SR-22 Insurance in Oregon: What Is It? How Much Does It Cost?

Find Cheap SR-22 Auto Insurance Quotes in Oregon

You may need to get an SR-22 certificate in Oregon if you've had your license revoked because of a serious violation, like a DUI. This document, also called SR-22 insurance, proves to the state that your insurance policy meets Oregon's minimum car insurance requirements.

SR-22 insurance in Oregon is generally more expensive than a standard car insurance policy.

Your insurance company will generally charge between $15 and $50 to file an SR-22 form. But your insurance rates are likely to go up as well, because drivers who need an SR-22 have prior driving violations and are more likely to be in an accident in the future.

Cheap SR-22 insurance in Oregon

State Farm and Progressive offer the cheapest SR-22 insurance in Oregon.

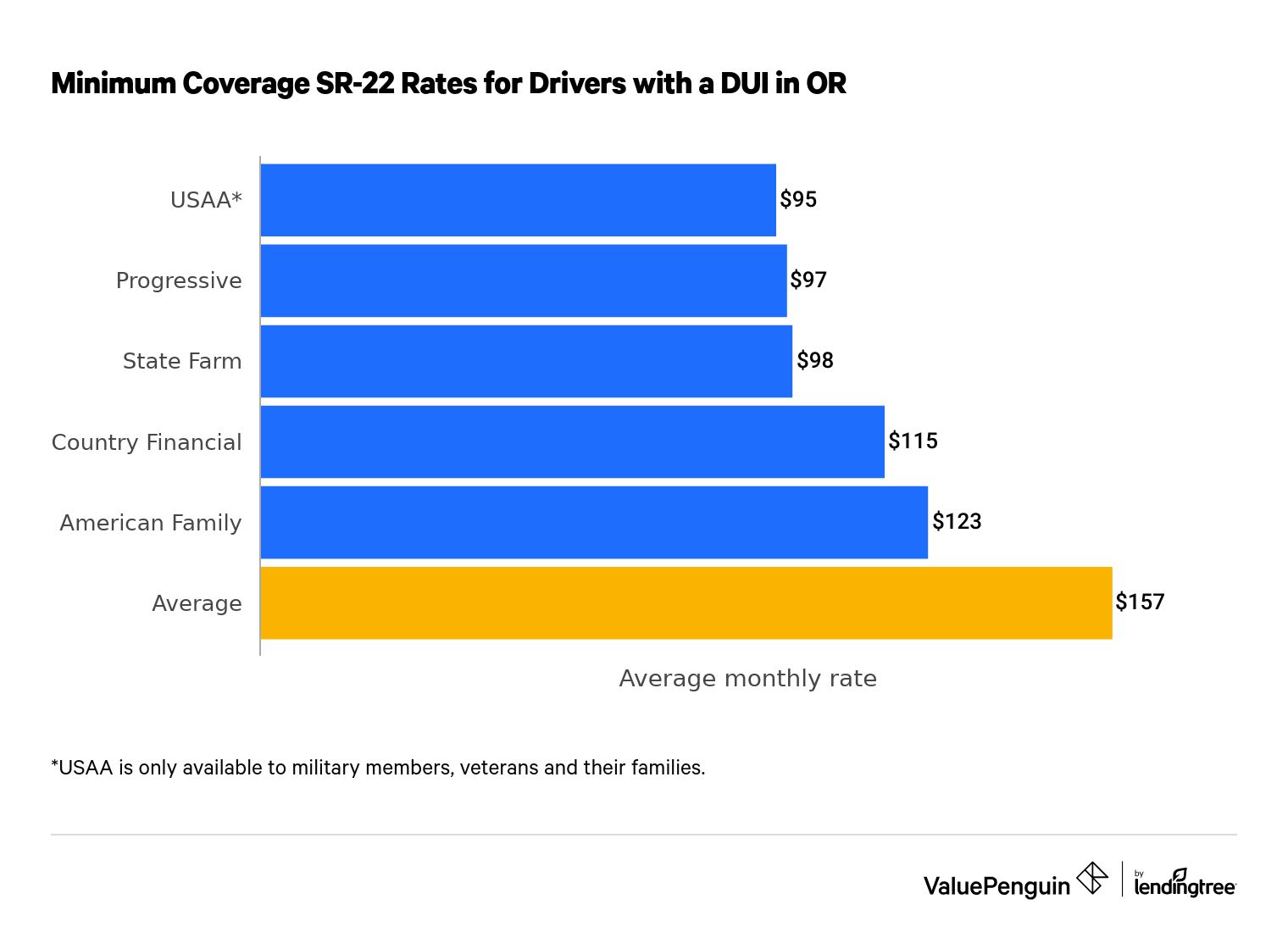

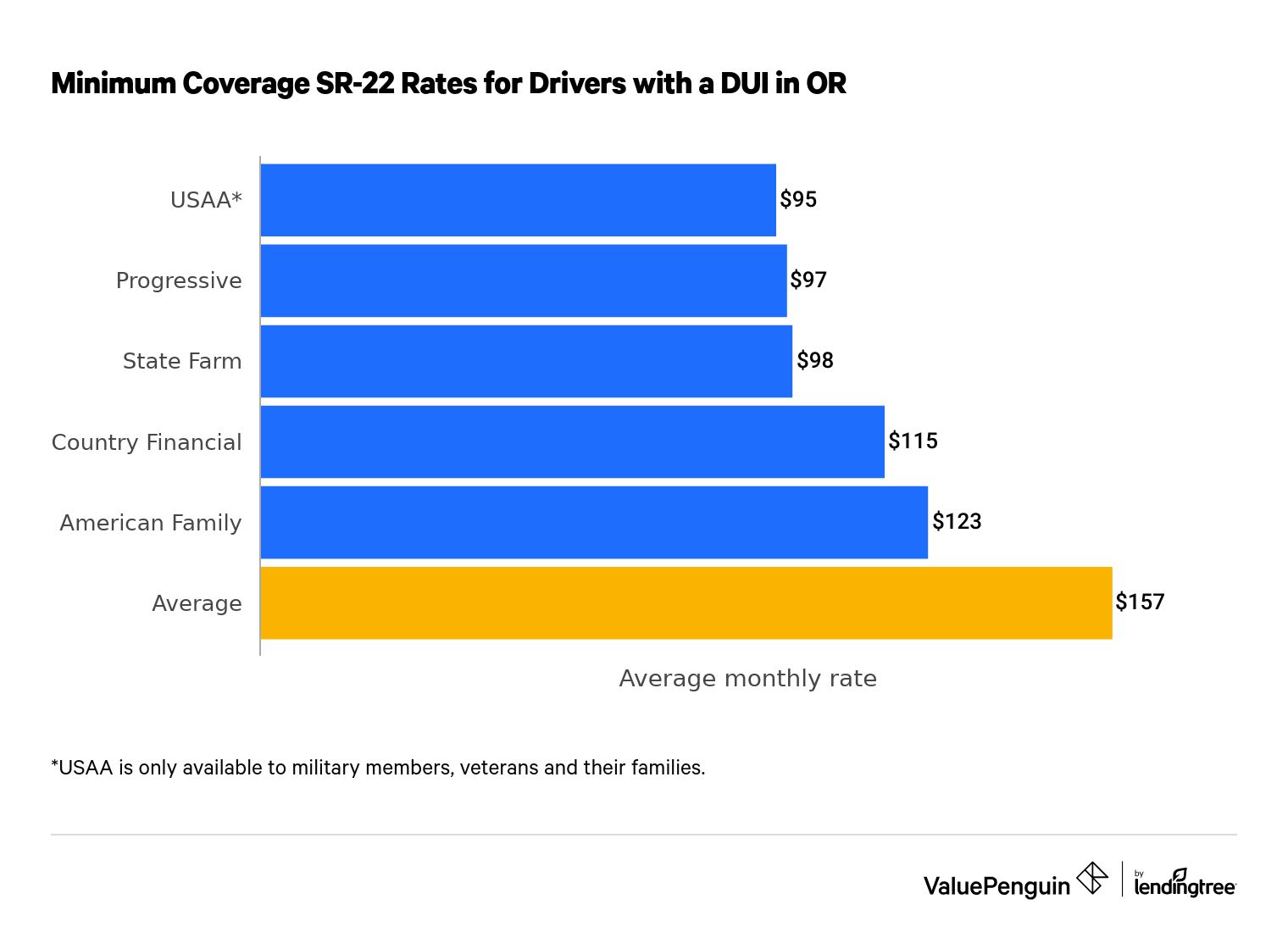

Drivers with a DUI conviction pay around $97 per month for minimum coverage insurance from Progressive, while a policy from State Farm costs $98 per month.

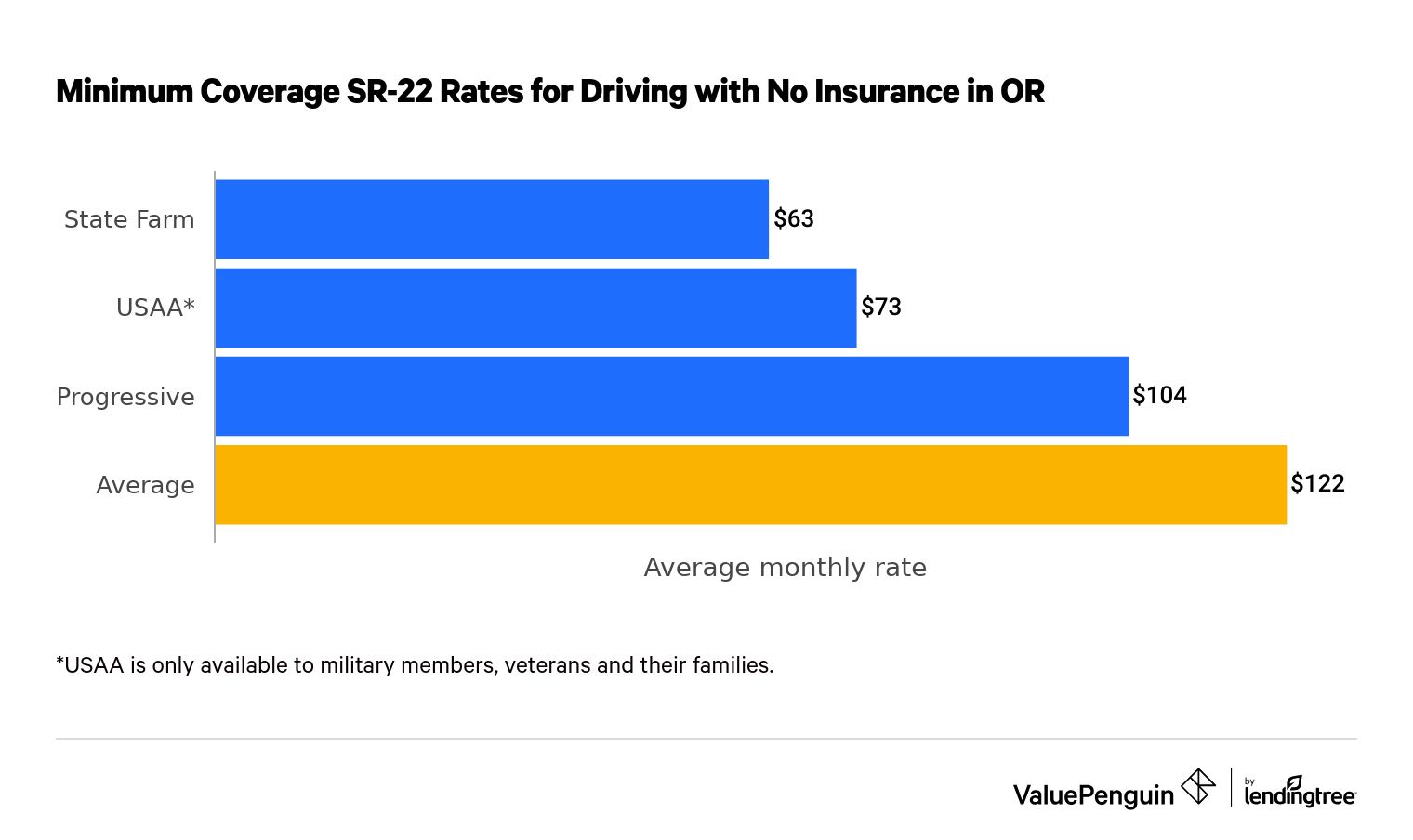

However, State Farm is much cheaper for drivers who need an SR-22 after getting a ticket for driving without insurance. Minimum coverage from State Farm costs $63 per month for these drivers, while Progressive charges $104 per month.

SR-22 with DUI

SR-22 with ticket for no insurance

Find Cheap SR-22 Auto Insurance Quotes in Oregon

USAA offers even cheaper rates for SR-22 insurance in Oregon after a DUI. A minimum coverage policy from USAA costs $95 per month, on average. However, only military members, veterans and their families can buy USAA car insurance.

Minimum coverage SR-22 car insurance quotes after a DUI

Company | Monthly rate | |

|---|---|---|

| State Farm | $63 | |

| Country Financial | $97 | |

| Progressive | $104 | |

| American Family | $123 | |

| Mutual of Enumclaw | $127 |

*USAA is only available to current and former military members and their families.

SR-22 with DUI

Find Cheap SR-22 Auto Insurance Quotes in Oregon

USAA offers even cheaper rates for SR-22 insurance in Oregon after a DUI. A minimum coverage policy from USAA costs $95 per month, on average. However, only military members, veterans and their families can buy USAA car insurance.

Minimum coverage SR-22 car insurance quotes after a DUI

Company | Monthly rate | |

|---|---|---|

| State Farm | $63 | |

| Country Financial | $97 | |

| Progressive | $104 | |

| American Family | $123 | |

| Mutual of Enumclaw | $127 |

*USAA is only available to current and former military members and their families.

SR-22 with ticket for no insurance

Find Cheap SR-22 Auto Insurance Quotes in Oregon

Drivers with military ties should also compare quotes from USAA. At $73 per month, a minimum coverage policy from USAA is 40% cheaper than average. But only military members, veterans and their families can get car insurance from USAA.

Minimum coverage SR-22 quotes after driving with no insurance

Company | Monthly rate | |

|---|---|---|

| Progressive | $97 | |

| State Farm | $98 | |

| Country Financial | $115 | |

| American Family | $123 | |

| Travelers | $168 |

*USAA is only available to current and former military members and their families.

How much do SR-22 policies cost?

The only cost directly associated with an SR-22 certificate is the filing fee, which is usually between $15 and $50.

However, if you need an SR-22 certificate, you'll likely have to pay more for insurance. Oregon drivers typically need SR-22 insurance after a DUI, repeat traffic offenses or driving without insurance. These traffic violations typically lead to higher car insurance rates, adding much more to your bill than the SR-22 fee.

For example, the average cost of car insurance in Oregon is $79 per month for a minimum coverage policy.

Just a single DUI can increase car insurance rates by an average of 51%, depending on your exact location and insurance company.

To find cheap SR-22 insurance in Oregon, you should shop around for quotes from multiple companies. Insurance companies all calculate rates differently, so comparing multiple quotes is one of the best strategies to find cheap SR-22 insurance.

What is an SR-22 in Oregon, and when is it required?

An SR-22 form proves to the state that your auto insurance policy meets the minimum coverage requirements in Oregon.

Oregon SR-22 insurance requirements

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $20,000 per accident

- Uninsured motorist bodily injury liability: $25,000 per person and $50,000 per accident

- Personal injury protection (PIP) : $15,000 per accident

People who've been convicted of certain driving violations may be required to carry more coverage, so make sure to check with Oregon Driver & Motor Vehicle Services.

When are you required to get an SR-22 in Oregon?

- When you get a ticket for driving without insurance

- When you're in an accident and you don't have insurance

- When you're convicted of driving under the influence (DUI)

- When you've failed to pay legal damages after an accident

- When you've had your license revoked

- When a judge has ordered you to have mandatory insurance supervision

- When you've applied for a hardship or probationary permit, which may be needed following a license suspension

If you're required to have an SR-22 certificate and you don’t own a car, you must buy a non-owner SR-22 policy if you want to drive in Oregon.

Non-owner car insurance protects drivers when they're operating cars they do not own and usually costs less than other SR-22 policies while still meeting the necessary legal requirements.

How to get an SR-22 in Oregon

To get SR-22 insurance coverage in Oregon, you will need to follow several steps.

If the state of Oregon requires you to have SR-22 insurance coverage and you move out of state, you must still file an SR-22 with Oregon prior to getting a driver's license from another state.

If you have an SR-22 from a different state, you need to maintain it when driving in Oregon.

How long is SR-22 insurance coverage required in Oregon?

Oregon drivers are typically required to have SR-22 insurance for three years.

However, you may need to keep SR-22 insurance for longer if you commit driving violations during that period.

Insurance companies will notify the Oregon DMV if you cancel or do not renew your SR-22 policy. If you let your SR-22 coverage lapse, you could lose your driver's license and be forced to pay reinstatement fees, along with higher car insurance rates.

To avoid any lapses in coverage, we recommend renewing your policy early — usually 30 days in advance — during the three years you're required to carry SR-22 insurance.

If you're wondering when your SR-22 is up, you can contact the Oregon DMV to confirm the date of completion.

After the Oregon DMV confirms you've completed your SR-22 requirement, contact your insurance company to inform it that an SR-22 filing is no longer required.

Frequently asked questions

Who has the cheapest SR-22 insurance in Oregon?

State Farm, Progressive and USAA have the cheapest SR-22 insurance rates in Oregon. However, your rate will depend on the reason you need an SR-22 certificate. For example, a minimum coverage SR-22 policy from State Farm costs $98 per month after a DUI but is only $63 per month for drivers who have a ticket for driving without insurance.

How long does an SR-22 last in Oregon?

Drivers that need SR-22 insurance usually have to keep it for three consecutive years. But you may need to keep it for longer if you get a ticket during that time period.

How much does an SR-22 cost in Oregon?

An SR-22 certificate usually costs between $15 to $50 to file. However, your car insurance rates will usually go up based on the reason you need an SR-22. For example, minimum coverage SR-22 insurance costs $157 per month after a DUI in Oregon, which is twice as much as drivers with a clean record pay for coverage.

How do I know when my SR-22 is up in Oregon?

You can contact the Oregon DMV with your SR-22 case number to find out how much longer you need an SR-22 on file. Once your requirement is complete, you can let your insurance company know that you no longer need an SR-22 filing.

Methodology

To find the best cheap SR-22 insurance in Oregon, we gathered quotes across all residential ZIP codes from the top insurance companies in the state. Rates are for a 30-year-old single man with a good credit score who drives a 2015 Honda Civic. Quotes are for a minimum coverage policy, which meets the legal requirements in Oregon and does not include comprehensive and collision coverage

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.