Who Has the Best Car Insurance Rates in Salt Lake City?

Compare Rates in Salt Lake City

Based on our analysis of top insurers, residents of Salt Lake City, Utah, will likely find the cheapest auto insurance from State Farm. Minimum coverage costs $58 per month, on average. The best rates for full coverage come from Farm Bureau, which charges $154 per month, on average.

Salt Lake City is the most populous city in Utah, and those who live there pay auto insurance premiums well above the state average. The statewide average for minimum coverage is $76 per month, but Salt Lake City drivers pay $89 per month.

Farmers, the most expensive insurer in our Salt Lake City study, charges over $300 more per month for full coverage than Farm Bureau. Differences like that show why it's so important to shop around.

Cheapest auto insurance in Salt Lake City: State Farm

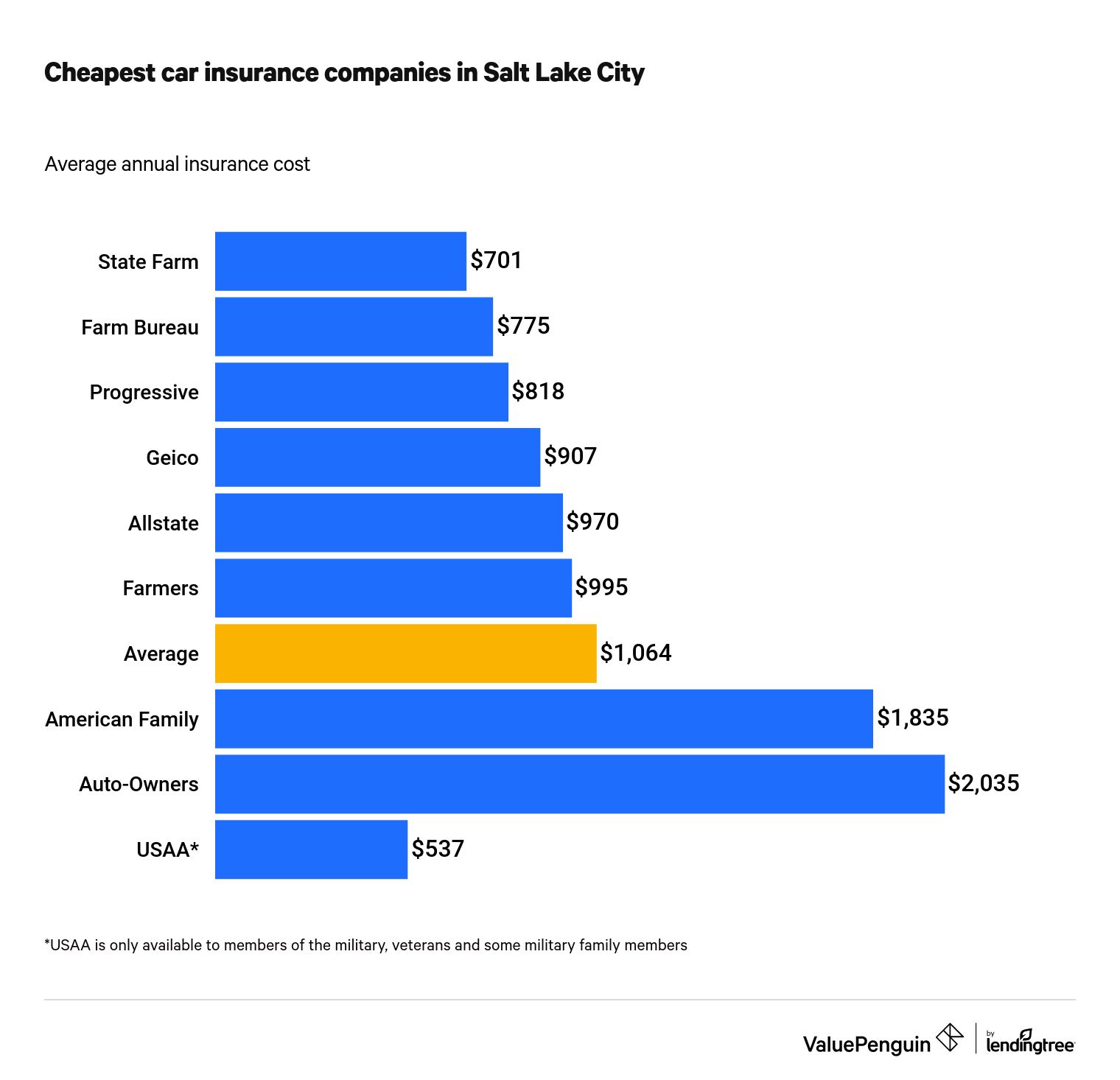

Minimum-coverage auto insurance in Salt Lake City costs $1,064 per year on average, but drivers can get much cheaper insurance from State Farm, Farm Bureau and Progressive. On average, these three insurers charge just $765 annually for minimum coverage, making them 28% cheaper.

The most affordable rates overall came from State Farm, whose annual premiums for minimum coverage in Salt Lake City average at $701 per year. That saves State Farm policyholders more than $350 every year.

Compare Rates in Salt Lake City

Many drivers choose minimum coverage because it is the cheapest option, but cheap premiums mean that drivers are left financially responsible for any damage sustained by their own car after an accident.

Cheapest car insurance in Salt Lake City

Company | Average annual cost | |

|---|---|---|

| State Farm | $701 | |

| Farm Bureau | $775 | |

| Progressive | $818 | |

| Geico | $907 | |

| Allstate | $970 |

*USAA is only available to current and former military members and their families.

Cheapest full-coverage car insurance in Salt Lake City: Farm Bureau

The best rates for a full-coverage policy in Salt Lake City come from Farm Bureau. The average cost of full coverage is $2,715 per year, but policyholders with Farm Bureau pay just $1,848 per year on average, saving $867 every year.

Rank | Company | Annual rate |

|---|---|---|

| 1 | State Farm | $701 |

| 2 | Farm Bureau | $775 |

| 3 | Progressive | $818 |

| 4 | Geico | $907 |

| 5 | Allstate | $970 |

| 6 | Farmers | $995 |

| 7 | American Family | $1,835 |

| 8 | Auto-Owners | $2,035 |

| N/A | USAA | $537 |

*USAA is only available to current and former military members and their families.

Eligible drivers can find even cheaper insurance from USAA. Although it's only available to current and former military members and their families, USAA charges just $1,260 per year. That's 54% less than the city average.

Full coverage includes collision and comprehensive coverage to the mandatory liability and personal injury protection (PIP) coverage requirements in Utah.

-

Comprehensive coverage: Pays for damages to your car that don't result from a collision, such as weather or animal damage.

- Collision coverage: Pays for collision-related damage.

Cheap car insurance for drivers with prior incidents

Insurance companies set your rates based on the risk that you pose on the road. Incidents on your driving history — such as accidents, DUIs or speeding tickets — and a low credit score can cause companies to raise rates.

We identified the cheapest auto insurance for Salt Lake City drivers who have:

Cheapest car insurance in Salt Lake City after an accident: Farm Bureau

Farm Bureau, State Farm and Progressive had the best cheap rates for Salt Lake City drivers with an at-fault accident on their records. The average rate for these drivers is $4,140 per year, but these three insurers charge companies an average of $3,265 per year — $875 less.

Rates in Salt Lake City go up by 53% after an at-fault accident, from $2,715 per year to $4,140 per year, on average. While your rates will almost always be higher after an accident, you should still compare quotes after your driving record changes to make sure you're getting the best deal.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Farm Bureau | $2,859 |

| 2 | State Farm | $3,117 |

| 3 | Progressive | $3,820 |

| 4 | American Family | $4,104 |

| 5 | Geico | $4,113 |

| 6 | Auto-Owners | $5,322 |

| 7 | Allstate | $5,334 |

| 8 | Farmers | $6,743 |

| N/A | USAA | $1,851 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for people with a speeding ticket: Farm Bureau

Your rates will go up after a speeding ticket in Salt Lake City, but not as much as they do after an at-fault accident. At-fault accidents cause average rates to increase by $1,425 per year, whereas speeding tickets cause rates to increase by just $538.

If you are a Salt Lake City driver with a speeding ticket on your record, start by getting quotes from Farm Bureau. Our analysis found that the company charged 36% less than the city average, with policyholders paying $2,095 per year for full coverage.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Farm Bureau | $2,095 |

| 2 | Progressive | $2,452 |

| 3 | Geico | $2,776 |

| 4 | State Farm | $2,852 |

| 5 | Auto-Owners | $3,318 |

| 6 | American Family | $3,357 |

| 7 | Allstate | $4,081 |

| 8 | Farmers | $6,714 |

| N/A | USAA | $1,627 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with a DUI: Farm Bureau

Driving under the influence (DUI) puts both you, your passengers and all those around you on the road at risk. Accordingly, the insurers in our study raised rates far more significantly for a DUI than for other offenses, increasing annual premiums by $1,474.

The cheapest auto insurance for these drivers came, once again, from Farm Bureau. Annual rates from Farm Bureau were $2,095 per year, making them 50% cheaper than the city average, which is $4,189 per year.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Farm Bureau | $2,095 |

| 2 | Progressive | $2,212 |

| 3 | State Farm | $2,852 |

| 4 | American Family | $3,357 |

| 5 | Geico | $4,079 |

| 6 | Allstate | $5,058 |

| 7 | Farmers | $6,487 |

| 8 | Auto-Owners | $9,124 |

| N/A | USAA | $2,436 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with poor credit: Progressive

While your credit score does not affect your ability to drive safely, many insurers use it to set your auto insurance rates. Salt Lake City drivers with very good credit pay just $1,561 per year on average — far less than drivers with average credit scores ($1,929 per year) or poor credit scores ($3,342).

The cheapest rates for drivers with low credit scores came from Progressive. The company charged these drivers just $2,589 per year, which is $752 less than the city average.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Progressive | $2,589 |

| 2 | Farm Bureau | $3,010 |

| 3 | Geico | $3,061 |

| 4 | Auto-Owners | $3,187 |

| 5 | Allstate | $3,823 |

| 6 | American Family | $3,861 |

| 7 | Farmers | $3,968 |

| 8 | State Farm | $4,585 |

| N/A | USAA | $1,990 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for married drivers: Farm Bureau

Married drivers in Salt Lake City pay $82 less per year on average than single drivers. Farm Bureau had the best rates for these drivers. The average for the city is $2,633 per year, but married policyholders with Farm Bureau pay 31% less — just $1,811 per year, on average.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Farm Bureau | $1,811 |

| 2 | Progressive | $1,969 |

| 3 | Geico | $2,345 |

| 4 | American Family | $2,517 |

| 5 | State Farm | $2,587 |

| 6 | Auto-Owners | $3,318 |

| 7 | Allstate | $3,560 |

| 8 | Farmers | $4,454 |

| N/A | USAA | $1,135 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers: Farm Bureau

Young drivers generally pay more for auto insurance than adult drivers. In fact, our sample 18-year-old driver paid $5,429 more per year than our 30-year-old driver did, with an average annual premium of $8,144 per year.

Farm Bureau offered our sample 18-year-old driver full coverage for $4,485 per year. That means young drivers who opt for Farm Bureau can save $3,659 each year.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Farm Bureau | $4,485 |

| 2 | Geico | $5,974 |

| 3 | American Family | $7,611 |

| 4 | State Farm | $8,278 |

| 5 | Progressive | $9,010 |

| 6 | Farmers | $9,583 |

| 7 | Allstate | $9,669 |

| 8 | Auto-Owners | $14,053 |

| N/A | USAA | $4,629 |

*USAA is only available to current and former military members and their families.

In addition to shopping around, other strategies young drivers can use to reduce their premiums include staying on their parents' policy and asking insurers for . Good student and student-away-from-home discounts can help make auto insurance more affordable for young drivers.

Best auto insurance companies in Salt Lake City, Utah

ValuePenguin asked policyholders at major auto insurance companies how satisfied they were with their most recent claims. Our survey showed that Auto-Owners, USAA and American Family had the highest percentages of customers who said they were "extremely satisfied" with their most recent claims.

Average car insurance cost in Salt Lake City, by ZIP code

Insurers set rates not just by city, age or marital status, but by ZIP code, as well. Certain ZIP codes have more traffic or crime than others, which can cause insurers to raise rates.

Residents of the most expensive ZIP code in Salt Lake, 84140, paid $2,912 per year for full coverage, which is $375 more than what residents of the cheapest ZIP code, 84108, paid per year.

ZIP code | Average full-coverage cost | Average minimum-coverage cost |

|---|---|---|

| 84101 | $2,816 | $1,086 |

| 84102 | $2,616 | $1,023 |

| 84103 | $2,626 | $1,007 |

| 84104 | $2,907 | $1,142 |

| 84105 | $2,629 | $1,040 |

| 84106 | $2,659 | $1,071 |

| 84108 | $2,537 | $981 |

| 84109 | $2,637 | $1,025 |

| 84111 | $2,712 | $1,042 |

| 84112 | $2,629 | $1,008 |

| 84113 | $2,572 | $1,011 |

| 84114 | $2,620 | $1,028 |

Auto theft statistics in Salt Lake City

Not only is Salt Lake City the most populous city in Utah, it also experiences the highest level of auto crime. Our analysis of 2019 FBI data found that about 6 cars are stolen in Salt Lake City for every 1,000 residents.

Rank | City | Population | Car thefts | Thefts per 1,000 |

|---|---|---|---|---|

| 1 | Salt Lake City | 202,426 | 1,260 | 6.22 |

| 2 | West Valley | 137,269 | 704 | 5.13 |

| 3 | Ogden | 87,875 | 345 | 3.93 |

| 4 | West Jordan | 117,644 | 204 | 1.73 |

| 5 | Sandy | 97,797 | 193 | 1.97 |

| 6 | St. George | 89,160 | 145 | 1.63 |

| 7 | Orem | 98,686 | 141 | 1.43 |

| 8 | Provo | 117,189 | 128 | 1.09 |

| 9 | Layton | 78,585 | 80 | 1.02 |

| 10 | South Jordan | 77,645 | 78 | 1.00 |

Motor vehicle theft data was pulled from the FBI 2019 Utah Crime Report.

Methodology

We gathered rate data from nine of the largest insurers in Utah. Unless otherwise noted, our sample driver was a 30-year-old man who drives a 2015 Honda Civic EX and had the following limits on his full-coverage policy:

Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Insurance rate data for this ValuePenguin analysis came from Quadrant Information Services. Rates were publicly sourced from insurer filings and should be used solely for comparative purposes since your own quotes may be different.