Nationwide SmartMiles Pay-Per-Mile Insurance Review: Is it Worth It?

Nationwide SmartMiles could save you an average of $320 per year, but it's only good if you don't drive much.

Find Cheap Auto Insurance Quotes in Your Area

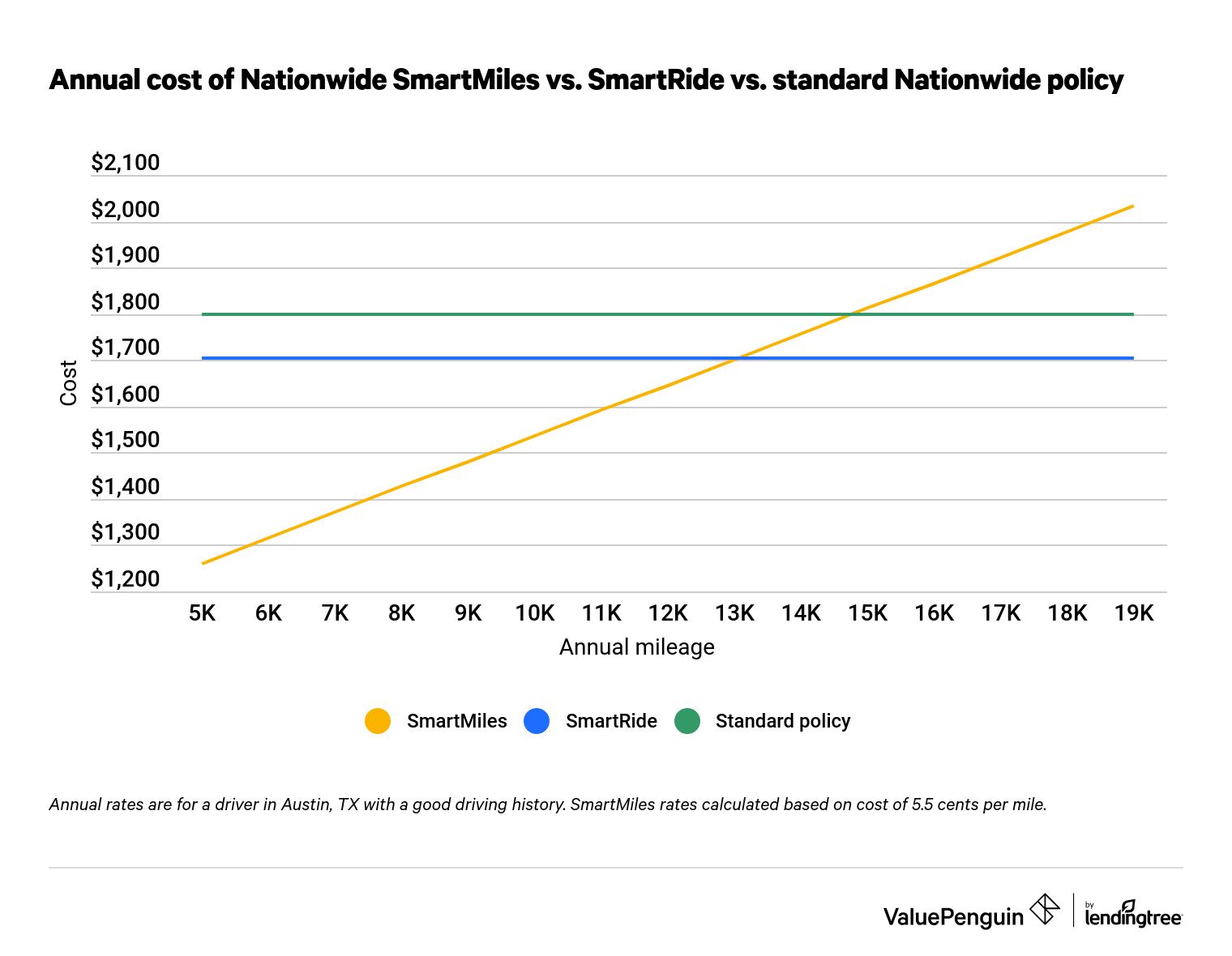

SmartMiles tracks your driving and adjusts your monthly rate based on how many miles you've driven. You can also save up to 10% if the tracking data shows you're a safe driver. But SmartMiles won't save you money if you drive more than 13,000 miles per year. And Nationwide's rates tend to be higher than other companies. So even with SmartMiles, you might find a better deal somewhere else.

Pros and cons

Pros

Cheap for low-mileage drivers

Lets you control your rate by driving less

Up to an extra 10% off for safe driving

Cons

Rates can be more expensive if you drive often

You must to pay monthly

Can't be used on cars made before 1996

How does Nationwide SmartMiles work?

Nationwide SmartMiles tracks your driving and changes your rate based on how many miles you drive.

A SmartMiles rate has two parts.

- Base rate: This stays the same no matter how much or how little you drive.

- Per-mile rate: This changes each month based on how many miles you've driven.

The less you drive, the lower your monthly bill will be.

The average cost per mile based on the quote that ValuePenguin gathered is 5.5 cents. That means for every mile you drive, you'll pay around 5.5 cents on top of your base rate. You'll only be charged for the first 250 miles of driving per day. If you drive more than that, the rest of the miles are free. This is called the "road trip exception," and it helps your rates from skyrocketing if you take a long road trip.

Nationwide SmartMiles also monitors your driving habits to make sure you're driving safely. You can get up to a 10% discount for safe driving. But this isn't the same thing as the Nationwide SmartRide program, which can give you a discount up to 40% for safe driving.

Find Cheap Auto Insurance Quotes in Your Area

How do I set up SmartMiles?

To sign up for SmartMiles, you first need to have a Nationwide car insurance policy. You can buy a policy online or through a local agent. You can choose SmartMiles as an option when you're first buying your policy. If you already have a policy, you can sign up when your policy renews. To qualify, your car has to be a 1996 model or newer.

Most people who sign up for SmartMiles will get a package in the mail from Nationwide with a plug-in device for their car. The device tracks your mileage and driving information and sends the information to Nationwide automatically. You won't need to install an app or manually report your mileage to Nationwide.

If you have a Ford or Lincoln that's 2018 or newer, you might be able to use your car's "connected" service to participate in SmartMiles, instead of a plug-in device.

Is Nationwide SmartMiles worth it?

SmartMiles is best for people who don't drive much, like those who work from home, get around on foot, use public transportation or have a second car they don't use very often. If you drive often, you shouldn't sign up for SmartMiles.

Nationwide SmartMiles is worth it if:

You don't drive often

People who drive less than 13,000 miles per year will likely save money compared to a regular Nationwide policy. Most people drive around 13,500 miles per year, or about 37 miles per day. You shouldn't sign up for SmartMiles if you drive more than this.

You're a good driver

Most of the savings from SmartMiles comes from tracking how far you drive. But you can earn up to a 10% discount for safe driving on top of the cheaper rate for low mileage. And you can combine SmartMiles with SmartRide to get an even bigger discount.

Nationwide SmartMiles is not worth it if:

You drive a lot

-

Why? SmartMiles could actually make your rates go up if you drive a lot. The program is designed for low-mileage drivers.

- Better options: Car insurance by the mile programs probably aren't right for you if you drive a lot. Other usage-based programs, like Nationwide SmartRide might be better, but even these programs also track how far you drive, so they might not save you much.

You don't like paying monthly

-

Why? You can't pay in full if you sign up for SmartMiles. The program changes your rate monthly based on how far you drive, so you're locked into monthly bills.

- Better options: You can still have Nationwide car insurance without signing up for SmartMiles, and that would allow you to pay in full. If you want a discount, you can try Nationwide SmartRide, State Farm Drive Safe & Save or Liberty Mutual RightTrack. Those aren't pay-per-mile programs, but because of that, you can pay in full.

You have an older car

-

Why? Cars made before 1996 don't have the right onboard diagnostic (OBD) port, so you can't plug in the SmartMiles tracking device.

- Better options: Mile Auto Insurance lets you report the mileage on your odometer and updates your rate based on how far you've driven. The company doesn't have the best customer service, though.

How much will I save with SmartMiles?

How much you'll save with SmartMiles depends largely on how much you drive, just like with other per-mile insurance policies. The less you drive, the more you could save.

If you only drive 5,000 miles per year (about 14 miles per day) you might save up to $540 per year.

That's $45 per month cheaper than Nationwide's standard policy.

But someone who drives 10,000 miles annually (27 miles per day) won't save as much — just $264 compared to a standard policy. Driving 13,000 miles annually (36 miles per day) means you don't save anything.

And Nationwide wouldn't give a quote for SmartMiles at all to someone who drives 15,000 miles annually (41 miles per day).

How much do you pay per mile with SmartMiles?

Nationwide doesn't share your per-mile price when you request a quote. But quotes for a driver in Austin, Texas, had an annual base price of $984, plus 5.5 cents per mile.

That means that SmartMiles stops being worth it when you drive around 13,000 miles per year. But if some of your annual mileage is from long road trips, you may be able to save using SmartMiles. That's because SmartMiles has a "road trip exception," where you won't pay for anything over 250 miles per day during occasional road trips.

Find Cheap Auto Insurance Quotes in Your Area

SmartMiles quotes compared to other Nationwide policy options

Miles driven | Smart Miles | Smart Ride | Standard policy |

|---|---|---|---|

| 5K | $630 | $852 | $900 |

| 10K | $768 | $852 | $900 |

| 15K | N/A | $852 | $900 |

| 20K | N/A | $852 | $900 |

Actual quotes for a six-month full-coverage policy in Austin, Texas, for a driver with a 2015 Honda Civic and a good driving history. All milage is annual. SmartMiles quotes were not available for 15,000 and 20,000 annual mileage profiles.

Nationwide SmartMiles vs. SmartRide

Nationwide has another safe driving discount program called SmartRide. Both programs use devices that plug into your car and track your driving behavior, including when you drive and your habits while you're behind the wheel.

The key difference between SmartMiles and SmartRide is that SmartRide doesn't have a per-mile cost. SmartRide only monitors your driving habits to see how safely you drive. It tracks how fast you drive, how hard you brake or accelerate and how often you drive after midnight. SmartRide also considers how much you drive overall because the more you drive, the more likely you are to get in a crash.

Differences between Nationwide SmartMiles and SmartRide

SmartMiles | SmartRide | |

|---|---|---|

| Best for | Infrequent drivers | Safe drivers |

| Can your rates go up? | Yes | No |

| Includes a per-mile rate? | Yes | No |

| Tracks driving behavior | Yes | Yes |

| Maximum discount | 30%* | 40% |

| Connects via | Plug-in device | App or plug-in device |

*The SmartMiles maximum discount is based on the difference between a SmartMiles policy for a driver who drives 5,000 miles per year and Nationwide's standard policy.

Where can I get Nationwide SmartMiles?

Nationwide SmartMiles is available in 44 states and the District of Columbia. It's available everywhere except:

- Alaska

- Hawaii

- Louisiana

- New York

- North Carolina

- Oklahoma

Frequently asked questions

How does SmartMiles work?

SmartMiles uses a device that you plug into your car to track your monthly mileage. Each month, you pay a base rate and then a per-mile rate based on how far you've driven, so your price is customized to how far you drive. If you have a 2018 or newer Ford or Lincoln, you might be able to use "connected" features on the car to join SmartMiles.

Does Nationwide SmartMiles track your speed?

Nationwide SmartMiles might be able to track your speed. That's because it tracks your driving habits to give you up to a 10% extra discount for safe driving. It might also track how fast you brake and accelerate, the time of day you drive, how long you spend idling and more.

What is the difference between SmartMiles and SmartRide?

SmartMiles is specifically for people who don't drive much. It customizes your rate each month based on how many miles you've driven. SmartRide looks at your overall driving habits and gives you a discount based on how safely you drive.

Methodology

ValuePenguin found the cost of a SmartMiles policy based on the quotes our experts gathered for a driver who travels between 5,000 and 19,000 miles per year. Note that Nationwide may not offer a SmartMiles quote to people who drive over a certain number of miles each year. The average savings for SmartMiles and other information about the program is from Nationwide.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.