Aetna Health Insurance Review: Cheap Rates, Poor Service

Aetna sells cheap health insurance plans but its customer service is below average.

Find Cheap Health Insurance Quotes in Your Area

Aetna is one of the cheapest health insurance companies and is good if you're on a budget. But Aetna's customer service is typically below average. The company may not be the best choice if you have a complex or chronic illness, or if customer satisfaction is a high priority for you.

Pros and cons

Pros

Cheap rates

Extra plans like dental and vision

Perks like a health line

Cons

Bad customer satisfaction

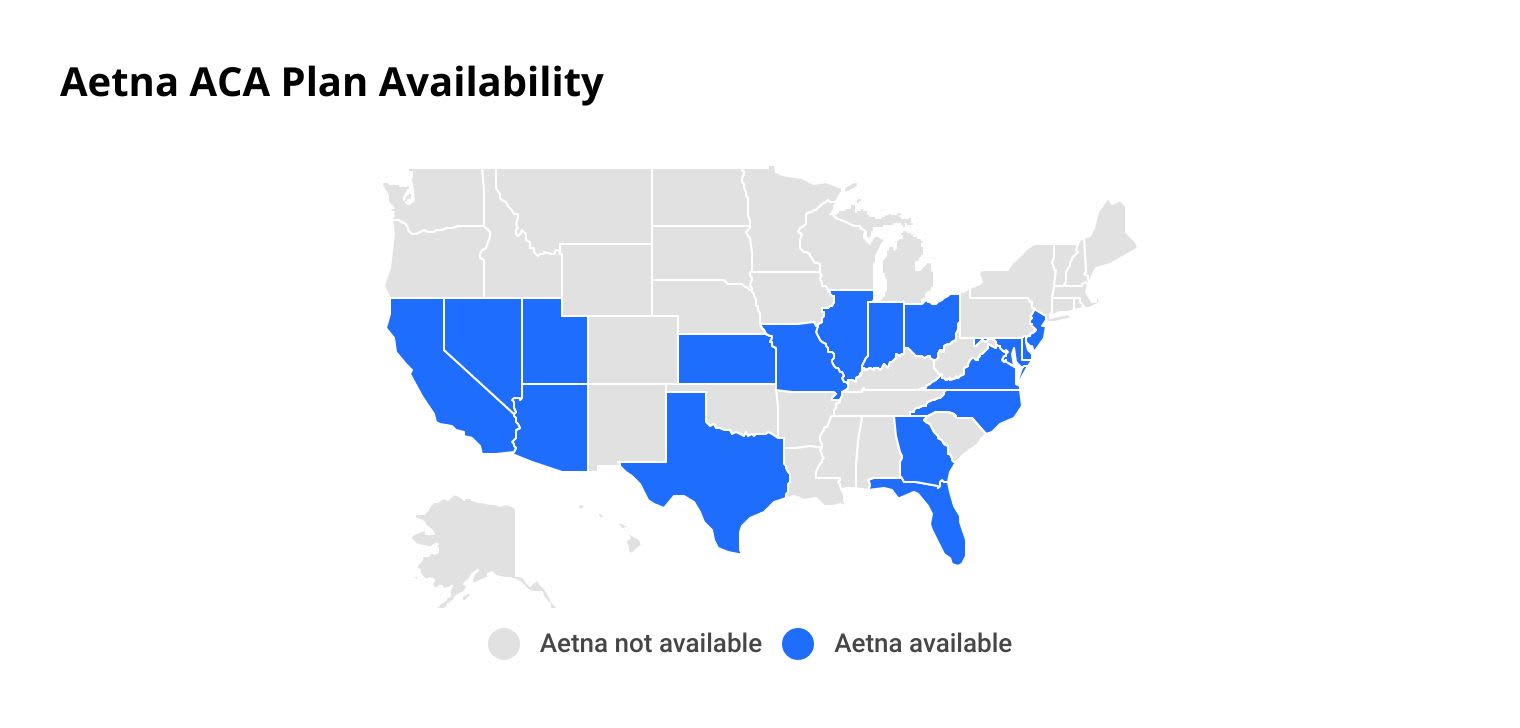

Only available in 17 states

How much does Aetna insurance cost per month?

A Silver plan with Aetna costs $502 per month, on average.

Aetna's rates are cheaper than the national average, no matter what plan level you choose. It's also one of the cheapest health insurance companies in most of the states where it sells plans.

Find Cheap Health Insurance in Your Area

Health insurance rates will be different based on where you live, your age, the plan tier you choose, how many people are on your plan and whether or not you smoke. While average rates are a helpful tool, your price will probably be different.

Aetna health insurance rates

Plan tier | Aetna rate | National rate |

|---|---|---|

| Bronze | $394 | $462 |

| Silver | $502 | $584 |

| Gold | $528 | $641 |

| Platinum | $702 | $813 |

Average monthly rates for a 40-year-old.

You should try to choose your health insurance plan based on how much health care you need. Choose a lower-tier plan if you don't need much health care and a higher-tier plan if you go to the doctor often.

Aetna vs. competitors

Aetna is cheaper than most other health insurance companies. On average, a Silver plan from Aetna costs $74 less per month than a plan from UnitedHealthcare, and over $100 less compared to a plan from Blue Cross Blue Shield. Kaiser Permanente is often a cheaper option, but it isn't available in most states.

If you live in California, Georgia, Maryland or Virginia, get quotes from both Aetna and Kaiser Permanente. Both companies sell health insurance in these states and both have cheap average rates. While Aetna is slightly cheaper than Kaiser Permanente in all four states, Kaiser tends to have better customer satisfaction. Comparing both companies can help find the best deal for the coverage you need.

Health insurance rates by company

Company | Rate | |

|---|---|---|

| Kaiser Permanente | $481 | |

| Aetna | $502 | |

| Ambetter | $521 | |

| UHC | $576 | |

| BCBS | $603 |

Average monthly rates for a 40-year-old with a Silver plan.

Plan options

Aetna sells several different kinds of health insurance, including plans on HealthCare.gov and state health insurance marketplaces. In addition, the company sells group health insurance, which is the kind you get from your job, dental and vision plans, and supplemental policies, like accident and hospital insurance.

Aetna also sells Medicare Advantage, Supplement and Part D plans. And in some states, Aetna helps Medicaid members use their benefits.

But if you need short-term health insurance, Aetna isn't an option. The company doesn't sell any short-term plans.

Aetna marketplace plans

If you don't have health insurance through your job, you'll probably need to buy a marketplace plan. Aetna sells four different levels of coverage.

Bronze plans are the cheapest options but generally have higher deductibles.

Bronze plans work well if you are generally healthy and don't go to the doctor often. But you'll pay more when you do get medical care.

Silver plans have mid-level monthly rates and are good if you have average health needs.

Plus, if you have a low income, Silver plans offer help with other insurance costs like deductibles and copays.

Gold and Platinum plans are best for people with high health care needs.

Gold and Platinum plans have the highest monthly rates but pay for the biggest share of your health care costs.

The plan levels you can buy might be different depending on where you live. The only coverage level that Aetna doesn't sell is Catastrophic.

Many of Aetna's health insurance plans let you get preventive care, like an annual wellness check, at no cost. And because Aetna is part of CVS Health, you can get urgent care at CVS MinuteClinics at no cost, too. Aetna also gives you a $100 annual allowance for CVS Health-brand products, like over-the-counter pain relievers and first aid supplies. You can also get 20% off CVS Health-brand items using the barcode on the back of your Aetna ID card.

You can buy Aetna health insurance on HealthCare.gov or your state's marketplace website. Plans are available in 17 states.

Find Cheap Health Insurance in Your Area

Indiana, Kansas, Maryland, Ohio and Utah will all have access to Aetna in 2024. Previously, Aetna was only available in 12 states.

States where Aetna sells ACA plans

- Arizona

- California

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Maryland

- Missouri

- Nevada

- New Jersey

- North Carolina

- Ohio

- Texas

- Utah

- Virginia

Aetna dental insurance

Aetna Dental Direct sells individual and family dental insurance plans. The plans cover the entire cost of preventive services such as dental exams, x-rays and flouride treatments, as long as you go to an in-network doctor.

Aetna offers three different dental plans: Preferred, Core and Preventive. The amount you pay for dental services depends on the plan you choose.

Pref. | Core | Prev. | |

|---|---|---|---|

| Monthly cost | $25 | $22 | $20 |

| Preventive care | $0 | $0 | $0 |

| Basic services | 20% | 50% | N/A |

| Major services | 50% | 50% | N/A |

| Deductible | $50/$100 | $50/$100 | $0 |

Average rates according to Aetna Dental Direct and are rounded to the nearest dollar. Costs are for in-network providers only.

You can use an out-of-network doctor, but you'll pay more for the care you get. That's because all of the Aetna dental insurance plans use PPO networks.

If you don't want to buy a dental plan, you could opt for a discount card, called the Aetna Vital Savings card. The card gives you discounts on dental and orthodontic services like cleanings, crowns and braces. It's not an Aetna dental insurance plan, but it can help you lower the cost for dental care. You'll pay at least $7.99 per month for the card, or $9.99 for the version that also gives you savings on prescription medications.

Aetna vision insurance

If you buy an Aetna dental plan, you can add vision coverage, called Aetna Vision Preferred. The plan comes with benefits like no-cost vision exams, a $130 allowance for glasses frames or contacts, and $25 standard plastic glasses lenses. You can also get 20% off sunglasses without a prescription and up to 15% off laser surgery through the U.S. Laser Network.

Aetna doesn't sell vision insurance as a stand-alone policy; you have to have the dental plan to get vision coverage.

Aetna supplemental plans

Aetna sells three types of supplemental health insurance. These plans pay you directly if you are injured, get sick or are in the hospital.

- Accident insurance

- Illness insurance

- Hospital insurance

You can use the money you get for anything, not just your health care bills. If you need to hire childcare, get someone to help you around the house or pay everyday bills, you can use the money from a supplemental policy.

Supplemental insurance gives you extra coverage. It isn't meant to be your main health insurance, and you should still have a regular plan through your job, the marketplace or Medicare.

Aetna Medicare plans

Aetna sells Medicare Advantage, Part D and Medicare Supplement plans. Aetna's Medicare Advantage and Medigap plans usually have good coverage, but the company's customer service is below average.

Aetna sells good Part D plans, though. Its SilverScript plan is the best Part D plan for a low deductible.

Member resources and benefits

Aetna's perks are useful, but they don't stand out as unique. Most health insurance companies offer similar perks.

- Gym memberships

- Discounts or coverage for yoga and massage

- Access to health coaches

- Diet and weight management advice

- A 24/7 health hotline

- An online medical payment calculator

Aetna also has a helpful health guide on its website. The guide features articles on topics like managing medical conditions, keeping kids healthy during the school year and how to create healthy habits.

Customer reviews and complaints

Aetna's customer satisfaction is usually below average.

But it depends on the specific Aetna company in your area. One of Aetna's largest companies has 7% fewer complaints compared to an average company its size, according to the National Association of Insurance Commissioners (NAIC). But the Aetna company in Texas gets over twice as many complaints as average. Before you buy an Aetna plan, you may want to check the company's customer service record and talk to current members.

Aetna's CVS Caremark Pharmacy is also ranked below average, both as an in-person location and a delivery service, according to J.D. Power. The company rated several areas of customer satisfaction, including a pharmacy's discounts, how prompt a pharmacy is and how well a pharmacy resolves problems. The below-average score for CVS could mean it's harder for Aetna customers to get their prescription medications.

Frequently asked questions

What is Aetna?

Aetna is a health insurance company. You can buy health insurance plans, dental and vision coverage, supplemental insurance and Medicare coverage from Aetna. Aetna also sells group health insurance, which is the kind you get through your job.

Is Aetna good insurance?

Aetna is a good insurance company if you want cheap rates. The plans have good coverage and perks, too. But the company's customer service is below average, so it might not be best if you are managing a complex or chronic medical condition.

How much does Aetna cost?

A Silver plan with Aetna costs an average of $502 per month for a 40-year-old. Aetna is one of the cheapest health insurance companies. It's usually one of the cheapest options no matter where you live or how much coverage you buy.

Methodology

Health insurance rates and data are from the Centers for Medicare & Medicaid Services (CMS) Public Use Files (PUFs). ValuePenguin calculated average rates and plan costs using a 40-year-old policyholder with a Silver plan unless otherwise stated. Plans and providers for which county-level data was included in the CMS Crosswalk file were used to find rates; those excluded from this data set may not appear.

Dental insurance rates are from Aetna and are for in-network doctors. Other sources include the National Association of Insurance Commissioners (NAIC) and the 2023 J.D. Power U.S. Pharmacy Study.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.