The General Auto Insurance Review: Last Chance Car Insurance

The General provides insurance to high-risk drivers who may not be able to get coverage from major national companies. This includes people who need an SR-22, have DUIs or have multiple accidents. However, the company’s expensive rates, negative reviews and lack of discounts make The General a poor choice for most drivers.

Even high-risk drivers might find better insurance elsewhere if they want a fast claims process and can qualify for discounts.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

The General car insurance quotes

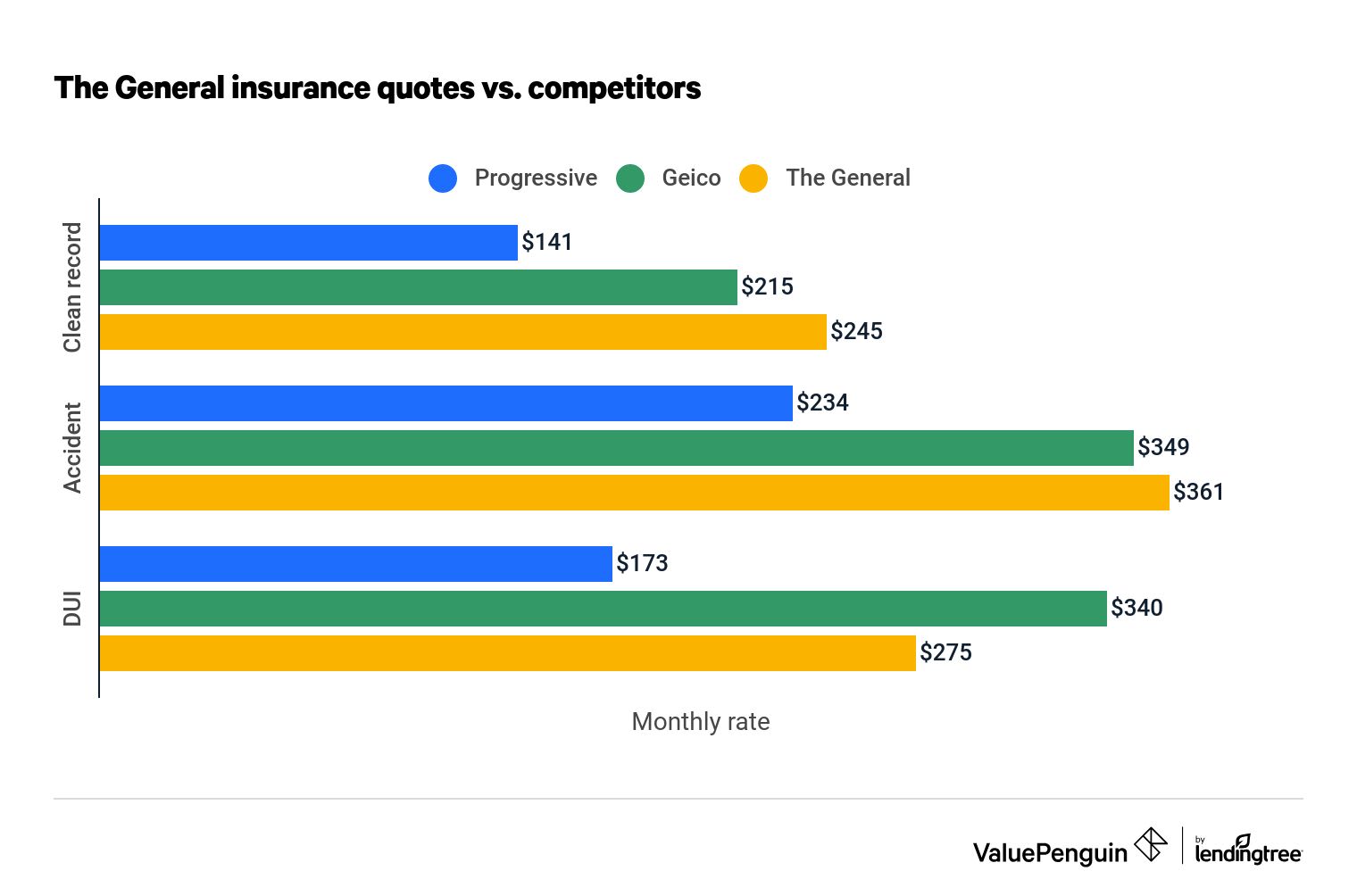

The General advertises cheap coverage for high-risk drivers, but the company's car insurance quotes are more expensive than its competitors' quotes.

Full coverage car insurance from The General costs $275 per month after a single DUI. That's 5% more expensive than average.

Coverage from The General is even more expensive for drivers with a major at-fault accident on their records. At $361 per month after an accident, a full coverage policy from the General is 15% more expensive than average.

Find Cheap Auto Insurance Quotes in Your Area

800-772-1213

Low-risk drivers should avoid The General altogether. Full coverage from The General costs 73% more than a policy from the cheapest company, Progressive.

Full coverage car insurance quotes: The General vs. competitors

Clean record

Accident

DUI

Company | Monthly rate | |

|---|---|---|

| Progressive | $141 | |

| Geico | $215 | |

| The General | $245 |

Clean record

Company | Monthly rate | |

|---|---|---|

| Progressive | $141 | |

| Geico | $215 | |

| The General | $245 |

Accident

Company | Monthly rate | |

|---|---|---|

| Progressive | $234 | |

| Geico | $349 | |

| The General | $361 |

DUI

Company | Monthly rate | |

|---|---|---|

| Progressive | $173 | |

| The General | $275 | |

| Geico | $340 |

Based on the insurer's expensive rates, drivers with traffic violations should compare quotes from multiple companies before buying a policy from The General.

The General auto insurance discounts

The General offers most of the discounts you'd expect to see from a major auto insurance company. However, many large companies offer more car insurance discounts than you'll find at The General. In addition, not all discounts are available in all states.

- Academic achievement

- Anti-theft device

- Defensive driving

- Homeowners

- Multicar

- Paid in full

- Paperless

- Passive restraint

- Recent auto insurance

- Safe driver

The General's most unusual discount is the double deductible discount.

This discount lowers your insurance cost for the first 45 days of coverage by doubling your deductible. After that 45-day period, your deductible returns to its normal level and the discount goes away. That means it's not very useful for most customers.

The General auto insurance coverages

The General has all of the standard coverage options you would expect from car insurance, like liability insurance and comprehensive and collision coverage. In addition, The General has a number of extra coverage options that drivers can add on at an additional cost.

The General also offers a number of coverage options that can help pay your bills if you're injured in an accident.

- Accidental death

- Combination first-party benefits

- Extraordinary medical benefits

- Funeral benefit

- Income loss

The General Insurance reviews

The General has poor customer service reviews — with typical complaints of slow claims handling or denials.

The General Insurance is underwritten by three companies: Permanent General Assurance Corp., Permanent General Assurance Corp. of Ohio and The General Automobile Insurance Co. Inc. If you're in an accident and need to make a claim, you'll deal directly with the company that underwrites your policy.

The General auto insurance reviews

Company |

NAIC

|

|---|---|

| Permanent General | 2.57 |

| Permanent General of Ohio | 1.88 |

| The General Auto Insurance | 1.68 |

All three companies receive more customer complaints than average based on their size, according to the National Association of Insurance Commissioners (NAIC). The largest company, Permanent General, has two and a half times as many complaints as expected.

That means drivers insured with The General may have to wait longer to repair their car after an accident. They could also end up spending more money to get back on the road.

However, drivers can feel confident about The General’s ability to pay claims. The company is in great financial standing and is owned by American Family, one of America's largest auto insurance companies.

AM Best assigned The General an A financial strength rating. That means that The General has an "excellent" ability to pay out claims — even if the claims process is often slower than with other companies.

The General also has a highly rated mobile app and an online portal to make managing your policy easier. The General’s online portal, MyPolicy, lets you make payments, view your ID card and check policy details. While this isn't unique, it provides high-risk drivers with the same benefits that standard drivers have access to through large national insurance companies, like State Farm and Geico.

Contact The General customer service

Drivers can contact The General by phone, email or using the live chat feature on the company's website.

The General Insurance phone number

- For customer service, call 844‑328‑030.

- For claims, call 800-280-1466 or email [email protected].

Frequently asked questions

Is The General a good insurance company?

The General is a good option for people who aren't able to get coverage elsewhere, like high-risk drivers with bad credit, multiple accidents or DUIs. However, prices tend to be high, and customers typically aren't happy with The General's claims process.

Does The General have full coverage?

Yes, The General sells full coverage car insurance, including comprehensive and collision coverages. It also offers optional coverages like gap insurance, roadside assistance, income loss coverage and accidental death coverage.

Why is The General so expensive?

The General specializes in providing coverage to high-risk drivers who are more likely to get in a crash. The General protects a lot of drivers who often make claims, and that makes insurance more expensive for everyone who uses The General, not just people who have a bad driving record.

Does The General sell home insurance?

No, The General does not sell homeowners insurance. However, it does offer homeowners a discount on car insurance, regardless of where they buy their home insurance.

Methodology

To compare car insurance quotes from The General, we collected rates for a 30-year-old single man living in Pennsylvania who drives a 2015 Honda Civic EX.

Rates are for a full coverage policy, which includes comprehensive and collision coverage along with higher liability limits than the Pennsylvania state requirements.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Medical payments: $5,000

- Uninsured/underinsured motorist coverage: $50,000 per person/$100,000 per accident

- Comprehensive and collision deductible: $500