Condo Insurance: Compare Companies & Quotes

State Farm has the best condo insurance for most people.

State Farm's rates are affordable, and customers are typically happy with the service they receive.

Best condo insurance companies

Find Cheap Homeowners Insurance Quotes in Your Area

Condo insurance covers unexpected damage to your personal property and the costs of living elsewhere if your home becomes uninhabitable.

Unlike homeowners insurance, condo insurance generally doesn't cover the structure of your building. That's because your condo association's master policy covers it. But condo owners need to make sure they buy a policy that fills the gaps in that master policy so they have enough coverage for unexpected disasters.

Best condo insurance companies

State Farm is the best company for condo insurance based on low rates, coverage features and customer service.

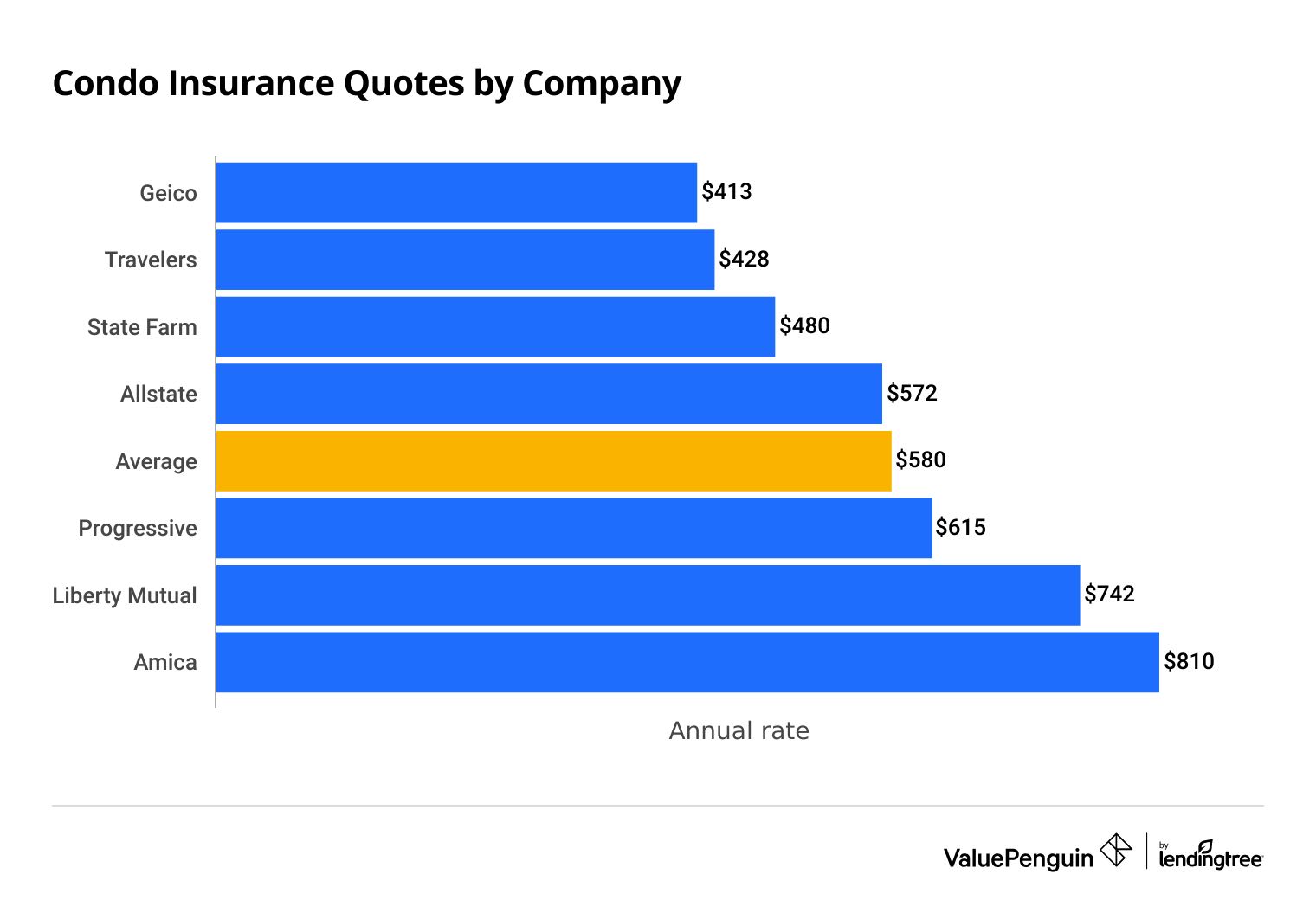

A condo insurance policy from State Farm costs around $480 per year, which is $100 per year cheaper than average.

Find Cheap Homeowners Insurance Quotes in Your Area

The cheapest condo insurance comes from Geico, which charges $413 per year. That's $167 per year cheaper than average and $67 cheaper than State Farm.

However, Geico's customer service can vary depending on where you live.

Cheapest condo insurance quotes

Company | Annual rate | ||

|---|---|---|---|

| Geico | $413 | ||

| Travelers | $428 | ||

| State Farm | $480 | ||

| Allstate | $572 | ||

| Progressive | $615 | ||

Best condo insurance for most people: State Farm

-

Editor rating

-

Annual rate

$480 ?

Pros and cons

State Farm has the best homeowners insurance for condos due to its reliable customer service, wide variety of add-on coverages and affordable rates.

Condo owners can count on State Farm to get their lives back to normal quickly after an emergency. State Farm gets 65% fewer complaints than an average insurance company its size, according to the National Association of Insurance Commissioners (NAIC). It also earned an above-average score on J.D. Power's home insurance customer satisfaction survey.

State Farm also gives condo owners lots of ways to upgrade their insurance coverage, including:

- Refrigerated products coverage: Pays to replace food in your fridge that spoiled during a power outage.

- Fair rental value coverage: If you regularly rent out your condo, this coverage will reimburse you for lost income after a covered event, like a fire.

- Inflation coverage: Increases your building and personal property coverage limits if inflation causes the cost of repairing your home or replacing your belongings to rise.

- Fire department surcharge: Will reimburse you up to $500 if the fire department charges you a fee for responding to an emergency.

Although condo insurance from State Farm is affordable, it's not the cheapest option. Condo insurance from State Farm costs around $480 per year or $40 per month. That's 16% more expensive than the most affordable option, Geico. However, it's still 17% less expensive than average.

Cheapest condo insurance: Geico

-

Editor rating

-

Annual rate

$413 ?

Pros and cons

Geico offers the cheapest condo insurance quotes compared to other major companies.

At $413 per year or $34 per month, a basic policy from Geico costs 29% less than average.

However, Geico offers very few discounts to help lower your rate. The only way to save is if you have a burglar or fire alarm or your building has built-in overhead sprinklers. Geico also offers a discount for bundling your condo and auto insurance. But the discount only applies to your car insurance policy — you won't save on your condo insurance quote.

In addition, Geico doesn't underwrite its condo insurance. After you buy the policy through Geico, you'll work directly with one of its 32 partners if you have to file a claim or make changes to your policy. For that reason, it can be hard to know what level of customer service you'll get until you buy a policy and learn the name of your underwriting company.

Best for extra condo insurance coverage: Allstate

-

Editor rating

-

Annual rate

$572 ?

Pros and cons

Allstate offers many ways for condo owners to customize their coverage, along with plenty of discounts to help lower rates.

If you're a condo owner who plans to rent out your space occasionally, Allstate's HostAdvantage feature may be the best option for you.

Typically, condo insurance policies don't protect your belongings when renting out your place. For around $50 a year, HostAdvantage protects your belongings from theft and damage while you rent out your home.

In addition, Allstate offers:

- Building code coverage

- Business property coverage

- Electronic data recovery

- Extended protection coverage

- Green improvement coverage

- Identity restoration

- Loss assessment coverage

- Valuables protection

- Water backup coverage

Basic condo insurance from Allstate costs around $572 per year or $48 per month. While that's slightly cheaper than average, it's 38% more expensive than the cheapest option, Geico.

However, there are many ways for Allstate customers to save on condo insurance. It offers a discount of up to 10% just for switching to Allstate and up to 15% for bundling your condo and auto insurance. You can also save up to 5% for making your payments automatically.

Best condo insurance company for customer service: Amica

-

Editor rating

-

Annual rate

$810 ?

Pros and cons

Amica is the best option for condo owners prioritizing excellent customer service, even if it costs more than average.

Customers are typically happy with their experience at Amica. It earned an outstanding score on J.D. Power's home insurance customer satisfaction survey. In addition, Amica gets 87% fewer complaints than a similar-sized insurance company, according to the NAIC. That means you can expect Amica to help fix your home quickly if you have to file a claim.

Condo insurance from Amica is very pricey. A policy costs $810 per year, which is 28% more expensive than average. However, Amica offers a few ways for condo owners to save on their insurance, including:

- Multipolicy discount of up to 20% when you bundle condo and car insurance

- Loyalty discount if you've had the same insurance company for two years or more before switching to Amica

- Claim-free discount if you've avoided filing a claim for three years or longer

- Autopay discount when you sign up to pay your bill automatically

- E-discount if you opt to get bills and policy documents via email

Best condo insurance company for people in the military: USAA

-

Editor rating

Pros and cons

If you're a current or former military member, finding a better option for condo insurance than the United Services Automobile Association (USAA) is difficult.

It consistently ranks among the top condo insurance companies for customer satisfaction.

However, you can only buy USAA condo insurance if you're part of the military, you're a veteran or you're an eligible family member of a current or former service member.

USAA's standard condo insurance policies have more coverage than most insurance companies offer in a basic policy. For example, USAA's loss assessment coverage has a limit of $10,000, whereas most other companies only include $1,000 of this coverage in their policies.

USAA's base policies include identity theft coverage, which you typically pay extra for from other companies. There's also special military coverage that pays up to $10,000 for damage to your belongings caused by war.

How to compare condo insurance

When shopping for a condo insurance policy, you should always compare quotes from multiple companies to find the best policy for you.

The best condo insurance should:

Fill the gaps in your condo association's master policy. If you own a condo, you'll be partially covered by a master condo association policy.

But master policy coverage can range from an all-in policy, which covers everything but your personal belongings, to a bare-walls policy, which only covers communal areas.

Be affordable. Price should be one of many considerations. You should always shop around to see if you can find the same coverage with lower prices from different companies.

Fit your needs. Certain condo insurance companies have more coverage features, add-ons and discounts than others.

If you're looking for extra coverage or a specific discount, it may be worth shopping around to see which company is the best fit for your situation.

Have excellent customer service. You'll likely only interact with your insurance company during times of need, like after a natural disaster or a robbery. When buying a policy, you'll want to be confident the company will help get your life back to normal quickly after an emergency.

Make sure your home is fully protected

Before shopping for a condo insurance policy, you should make sure you understand what your condo association's master insurance policy covers.

That way, you can fill any coverage gaps with your condo insurance policy.

Master insurance policies generally cover common areas, such as the roof and walkways. However, beyond the communal features of your building, master policies can vary, and some may cover things inside the walls of your condo.

Most master policies fall under one of three categories.

-

All-in policies cover you for everything except for your personal belongings. They're sometimes called all-inclusive policies.

All-in policies cover the walls, floors and ceilings of a condo and the original building fixtures. This means you won't have to get building property coverage when buying a condo insurance policy.

-

Bare-walls policies cover nothing inside your condo except walls, floors and ceilings.

If your condo association has a bare-walls policy, you'll need a condo insurance policy with building property coverage for fixtures inside your condo. This can include countertops, wall coverings, appliances (such as stoves and refrigerators) and any home improvements you've made.

-

Original specifications policies cover your condo's original building materials. They don't protect any improvements or additions you've made. This is also called single-entity coverage.

So if your condo came with a washing machine and a fire damages it, an original specifications master policy will replace it. But if you upgrade your washing machine, it's not covered under an original specifications master policy. You would have to get coverage for it separately as part of your condo insurance policy.

You can contact your condominium association to find details on which type of master policy your building has.

Find the best rates for a condo insurance policy

The main factor in determining the cost of your condo insurance is the amount of personal property coverage you get. However, not all insurance companies have the same rates for the same amount of coverage.

You should always get multiple quotes to compare the prices of condo insurance policies with similar coverage levels.

Prices can vary widely by insurance company depending on your location and the features of your home. Most major insurance companies offer condo insurance quotes online, making it easy to get quotes from multiple companies.

Additionally, most companies offer condo insurance discounts. For instance, bundling your auto and condo insurance can save you a lot of money.

Find a condo insurance policy that fits your needs

Almost all condo insurance companies include the same basic features.

- Personal property coverage pays for damage to your belongings caused by a covered event, like a windstorm.

- Building property coverage pays for damage to fixtures inside your condo if your master association policy doesn't cover them.

- Personal liability coverage covers costs associated with lawsuits for injuries or property damage caused by you or your family members.

- Loss of use coverage pays any costs above and beyond your normal expenses for living elsewhere if your condo becomes unsafe.

- Loss assessment coverage applies to events where a condo owner is responsible for a share of damage that affects the entire condo association, such as wind damage to a window in the common area. Some insurance companies include loss assessment with a basic policy. Sometimes, it's available as add-on coverage.

Beyond this standard coverage, condo insurance policies allow you to add various features for an extra fee. Features can range from special coverage for condo owners who use their home as a short-term rental to protection against water from a backed-up pipe.

Condo insurance companies with the best customer service

USAA and Amica offer the best customer service for condo owners.

However, USAA is only available to military members, veterans and their families. And condo insurance from Amica can be expensive.

For that reason, the best condo insurance for most people is State Farm. It offers reliable customer service at an affordable rate.

Company |

Editor's rating

|

J.D. Power

|

|---|---|---|

| USAA | 884 | |

| State Farm | 829 | |

| Erie | 827 | |

| Auto-Owners | 825 | |

| Nationwide | 816 |

You probably won't interact with your condo insurance company often. But when you do, it will usually be in a stressful situation — maybe your condo caught fire or a thief stole your valuables.

You'll want a company with a strong customer service reputation to make the claims process easy and help get your home fixed quickly.

Frequently asked questions

Who has the cheapest condo insurance quotes?

Geico has the best rates for condo insurance among major companies. At around $413 per year, its rate is 29% lower than average.

Which insurance company is best for condos?

State Farm has the best condo insurance for most people based on its reliable customer service, helpful coverage and affordable rates.

What is condo insurance?

Condo insurance is the type of insurance policy you need if you live in a condominium. It protects your personal property and some parts of the condo itself, like cabinets and lights. However, it doesn't cover most parts of your building, like the roof or walls, which your condo's master policy covers.

Methodology

ValuePenguin collected quotes from top condo insurance companies for condos in New York, Washington, D.C., Dallas, Seattle and Chicago to find the best condo insurance companies. Rates are for a 30-year-old single man who lives alone and has no insurance claims history.

Dwelling coverage is for 20% of each property's market value or $100 per square foot, whichever was less. Quotes also include:

- Personal property protection: $30,000

- Liability coverage: $100,000

- Medical payments: $1,000

- Loss assessment: $25,000 or the highest available

- Deductible: $1,000

Customer service scores are based on data from J.D. Power, the National Association of Insurance Commissioners and ValuePenguin editors' ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.