Cheapest and Best Auto Insurance Companies in San Francisco

Compare Car Insurance Rates in San Francisco

Geico has the cheapest car insurance in San Francisco, Calif., with average rates of $30 per month for minimum coverage and $109 per month for full coverage.

Cheapest auto insurance in San Francisco: Geico

Geico has the cheapest car insurance policies in San Francisco.

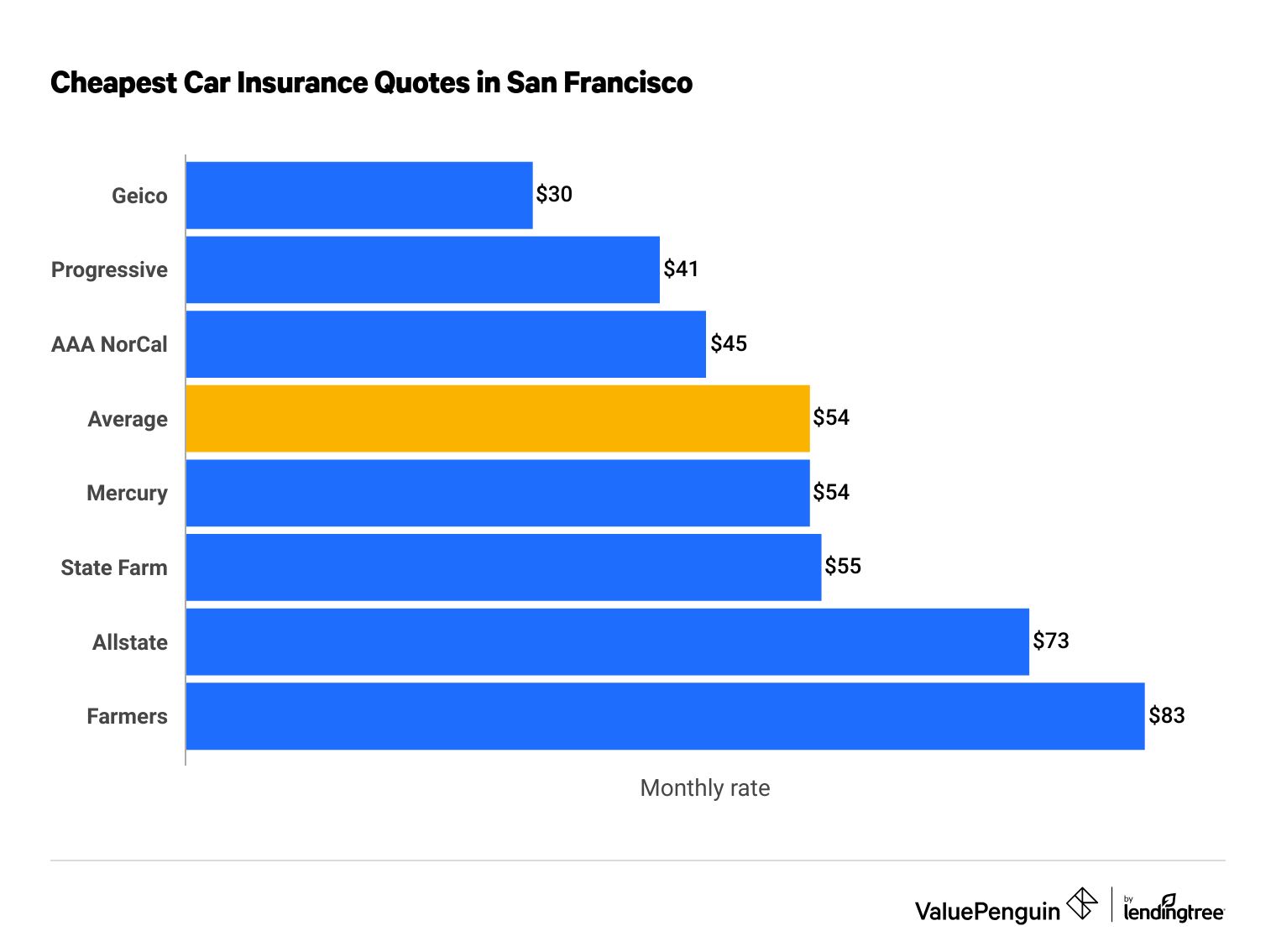

Minimum-coverage policies from Geico cost an average of $30 per month, which is 44% cheaper than average. The average cost of car insurance in San Francisco is $54 per month, or $653 per year, for a minimum-coverage policy. Progressive is the second-cheapest company at $41 per month.

Compare Car Insurance Rates in San Francisco

Cheapest car insurance quotes in San Fransisco

Company | Monthly rate | |

|---|---|---|

| Geico | $30 | |

| Progressive | $41 | |

| AAA NorCal | $45 | |

| Mercury | $54 | |

| State Farm | $55 |

Geico is also the cheapest car insurance company across California.

Cheapest full-coverage car insurance in San Francisco: Geico

Geico has the cheapest full-coverage car insurance in San Francisco with rates averaging $109 per month. That's 27% less than average rates from top insurers.

Full coverage costs an average of $150 per month in San Francisco. That's nearly $100 more per month than a minimum-coverage policy.

Company | Monthly rate |

|---|---|

| Geico | $109 |

| Progressive | $147 |

| Mercury | $155 |

| State Farm | $159 |

| AAA NorCal | $186 |

Full-coverage car insurance costs more than the minimum coverage that California requires. However, full coverage protects you against costs such as paying to repair your car when you cause an accident.

Full coverage includes:

- Comprehensive coverage: Pays for damage to your car that's caused by something besides a crash, such as hail or theft.

- Collision coverage: Pays for damage to your car as a result of a crash, no matter who was at fault.

Cheap car insurance for drivers with prior incidents

Mercury and Geico have the cheapest rates for drivers with traffic tickets or accidents on their records.

Car insurance companies charge higher rates if you don't have a clean driving record. Prior incidents like a speeding ticket or DUI mean that you're more likely to file a claim.

Cheapest car insurance in San Francisco after an accident: Geico

Mercury has the cheapest quotes for car insurance in San Francisco if you've caused a car accident. Policies cost about $233 per month, which is 34% less than the city average.

Company | Monthly rate |

|---|---|

| Mercury | $233 |

| Geico | $278 |

| Progressive | $302 |

| State Farm | $315 |

| AAA NorCal | $376 |

An at-fault car crash is one of the most common causes of high car insurance rates. On average, San Francisco drivers pay 136% more after causing a crash compared to drivers with clean records.

Cheapest car insurance for people with a speeding ticket: Geico

Geico has the best rates in San Francisco if you've had a recent speeding ticket. Its policies cost an average of $171 per month, which is 31% cheaper than average.

Company | Monthly rate |

|---|---|

| Geico | $171 |

| Mercury | $205 |

| AAA NorCal | $235 |

| State Farm | $244 |

| Allstate | $280 |

In San Francisco, car insurance rates go up an average of 66% after a speeding ticket to $248 per month.

Cheapest car insurance for drivers with a DUI: Mercury

Mercury Insurance has the best price for San Francisco drivers with a DUI. Policies cost about $257 per month, which is 43% cheaper than the average citywide rate.

Company | Monthly rate |

|---|---|

| Mercury | $257 |

| Geico | $274 |

| Progressive | $352 |

| Farmers | $397 |

| State Farm | $559 |

Driving a car while you're drunk or intoxicated is one of the most serious driving offenses, and you're likely to see a big increase in your car insurance rates if you're convicted of driving under the influence.

The average cost of full coverage in San Francisco if you have a DUI is $451 per month. That's about three times as expensive as what you'll pay with a clean record.

Cheapest car insurance for married drivers: Geico

Geico has the best rates for San Francisco drivers who are married with one car. Full-coverage policies cost an average of $93 per month. That's a 15% savings versus the company's already cheap rates for single drivers.

Across all companies, married drivers in San Francisco pay 2% less for car insurance than single drivers.

Company | Monthly rate |

|---|---|

| Geico | $93 |

| Progressive | $115 |

| Mercury | $137 |

| State Farm | $159 |

| Allstate | $172 |

Note that married drivers may save even more by bundling multiple drivers or multiple cars into a single policy. These discounts aren't factored into our rates.

Cheapest car insurance for young drivers: Geico

Geico has the cheapest rates in San Francisco for 18-year-olds buying a minimum-coverage policy. The average cost is $94 per month, which is 37% cheaper than the city average.

For young drivers who want full coverage, State Farm has slightly cheaper rates than Geico. An 18-year-old in San Francisco will pay an average of $278 per month for full coverage from State Farm.

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $94 | $284 |

| State Farm | $105 | $278 |

| Progressive | $121 | $445 |

| Mercury | $134 | $377 |

| AAA NorCal | $142 | $582 |

Young drivers have very high car insurance rates because of their inexperience behind the wheel and greater chance of causing an accident.

Two ways younger drivers can save money on their car insurance are by sharing a policy with a parent and by qualifying for a good student discount.

Best San Francisco car insurance companies

State Farm has the best-rated car insurance in San Francisco based on its good customer service.

State Farm has top scores from ValuePenguin editors due to its low number of customer complaints, great coverage options and high scores on J.D. Power's claims satisfaction survey.

AAA NorCal is another good option. It has high ratings from editors and strong customer satisfaction in California.

Best car insurance companies in San Francisco

Company |

Editor's rating

|

|---|---|

| State Farm | |

| AAA | |

| Geico | |

| Farmers | |

| Allstate | |

| Mercury | |

| Progressive |

Choosing a top-rated company can make a difference when you're calling customer service or filing a claim. For example, after an accident, a company with a good customer service reputation may have a fast and easy claims process. In contrast, poor customer service could mean it will take longer to repair your car or you could have to pay more to get your car fixed.

Average car insurance cost in San Francisco by neighborhood

Within San Francisco, rates vary by ZIP code, and car insurance is cheapest near the airport and in the Marina district.

Quotes for car insurance are more expensive in Bayview.

Car insurance rates can change based on local factors in your neighborhood, such as the number of car accidents or car thefts. In San Francisco, rates vary by $44 per month between the cheapest and most expensive ZIP codes.

City | Average monthly cost | % from average |

|---|---|---|

| 94102 | $184 | 23% |

| 94103 | $165 | 10% |

| 94104 | $175 | 17% |

| 94105 | $167 | 11% |

| 94107 | $156 | 4% |

Methodology

Car insurance rates in San Francisco are based on hundreds of quotes from every ZIP code in the city. ValuePenguin compared prices from the largest insurance companies based on their rates for a 30-year-old man who has good credit and drives a 2015 Honda Civic EX.

Minimum-coverage policies meet the California minimum liability requirements. Quotes for full coverage have higher liability limits, uninsured/underinsured motorist coverage, comprehensive and collision.

Type | California minimum | Full coverage |

|---|---|---|

| Bodily injury (BI) liability | $15,000 per person/ $30,000 per accident | $50,000 per person/ $100,000 per accident |

| Property damage (PD) liability | $5,000 per accident | $50,000 per accident |

| Uninsured or underinsured motorist BI | $50,000 per person/$100,000 per accident | |

| Uninsured or underinsured motorist PD | $50,000 per accident | |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Our statewide analysis of California insurance rates included both AAA of Northern California and AAA of Southern California. However, AAA of Southern California doesn't offer insurance to San Jose residents, so we removed it from city averages and rankings.