HMO Plan Basics: About Health Maintenance Organizations

An HMO (health maintenance organization) is a type of health insurance plan that tends to be cheaper but also has more restrictions than other plans.

With an HMO, you can only see a specialist through a referral from your primary care doctor. And you'll usually only have coverage when you use a doctor from the plan's network of providers. If you go out of network, an HMO won't pay anything, unless it's an emergency.

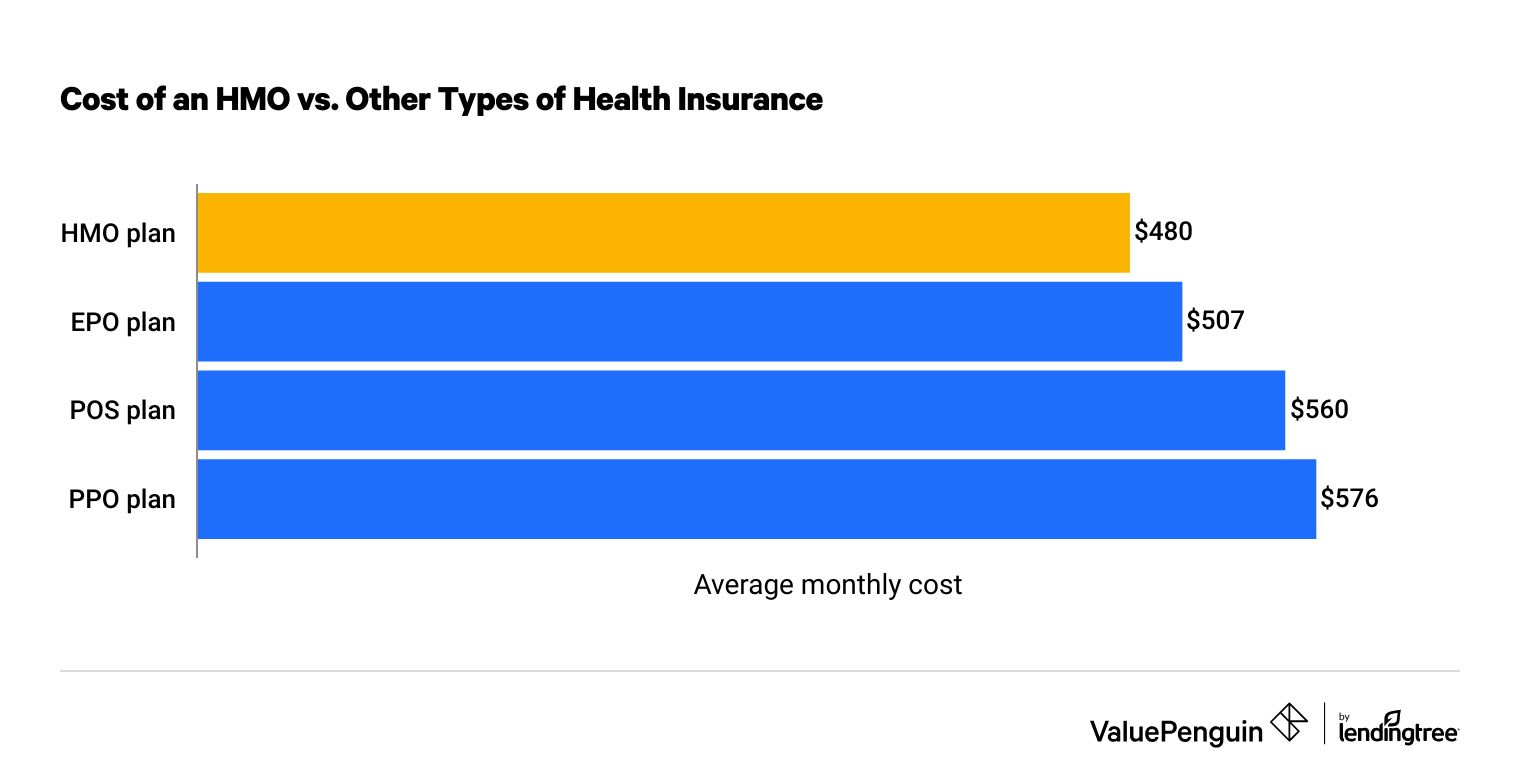

An HMO costs an average of $480 per month, which is nearly $100 per month cheaper than a PPO plan.

Find Cheap Health Insurance Quotes in Your Area

What is an HMO health insurance plan?

An HMO is a cheap health insurance plan that's less flexible than other types of plans.

You'll usually pay less each month for the policy. You could also have lower copays and deductibles, which means you'll pay less when you need medical care.

The trade-off is that you'll have to use doctors and facilities listed in the plan's network of providers if you want coverage. Emergencies are the exception when you'll have coverage anywhere.

You'll also need referrals from your primary doctor if you want to see a specialist such as a podiatrist or a cardiologist.

Pros and cons of HMOs

Pros

- Good value with lower monthly costs

- Emergency care is covered anywhere

- All claim paperwork is filed by the doctor's office after medical care

Cons

- Less flexibility about your medical care

- Only have coverage for doctors that are in the plan's network

- Need a referral from your primary doctor to see a specialist

When is an HMO a good choice?

Who should get an HMO?

Who shouldn't get an HMO?

Always compare doctor networks when getting an HMO

It's especially important for those choosing an HMO to review the plan's network of providers. Because you usually won't have any coverage outside of the network, look closely to see that you'll have access to any doctors you prefer, medical practices you regularly use and nearby hospitals.

Also, watch out for HMO plans that have a very small network of doctors. That would leave you with few choices and potentially very little flexibility. The network of providers can change between companies and even between plans. So check that you'll be able to use your medical coverage at the locations you want.

How much does an HMO plan cost?

An HMO plan costs an average of $480 per month.

By choosing an HMO, you'd save nearly $100 per month on average versus a PPO plan that gives you more flexible health care coverage. However, costs vary, and there are usually plans available for a range of prices.

Cost of an HMO vs. other types of health insurance

Find insurersHMO plans are more affordable because of the restrictions they put on your coverage.

By requiring referrals before a specialist visit, an HMO plan makes it harder for you to get these more expensive appointments. This helps the company control its overall medical spending by seeing if the issue can be treated by your primary doctor before you see a specialist.

Plus, the company negotiates lower costs for medical care with the doctors that are in its network. This also helps control the cost of medical treatment.

HMOs also tend to focus on helping you stay healthy. This has the dual benefit of giving you cheap access to preventive care and wellness while also reducing the need for expensive medical care.

Differences between HMOs and other plan types

Cost and flexibility are the main differences between HMO health insurance and other plan types.

HMO | EPO | POS | PPO | |

|---|---|---|---|---|

| Cost | Cheap | Mid | Mid | Expensive |

| In-network coverage | ||||

| Out-of-network coverage | ||||

| Specialist visits allowed without a referral |

Out-of-network medical care is always covered in an emergency.

HMO vs. PPO insurance

PPOs are more flexible than HMOs, and they cost more for the same level of coverage.

PPO (preferred provider organization) plans are a popular type of health insurance where you have coverage no matter what doctor you use. However, you'll pay more to use a doctor that's not in the plan's network. You can also see specialists without having to obtain a referral.

HMO vs. EPO insurance

EPO plans are somewhat more flexible than HMOs with slightly higher costs.

Exclusive provider organization (EPO) plans let you see a specialist without having to first get a referral or prior authorization. This lets you be more direct in getting the medical care you want without adding delays or hassle.

However, EPOs are similar to HMOs in that your coverage is still restricted to the doctors that are in the plan's network of providers. If you go out of network, you'll pay the full cost of treatment unless it's an emergency.

HMO vs. POS insurance

POS plans are also more flexible than HMOs, giving you coverage for any doctor for an average of $80 more per month.

Point of service (POS) plans cover both in-network and out-of-network medical care. But like a PPO, you'll pay more if you go to a doctor that's outside of the network.

POS plans are like HMOs in that you do need to select a primary care physician (PCP) who will refer you to specialists when you need it. Plus, POS plans usually do not have a deductible for in-network care.

Downsides of HMOs: Are the trade-offs worth it for cheaper costs?

The main disadvantage of HMOs is you have less flexibility in which doctors your insurance will pay for because you have to stay in the plan's network. It's also more of a hassle to see a specialist because you'll need to first see your primary doctor to get a referral.

However, choosing an HMO versus a PPO will save you an average of $1,152 per year. You'll have to decide if that savings is worth it considering the drawbacks of an HMO plan.

- Referrals: Because HMOs require a referral before seeing a specialist, you could have costs for both the referral appointment and the specialist appointment. You may also get referred to a specific doctor, rather than the one you choose. This process could add some extra expenses for appointments and potentially delay your medical treatment as you wait for multiple appointments.

- Out-of-network coverage: Not being covered for out-of-network medical care limits your choices about where you get health services. But it can also potentially lead to large medical bills in cases when you do go out of network.

For example, if you had a $1,000 bill from an out-of-network doctor, you'd have to pay the full $1,000 yourself if you had an HMO plan. If you had a PPO plan, you'd have some coverage for out-of-network care. So you may only have to pay $500 of the same $1,000 bill, on top of the more expensive plan costs.

Some of the worst-case scenarios are when you don't have coverage for large, out-of-network medical bills.

For example, with an HMO, emergency room care would be covered at any hospital. But if you need to be admitted to the hospital after the ER, you may not be covered for the medical care at the out-of-network hospital. Instead, you could need your primary doctor to refer you to an in-network hospital to have coverage.

Without this step, you could get a $20,000 bill from an out-of-network hospital, which you'd have to pay yourself. But if you had a PPO, you'd only pay a portion of the cost based on your plan's coverage details, and there would be a cap on your expenses called the out-of-pocket maximum.

Choosing a health insurance plan

The choice between HMOs and other health plans often comes down to price and flexibility. Ask yourself how much you're willing to pay to have more flexibility about your medical care.

The quality of your health insurance is not determined by whether it's an HMO or another type of plan. Instead, you can get a good plan by choosing a top-rated health insurance company and choosing the right level of coverage for your needs.

- Many people do not like the restrictions of HMOs, believing they should have more control over choosing their medical providers and deciding for themselves when to see a specialist. These people are generally willing to pay more for this flexibility and freedom.

- However, some people like the convenience of an HMO. Oftentimes, a range of services are available at one location, including a primary doctor who manages your care and makes referrals.

In choosing a plan, if flexibility is your main concern, then an HMO should not be your first choice. But if cost is most important, then a low-cost HMO can help you save.

Frequently asked questions

What does HMO mean in health care?

HMO stands for health maintenance organization. This is a type of health insurance plan that is more restrictive than other plans. It will only cover medical care at locations that have a relationship with the insurance company, unless it's an emergency. And you'll need a referral from your primary doctor before seeing a specialist. However, HMOs are usually the cheapest type of health insurance plan, costing an average of $480 per month.

What are the benefits of an HMO?

The main benefit of an HMO is the savings. HMO plans cost nearly $100 less per month than a PPO. Plus, HMOs also give you a strong relationship with your primary doctor, who will coordinate your medical care and refer you to specialists when needed.

What are the disadvantages of an HMO?

The main disadvantage of an HMO is that you won't have as much flexibility in where you can get medical care. You'll only have coverage at the doctors and facilities on the plan's list of providers. Emergencies are an exception when you'll have coverage anywhere.

How much does an HMO cost?

The average cost of an HMO is $480 per month for a 40-year-old who pays full price. That's $5,760 per year. HMOs are the cheapest type of health insurance plan, costing nearly $100 less per month than a PPO.

Methodology

The average cost of health insurance is based on quotes for a 40-year-old. Those who are younger usually have lower rates, while those who are older pay more.

Health insurance premiums were calculated using public use files (PUFs) from the Centers for Medicare & Medicaid Services (CMS) government website. Plans and providers for which county-level data was included in the CMS Crosswalk file were used in our analysis; those excluded from this data set may not appear. Separately, data was aggregated from the websites of state-run marketplaces that don’t utilize the federal marketplace.