Jaguar Car Insurance: Rates by Model

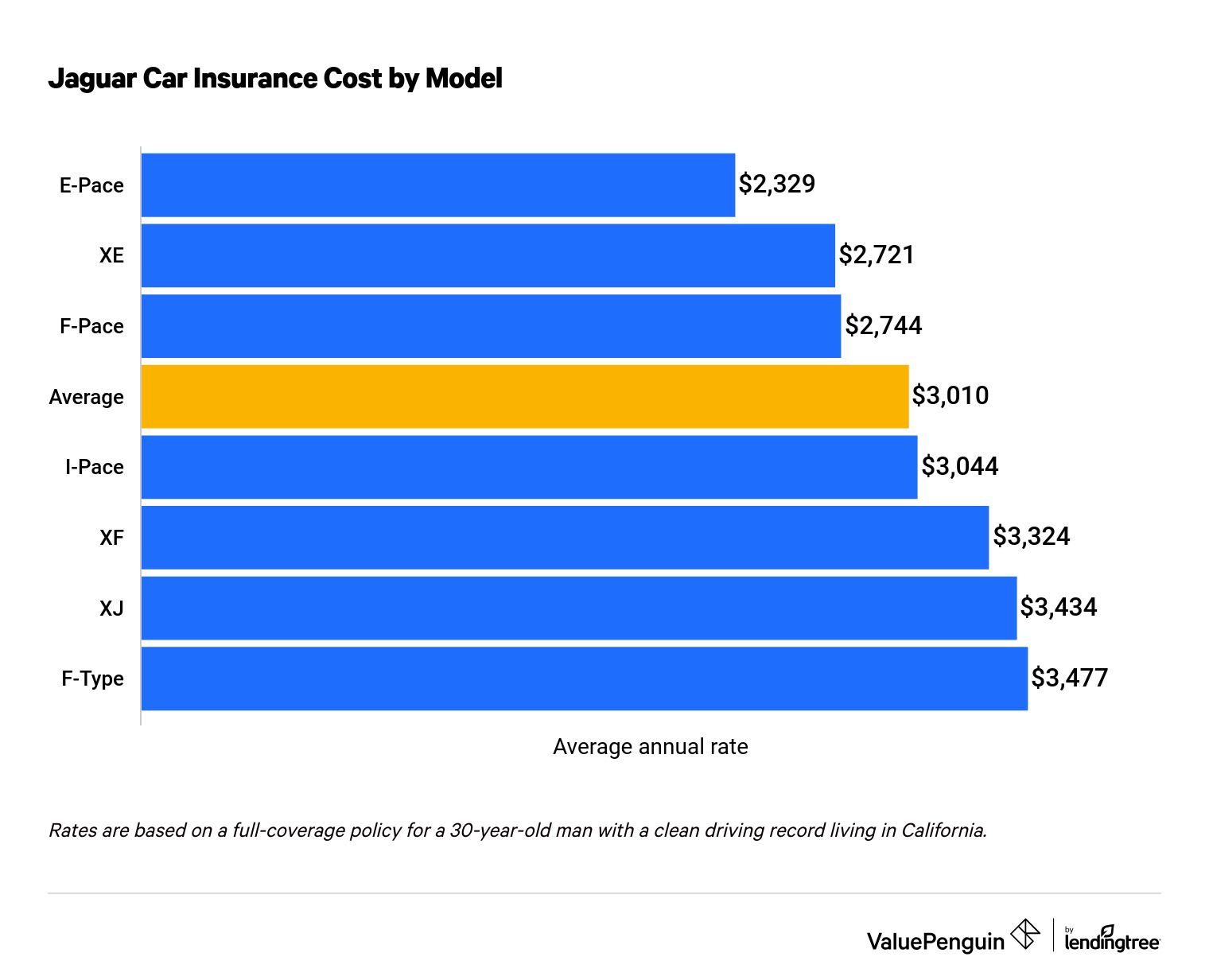

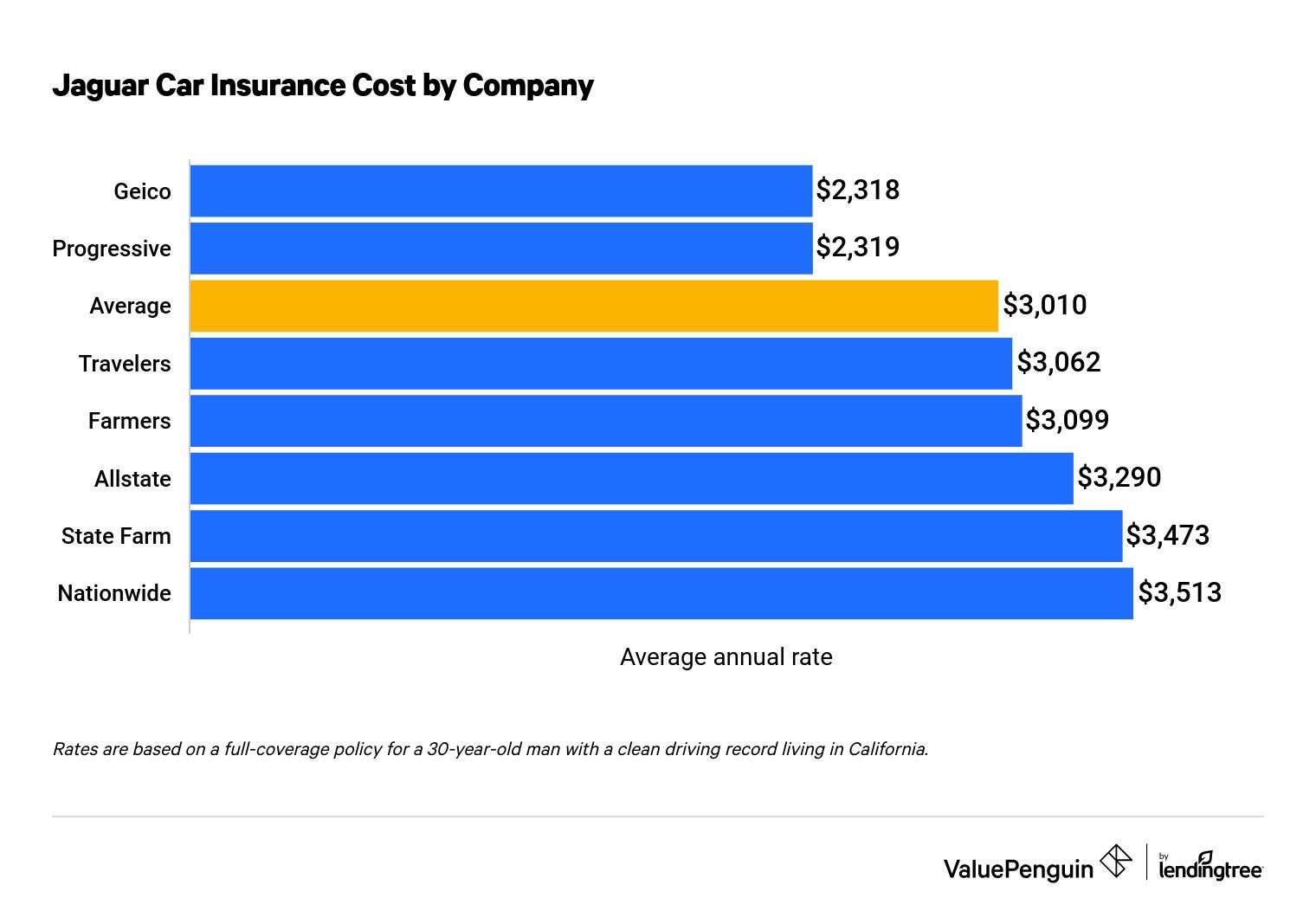

The average price of car insurance for a Jaguar is $3,010 per year for full coverage, based on an analysis of rates for seven models produced over the last five years.

However, insurance rates vary by up to $1,195 per year, depending on the model and insurance company you choose.

For example, Geico and Progressive offer the most affordable Jaguar car insurance rates at $2,318 and $2,319 per year, respectively. Conversely, a policy from Nationwide costs $3,513 per year — a difference of $100 per month.

Compare Jaguar insurance quotes by model and by insurance company:

Jaguar auto insurance cost by model

The E-Pace, Jaguar's compact SUV, is the cheapest Jaguar model to insure.

On average, a full-coverage policy costs $2,329 per year, or $194 per month. The Jaguar F-Type sports car is the most expensive model to insure. The average insurance cost for an F-Type is $3,477 per year, or $290 per month.

The I-Pace is Jaguar's most expensive SUV to insure, likely because it is an electric vehicle.

Jaguar insurance quotes by company

Geico offers the most affordable Jaguar car insurance of any company — a full-coverage policy costs $2,318 per year, on average. Progressive also has cheap rates for Jaguar owners, as a policy only costs marginally more than Geico's.

On the other hand, it costs $3,513 per year to insure a Jaguar with Nationwide, which is 17% more than average and the most expensive rate we found.

Jaguar car insurance cost by company

Company | Average monthly rate | Average annual rate | |

|---|---|---|---|

| Average | $251 | $3,010 | |

| Geico | $193 | $2,318 | |

| Progressive | $193 | $2,319 | |

| Travelers | $255 | $3,062 | |

| Farmers | $258 | $3,099 | |

| Allstate | $274 | $3,290 | |

| State Farm | $289 | $3,473 | |

| Nationwide | $293 | $3,513 |

Jaguar insurance quotes vary based on the model you drive, but the insurer you choose has a greater impact on the price you pay. A full-coverage policy with Nationwide is $100 per month more expensive than the same policy from Geico.

Jaguar E-Pace insurance cost

The E-Pace compact SUV is the cheapest Jaguar model to insure. The base MSRP for an E-Pace is $41,800, which means that it is also the cheapest Jaguar model available.

The average cost of full-coverage insurance for a Jaguar E-Pace is $2,329 per year, or $194 per month. That's 23% cheaper than the average rate to insure a Jaguar. Progressive offers the most affordable insurance for E-Pace drivers — a full-coverage policy costs $1,815 per year, on average.

Jaguar E-Pace car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2022 | $200 | $2,395 |

| 2021 | $194 | $2,327 |

| 2020 | $197 | $2,370 |

| 2019 | $194 | $2,328 |

| 2018 | $185 | $2,225 |

| Average | $194 | $2,329 |

Quotes are based on the base model E-Pace.

The most expensive rate for the Jaguar E-Pace comes from Farmers — at $2,598 per year, it's 43% more expensive than a policy from Progressive.

Jaguar F-Pace insurance cost

The average cost to insure a Jaguar F-Pace is $2,827 per year, or $236 per month, for full coverage. That's 9% cheaper than Jaguar's overall average. A brand new 2022 F-Pace costs $578 per year more to insure than a 4-year-old model.

Progressive has the cheapest full-coverage policy for F-Pace owners at $156 per month or $1,870 per year.

Jaguar F-Pace car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2022 | $251 | $3,013 |

| 2021 | $243 | $2,912 |

| 2020 | $246 | $2,948 |

| 2019 | $235 | $2,824 |

| 2018 | $203 | $2,435 |

| Average | $236 | $2,827 |

Quotes are based on the F-Pace model S.

The most expensive insurance comes from State Farm, where a policy costs $286 per month or $3,436 per year.

Jaguar F-Type insurance cost

The F-Type is the most expensive Jaguar in our study to insure. On average, insurance on a Jaguar F-Type costs $3,477 per year for full coverage, which is $467 per year more than the overall average to insure a Jaguar. The F-Type is Jaguar's sports car and therefore is the fastest and most expensive model in our study. The base price is $71,300, and the F-Type has a maximum speed of 186 mph.

Geico offers the most affordable rates for Jaguar F-Type drivers — a full-coverage policy costs $2,870 per year.

Jaguar F-Type car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2022 | $316 | $3,791 |

| 2021 | $307 | $3,680 |

| 2020 | $289 | $3,474 |

| 2019 | $275 | $3,302 |

| 2018 | $262 | $3,138 |

| Average | $290 | $3,477 |

Quotes are based on an F-Type coupe with two-wheel drive.

Conversely, State Farm has the highest rates we found — drivers can expect to pay $4,241 per year, which is 48% more than the cost of a policy with Geico.

Jaguar I-Pace insurance cost

The I-Pace is the most expensive Jaguar SUV to insure. I-Pace drivers can expect to pay $3,044 per year for full-coverage insurance, or $254 per month. That's $34 more per year than the average cost to insure a Jaguar.

Geico is the cheapest insurance company for a Jaguar I-Pace — the average rate for a full-coverage policy is $1,809 per year, or $151 per month.

Jaguar I-Pace car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2022 | $253 | $3,037 |

| 2020 | $259 | $3,111 |

| 2019 | $249 | $2,983 |

| Average | $254 | $3,044 |

Quotes are based on an I-Pace HSE model. Rates were unavailable for 2018 and 2021 models years.

Alternatively, the most expensive insurance for I-Pace drivers comes from Allstate, where a policy costs $4,202 per year.

Electric vehicles cost more to insure than gas-powered vehicles because their technology is more expensive to repair or replace in the event of an accident, resulting in more expensive claims for insurance companies. The Jaguar I-Pace is fully electric, which is why it costs more to insure than Jaguar's other SUVs.

Jaguar XE insurance cost

The Jaguar XE is the least-expensive Jaguar sedan to insure. The average insurance cost for an XE is $2,936 per year for full coverage, which is 10% cheaper than the overall average to insure a Jaguar. However, Jaguar discontinued the XE in 2021, so it is only available as a used car.

Geico offers the most competitive rates for Jaguar XE drivers. A full-coverage policy costs $2,098 per year, or $175 per month.

Jaguar XE car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2020 | $245 | $2,936 |

| 2019 | $238 | $2,856 |

| 2018 | $223 | $2,677 |

| Average | $245 | $2,936 |

Quotes are based on a Jaguar XE 20D Premium model. The Jaguar XE was discontinued in 2021.

The most expensive rates for an XE are offered by State Farm, with an average cost of $3,155 per year.

Jaguar XF insurance cost

The XF is the only sedan currently offered by Jaguar. The average insurance cost for a Jaguar XF is $3,324 per year, or $277 per month, for a full-coverage policy. That's $26 per month cheaper than the overall Jaguar option average.

Progressive has the best insurance rates for Jaguar XF owners — a full-coverage policy costs $2,834 per year, or $236 per month, on average.

Jaguar XF car insurance by year model

Year | Average monthly cost | Average annual cost |

|---|---|---|

| 2022 | $253 | $3,032 |

| 2021 | $263 | $3,155 |

| 2020 | $270 | $3,243 |

| 2019 | $295 | $3,541 |

| 2018 | $304 | $3,648 |

| Average | $277 | $3,324 |

Quotes are based on a Jaguar XF S model.

The most expensive insurer is Nationwide, where a policy costs $4,031 per year, 42% more expensive than Progressive.

Jaguar XJ insurance cost

Jaguar discontinued production of the XJ in mid-2019, and it is the company's most expensive sedan to insure. On average, the cost to insure an XJ is $3,434 per year, which is 14% more expensive than the overall average cost to insure a Jaguar.

Jaguar XJ car insurance by year model

Year | Average monthly rate | Average annual rate |

|---|---|---|

| 2020 | $290 | $3,483 |

| 2019 | $283 | $3,391 |

| 2018 | $286 | $3,429 |

| Average | $286 | $3,434 |

Quotes are based on an XJ R-Sport model. Jaguar discontinued the XJ in 2019.

Jaguar XJ insurance costs vary significantly from one insurer to the next. Geico offers the best rate for a full-coverage policy at $2,156 per year, while Farmers is the most expensive at $4,893. That's a difference of $2,737 per year.

Jaguar Owners Insurance

Drivers can also purchase an insurance policy directly through Jaguar. Jaguar Owners Insurance is underwritten by multinational insurer Aon.

There are a few benefits of purchasing car insurance through Jaguar:

- If your car is damaged, repairs are made by Jaguar-trained technicians using original manufacturer parts.

- If your new Jaguar is totaled within 24 months of purchase, you'll receive the amount you paid to purchase the vehicle .

- After an accident, you'll receive a rental vehicle that is comparable to your Jaguar while repairs are being made.

Although Aon is a large company, there is a lack of customer satisfaction or financial stability data available for Aon, so we can't recommend it for your car insurance needs.

Frequently asked questions

Who has the cheapest Jaguar insurance?

Geico and Progressive have the cheapest rates across all Jaguar models — both cost $193 per month, on average. That's $58 per month cheaper than the average cost to insure a Jaguar.

How much does insurance for a Jaguar cost?

The average cost to insure a Jaguar is $3,010 per year. However, rates vary by as much as $1,148 per year depending on the model you own.

How much is insurance on a Jaguar XF?

Full-coverage insurance for a Jaguar XF costs $277 per month, or $3,324 per year, on average. Jaguar XF owners can find the cheapest rates with Progressive and Farmers.

Methodology

To calculate the average cost of insurance for a Jaguar, we gathered thousands of quotes for a 30-year-old sample driver living in California, with a clean driving record and average credit score. Rates are based on a full-coverage policy with the following limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Our analysis is based on insurance quote data from Quadrant Information Services. The quotes referenced were publicly sourced from insurer filings and should only be used for comparison purposes. Actual rates for your Jaguar model may differ.