Mile Auto Insurance Review: Insurance by the Mile

Mile Auto is a per-mile insurance company, which means rates are based mostly on the number of miles you drive each month. Drive less and your bill goes down; drive more and it goes up. Its cheap rates and its simple pricing model may make it an excellent fit for people who drive less than 27 miles per day.

Mile Auto insurance review: Our thoughts

Mile Auto is a good choice for drivers who don't drive often and live in one of the seven states where the company offers insurance . Because part of your rate is set by the number of miles you drive your car, Mile's prices may change from month to month.

Mile Auto is between 13% and 94% cheaper than other pay-per-mile insurers, depending on the number of miles you drive and the coverage level you choose.

In order to know whether Mile is a good choice for you, you'll need a solid understanding of how much you drive each month and how that amount fluctuates during the year. Additionally, long-distance trips can easily make your insurance rates spike.

Mile's pricing is best for people who don't drive to work every day. This includes people who commute by public transit or work from home, college students, retirees and anyone else who primarily uses their car for errands or occasional trips.

Unfortunately, Mile Auto's customer service is sub par. Its policies are underwritten by Spinnaker Insurance, which receives a lot of customer complaints, according to the National Association of Insurance Commissioners (NAIC). The majority of complaints are about the company's slow claims process, which means it may take longer to get your claim finished and paid out.

Compare Mile Auto to other pay-per-mile auto insurers | |

|---|---|

| |

| |

| |

| |

| |

Bottom line: Mile Auto offers cheaper rates than other pay-per-mile insurers, and could be worth considering for people who drive fewer than 10,000 miles per year. Some drivers may prefer not to worry about the per-mile cost and go with an insurer that charges the same amount no matter how much you use your car.

On the other hand, drivers who value a fast and easy claims process should consider other insurers.

Mile Auto insurance quotes

Mile Auto offers cheaper rates than other pay-per-mile programs for both minimum and full-coverage car insurance.

People who drive 10,000 miles per year, or about 27 miles per day, save the most with Mile Auto. A minimum-coverage policy from Mile is $44 per month, or $528 per year, which is 36% cheaper than the average of its competitors for these drivers. Full-coverage costs $65 per month, or $780 per year — 93% less expensive than average.

Minimum coverage

Full coverage

Find Cheap Auto Insurance Quotes in Your Area

Those who drive 5,000 miles will also find the best rates for minimum-coverage insurance with Mile Auto. At $38 per month, or $456 per year, a policy is 13% cheaper than our study average.

Mile auto insurance vs. competitors

Company | 5,000 miles | 10,000 miles |

|---|---|---|

| Mile Auto | $38 | $44 |

| Allstate Milewise | $41 | $66 |

| Nationwide SmartMiles | $46 | $59 |

| Metromile | $47 | $70 |

Minimum coverage

Find Cheap Auto Insurance Quotes in Your Area

Those who drive 5,000 miles will also find the best rates for minimum-coverage insurance with Mile Auto. At $38 per month, or $456 per year, a policy is 13% cheaper than our study average.

Mile auto insurance vs. competitors

Company | 5,000 miles | 10,000 miles |

|---|---|---|

| Mile Auto | $38 | $44 |

| Allstate Milewise | $41 | $66 |

| Nationwide SmartMiles | $46 | $59 |

| Metromile | $47 | $70 |

Full coverage

Find Cheap Auto Insurance Quotes in Your Area

Mile Auto also has the most affordable full-coverage rates for those who drive 5,000 miles per year. A policy costs $54 per month, or $648 per year, on average. That's 61% cheaper than our study average.

Company | 5,000 miles | 10,000 miles |

|---|---|---|

| Mile Auto | $54 | $65 |

| Nationwide SmartMiles | $91 | $117 |

| Allstate Milewise | $100 | $161 |

| Metromile | $103 | $160 |

What happens if you take a road trip?

Although Mile Auto has low rates for people who consistently drive fewer than 27 miles per day, long distance trips will cause your monthly premium to increase.

For example, the distance from Chicago to New York City is about 800 miles. If you have a full-coverage policy, a round trip between those cities would add around $31 to that month's insurance bill.

On the other hand, some insurers cap the number of miles they charge per day. Metromile will only charge you for a maximum of 250 miles per day, so the same round trip (driven over two separate days) would add just $12 total to your bill. After that point, any additional miles are free each day.

Mile Auto insurance coverages and discounts

Coverage offerings from Mile Auto are fairly bare-bones compared to most car insurance companies. The company offers the basic coverages you need to legally drive in every state where it operates, along with a few optional add-ons.

It's somewhat typical for newer insurance companies to offer limited coverage options — it's one reason they can offer such cheap rates. Drivers who want extra coverage should consider a pay per mile program from a major insurer instead.

Mile also doesn't offer any discounts or accident forgiveness. Instead, any "discounts" you might earn, like good driving or claims-free discounts, are built into your rate.

How does Mile Auto insurance work?

Mile Auto offers pay-per-mile insurance. That means your rate is calculated by adding together a predetermined monthly base rate and a per-mile rate that fluctuates based on the number of miles you drive each month.

For example, a sample driver with Mile Auto might pay a base rate of $35 + $0.04 per mile for a minimum-coverage policy. If this person drives 300 miles per month, their total rate would be $47. But if the person drives 1,000 miles (the national median), their bill would be $75 for that month.

Your monthly base amount and mileage rate are set using typical criteria auto insurers use. This includes your driving history, location, age and the level of insurance coverage you choose.

Unlike other per-mile insurance companies, Mile Auto doesn't track your driving with a smartphone app or a device that plugs into your car.

Instead, you'll take a picture of your odometer once a month, and Mile tabulates the distance and bills accordingly. The company's MVerity system prompts drivers to provide an odometer photo with monthly texts and emails which contain a link that opens your phone camera. Once you snap a photo, it's uploaded to MVerity, which confirms the authenticity of the photo and verifies your odometer data.

There are pros and cons to this snap-and-send method:

Pros

- Privacy-minded drivers may find Mile's minimally intrusive data collection preferable to providing an insurer with access to their location and driving habits at all times.

Cons

- Photographing and submitting your odometer reading doesn't take long, but it's another task you have to complete each month.

- A per-mile rate means your insurance bill can spike if you take a long car trip. By comparison, other pay-per-mile insurers have a daily mileage limit. Once you've driven a given number of miles in a day, additional miles are free.

How does Mile Auto compare with other per-mile insurers?

Pay-per-mile auto insurance is a recent trend, and there aren't many companies that offer this type of pricing. But for people who don't drive very much and would benefit from this model of coverage, it's worth comparing the options to see which is the best fit.

Insurer | Availability | Tracking method | Best for |

|---|---|---|---|

| Allstate Milewise | 21 states | Plug-in device paired with app. | People who prefer an established insurer. |

| Liberty Mutual ByMile | 17 states and Washington, D.C. | Plug-in device paired with app. | Drivers who take frequent road trips |

| Metromile | Eight states | Plug-in device paired with app. | Tech-savvy drivers who prefer to manage their policy via an app. |

| Mile Auto | Seven states | Monthly odometer photos. | Drivers who want the cheapest rates. |

| Nationwide SmartMiles | 40 states and Washington, D.C. | Plug-in device. | Drivers who value solid customer service. |

Where can you get Mile Auto insurance?

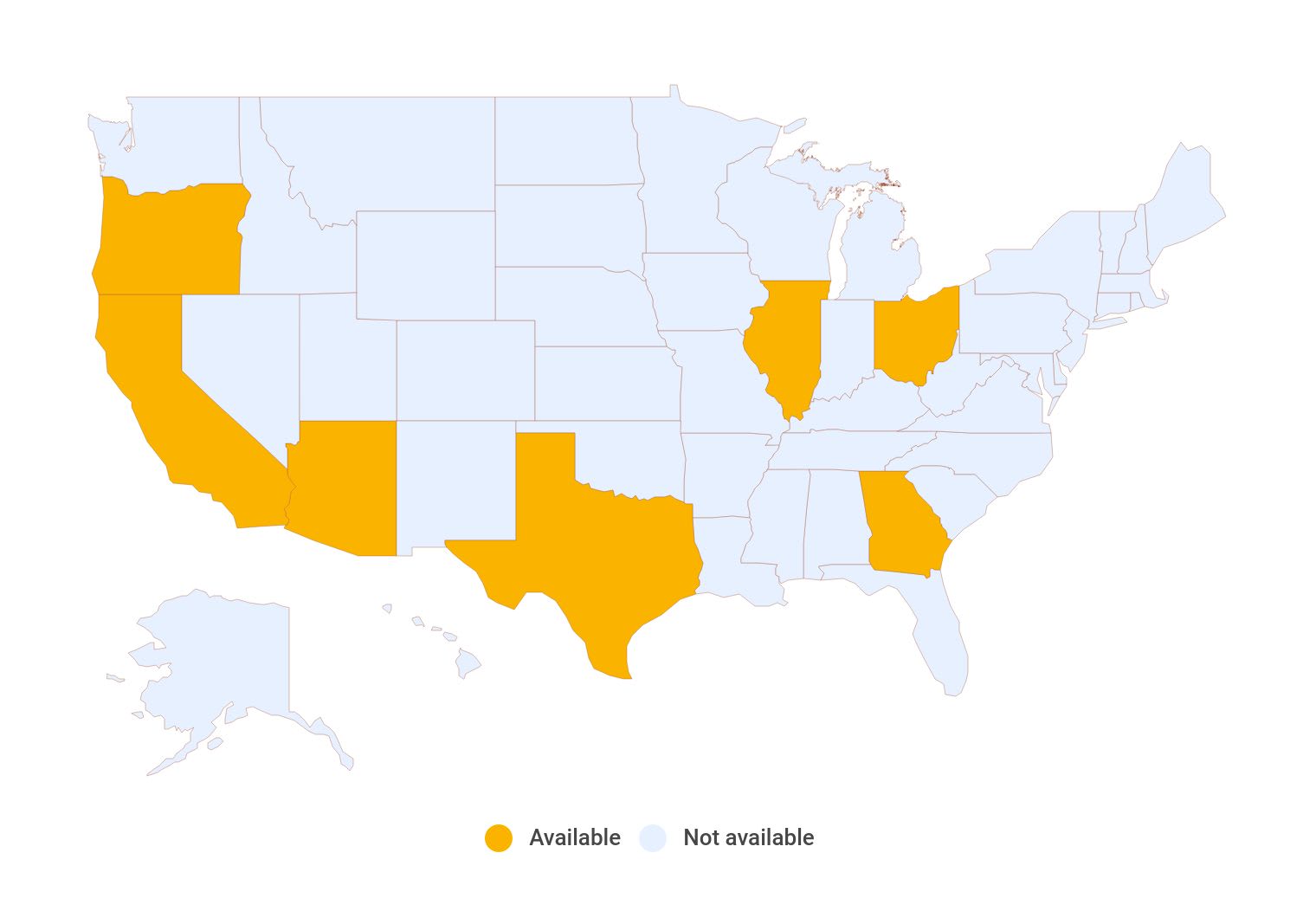

Mile currently offers car insurance in seven states.

Mile Auto had planned to offer car insurance to half of the U.S. by the end of 2021. However, it has yet to expand. Drivers who live outside of their current footprint can visit Mile's website and sign up to receive an email when Mile insurance is available near you.

Mile Auto customer service

Although Mile Auto is a newer company, its car insurance is underwritten by Spinnaker Insurance, which has been in business since 1986.

Unfortunately, Spinnaker received nine times as many complaints as other insurers of a similar size on the NAIC Complaint Index. The most common complaint is for delays in the claims process.

On a positive note, Spinnaker has an A- ("excellent") financial stability rating from A.M. Best, meaning policyholders can feel confident that Mile can pay claims, even in difficult economic situations.

We recommend caution when buying a product of any kind from a company without a strong track record — car insurance is no exception. The lack of long-term reviews about Mile's pricing or customer service is cause for concern, and only time will tell whether Mile Auto can meet the expectations of drivers regarding affordable rates, customer service and claims satisfaction.

Mile was previously backed by Lyndon Southern Insurance Company, a medium-sized insurer based in Florida that is a subsidiary of Fortegra.

Contact Mile Auto

Drivers can reach the Mile Auto customer service department and claims center by calling Mile Auto's phone number: (888) 645-3001. Customer service representatives are available Monday through Friday from 7 a.m. to 7 p.m. The claims center is open 24/7. The Mile Auto website has an email portal for non-urgent matters.

Mile Auto is also available through a network of independent insurance agents. Drivers who are looking for more personalized service should consider purchasing a policy through an agent as opposed to using the company's online quote tool.

Frequently asked questions

How much does Mile Auto insurance cost?

Rates from Mile Auto fluctuate based on the number of miles you drive each month. People who drive 417 miles per month, or 5,000 miles per year, can expect to pay $38 per month for minimum-coverage insurance or $54 per month for full-coverage insurance. Those who drive twice as much (10,000 miles per year) pay $44 per month for minimum coverage or $65 per month for full coverage, on average.

Is Mile Auto insurance cheap?

Mile Auto is the cheapest pay-per-mile insurer we found. Drivers pay between 13% and 93% less with Mile than its competitors, on average.

Does Mile Auto have a maximum mileage charge per day?

No, Mile Auto does not have a maximum mileage charge per day. That means you can expect an increase in your monthly rate if you drive a long distance. Conversely, other pay-per-mile insurers offer a daily limit of 150 or 250 miles, after which additional miles are free. This can help you avoid a spike in your car insurance rate if you take a road trip. However, drivers who regularly make long trips should consider traditional insurance.

Methodology

To compare Mile Auto insurance rates, we gathered quotes for addresses in the five most populous cities in Illinois . Our sample driver was a single, 30-year-old man with a clean driving record who drives a 2015 Honda Civic EX sedan.

Quotes were based on the following coverage limits:

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability | $25,000/$50,000 | $50,000/$100,000 |

| Property damage liability | $20,000 | $25,000 |

| Uninsured/underinsured motorist liability | $25,000/$50,000 | $50,000/$100,000 |

| Comprehensive and collision coverage | waived | $500 deductible |

Car insurance rates vary based on your driver profile, driving history, car and the coverage limits you choose. Your own quotes may differ.

To determine how Mile Auto compares to other pay-per-mile insurers, we analyzed coverage options, availability, tracking methods and customer service for four of Mile's top competitors: Allstate Milewise, Liberty Mutual ByMile, Metromile and Nationwide SmartMiles.