Best Car Insurance Rates in Buffalo, NY

Find Cheap Auto Insurance Quotes in Buffalo

Best cheap car insurance in Buffalo, NY

To help you find the best cheap car insurance in Buffalo, ValuePenguin compared thousands of car insurance quotes from the top companies in New York. We rated the cheapest companies based on factors like cost, coverage and customer service.

Minimum liability quotes meet the New York state minimum requirements of $25,000 in bodily injury liability per person and $50,000 per accident plus $10,000 in property damage coverage. Also included are $50,000 of personal injury protection (PIP) coverage and $25,000/$50,000 of uninsured motorist bodily injury coverage.

Full coverage quotes have higher liability limits, plus comprehensive and collision coverage.

Depending on your background and driving history, insurers can offer different rates and discounts. For the best prices, we recommend comparing quotes before purchasing a policy.

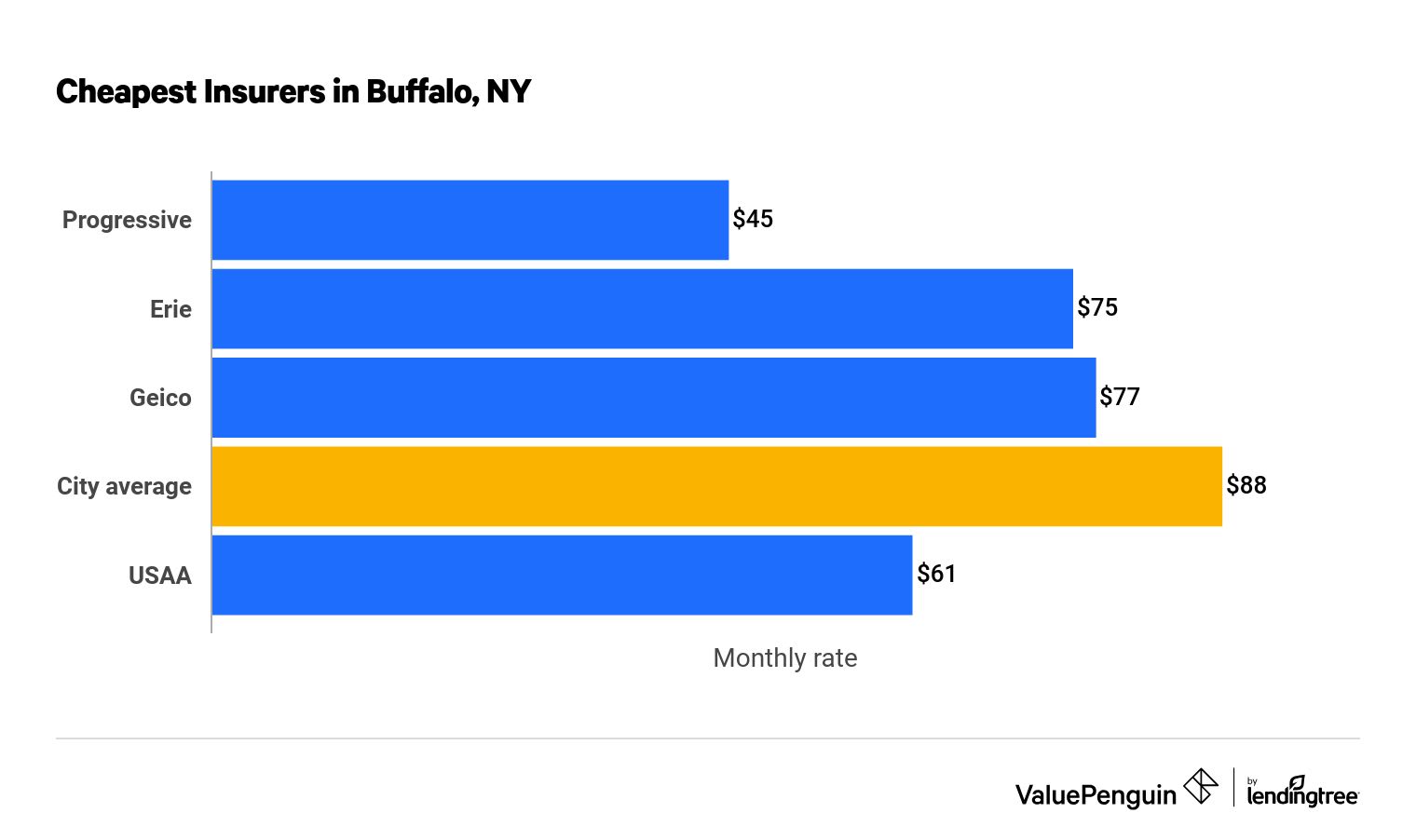

Cheapest auto insurance in Buffalo: Progressive

Progressive offers the cheapest widely available minimum liability car insurance rates in Buffalo.

Progressive, with an average rate of $45 per month, costs hundreds of dollars less per year than any other option.

Find Cheap Auto Insurance Quotes in Buffalo

Cheapest insurers in Buffalo, NY

Company | Monthly rate | |

|---|---|---|

| Progressive | $45 | |

| Erie | $75 | |

| Geico | $77 | |

| Travelers | $110 | |

| State Farm | $120 | |

| Allstate | $126 | |

| USAA | $61 |

USAA is only available to current and former military members and their families.

As the least expensive option, minimum liability coverage also offers you the least protection. Those who drive a lot, own an expensive car or would like a greater degree of financial protection should consider raising coverage beyond the minimum.

Cheapest full coverage car insurance in Buffalo: Progressive

Progressive offers Buffalo's cheapest rates for full coverage auto insurance. Progressive's average monthly rate is $80, $45 lower than Erie's rate and 48% lower than the city average.

The average rate for Buffalo is $153 per month, with only Progressive, USAA and Erie charging less.

Company | Monthly rate |

|---|---|

| Progressive | $80 |

| Erie | $125 |

| Geico | $157 |

| State Farm | $183 |

| Travelers | $197 |

| Allstate | $207 |

| USAA | $122 |

USAA is only available to current and former military members and their families.

The average rate in Buffalo is $4 higher than the average cost of full coverage car insurance in New York.

Collision and comprehensive coverage are key parts of full coverage, offering protection for a driver's own vehicle in both an accident and other situations.

- Collision coverage: Covers damage from an at-fault accident with another vehicle or object.

- Comprehensive coverage: Offers protection from events outside the customer's control, such as hail, vandalism, theft and other events.

Cheap car insurance for drivers with prior incidents

Progressive and Erie generally offer the best rates after a driving incident.

A speeding ticket, accident or DUI on your driving record can mean a major increase in your rates.

Cheapest car insurance for drivers with an incident or poor credit

Cheapest car insurance in Buffalo after an accident: Erie

In Buffalo, Erie Insurance offers the lowest insurance rates for drivers after an at-fault accident. Progressive offers the next-best rates, followed by State FarmGeico.

Erie's rate of $125 per month is 39% lowerless than the average rate overall, which is $204 for full coverage.

Company | Monthly rate |

|---|---|

| Erie | $125 |

| Progressive | $127 |

| State Farm | $221 |

| Travelers | $251 |

| Allstate | $285 |

Cheapest car insurance for people with a speeding ticket: Progressive

Progressive has Buffalo's best rates for drivers with a speeding ticket. Its average monthly price is $82 for full coverage, or 54% lower than the average price citywide.

Buffalo drivers with one speeding ticket pay, on average, 17% more than a driver with a clean record. Insurance companies have found that someone with a ticket is more likely to make a claim on their car insurance.

Company | Monthly rate |

|---|---|

| Progressive | $82 |

| Erie | $154 |

| Geico | $202 |

| State Farm | $202 |

| Travelers | $225 |

Cheapest car insurance for drivers with a DUI: Progressive

Progressive offers the cheapest auto insurance rates for drivers with a DUI in Buffalo. The company's average rate is $83 per month for full coverage, which is 59% lower than the rate from the next-closest competitor.

Company | Monthly rate |

|---|---|

| Progressive | $83 |

| State Farm | $202 |

| Erie | $213 |

| Travelers | $247 |

| Allstate | $289 |

A DUI is among the most serious driving infractions, and you'll likely face a steep increase in your car insurance rates if you're convicted.

Cheapest car insurance for drivers with poor credit: Geico

Geico has the best rates for Buffalonians with bad credit, with an average of $223 per month for full coverage. That's 39% lower than the city average.

Your credit score isn't impacted by how well you drive, but it can increase your rates. The average rate for full coverage increases by 138% to $364 per month if your credit drops from good to poor.

Company | Monthly rate |

|---|---|

| Geico | $223 |

| Erie | $316 |

| Allstate | $355 |

| Travelers | $393 |

| State Farm | $400 |

Cheapest car insurance for young drivers: Geico

Geico offers the lowest rates in Buffalo for 18-year-old drivers. The company's average price is $124 per month for minimum coverage. Progressive has the most affordable full coverage for a young driver, at $245 per month, though Geico only costs $1 more per month.

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $124 | $246 |

| Progressive | $149 | $245 |

| Travelers | $290 | $525 |

| Allstate | $294 | $559 |

| Erie | $304 | $467 |

The average price of car insurance for an 18-year-old is $445 for full coverage; that's 191% more than a 30-year-old driver pays.

Teen drivers are usually considered high-risk drivers and thus pay notably higher rates.

Cheapest car insurance for married drivers: Progressive

Married drivers in Buffalo can save the most money with Progressive. The company's monthly rate of $63 for full coverage is 58% lower than the city average.

Erie has the second-cheapest rate, at $109 per month. They're both much cheaper than the average rate for married drivers in Buffalo overall, which is $149 per month.

Insurers tend to view married drivers as less risky to insure, which often means slightly lower rates.

Company | Monthly rate |

|---|---|

| Progressive | $63 |

| Erie | $109 |

| Geico | $159 |

| State Farm | $183 |

| Travelers | $197 |

Best auto insurance companies in Buffalo, New York

Erie, State Farm and USAA are the top insurers for customer satisfaction in New York state. These companies tend to get positive reviews from customers and have few complaints, alongside their affordable prices and coverage options.

Company |

Editor's rating

|

|---|---|

| Erie | |

| State Farm | |

| USAA | |

| Geico | |

| Travelers | |

| Allstate | |

| Progressive |

Average car insurance cost in Buffalo, by neighborhood

The most expensive area in Buffalo for car insurance includes Willert Park and its surrounding neighborhoods, just outside of downtown.

There, car insurance costs an average of $170 per month for full coverage. That's $40 per month higher than the rate in the cheapest part of Buffalo for car insurance, Blasdell.

Car insurance tends to cost more if you live in an area with narrow roads, high traffic or frequent theft.

ZIP code | Average monthly cost | % from average |

|---|---|---|

| 14201 | $167 | 9% |

| 14202 | $166 | 9% |

| 14203 | $168 | 10% |

| 14204 | $170 | 11% |

| 14206 | $143 | -6% |

Factors such as crime levels, the rate of accident claim filings from that particular area and overall traffic density impact the price of insurance in any neighborhood or ZIP code. One of the top ways to save money on insurance is to compare quotes from multiple insurers.

Methodology

To determine the best rates in Buffalo, data was collected from the largest insurers in New York. Rates are for a 30-year-old man who drives a 2015 Honda Civic EX. Unless otherwise stated, the driver had good credit and rates are for a full coverage policy.

Full coverage policies include comprehensive and collision coverage, plus higher liability limits than the state requires.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $50,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

This analysis used insurance rate data from Quadrant Information Services that was publicly sourced from insurer filings. Quotes should be used only for comparative purposes.