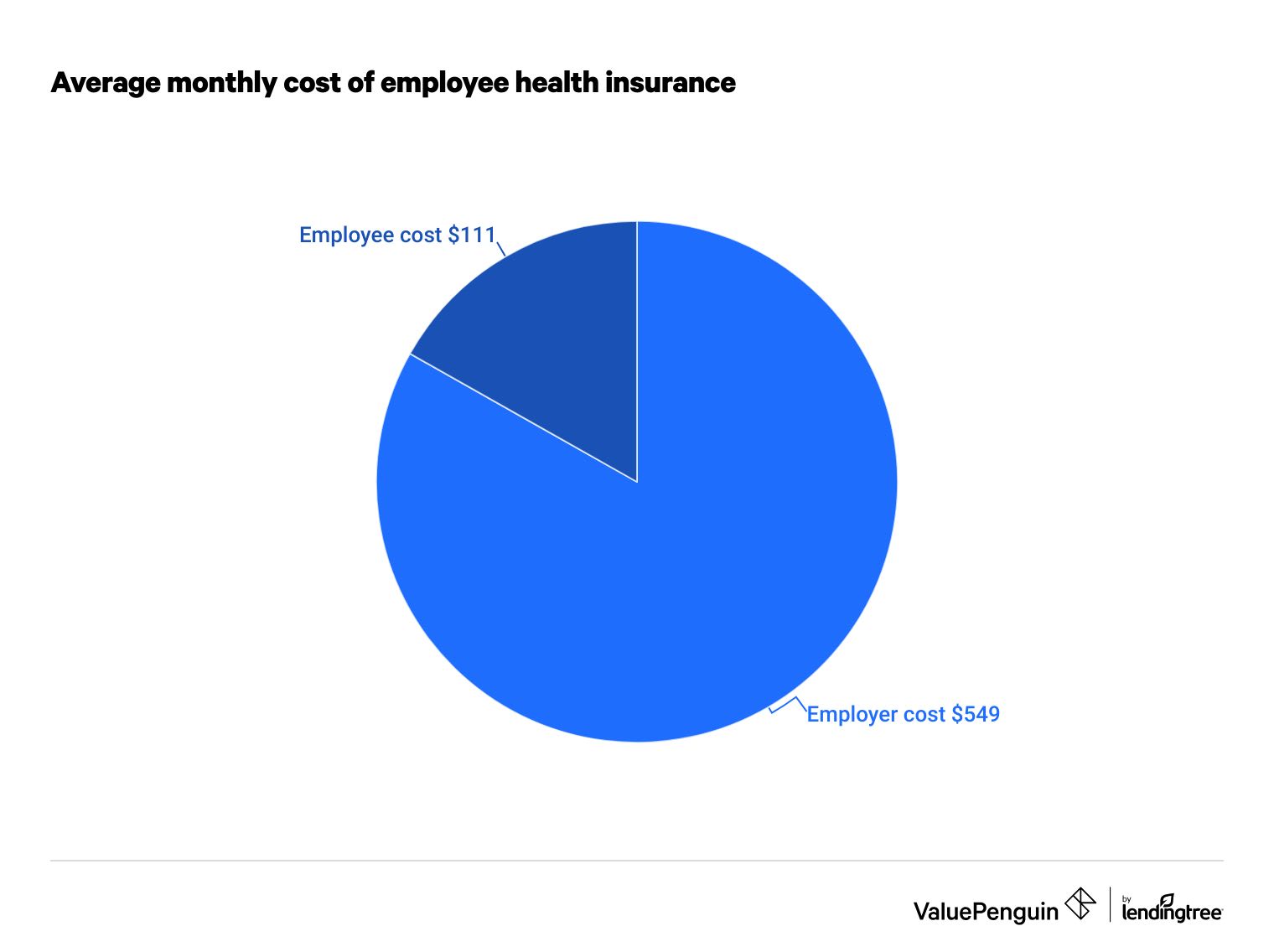

The cost of health insurance for an employee averages $659 per month to cover an individual.

That's typically split with the employee paying 17%, or $111 per month, and the employer paying the other $549 per month.

Find Cheap Health Insurance in Your Area

Employer coverage for families can be expensive. Even though workers pay a larger portion of the cost for their coverage, a company's portion of the monthly cost averages $1,363 per family.

Monthly cost of workplace health insurance

Individuals

Families

Employer cost | Worker cost | Total | |

|---|---|---|---|

| Average | $549 | $111 | $659 |

| HMO | $564 | $99 | $663 |

| PPO | $568 | $122 | $689 |

Individuals

Employer cost | Worker cost | Total | |

|---|---|---|---|

| Average | $549 | $111 | $659 |

| HMO | $564 | $99 | $663 |

| PPO | $568 | $122 | $689 |

Families

Employer cost | Worker cost | Total | |

|---|---|---|---|

| Average | $1,363 | $509 | $1,872 |

| HMO | $1,386 | $522 | $1,908 |

| PPO | $1,420 | $532 | $1,952 |

Employers contribute different amounts for the cost of employee health insurance, and the level of benefits varies, too.

For employers with more than 50 full-time employees, the plan needs to provide "minimum value" coverage. That means it pays for at least 60% of health care costs for an average person and provides coverage for both hospitalization and doctor appointments.

Tax benefits for providing health insurance to employees

The amount you spend on employee health insurance premiums is considered a tax-deductible business expense. This reduces how much you pay for federal and state taxes.

Tax deductions reduce your taxable income and can lower your tax bracket. The amount of money you save depends on your tax bracket.

Plus, small businesses may qualify for the Small Business Health Care Tax Credit. This is a federal subsidy that can reduce your cost for providing health insurance by up to 50%. To qualify, your business must:

- Have 25 or fewer full-time employees.

- The average employee salary paid is $50,000 or less.

- The business covers at least 50% of employees' premiums.

- All full-time employees are offered health care through SHOP.

Any tax credits you qualify for directly reduce the amount of taxes you owe. So if you owe $10,000 in taxes and receive a $1,000 tax credit, then you only owe $9,000 in taxes. Use HealthCare.gov's Small Business Health Care Tax Credit Estimator to see how much you could save.

Ways to save on employee health insurance

Paying for group insurance can be challenging, but there are a few ways you can reduce those costs.

- Share costs with employees: Providing health insurance benefits for your employees isn't an all-or-nothing effort. Most employers share plan costs with employees. Common ways to save are to have employees pay a higher portion of the plan's cost or reduce the plan's coverage so that employees pay more when they need medical care.

- Create your own health insurance group: If your employees are healthy and risk-averse, you may want to consider a self-insurance plan. Rather than paying premiums to a health insurance company, you set aside part of your own budget for your employee's health care. This means the risk of paying high health care costs falls on you as the employer. This may save money in the short term, but it only takes one expensive health care bill to completely use up the entire budget. Companies typically work with an insurance agent to set this up and partner with a health insurance company to run the plan.

Where to find health insurance plans

To start, we highly recommend assessing what benefits your employees are looking for. If a high percentage of your employees, for example, are looking for strong dental benefits, you'll want a plan that meets their needs. If your employees want cheap, minimal insurance that they'll only use for emergencies, that's helpful to know as well.

After assessing their wants and needs, you can now enter the insurance market with a comprehensive list of the services you'd like covered and your budget, two of the most helpful initial filters.

Find Cheap Health Insurance in Your Area

1. Small Business Health Options Program (SHOP)

SHOP is a federal marketplace for small-business owners seeking health care plans. Each state maintains its own SHOP marketplace, but they're all similar. In order to qualify to use the marketplace, businesses must generally meet the following requirements:

- Have one to 50 employees.

- Offer health care benefits to all employees who work over 30 hours a week.

- 70% of your employees must enroll.

- Have an office or employee in the state whose SHOP you'd like to use.

Employers can select from three tiers of health insurance based on price and coverage. Once a tier is selected, employees can then access SHOP and select their own individual plan based on the tier the employer selected.

2. Private health insurance marketplace

You can also find health insurance through private health insurance marketplaces. The quality and availability of plans vary based on your location, but we recommend exploring these as well in order to choose the best option for your employees. Here are the top four biggest private exchanges:

- Aon

- Mercer

- Via Benefits

- Right Opt

Like SHOP, companies can choose the plans that are available to employees and how much the employee must pay for the plan. Employees then select the individual plan they want, and the employer receives a single comprehensive bill for every employee. The marketplace typically provides administrative support services, like call centers and online support.

3. Use a health insurance broker or agent

If you don't have time to manually compare plans side by side, you should consider hiring a health insurance broker. You can find a trusted broker through colleagues or SHOP. A good broker should be able to clearly break down more challenging aspects of picking a health insurance plan, such as the value of different networks or the quality of various providers.

4. Professional employer organization (PEO)

PEOs are a way of outsourcing your HR admin tasks to another company. They can be great for small businesses and startups because they handle insurance enrollment and claims paperwork. Professional employer organizations like Justworks provide health insurance benefits at the same or cheaper rates than traditional health insurance providers charge.

5. HealthCare.gov marketplace if you're self-employed

If you're self-employed, consider the Affordable Care Act (ACA) Health Insurance Marketplace, also called Obamacare.

The benefit of the Health Insurance Marketplace is that when you apply, you can see which tax credits and plans you qualify for, and if you can get a subsidy to reduce your costs.

Common terms to know when shopping for employee health insurance

Buying health insurance for employees isn't easy. Understanding these common terms can help you navigate the process.

- Premium: The monthly cost for a health insurance plan that is often split between the employer and employee. This doesn't include copays or deductibles.

- Deductible: The amount of money that an enrollee must spend on health care before the plan's full benefits kick in. The average annual deductible for employees is $1,763 for single coverage. The deductible resets every calendar year.

- Copay: Copayments and coinsurance are an enrollee's share of medical costs when they receive treatment. For example, an enrollee could have a $20 copay for a $100 X-ray bill. In many cases, these lower rates are only available after the deductible has been met.

- Out-of-pocket maximum: This is the limit on how much the policyholder spends on medical care in a year. So even if they need very expensive medical care, they wouldn't pay more than the plan's out-of-pocket maximum.

- Primary care physician (PCP): Some health insurance plans require enrollees to choose a main doctor from whom they need a referral before seeing a specialist for a health concern.

- Network: This is the list of doctors and hospitals that are affiliated with your health insurance plan. Depending on the plan, enrollees may only have coverage if they use these medical providers, or it may be cheaper if the provider is in-network.

Frequently asked questions

Is employee health insurance tax-deductible?

Yes, companies can deduct 100% of what they pay to provide health insurance to employees.

What are the rules for offering health insurance to employees?

Companies with more than 50 full-time employees (or the equivalent number of part-time employees) must provide health insurance coverage. The policy must provide "minimum value" coverage, meaning it pays for at least 60% of health costs for an average person.

How much does employee health insurance cost?

Employee health insurance costs an average of $659 per month for an individual. This cost is split between the employee and the company. The company typically pays 83% of the cost, or $549 per month.

Sources

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.