Obamacare / Affordable Care Act Subsidy Calculator

Health insurance subsidy calculator for 2025

Calculate your ACA health insurance savings for your income and state.

Your health insurance estimated subsidy

Per person

Income vs. federal poverty level

0%

Your cost for a Silver plan

$0/month

Your cost without the subsidy

$0/month

Find Cheap Health Insurance in Your Area

After you enter your ZIP code and income, you'll learn your estimated subsidy and how much you'll pay for health insurance from HealthCare.gov or a state marketplace. The amount of your subsidy depends on the cost of health insurance in your area and your income compared to the federal poverty level.

What is an Affordable Care Act (ACA) subsidy?

The Affordable Care Act (ACA) subsidies (also called "Obamacare" subsidies) give you tax credits that help you pay less for a health insurance plan you buy from an ACA marketplace.

- How it works: Subsidies lower the cost of private health insurance based on the size of your family and your household income. Subsidies can be used throughout the year to reduce your monthly bill, or the lump sum can be taken as a credit when you file income taxes.

- Who can sign up: Health insurance subsidies are available if your income falls in a certain range based on family size. You also have to buy insurance on HealthCare.gov or a state-run health insurance marketplace to get a subsidy.

- Which insurance plans qualify: ACA subsidies can lower the cost of insurance from any company. The discount can be applied to four levels of coverage: Bronze, Silver, Gold and Platinum. Subsidies can't be used for the cheapest options: Catastrophic plans, Medicaid, the Children's Health Insurance Program (CHIP) or coverage offered by your employer.

About 92% of marketplace plans sold in 2024 have subsidies. Currently, 19.7 million people get subsidies that make their health insurance cheaper. And 4 in 5 people who apply could get a subsidized plan for $10 or less per month.

Find Cheap Health Insurance in Your Area

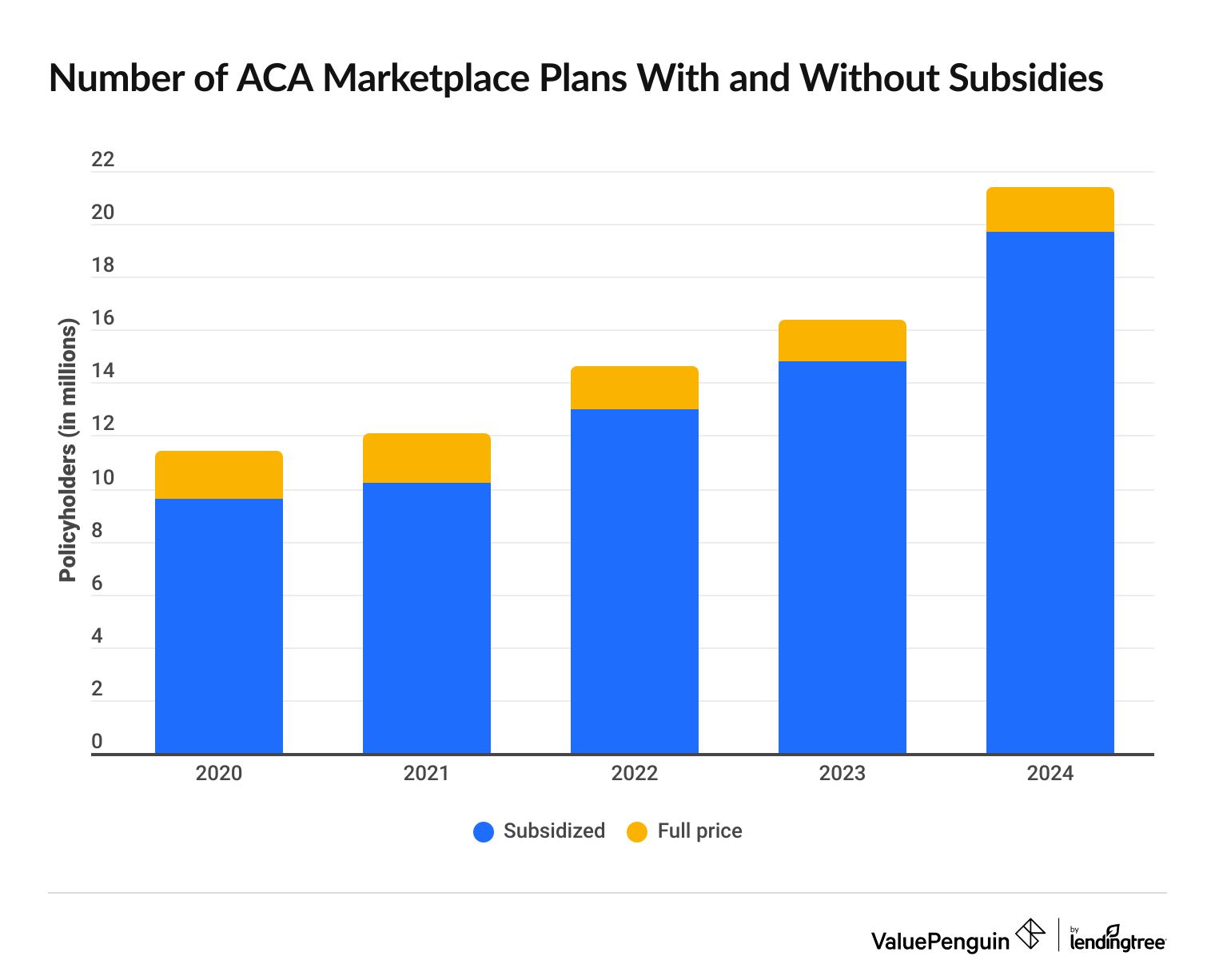

Obamacare enrollment with and without subsidies

Year | Subsidized plans | Unsubsidized plans |

|---|---|---|

| 2020 | 9.6 million | 1.8 million |

| 2021 | 10.2 million | 1.9 million |

| 2022 | 13 million | 1.6 million |

| 2023 | 14.8 million | 1.6 million |

| 2024 | 19.7 million | 1.7 million |

Who is eligible for health insurance subsidies?

In 2025, you'll typically be eligible for ACA subsidies if you earn between $15,060 and $60,240 as a single person.

A family of four is eligible with a household income between $31,200 and $124,800.

For most people, health insurance subsidies are available if your income is between 100% and 400% of the federal poverty level (FPL). The table below shows the income range based on household size that you have to fall in to qualify for ACA health insurance subsidies in 2025.

Obamacare subsidy income limits for 2025

Household size |

Typical min. income

|

Typical max. income

|

|---|---|---|

| 1 person | $15,060 | $60,240 |

| 2 | $20,440 | $81,760 |

| 3 | $25,820 | $103,280 |

| 4 | $31,200 | $124,800 |

| 5 | $36,580 | $146,320 |

- If you earn more than these income limits, you might qualify for subsidies if health insurance plans cost more than 8.5% of your income. For example, a 60-year-old who is quoted $800 per month for health insurance and who earns $70,000 would get a subsidy to reduce the plan's cost to $496 per month, or 8.5% of their income.

- If you earn less than the federal poverty level, you aren't eligible for ACA subsidies. But you are usually eligible for Medicaid, which provides cheaper health insurance than you can get with a marketplace subsidy.

If you can get Medicaid because of your income, you can't get marketplace subsidies.

In most states, there's an overlap between Medicaid and subsidy qualifications.

For example, you can usually get Medicaid if you make up to about $21,000 per year as a single person. And the typical minimum income for subsidies is $15,060 per year. If you're in the gap between $15,060 and about $21,000, you can't get subsidies. You can still buy a marketplace plan if you don't want Medicaid, but you'll have to pay full price.

Medicaid is harder to get in 10 states. In these states, you usually have to have a very low income and meet another requirement, like having a disability or being pregnant. You can probably get marketplace subsidies at the lower end of the income spectrum in these states.

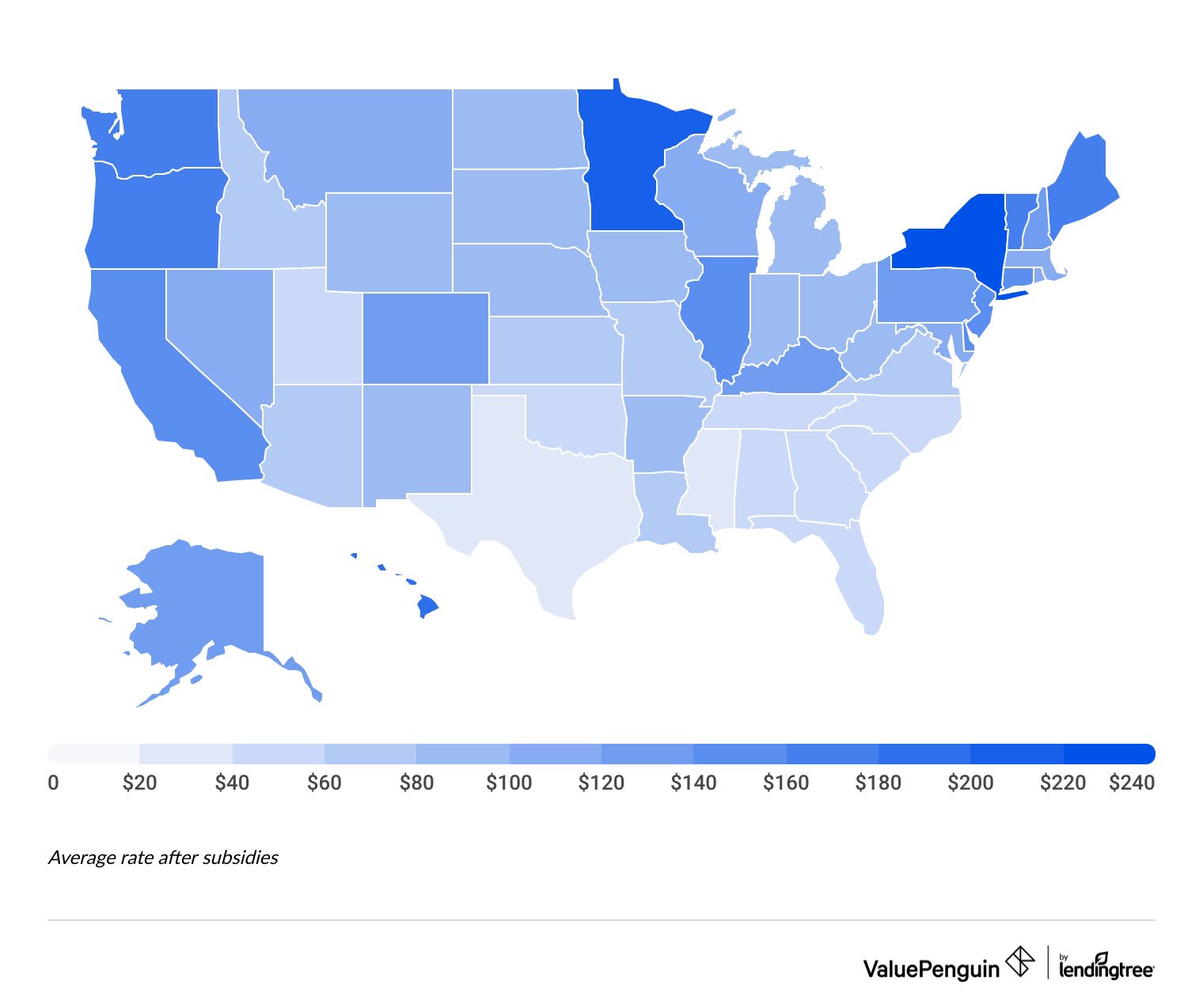

How much does health insurance cost after ACA subsidies?

The average cost of a subsidized health insurance policy in the U.S. is $74 per month.

How much you'll pay for health insurance is based on your income and other factors. Plans can cost as little as $0 per month. These low prices will be available through 2025 because of recent legislation.

Find Cheap Health Insurance in Your Area

Washington, D.C., residents who get subsidies pay the highest average rates for Obamacare after the discounts are applied — $447 per month. Shoppers in Mississippi who get subsidies have the cheapest monthly rates in the country, averaging $25 per month after subsidies.

Average cost of health insurance after subsidies

If you qualify for a rate subsidy, you may also be eligible for another type of health insurance discount called a cost-sharing reduction. Cost-sharing reductions help reduce out-of-pocket medical costs like deductibles and copays if you qualify for the reductions and choose a Silver plan.

Calculating your subsidies

Before shopping for an ACA health insurance plan, you can estimate your health insurance costs by using the subsidy calculator or doing the math yourself. Knowing if you can get a subsidy and how much it will be can help you choose a plan that best fits your needs.

How much you might save depends on your income, your family size and the cost of what's called a benchmark Silver plan where you live.

Subsidies are calculated in two ways:

- If you earn between one and four times the federal poverty level, you’ll qualify for a sliding scale discount based on your income.

- If you earn more than four times the federal poverty level, you won’t pay more than 8.5% of your household income for health insurance, no matter how much you earn.

You'll start by figuring out how much you earn compared to the federal poverty level. For 2025 health insurance plans, you'll use your estimated 2025 income and compare that to the 2024 federal poverty level amounts. For example, if you're single with an income of $30,120 per year, you're earning twice the federal poverty level.

Household size | Federal poverty level |

|---|---|

| 1 person | $15,060 |

| 2 | $20,440 |

| 3 | $25,820 |

| 4 | $31,200 |

| 5 | $36,580 |

For a family of nine or more, add $5,380 for each extra person. Poverty levels are higher in Alaska and Hawaii.

The ACA limits the monthly price you spend on health insurance based on how much you earn. If you make more, you'll pay a higher percentage of your total insurance rate, but you won't pay more than 8.5% of your income for a plan.

If you have a lower income, you might get enough of a subsidy to cover the entire cost of your plan. For example, a family of three with an income below $38,730 won't pay anything for a health insurance plan. But if that same family makes around $51,640 per year, it will pay no more than 2% of that amount, or about $86 per month, for health insurance.

The percentage of your income you pay for insurance is based on recent federal legislation and will be used through 2025.

Your health insurance discount is based on the cost of a "benchmark Silver plan," which is the second-cheapest Silver plan in your area. You can view available quotes in the federal or state insurance exchange to find the benchmark plan, or you can call the marketplace. HealthCare.gov can be reached at 800-318-2596. If your state uses a state marketplace site, check the website for a phone number.

If the amount you should pay for insurance is less than the cost of a benchmark plan, your subsidy will be the difference between the two. For example, if the benchmark Silver plan costs $3,000 a year and you're expected to pay $1,000 for a plan, according to your income calculations, then you will get a subsidy of $2,000.

If your expected contribution for health insurance is more than the cost of a benchmark plan, you won't get any health insurance subsidies. However, you can still enroll in full-priced plans.

A person earning $30,120 (twice the federal poverty level) is expected to spend 2% of their income toward a typical health insurance plan. That amounts to about $50 per month.

If it costs $500 per month for a benchmark Silver plan, that person would get a subsidy of $450 per month to cover the difference. The $450 subsidy can be used for any Bronze, Silver, Gold or Platinum plan.

If you earn more than four times the federal poverty level, subsidies limit the cost of insurance to 8.5% of your annual income, regardless of how much you earn.

For example, a family of four with an income of $150,000, well over four times the federal poverty level, would pay no more than 8.5% of their income, or $12,750 per year, for an ACA benchmark plan. That's a monthly rate of about $1,063.

When can you sign up for ACA subsidies?

You can sign up for a subsidized health insurance plan each year during the annual open enrollment period. But if you have a qualifying life event, you may be eligible for a special enrollment period, which would give you access to get coverage midyear.

Examples of qualifying events include:

- Loss of health care coverage

- Changes in household

- Changes in residence

Do I have to pay back subsidies?

No, you don't have to pay back health insurance subsidies.

But there may be an adjustment at tax time, when your actual income for the year is used to determine if you were receiving subsidies that were too large or too small.

Most people get rate subsidies in the form of an "advance premium tax credit," with the subsidy lowering the monthly insurance bill they get. Since these discounts are based on your estimated income for the year, the actual subsidy amount you are eligible for might be different once you know your actual income earned at the end of the year.

- If you qualify for more subsidies than you got, you'll get the extra amount as a tax credit when you file income taxes.

- If you got higher subsidies than you were ultimately eligible for, then you will have to repay some or all of the money you got as a subsidy when you file your taxes.

Are $6,400 subsidies for health insurance real?

Health insurance subsidies are real, but the advertisements for $6,400 subsidies are scams.

These ads are scams to get you to share your personal info. They are also misleading about how the subsidy program works. Health insurance subsidy amounts vary by household, and you have to shop through the government marketplace to be eligible.

Subsidy amounts change based on your income and location.

You have to shop in the government-run marketplace to get subsidies.

You'll never get a gift card or cash as a subsidy.

Claims that you must 'act now' are exaggerated.

It will probably take longer than the 30 seconds advertised.

Frequently asked questions

Is Obamacare free?

Obamacare health insurance usually isn't free for most people, and those who get subsidies typically pay an average of $74 per month. Obamacare might be free if you earn close to the federal poverty level because costs are on a sliding scale based on your income.

What are the income limits for health insurance subsidies?

To qualify for health insurance subsidies, you'll typically need to earn between $15,060 and $60,240 as a single person or between $31,200 and $124,800 as a family of four. But the income limits are not exact, and you can still qualify with a higher income if your costs for health insurance are very high.

Who is eligible for Obamacare?

Most people who don't have health insurance through their job can buy an insurance plan through HealthCare.gov or their state health insurance marketplace. Your income determines if you can get health insurance subsidies. Use a subsidy calculator to estimate your final cost for health insurance.

How much is Obamacare insurance?

The average cost of health insurance through Obamacare is $621 per month for a single person. For those with low to moderate incomes, subsidies can reduce the cost of health insurance, and those who qualify pay an average of $74 per month.

Methodology and sources

Costs and calculations are based on data from public use files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website.

Other sources include HealthCare.gov, CMS.gov, KFF and the U.S. Department of Health & Human Services.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.