Who Has The Cheapest Car Insurance in San Jose, CA?

Compare Car Insurance Rates in San Jose

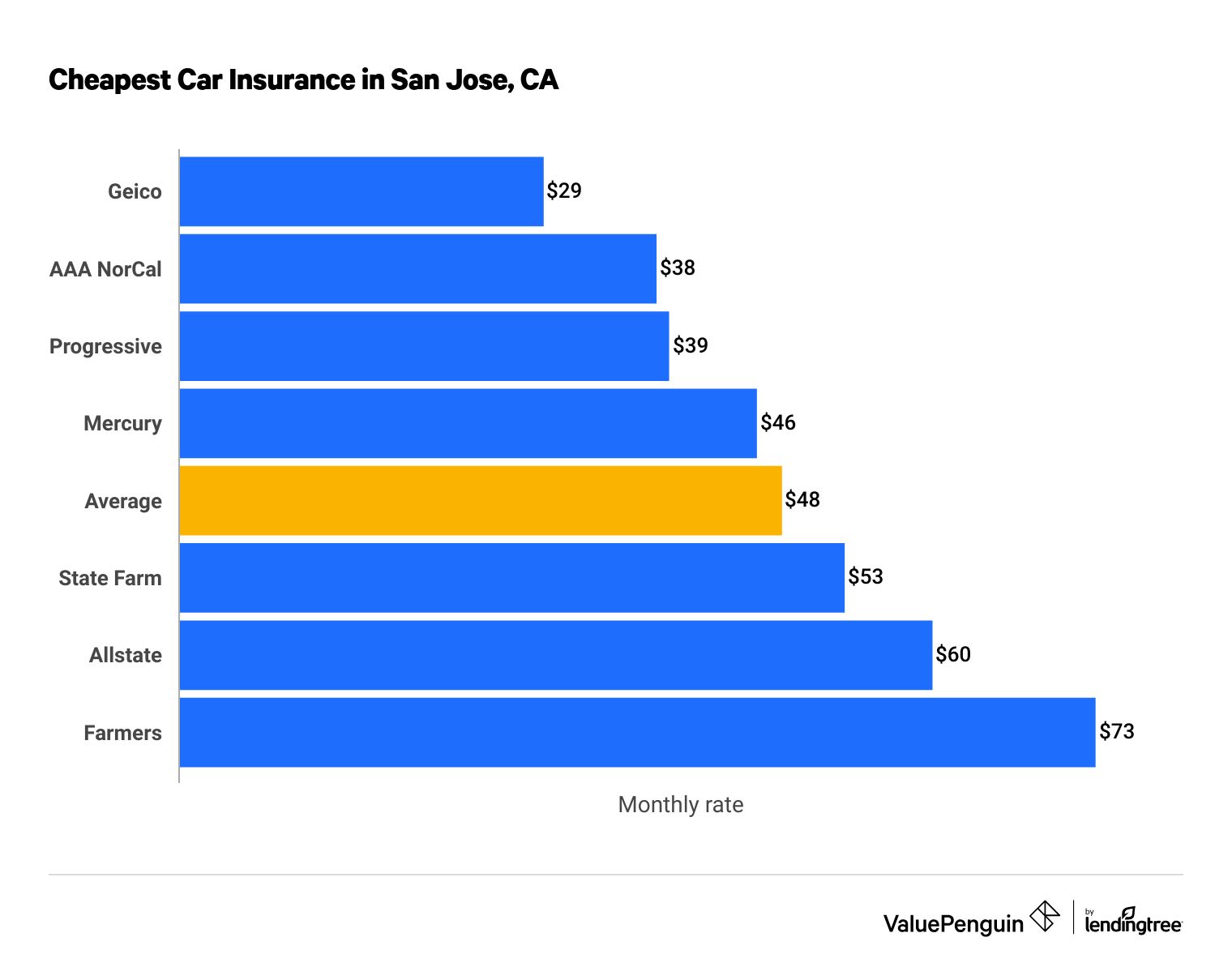

Geico has the cheapest car insurance in San Jose, California, with an average of $29 per month for minimum coverage.

Geico also has the best rates for full coverage car insurance, averaging $100 per month.

Best cheap car insurance in San Jose

Every driver will pay a different amount for car insurance depending on their vehicle, driving history and other personal details. Getting quotes from several insurance companies can help you find the best rates.

Cheapest auto insurance in San Jose: Geico

Geico has the most affordable minimum coverage car insurance in San Jose.

Geico's minimum coverage policies cost $29 per month, on average. That's 40% cheaper than the citywide average. AAA Northern California is the second cheapest company, costing an average of $38 per month for minimum coverage.

Compare Car Insurance Rates in San Jose

Minimum coverage costs an average of $49 per month in San Jose. That's an annual rate of $580. San Jose's car insurance rates are 2% lower than the California state average.

Cheap minimum coverage car insurance in San Jose

Company | Monthly rate | |

|---|---|---|

| Geico | $29 | |

| AAA NorCal | $38 | |

| Progressive | $39 | |

| Mercury | $46 | |

| State Farm | $53 |

Minimum coverage car insurance meets California's required limits for coverage. Policies don't cover damage to your own vehicle when you cause an accident. Also, its liability limits may not be high enough to pay for other people's injuries and damage after a bad car accident.

If your car has a value higher than $5,000, it's usually worth it to buy a full coverage car insurance policy to protect yourself from large repair bills after an accident.

Cheapest full coverage car insurance in San Jose: Geico

Geico has the cheapest full coverage insurance in San Jose. Its quotes average $100 per month, which is 21% less than the citywide average.

The second cheapest option is Mercury, which costs an average of $130 per month for full coverage.

Company | Monthly rate |

|---|---|

| Geico | $100 |

| Mercury | $130 |

| Progressive | $135 |

| AAA NorCal | $141 |

| Allstate | $146 |

Full coverage includes comprehensive and collision coverage and higher liability limits than what's required.

- Collision coverage: Pays for repairs to your vehicle after you cause a car accident.

- Comprehensive coverage: Pays for damage to your car that's not caused by a collision, such as damage from falling debris, animals chewing on wiring or earthquakes.

Cheap car insurance for drivers with prior incidents

Mercury and Geico have the cheapest car insurance for San Jose drivers who have a traffic violation on their record.

Drivers who have had a recent driving violation are more likely to file an insurance claim, according to insurance companies. This means you'll pay more for car insurance if you have a recent accident or ticket on your record.

Cheapest car insurance in San Jose after an accident: Mercury

Mercury is the cheapest car insurance company in San Jose for drivers who have caused a car accident. Its quotes average $195 per month for a full coverage policy, which is 33% cheaper than the citywide average.

Company | Monthly rate |

|---|---|

| Mercury | $195 |

| Geico | $256 |

| Progressive | $279 |

| AAA NorCal | $284 |

| State Farm | $297 |

In San Jose, drivers who've been in an accident pay an average of $285 per month for full coverage. That's more than twice as much as drivers who have a clean driving record.

The steep price increase after an accident means it's important to shop around to find the lowest rates.

Cheapest car insurance for people with a speeding ticket: Geico

Geico has the cheapest rates in San Jose if you've had a speeding ticket. Full coverage from Geico costs an average of $156 per month, which is $56 more than what Geico charges drivers who have a clean record.

Company | Monthly rate |

|---|---|

| Geico | $156 |

| Mercury | $172 |

| AAA NorCal | $178 |

| Allstate | $212 |

| State Farm | $229 |

In San Jose, drivers who have a speeding ticket pay an average of $211 per month for full coverage car insurance. That's 66% higher than the rate for drivers with a clean record.

Insurance companies charge more after a speeding ticket because their data shows that drivers who speed are more likely to cause an accident.

Cheapest car insurance for drivers with a DUI: Mercury

Mercury has the best rates for drivers in San Jose who have a DUI (driving under the influence). Its policies cost an average of $215 per month for full coverage, which is 42% cheaper than average.

Geico is the second cheapest option, and it's the only other company with an average lower than $300 per month.

Company | Monthly rate |

|---|---|

| Mercury | $215 |

| Geico | $251 |

| Progressive | $323 |

| Farmers | $339 |

| AAA NorCal | $504 |

A DUI is a severe offense, and insurance companies usually increase rates sharply if you're convicted. On average, drivers in San Jose pay $371 per month for full coverage insurance after a DUI.

Cheapest car insurance for young drivers: Geico

Geico has the cheapest car insurance for young drivers in San Jose buying their own policy.

Geico's rates for 18-year-old drivers in San Jose average $90 per month for minimum coverage and $261 per month for full coverage.

State Farm is the second cheapest company for young drivers in San Jose.

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $90 | $261 |

| State Farm | $102 | $263 |

| Mercury | $112 | $316 |

| Progressive | $115 | $411 |

| AAA NorCal | $118 | $442 |

In San Jose, 18-year-old drivers pay an average of $129 per month for minimum coverage car insurance. That's $81 more per month than what 30-year-old drivers pay.

Car insurance is more expensive for young drivers because they're less experienced on the road and are more likely to have car accidents.

The best way for young drivers to save on car insurance is to join a family member's policy. However, young drivers who buy their own car insurance and avoid driving violations will see rates decrease dramatically between ages 18 and 25.

Cheapest car insurance for married drivers: Geico

Geico has the cheapest rates for married drivers in San Jose.

In San Jose, Geico charges married drivers 15% less than its already low rates for single drivers. Its full coverage quotes average $85 per month for households with one car.

Company | Monthly rate |

|---|---|

| Geico | $85 |

| Progressive | $107 |

| Mercury | $116 |

| Allstate | $132 |

| AAA NorCal | $141 |

Married drivers in San Jose save an average of 2% on car insurance. Insurance companies have found that married people tend to file insurance claims less often, so they'll often charge lower rates.

Married drivers can also save on car insurance with a multicar discount if there's more than one car in the household.

Best car insurance companies in San Jose

State Farm has the highest-rated car insurance in San Jose because of its good customer satisfaction.

State Farm has great coverage options, few customer complaints and good customer service.

Company |

Editor's rating

|

|---|---|

| State Farm | |

| AAA | |

| Geico | |

| Farmers | |

| Allstate |

Choosing a high-rated car insurance company can mean that if you do have an accident, filing a claim can be quick and easy. In contrast, a car insurance company with poor customer service could add to your stress after an accident and potentially cause longer repair times.

Average car insurance quotes in San Jose by ZIP code

Car insurance rates in San Jose can vary by as much as $33 per month based on ZIP code, and Cambrian Park is the cheapest neighborhood.

In Cambrian Park, rates for full coverage average $129 per month. The downtown area has the most expensive auto insurance in San Jose, averaging $162 per month.

ZIP code | Average monthly cost | % from average |

|---|---|---|

| 95008 | $134 | 5% |

| 95014 | $130 | 2% |

| 95032 | $136 | 7% |

| 95101 | $144 | 13% |

| 95110 | $152 | 19% |

Rates vary by neighborhood because of local factors such as the number of car accidents, auto thefts or uninsured drivers. Insurance companies charge more when there is a higher risk that drivers will file a claim.

Frequently asked questions

How much does car insurance cost in San Jose?

Car insurance in San Jose costs an average of $48 per month for minimum coverage. Full coverage policies cost an average of $127 per month.

Is car insurance cheap in the Bay Area?Rates in the Bay Area vary widely. In Oakland and San Francisco, car insurance rates are 13% to 14% higher than California's average. However, rates are 8% cheaper than average in Palo Alto and 2% cheaper in San Jose.

How do you get Geico car insurance in San Jose?

In California, you can buy a Geico insurance policy online, over the phone or through an independent insurance agent. However, Geico has closed its physical offices in California.

Methodology

To find the best and cheapest car insurance companies in San Jose, ValuePenguin compared hundreds of quotes from the top insurance companies in California. Rates are for a 30-year-old man with a good credit score and clean driving record who drives a 2015 Honda Civic EX.

Minimum coverage policies meet California's car insurance requirements. Full coverage quotes include comprehensive and collision coverage and higher liability limits than what's required by California.

Type | California minimum | Full coverage |

|---|---|---|

| Bodily injury (BI) liability | $15,000 per person; $30,000 per accident | $50,000 per person; $100,000 per accident |

| Property damage (PD) liability | $5,000 per accident | $50,000 per accident |

| Uninsured or underinsured motorist BI | $50,000 per person; $100,000 per accident | |

| Uninsured or underinsured motorist PD | $50,000 per accident | |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.