Best & Cheapest Car Insurance Quotes in Wyoming (2025)

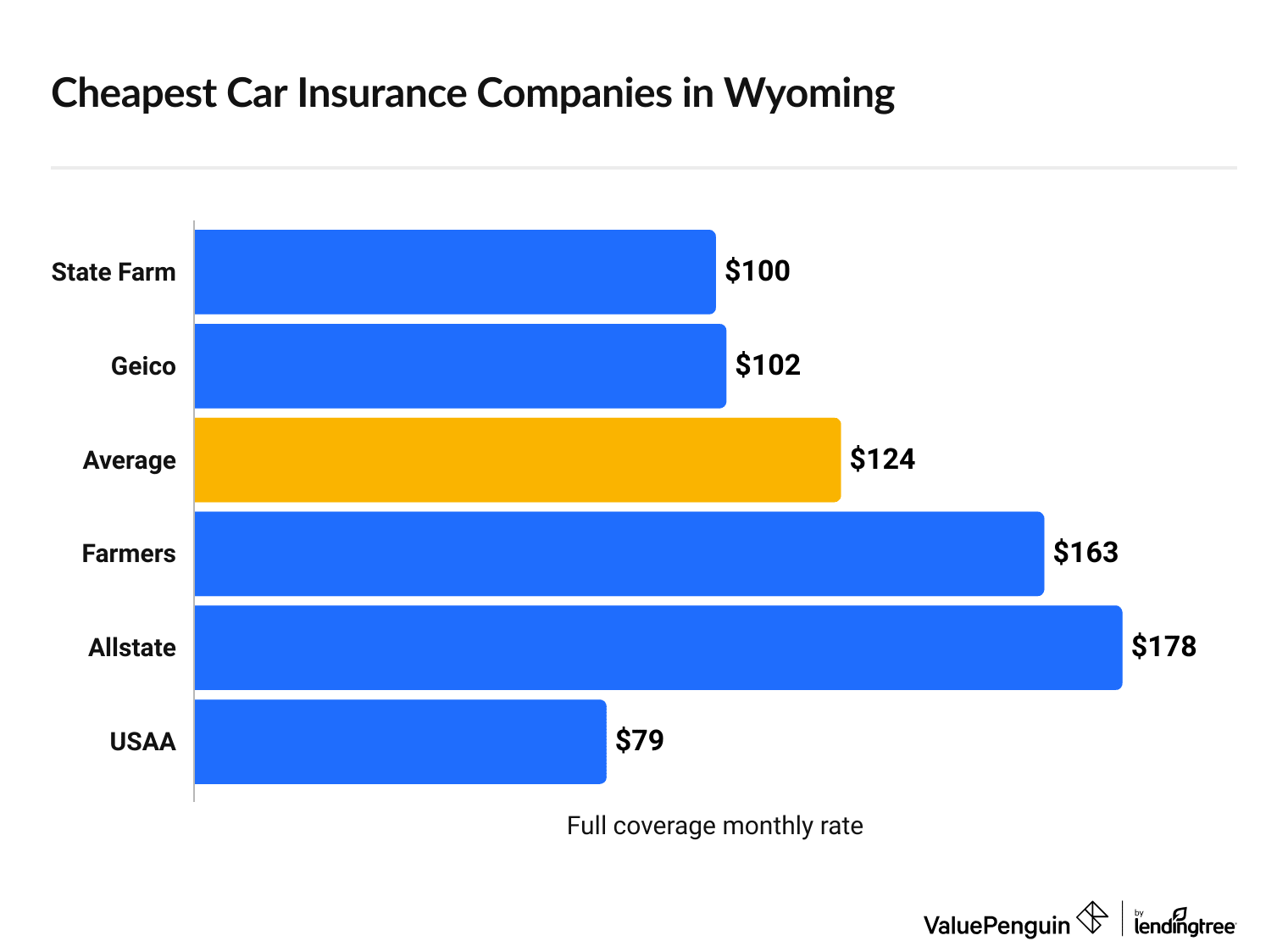

State Farm has the cheapest car insurance in Wyoming, at $100 per month for full coverage.

Find Cheap Auto Insurance Quotes in Wyoming

Best cheap auto insurance in WY

How we chose the top companies

Best and cheapest car insurance in Wyoming

- Cheapest full coverage: State Farm, $100/mo

- Cheapest minimum liability: Geico, $18/mo

- Cheapest for young drivers: Geico, $59/mo

- Cheapest after a ticket: State Farm, $108/mo

- Cheapest after an accident: State Farm, $116/mo

- Cheapest for teens after a ticket: State Farm, $64/mo Geico, $73/mo

- Cheapest after a DUI: State Farm, $189/mo

- Cheapest for poor credit: Geico, $141/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm offers the best combination of affordable rates and great customer service in Wyoming.

Geico also has cheap quotes, but its customer service isn't typically as good as State Farm's.

Cheapest Wyoming car insurance: State Farm

State Farm has the cheapest full coverage car insurance in Wyoming.

State Farm charges around $100 per month for full coverage, which is $25 per month less than the Wyoming state average.

Wyoming drivers with military ties can get even cheaper rates from USAA. At $79 per month, full coverage from USAA costs $45 per month less than the state average. However, only military members, veterans and some of their family members can get car insurance from USAA.

Find Cheap Auto Insurance Quotes in Wyoming

The average cost of a full coverage car insurance policy in Wyoming is about $124 per month. That's $51 cheaper than the U.S. average.

Cheapest full coverage auto insurance in Wyoming

Company | Monthly rate | |

|---|---|---|

| State Farm | $100 | |

| Geico | $102 | |

| Farmers | $163 | |

| Allstate | $178 | |

| USAA* | $79 |

*USAA is only available to current and former military members and their families.

Cheapest liability-only auto insurance in Wyoming: Geico

Geico has the cheapest minimum liability car insurance quotes in Wyoming.

A minimum liability policy from Geico costs just $18 per month, which is $13 per month less than the Wyoming state average.

USAA has the best liability-only insurance for military members, veterans and their families in Wyoming. At just $16 per month, minimum liability insurance from USAA is nearly half the state average. In addition, USAA has much better customer service than Geico.

Cheapest Wyoming auto insurance companies

Company | Monthly rate |

|---|---|

| Geico | $18 |

| State Farm | $22 |

| Farmers | $39 |

| Allstate | $60 |

| USAA* | $16 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Your Area

Cheap auto insurance in Wyoming for teens: Geico

Geico has the most affordable quotes for young drivers in Wyoming. Geico's rate of $59 per month for liability-only coverage is $34 per month cheaper than the average across the state.

Geico also has the best price for full coverage, at $296 per month. That's $91 per month less than the Wyoming average.

Cheapest WY car insurance companies for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $59 | $296 |

| State Farm | $71 | $316 |

| Farmers | $107 | $471 |

| Allstate | $180 | $630 |

| USAA | $46 | $223 |

*USAA is only available to current and former military members and their families.

Wyoming teens pay around three times more for car insurance than older drivers. That's because insurance companies believe their lack of driving experience makes them more likely to cause an accident in the future.

The best way for young drivers in Wyoming to save money on car insurance is by sharing a policy with their parents or an older relative. A shared policy typically costs much less than two standalone policies, and you can qualify for a multi-car discount.

Best Wyoming car insurance quotes after a speeding ticket: State Farm

State Farm has the cheapest auto insurance quotes in Wyoming for drivers with a speeding ticket.

At $108 per month, a full coverage policy from State Farm costs $45 per month less than the Wyoming average. It's also $63 per month less than the second-cheapest option, Farmers.

Cheap Wyoming car insurance with a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $108 |

| Farmers | $171 |

| Geico | $197 |

| Allstate | $202 |

| USAA | $89 |

*USAA is only available to current and former military members and their families.

In Wyoming, a single speeding ticket will raise your rates by around 23%. That's an average increase of $29 per month for a full coverage policy.

Cheapest Wyoming insurance after an accident: State Farm

State Farm has the cheapest full coverage car insurance quotes for Wyoming drivers with an accident on their record. Full coverage from State Farm costs around $116 per month, which is $43 per month cheaper than the Wyoming average.

Company | Monthly rate |

|---|---|

| State Farm | $116 |

| Geico | $150 |

| Farmers | $187 |

| Allstate | $242 |

| USAA | $98 |

*USAA is only available to current and former military members and their families.

Just one accident on your driving record can increase full coverage quotes by $34 per month in Wyoming.

You shouldn't worry about switching car insurance companies right after an accident. Your rates won't increase until your current policy renews. But any quotes you get will include your accident, so they'll probably be more expensive than what you're currently paying.

It's best to wait until your insurance company sends your renewal offer, which should be a few weeks to a month before your current policy expires. Then, you should compare quotes from multiple companies to find the best price.

Cheapest auto insurance in WY for teens with a ticket or accident: Geico

Geico is the best company for young drivers with a speeding ticket or accident on their record.

At Geico, an 18-year-old can expect to pay around $73 for a minimum-liability policy after a ticket or $65 per month after a crash.

Company | Ticket | Accident |

|---|---|---|

| Geico | $73 | $65 |

| State Farm | $79 | $88 |

| Farmers | $113 | $124 |

| Allstate | $208 | $209 |

| USAA | $49 | $55 |

*USAA is only available to current and former military members and their families.

In Wyoming, 18-year-old drivers with a speeding ticket pay 12% more for car insurance. And an at-fault crash raises rates by 16%.

Cheapest car insurance in Wyoming after a DUI: State Farm

State Farm offers the best quotes in Wyoming if you have a DUI or DWI, at $189 per month for full coverage. That's $32 per month less than the Wyoming state average.

Company | Monthly rate |

|---|---|

| State Farm | $189 |

| Allstate | $218 |

| Geico | $253 |

| Farmers | $302 |

| USAA | $144 |

*USAA is only available to current and former military members and their families.

Drivers in Wyoming pay 78% more for full coverage auto insurance after a DUI.

In addition, Wyoming drivers who get a DUI may need SR-22 insurance.

Insurance companies usually charge between $15 and $50 to file your SR-22 form. This is on top of any increase to your car insurance rates.

Cheapest car insurance in WY for drivers with poor credit: Geico

Geico has the best quotes in Wyoming for drivers with poor credit scores. At $141 per month, full coverage from Geico is $58 per month cheaper than the state average.

Company | Monthly rate |

|---|---|

| Geico | $141 |

| State Farm | $166 |

| Farmers | $195 |

| Allstate | $266 |

| USAA | $227 |

*USAA is only available to current and former military members and their families.

In Wyoming, drivers with poor credit pay 60% more for auto insurance than those with good credit. That's because insurance companies believe people with bad credit scores are more likely to make insurance claims.

Best car insurance in Wyoming

USAA is the best insurance company in Wyoming.

That's because USAA has excellent customer service, cheap quotes and helpful coverage options.

State Farm is a great choice if you're not eligible for USAA. It offers reliable customer service at an affordable rate.

Top Wyoming car insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 739 | A++ | |

| State Farm | 657 | A++ | |

| Geico | 637 | A++ | |

| Farmers | 619 | A | |

| Allstate | 635 | A+ |

Average cost of car insurance in Wyoming by city

The city of Sheridan and its nearby communities of Big Horn, Ranchester and Wyarno are the cheapest areas for car insurance in Wyoming.

Drivers in these locations pay an average of $117 per month for full coverage insurance.

The most expensive locations for auto insurance quotes in Wyoming are Hoback, Jackson, Moose Wilson Road, South Park, Teton Village and Wilson. The average cost in each of these areas is $130 per month.

Average Wyoming car insurance quotes by location

City | Monthly Rate | % from average |

|---|---|---|

| Afton | $121 | 0% |

| Aladdin | $123 | 1% |

| Albin | $122 | 0% |

| Alcova | $123 | 1% |

| Alpine | $121 | 0% |

What car insurance is required in Wyoming?

Wyoming drivers need to have a minimum amount of liability insurance to legally drive on public roads, which is sometimes written as 25/50/20.

- Bodily injury (BI) liability: $25,000 per person and $50,000 per accident

- Property damage (PD) liability: $20,000 per accident

What's the best car insurance coverage for Wyoming drivers?

Full coverage car insurance with higher liability limits and comprehensive and collision coverage is the best choice for most drivers.

Most lenders require you to have comprehensive and collision coverage if you have a car loan or lease. That's because these coverages pay for most types of damage to your car, regardless of whose fault it is. Comprehensive and collision are also a good idea if your car is less than eight years old or worth more than $5,000.

Although full coverage usually costs more, higher liability limits could save you money if you're ever in a serious accident. That's because the minimum required coverage may not be enough to cover the cost or a major crash.

For example, if you crash into and total an expensive pickup truck, $20,000 of property damage coverage probably won't be enough to fully replace it. If you have minimum coverage, you'll have to pay the remainder out of pocket.

Frequently asked questions

What is the cheapest insurance in Wyoming?

State Farm has the cheapest full coverage car insurance in Wyoming, at $100 per month. Geico has the cheapest minimum liability rates, at $18 per month.

How much is car insurance in Casper, WY?

The average cost of car insurance in Casper is $123 per month for a full coverage policy. That's $1 per month less than the Wyoming average.

Is car insurance expensive in Wyoming?

Wyoming has the cheapest minimum liability car insurance rates in the country, and the seventh-cheapest full coverage rates. That's probably because Wyoming doesn't have any major cities with high traffic and crime rates. It also has a very low percentage of uninsured drivers.

Methodology

ValuePenguin collected thousands of rates from every ZIP code in Wyoming for a 30-year-old man who owns a 2015 Honda Civic EX and has good credit.

Quotes are for a full coverage policy with liability, collision and comprehensive coverage:

- $50,000 of bodily injury liability coverage per person, and $100,000 per accident

- $25,000 of property damage liability

- $50,000 of bodily injury uninsured motorist coverage per person, and $100,000 per accident

- $25,000 of uninsured motorist coverage for property damage

- Collision and comprehensive coverage with a $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.