The Best Cheap Philadelphia Car Insurance Companies

Travelers offers the cheapest car insurance in Philadelphia, just $60 per month for minimum coverage.

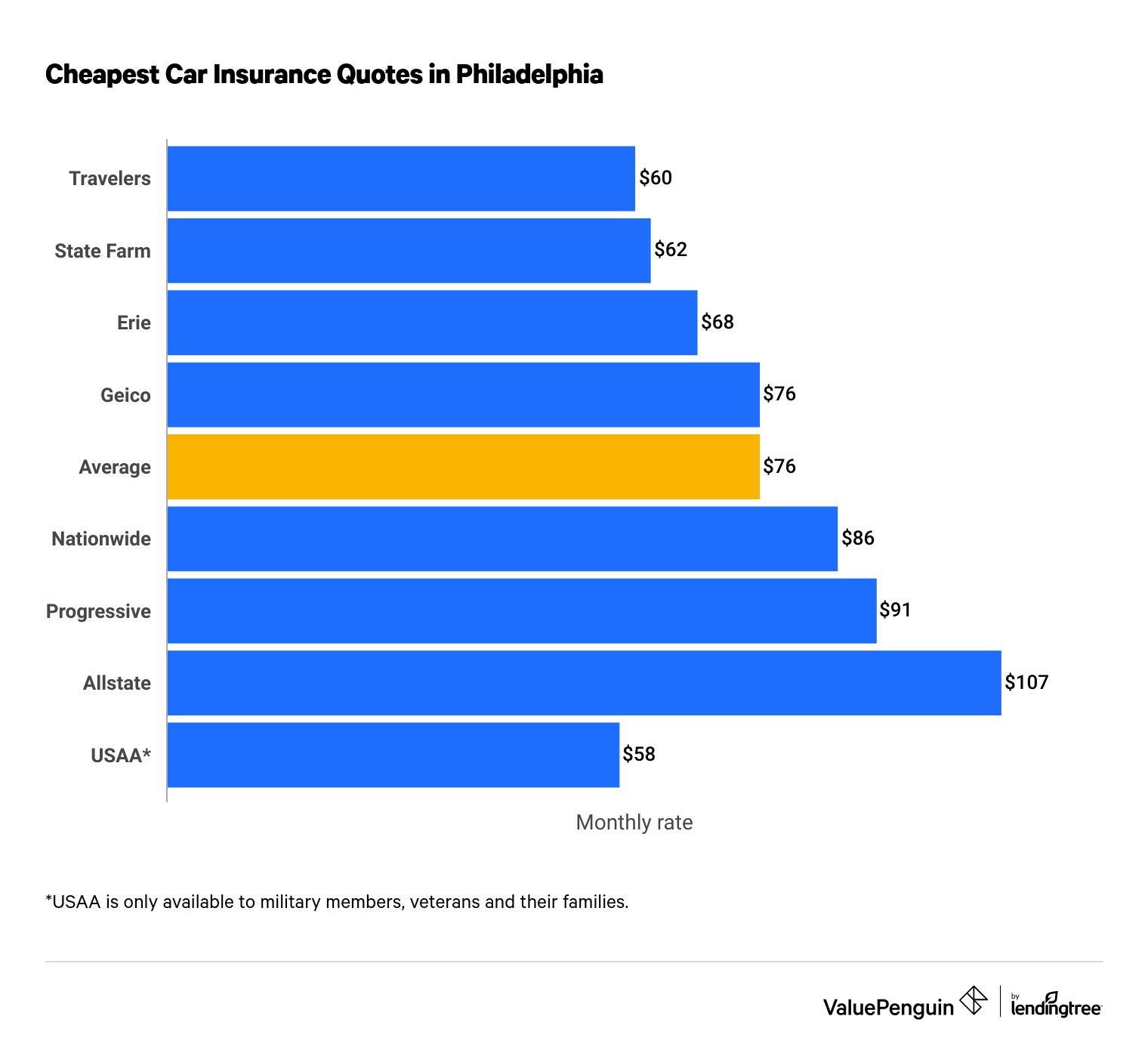

Best cheap car insurance quotes in Philadelphia, PA

ValuePenguin compared thousands of auto insurance quotes from top companies in Pennsylvania to help you find the best cheap car insurance in Philadelphia. Companies are also ranked based on factors like customer support, coverage and cost.

Minimum coverage quotes meet the Pennsylvania state requirements of $15,000 in bodily injury liability per person and $30,000 per accident, plus $5,000 in property damage coverage and $5,000 in medical payments coverage. Quotes for coverage include higher liability limits plus comprehensive and collision coverage.

Cheapest auto insurance in Philadelphia: Travelers

Travelers offers the cheapest auto insurance rates in Philadelphia, on average, $60 per month for minimum coverage.

State Farm is only a little more expensive at $62 per month, and the overall average for the city is $76 per month.

Compare Car Insurance Rates in Philadelphia, Pennsylvania

Former and current military members should check out USAA, which has the overall cheapest annual policy at only $58 per month.

Cheap minimum-coverage car insurance in Philadelphia

Company | Monthly rate | |

|---|---|---|

| Travelers | $60 | |

| State Farm | $62 | |

| Erie | $68 | |

| Geico | $76 | |

| Nationwide | $86 | |

| Progressive | $91 | |

| Allstate | $107 | |

| USAA | $58 |

*USAA is only available to current and former military members and their families.

The most inexpensive auto insurance you can buy is a minimum coverage policy, which is the least amount of coverage you need to legally drive in the state.

A minimum coverage policy will cost less up front but only protects you against the cost of damage you cause to others. It doesn't cover the cost of damage to your own vehicle. If you want to protect against the costs of damage to your own car, you should consider a full coverage policy.

Cheapest full-coverage car insurance in Philadelphia: State Farm

State Farm has the cheapest full-coverage insurance policy at a rate of $148 per month. Travelers, the second-cheapest company, is $9 per month more expensive than State Farm.

Company | Monthly rate |

|---|---|

| State Farm | $148 |

| Travelers | $157 |

| Erie | $192 |

| Nationwide | $237 |

| Geico | $263 |

| Progressive | $302 |

| Allstate | $343 |

| USAA | $189 |

*USAA is only available to current and former military members and their families.

The average cost of full coverage in Philadelphia is $229 per month, the most expensive car insurance in Pennsylvania. Average full coverage rates in Philly are 84% higher than the state average.

Full coverage insurance is more than three times as expensive as a minimum policy in Philadelphia, but it provides a different type of protection than liability insurance.

A full coverage policy meets the minimum coverage requirements of state law while including collision and comprehensive coverage. To summarize collision and comprehensive coverage:

- Collision insurance covers damage caused when you drive into another vehicle or object.

- Comprehensive insurance covers damage caused by something out of your control, including natural disasters, vandalism, theft and terrorism.

A good rule of thumb: Invest in a full coverage policy if your vehicle is fewer than 10 years old or worth more than $5,000. If it's worth less than that, the value you can potentially get from your policy won't match what you're paying.

Cheap car insurance for Philadelphia drivers with prior incidents

State Farm has the cheapest quotes in Philadelphia if you have a traffic ticket or bad credit.

Insurance companies will almost always raise your rates if you've been at fault in an accident, caught speeding or convicted of DUI. Tickets like that show you might be more risky on the road.

Cheapest car insurance after a speeding ticket: State Farm

State Farm has the lowest rates for Philadelphia drivers after a speeding ticket. At $159 per month, State Farm's average prices are 17% cheaper than any other company.

Company | Speeding rate |

|---|---|

| State Farm | $159 |

| Travelers | $192 |

| Erie | $216 |

| Nationwide | $285 |

| Progressive | $302 |

A speeding ticket will increase your rates by an average of 13% in Philadelphia, which is a difference of about $370 per year.

Cheapest car insurance in Philadelphia after an accident: State Farm

State Farm has Philadelphia's most affordable rates for drivers with an at-fault accident, at $172 per month. That's half the city average overall and $46 per month less than any other company.

Company | Accident rate |

|---|---|

| State Farm | $172 |

| Travelers | $218 |

| Erie | $270 |

| Nationwide | $395 |

| Progressive | $459 |

Depending on your insurance company, your annual rate can increase by as much as $222 per month or as little as $24 per month following an accident. These differences show how crucial it is that you get free car insurance quotes from multiple companies and ask about how your own driver profile will affect your quote.

In addition to researching different companies and looking into discounts, you should also ask companies if they have an accident forgiveness policy. Accident forgiveness may cost extra, but it can protect you from a price hike following an accident.

Cheapest car insurance after a DUI: State Farm

State Farm's rates for drivers after a DUI are the cheapest in Philadelphia, only $159 per month. That's half the price of the city average.

Company | Monthly rate |

|---|---|

| State Farm | $159 |

| Travelers | $230 |

| Nationwide | $285 |

| Erie | $323 |

| Allstate | $343 |

Committing a DUI is one of the most serious driving offenses you can commit. As a result, rates in Philadelphia go up an average of $88 per month, or 39%.

Cheapest car insurance for drivers with poor credit: State Farm

State Farm has Philadelphia's cheapest car insurance for drivers with poor credit. The company's rate of $324 per month is 23% cheaper than the city average and a hair cheaper than Nationwide, the second-cheapest option.

Company | Monthly rate |

|---|---|

| State Farm | $324 |

| Nationwide | $332 |

| Travelers | $457 |

| Erie | $465 |

| Geico | $498 |

Your credit score does not impact how much of a risk you are on the road. However, insurance companies have found drivers with low credit tend to file more claims, which makes them more expensive to cover.

In Philadelphia, bad credit raises rates 85% compared to good credit.

Cheapest full-coverage auto insurance for young drivers in Philly: Travelers

Travelers has the most affordable insurance for young drivers seeking a minimum or full coverage policy.

The company's average rates of $146 per month for minimum coverage and $349 per month for full coverage will save you at least $25 per month compared to the next-cheapest competitors.

Monthly car insurance rates for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Travelers | $146 | $349 |

| Geico | $171 | $572 |

| State Farm | $177 | $408 |

| Erie | $186 | $505 |

| Nationwide | $244 | $652 |

Drivers under the age of 25 are seen as riskier drivers and will often pay substantially more for insurance. For example, young drivers pay nearly three times as much as the average 30-year-old driver for minimum coverage in Philly.

Cheapest quotes for teens with traffic violations: Travelers

Travelers has the cheapest minimum coverage rates in Philadelphia for young drivers who have tickets or accidents on their records.

An 18-year-old with one speeding ticket pays an average of $174 per month with Travelers, which is 27% less than average. If you have an accident and you're 18, you'll pay 23% less with Travelers, at $209 per month.

Company | Speeding rate | Accident rate |

|---|---|---|

| Travelers | $174 | $209 |

| State Farm | $193 | $212 |

| Geico | $225 | $261 |

| Erie | $234 | $276 |

| Progressive | $246 | $284 |

Cheapest car insurance for married drivers: State Farm

State Farm offers the cheapest car insurance for married drivers in Philadelphia. The average rate of $148 per month for a married driver with one car is 31% cheaper than the city average for married drivers.

Company | Monthly rate |

|---|---|

| State Farm | $148 |

| Travelers | $158 |

| Erie | $185 |

| Nationwide | $223 |

| Progressive | $241 |

If you're a married driver in Philadelphia, you'll pay an average of 6% less for car insurance. Progressive has the biggest discount at about 20%. Married drivers statistically get into fewer accidents than single drivers, so they will pay lower rates in some cases.

Best auto insurance company in Philadelphia

USAA has the best customer service of insurance companies serving Philadelphia, measured by multiple factors.

The company is rated well by J.D. Power and gets few complaints, according to the National Association of Insurance Commissioners. It also has a wide variety of coverage options and low rates, but it's only available to current and former military personnel, as well as some military family members.

If you live in Philadelphia and are not eligible for USAA, you should consider Erie and State Farm.

Best car insurance companies in Philadelphia, PA

Company |

Editor's rating

|

|---|---|

| Erie | |

| State Farm | |

| USAA | |

| Geico | |

| Nationwide | |

| Travelers | |

| Allstate | |

| Progressive |

Customer service is a key factor for you to consider when looking at car insurance. Good service will help you get your life back on track and reduce hassle if something happens to your car. Bad customer service can lead to more stress and make it take longer to get back on the road.

Average cost of auto insurance by neighborhood and ZIP code

Residents in Tinicum Township, Philadelphia's cheapest neighborhood pay an average of $182 per month, while Tioga residents pay the most at $260 per month.

Every neighborhood of Philly is different, with some having higher rates of crimes or accidents. This will result in insurance costs that can vary by the hundreds, depending on where you live.

ZIP code | Neighborhood | Average monthly cost | Percentage from average |

|---|---|---|---|

| 19102 | Logan Circle/Center City West/Center City | $206 | -10% |

| 19103 | Rittenhouse/Center City West/Center City | $206 | -10% |

| 19104 | Belmont | $225 | -1% |

| 19106 | Olde City/Center City East/Center City | $205 | -10% |

| 19107 | Market Street Department Stores/Washington Square/Center City East/Center City | $208 | -9% |

Frequently asked questions

How much is car insurance in Philadelphia?

Minimum-coverage car insurance costs an average of $76 per month in Philadelphia, while full coverage costs $229 per month. That makes Philadelphia the most expensive city for car insurance in Pennsylvania.

Why is car insurance so expensive in Philadelphia?

Car insurance in major cities like Philadelphia tends to be more expensive because of a higher density of cars, which leads to more accidents. Philly is also in a no-fault state, which tends to raise rates.

What's the cheapest car insurance company in Philadelphia?

Travelers is the cheapest car insurance company in Philadelphia, with an average rate of $60 per month for minimum coverage. State Farm, Erie and USAA all have cheaper-than-average rates.

Methodology

ValuePenguin collected data from the largest insurance companies in Philadelphia. Quotes are for a 30-year-old single man who owns a 2015 Honda Civic EX with good credit. Rates are for a full coverage policy unless otherwise noted.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

Minimum policies include the legally required amount of coverage in Pennsylvania.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.