Elephant Auto Insurance Review

Elephant offers average rates, good discounts and unique add-ons like pet injury coverage, but customer experience is an issue.

Find Cheap Auto Insurance Quotes in Your Area

Elephant Insurance stands out for its rates and coverage. After applying discounts, you could get an affordable policy that includes benefits not typically offered by major insurance companies.

However, you could face frustrations with Elephant due to its high rate of complaints about billing and the claims process.

Pros and cons

Pros

Lots of discounts

Offers pet injury coverage

Extra savings for safe drivers

Cons

Poor customer service

Only available in eight states

Elephant Insurance: Our thoughts

Even though Elephant's base prices aren't the lowest available, those who qualify for several discounts may get quotes that are cheaper than major companies like Geico.

The downside is that Elephant has a high rate of customer complaints.

This means it could be difficult managing your account or filing a claim after an accident. Elephant's easy online quotes process will give you rates immediately so you can know if it's worth it based on how much you'll save.

Elephant is a newer auto insurance company that's available in eight states. Plus, Elephant has several useful coverages in addition to standard options like liability, collision and comprehensive coverages.

- Pet owners benefit from pet injury protection, which is automatically included in collision coverage to pay for vet bills after a car accident.

- Safe drivers can save with coverages like accident forgiveness and diminishing deductibles.

Elephant auto insurance quotes

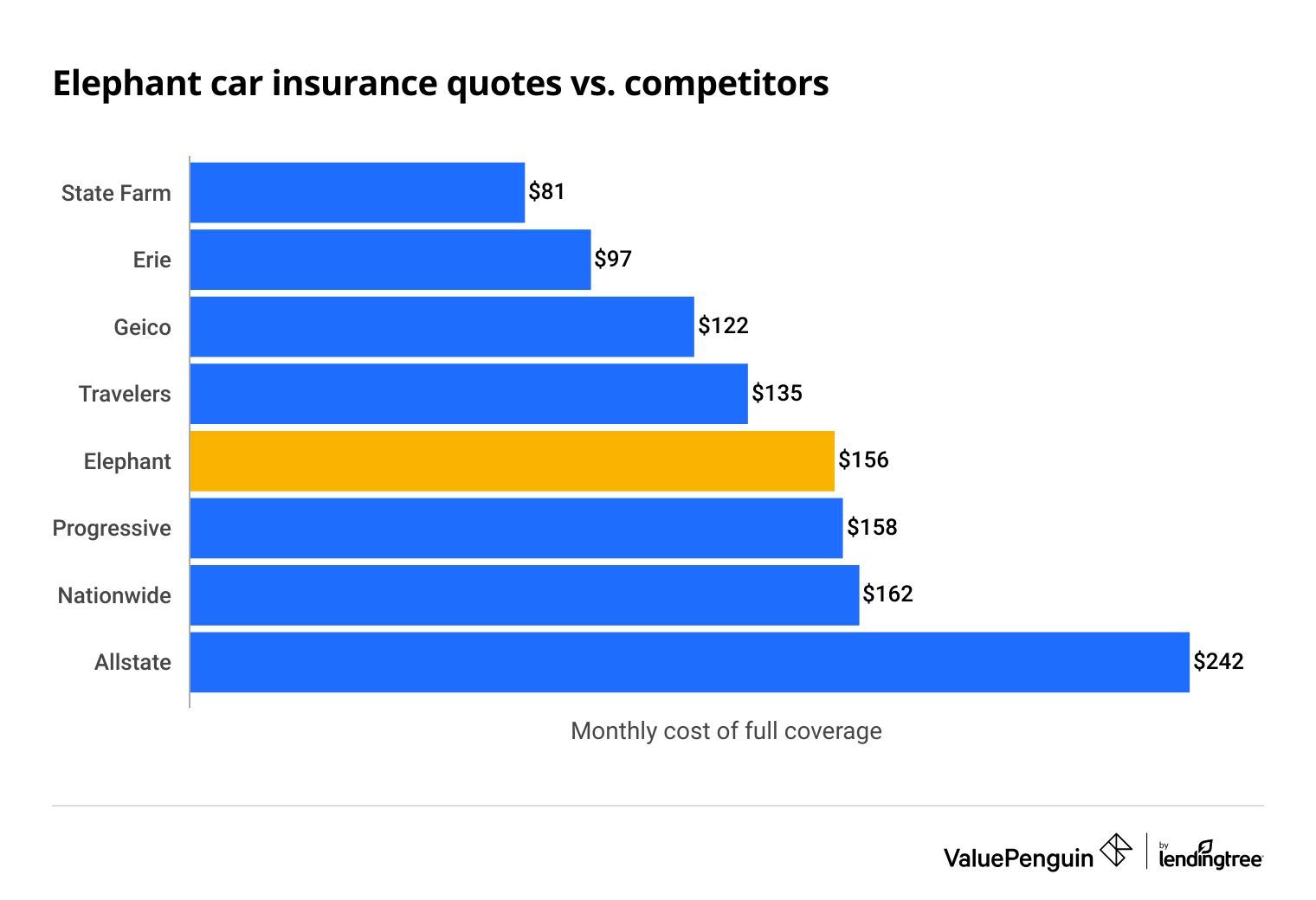

Elephant's car insurance quotes are 8% higher than average.

Full-coverage car insurance from Elephant costs about $156 per month. That's nearly twice as much as State Farm, which is one of the cheapest car insurance companies in the country.

Find Cheap Auto Insurance Quotes in Your Area

Car insurance rates can vary based on the car you drive, where you live, your driving history and your credit score.

Elephant car insurance quote comparisons

Company | Monthly cost | |

|---|---|---|

| State Farm | $81 | |

| Geico | $122 | |

| Travelers | $135 | |

| Elephant | $156 | |

| Progressive | $158 | |

Rates for full-coverage car insurance

Even though Elephant doesn't have the best rates for a typical driver, getting a free online quote may be worth it for those who are struggling to find affordable rates.

Insurance companies each use different ways to calculate their rates, which is why comparing car insurance quotes is the best way to save, because you can find the company with the cheapest rates for your situation.

Elephant Insurance discounts

Discounts are the main reason why Elephant insurance can be so cheap.

For example, say you qualify for enough discounts to lower your Elephant rates by 30%. That brings the cost of a full coverage policy to $109 per month, which is cheaper than Geico's rates before any discounts.

Discounts | Savings |

|---|---|

| Multicar | 46% (maximum) |

| E-signature | 18% (average) |

| Pay in full | 15% (maximum) |

| Multipolicy | 12% (maximum) |

| Early bird | 10% (maximum) |

In addition to standard discounts, such as multicar and multipolicy, Elephant offers unusual discounts not available from many major insurers, such as a work-from-home discount. Elephant advertises that you can save up to 40%. That means you won't be able to save the full amount in each category.

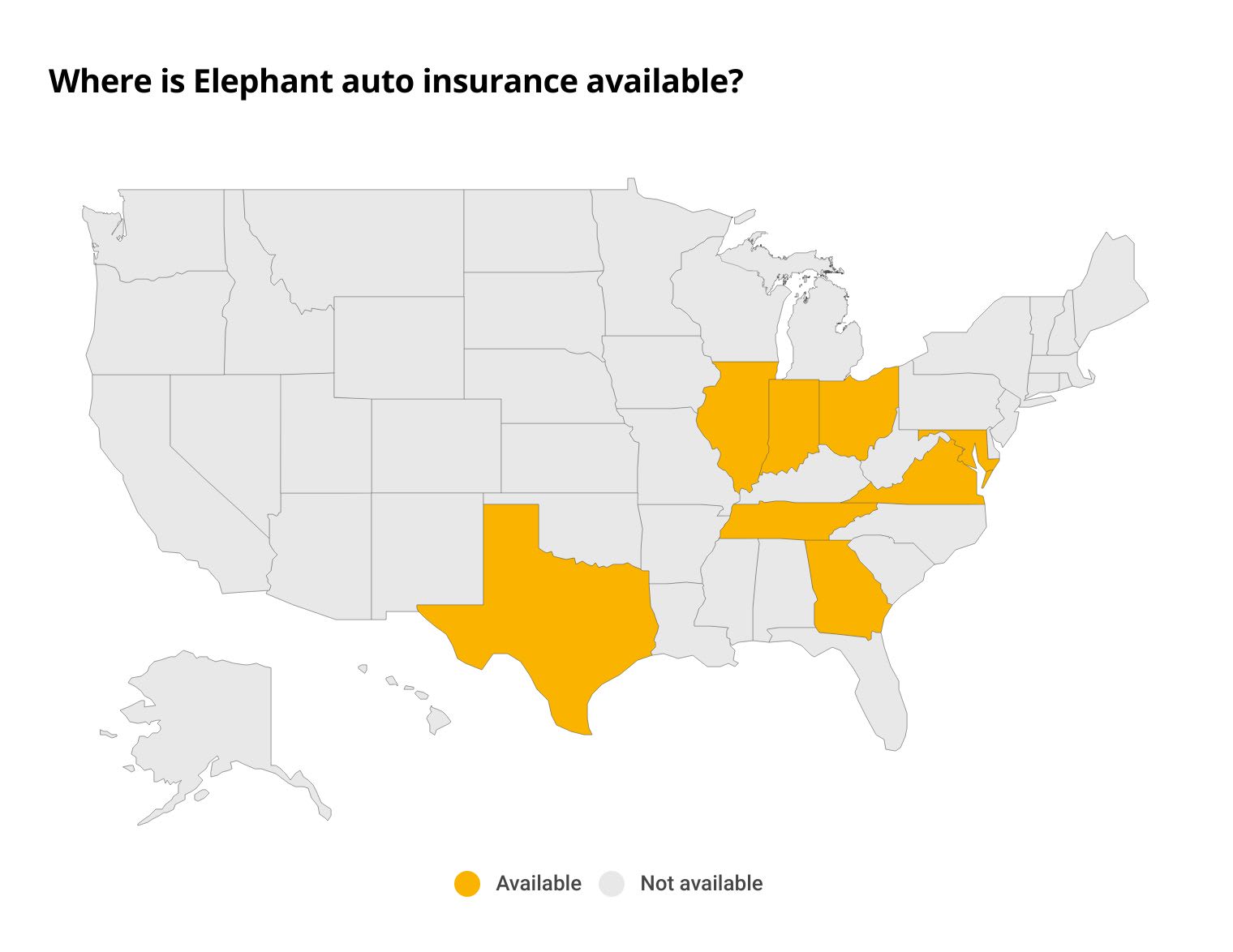

Where can you buy Elephant insurance?

Elephant Insurance is only available in eight states in the midwest and south.

States where Elephant car insurance is available

Elephant auto insurance coverages

Despite being a small and fairly new insurer, Elephant offers a great set of coverage options and add ons.

It particularly stands out for its automatic pet injury protection,discounts on a car repair service and legal support after a driving incident.

Diminishing deductible

When you sign up for Elephant's diminishing deductible, your deductible will immediately be lowered by $100 for annual policies and $50 for six-month policies. Then, as long as you don't have an accident, your deductible will continue to be reduced at each renewal by $100 for yearly policies or $50 for six-month policies. The most you can save on your deductible is $500.

Roadside assistance

Elephant Insurance offers roadside assistance coverage through a company called Agero to help drivers with towing, jump starts, flat tires, gas delivery or lockouts. After calling for help, you'll be able to see in real-time when the tow truck is dispatched and how close they are to your location.

Pet injury coverage

Elephant automatically includes $1,000 of pet injury protection in your collision coverage to help pay for vet bills after an accident.

While many other insurers make you pay extra to protect your pets, Elephant does not. Up to $1,000 of coverage can be used for your dogs or cats that were inside the car with you during the covered accident.

Accident forgiveness

Drivers who haven't had an accident for three years won't see their rates go up after causing an accident. Only one accident can be waived per policy. You can also choose to upgrade your accident forgiveness so that it begins right away, without needing to have three years of clean driving.

Discounted car repairs

This policy feature gives you discounted car repairs through YourMechanic. The repairs can be done at your home or office so you don't have to go to the repair shop. Services are guaranteed for 12 months or 12,000 miles.

Legal resources plan

This add-on coverage, which costs $6 per month or more, will pay the attorney fees for one minor traffic violation per year. It will also give you a 25% discount on other attorney services, such as will preparation, family law and real estate transactions.

Other add-on coverages from Elephant Insurance

In addition to the standard coverages offered by major insurance companies, Elephant Insurance also offers the following add-on coverages to enhance your car's protection on the road:

- Loan/lease covers up to 25% of your car's actual cash value if you get in an accident or your car is stolen and you still owe money on it.

- Rental reimbursement covers the cost of a rental car while your car is in the shop after a claim.

- Non-owner car insurance covers liability claims for those who frequently drive cars they don't own.

- Custom parts and equipment covers enhancements to your car, such as custom rims, tires or a wheelchair lift.

Is Elephant a good car insurance company?

Elephant is a mediocre insurance company with a high rate of customer complaints.

This means it could be frustrating to manage your policy or file a claim.

Elephant's user reviews

Elephant has received 65% more complaints than a typical insurance company of its size, according to the National Association of Insurance Commissioners (NAIC). The main problems are with billing and claims processing.

Similarly, customer service reviews are poor on Better Business Bureau (BBB), with many people frustrated by trying to file a claim after an accident.

Elephant's financial strength

Elephant has a strong ability to pay its claims. Elephant is a subsidiary of The Admiral Group, a U.K.-based insurance company, which has good financial ratings and receives an A rating from Fitch.

That means Elephant's financials are nearly as good as those of Progressive, which received an A+ from Fitch.

Elephant's app reviews

Elephant's app users are generally satisfied with apps, and ratings are higher than four stars in most cases. However, the limited number of reviews means ratings will probably change after more people use them.

Elephant insurance app: Lets you view your insurance cards, pay your bill or file a claim.

- 4.8 stars on Android

- 4.9 stars on iOS

Elephant Safe Driver app: You may qualify for a discount based on your driving habits after using this telematics app that monitors your driving behavior for a few weeks.

- 2.3 stars on Android

- 4.5 stars on iOS

About Elephant Insurance

Elephant Insurance was founded in 2009 and is a subsidiary of The Admiral Group, a major insurer in the United Kingdom. Elephant sells insurance policies directly to consumers, so you won't have the personal touch of an agent.

Other policies sold in addition to auto insurance:

- Home insurance

- Renters insurance

Plus, Elephant partners with other insurance companies to sell other types of insurance. You may still be able to get a bundling discount if you purchase one of these plans through Elephant, even though the insurance is issued by another company.

- Condo insurance

- Motorcycle insurance

- Life insurance

- Umbrella insurance

- ATV insurance

Contact Elephant Insurance: claims, payments and cancellations

To file a claim with Elephant Insurance, policyholders have two options:

Option 1: By phone: Call the Elephant Insurance claims department phone number at 877-218-7865.

- For new auto insurance claims, call Elephant from 8 a.m. to 8 p.m. Eastern on weekdays and from 9 a.m. to 5:30 p.m. on Saturdays. The claims department is closed on Sundays.

- For existing car insurance claims, call Elephant from 8 a.m. to 5 p.m. during weekdays.

- For glass insurance claims, such as windscreen replacement, call Elephant at 1-800-413-8860.

Option 2: Online: File your claim via the online form.

- For new auto insurance claims, you can enter the incident details without needing to log in.

- To track the status of the claim, Elephant customers will need to log in to their online accounts.

To make a payment to Elephant Insurance, log in to your account to pay online or send a check to Elephant's mailing address at:

Elephant Insurance

P.O. Box 715658

Philadelphia, PA 19171-5658

Frequently asked questions

What states does Elephant Insurance cover?

Elephant Insurance sells auto insurance policies in eight states: Georgia, Illinois, Indiana, Maryland, Ohio, Tennessee, Texas and Virginia.

Where is Elephant Insurance located?

Elephant Insurance's headquarters are located in the Richmond, VA, area. Payments can be made to Elephant Insurance at P.O. Box 715658 Philadelphia, PA 19171. Other mail can be sent to P.O. Box 5005, Glen Allen, VA 23058.

Who is Elephant Insurance owned by?

Elephant Insurance is owned by The Admiral Group, a major insurer in the U.K. Admiral Group was founded in 1993 and its headquarters are in Cardiff, Wales, United Kingdom.

Methodology

Rates are based on a 30-year-old male with a clean driving record purchasing full coverage in Richmond, VA, for a 2015 Honda Civic EX. Car insurance quotes have the following limits:

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Medical payments coverage | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Elephant's sample quotes were obtained directly from the insurance company. Rates for the same driver were compared to other top insurance companies using data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Overall company ratings are based on independent research, factoring in customer service, affordability, coverage offered and overall shopping experience.

- Customer complaint ratings are based on data from the National Association of Insurance Commissioners (NAIC), with three stars being a typical rate of customer complaints.

- Financial strength ratings are based on financial data from Fitch, with the best score being 5 stars.

- Mobile app ratings are an average of user reviews across the two available apps on Google Play and Apple App Store.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.