Auto Insurance Rates Increases in Florida (2022)

Florida drivers have experienced above-average increases to their auto insurance bills since 2015. The average rate hike was about 3.5% per year, though some companies increased premiums by as much as 22% in one year.

Car insurance rate increases in Florida

Auto insurance rates in Florida have increased by an average of 23% overall since 2015 — faster than the national increase of 17% in the same period. During the past six years, nearly every major company in the Sunshine State has raised rates significantly. USAA, Liberty Mutual and American Family had the biggest increases: 43% to 44% over six years.

Progressive had the smallest increase by far, with a cumulative jump of only 3.6% since 2015.

2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|

| Florida average (weighted) | 7.27% | 8.46% | 2.71% | -0.43% | 1.47% | 1.72% |

| Geico | 5.50% | 10.70% | 5.60% | -0.40% | 10.10% | 0.00% |

| Progressive | 5.40% | 2.40% | 0.20% | -3.10% | -3.50% | 2.40% |

| State Farm | 7.30% | 15.70% | -0.90% | -4.90% | -9.00% | 7.00% |

| Allstate | 10.80% | 3.60% | 2.10% | 5.80% | 1.80% | -1.80% |

| USAA | 10.20% | 10.10% | 4.40% | 9.30% | 4.00% | 0.20% |

| Kemper | 13.10% | 7.20% | 6.50% | -15.80% | 3.90% | -0.80% |

| Liberty Mutual | 8.50% | 13.20% | 6.60% | 1.90% | 2.40% | 5.50% |

| National General | 7.90% | 7.30% | 5.20% | 5.90% | 9.40% | -0.10% |

| Travelers | 2.70% | 13.10% | 2.50% | 0.10% | 0.00% | -0.40% |

| Farmers | 12.10% | 3.90% | 3.80% | 4.90% | -0.10% | 3.70% |

| American Family | 21.50% | 5.00% | 4.30% | 3.70% | 3.90% | 0.00% |

Statewide average is weighted based on each insurer's market share in Florida.

While most car insurance companies raise their rates each year, the amount varies. This is why we recommend always collecting three or more quotes when you go to buy coverage. For example, while Geico has raised rates by 35% in Florida since 2015, Geico is still one of the cheapest car insurance companies in Florida.

How Florida's car insurance rates compare to other states

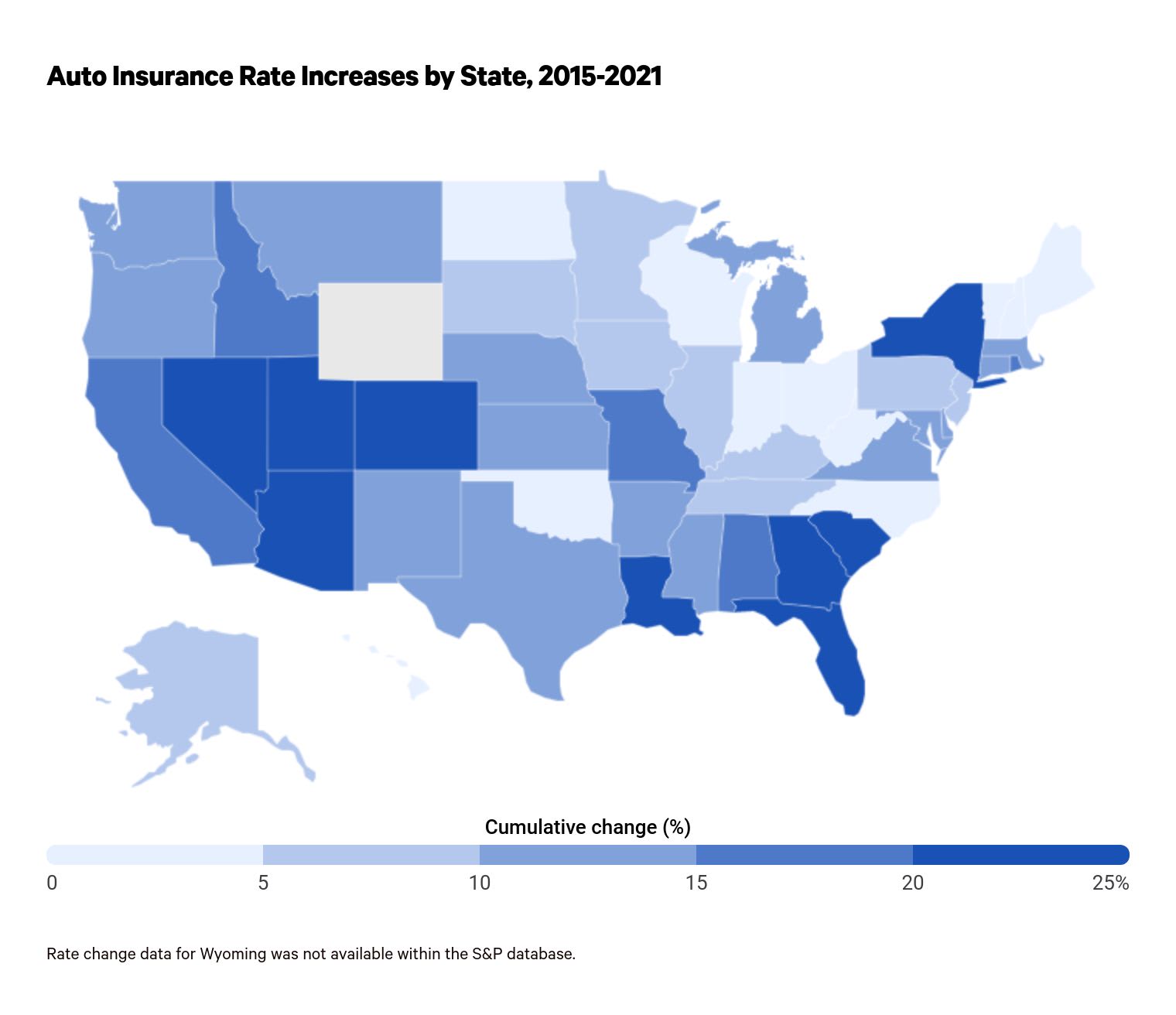

Among all 50 states, Florida had the fifth-highest increase in car insurance rates since 2015. In general, states in the South and in the mountain region saw some of the highest rate increases: nine of the 10 states with the highest increases are in these two areas. Georgia and Colorado both had cumulative increases of 29% — the largest in the country.

Why car insurance rates have gotten so high in Florida

The quick explanation for why car insurance costs have increased in Florida is because the frequency and cost of car insurance claims have gone up. Most of the money you spend on car insurance goes towards paying other people's claims, so if more drivers make car insurance claims, your rates will likely go up as a result.

Why rates are increasing in Florida

Natural disasters

Due to its location on the Gulf Coast, Florida is more susceptible to natural disasters than most other states. Twenty-three percent of all billion-dollar disasters (adjusted for inflation) in the United States since 1980 have occurred in Florida, according to NOAA.

What's more, these costly disasters have increased in frequency over time: there have been 21 such disasters in Florida since 2016, compared to only six between 2010 and 2015.

An increase in natural disasters like hurricanes, tropical cyclones and floods leads to higher insurance costs because car insurance, specifically comprehensive coverage, pays when these events damage your vehicle. As long as you have comprehensive coverage, you'll likely be covered if your car is damaged by wind, hail or flooding. However, these costs are ultimately passed on to your insurer and other drivers.

Uninsured drivers

Florida has among the highest rates of uninsured drivers in the U.S., 20% as of 2019. That's much higher than the U.S. average of 13%, and sixth-highest overall.

Florida's high rate of uninsured motorists leads to higher premiums for drivers who do carry coverage. That's because the 80% of drivers who do have coverage will ultimately foot the bill for the accidents that the uninsured 20% are responsible for: either through uninsured motorist coverage or collision coverage, if they have it, or out of their own pockets.

Why rates are increasing nationwide

Although some causes for increased rates are more common in Florida, there are other trends that are true no matter where in the country you live.

Drivers returning to commuting, interstate travel after 2020 COVID-19 lull

In spring 2020, driving plummeted as people stayed home due to the coronavirus pandemic. As a result, crashes dropped, and so did insurance rates — some insurers even offered refunds as a result of having collected more premiums than they needed.

However, as people have returned to working in the office and traveling around the country in 2021, road use resumed. There was a 55% nationwide year-over-year increase in driving in April 2021, according to the Department of Transportation, resulting in more accidents and claims.

Car prices (and repair costs) are rising nationwide

The typical price for a new car has gone up substantially in the past few years — the average price in 2021 was about $46,000, according to Kelley Blue Book. That's an increase of 39% since 2015.

What's more, the cost to repair cars has increased nationwide. ValuePenguin found that car repair and maintenance costs more than doubled in 2020.

Cars that cost more at the dealership, and cost more to repair after a crash, mean that the dollar amount of claims goes up, too. Unfortunately, this applies even if you don't have a fancy new car. If you're at fault in a crash with a Lexus, your insurer is still responsible for the high repair cost.

What can Floridians do if their car insurance rates go up?

If your car insurance is becoming less affordable for you, there are several key steps you can take to address the issue.

Check out rates at other insurers

First, assess whether there are cheaper options for your coverage. According to Nielsen survey data, only 25% of Floridians with auto policies have shopped for new insurance in the past three years.

We recommend drivers search for a new policy once a year or so. For example, drivers in Miami may see annual rates vary by several thousand dollars. There's no way to know if your current policy is overly expensive until you take the time to shop around once in a while.

Make sure you're only paying for coverage you need

Adjusting the limits of your coverage is another way to save money on your auto insurance. For example, a car that is more than 10 years old or worth less than $3,000 probably doesn't need to have comprehensive or collision insurance — the cost of your insurance will be higher than the declining value of your vehicle. Eliminating comprehensive and collision coverage cuts your rates dramatically.

You should also look at your liability coverage limits. Make sure that they make sense in the context of your assets and the likelihood of you getting involved in a lawsuit. If you're confident in your ability to drive safely and want to prioritize savings, you might also adjust your liability limits to meet Florida's minimum requirements.

Apply for discounts from your insurer

Discounts are another easy way to save money on your auto insurance. In Florida, there are defensive driving courses which can save you 5% to 10% on your premium. Another example is the good student discount: drivers with children with at least a 3.0 GPA can qualify for a 10% discount.

Methodology

We determined the typical historical rate increases for Florida drivers by analyzing the rate changes filed by Florida car insurers. Statewide averages are based on 2020 insurer market share.

Additional sources:

Kelley Blue Book Insurance Information Institute Nielsen U.S. Department of Transportation National Oceanic and Atmospheric Administration