Best Cheap SR-22 Insurance Rates in California

If you need SR-22 insurance in California, your rates could be 183% more expensive, depending on the driving violation.

California drivers who get certain tickets, such as a DUI or reckless driving, may be required to buy SR-22 insurance to restore their driver's license. You'll need SR-22 insurance in California for three to ten years, depending on the ticket.

Find Cheap SR-22 Auto Insurance Quotes in California

What's next

How much does SR-22 cost in California?

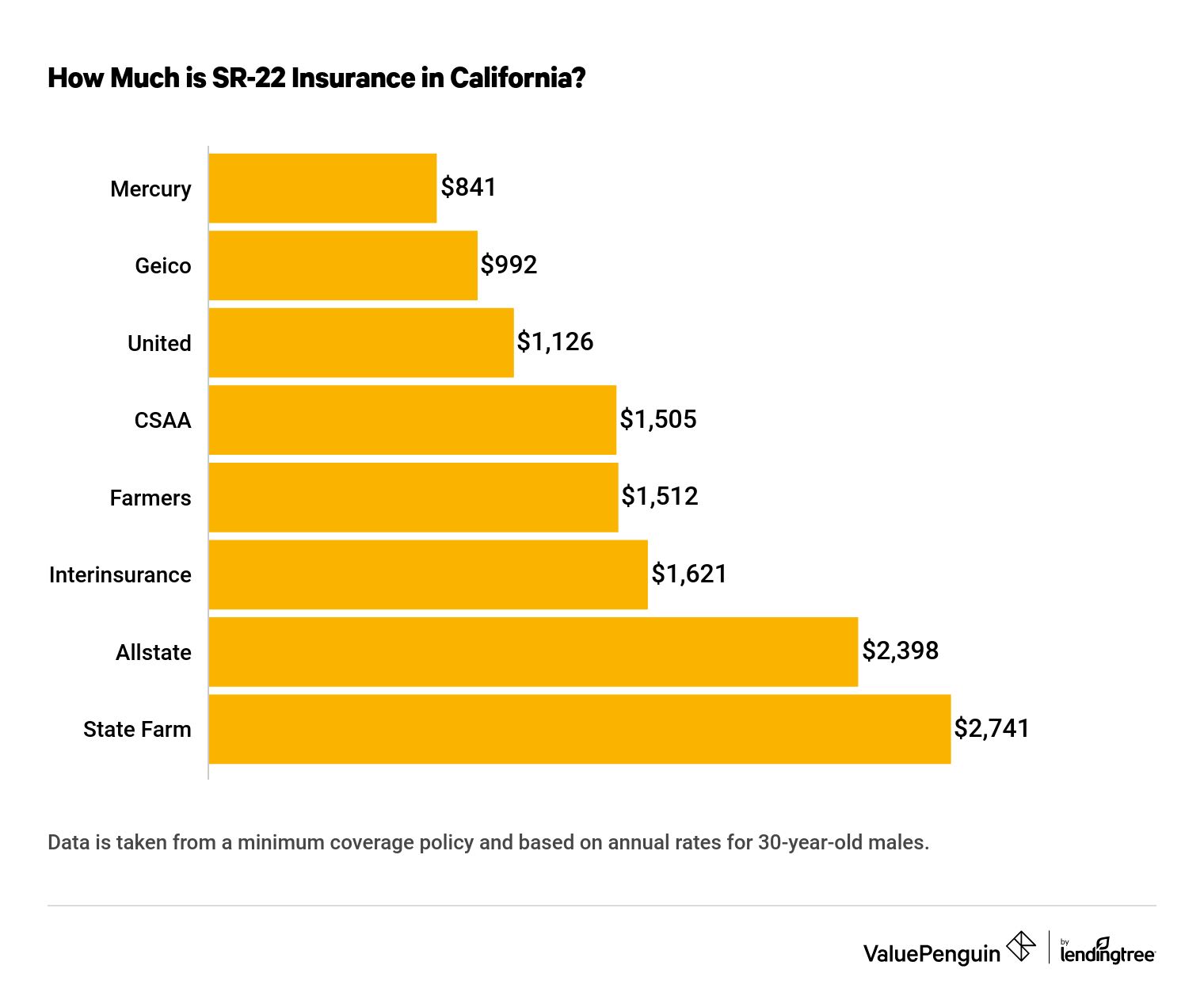

The average cost of SR-22 insurance after a DUI in California is $1,592 — meaning rates can nearly triple after a DUI.

SR-22 insurance in California will cost more than what you previously paid for auto insurance based on the violation.

Your SR-22 rates depend on a wide variety of factors, such as your car, location, age and driving history. The best ways to make sure you're getting the most affordable SR-22 coverage is to compare quotes from multiple companies.

California law also prohibits insurance companies from providing a good driver discount to anyone with a DUI conviction for 10 years following the violation. Even if your insurance company renews your policy, the loss of the good driver discount may lead to a higher rate.

Cheapest companies for California SR-22 insurance

Mercury, Geico and UAIC have the cheapest SR-22 quotes in California.

Not every insurance company will file an SR-22 for you, and some might even drop your policy if you need an SR-22. Many major companies in California, including Progressive and Geico, will file SR-22 forms for you.

Find Cheap SR-22 Auto Insurance Quotes in California

Cheapest SR-22 quotes in California

The cheapest SR-22 company for you also depends on your location. For example, if you get a DUI in Los Angeles and need an SR-22, you may get better rates with Progressive. On the other hand, a driver in San Diego with multiple speeding tickets may get a better SR-22 insurance quote from Geico.

Can I file an SR-22 with my current insurance company?

You can contact your current company and ask to file an SR-22, but there's no guarantee they will.

Although California law prohibits companies from canceling your car insurance policy or increasing your rates in the middle of the policy term, your policy can change when it's time for renewal.

At that point, your insurance company might choose to raise your rates or not renew your policy. You'll typically be given at least 30 days' notice in either case.

How do I get my California driver's license reinstated?

To get your driving privileges reinstated or to get a restricted license, you'll need to get proof of SR-22 insurance first. Most insurance companies charge a one-time SR-22 form filing fee of $25 to $50.

Your SR-22 insurance policy needs to list all cars you own or regularly drive.

Once the California DMV has your SR-22 form from the insurance company, you'll get a copy and confirmation, which you should keep in your car in case you're pulled over. You may need to apply with the DMV to get your license reinstated. The cost of getting your license reinstated is about $125 in California.

There are a few alternatives to paying for SR-22 insurance. For example, you could post a $35,000 cash deposit or security bond with the DMV to show proof of financial responsibility. However, the risks and high upfront cost mean this option is probably not worth it for most drivers. Without car insurance, you'd also be on the hook to pay for any damage you cause in a car accident.

What is SR-22 insurance in California and how does it work?

SR-22 insurance in California is often required if you have a record of high-risk driving and your license has been suspended.

In California, getting SR-22 insurance involves two steps: buying a car insurance policy that meets the state's liability insurance requirements, and then having the insurance company file an SR-22 form with the DMV on your behalf.

SR-22 insurance demonstrates proof of financial responsibility, as the company files it directly with the DMV, and shows that your car insurance liability limits include at least the state minimum of 15/30/5 coverage.

- $15,000 of bodily injury coverage per person injured in an accident

- $30,000 of bodily injury coverage per accident

- $5,000 of property damage coverage per accident

Do I need an SR1P or SR-22?

If you drive a vehicle with fewer than four wheels, such as a motorcycle or moped, you may need to file an SR1P form in California, instead of an SR-22 and proof of liability insurance. SR1Ps are usually required if you've had your license suspended after driving without insurance or after being convicted of risky driving behavior.

How long do I need to have an SR-22 in California?

Most violations require an SR-22 for three years, but more serious infractions such as reckless driving can land you a 10-year requirement.

The length of time you'll need to have SR-22 insurance in California depends on your conviction, which should state how long you're expected to have the SR-22 filing.

Having continuous coverage is important. Any lapses in your SR-22 car insurance will cause your driving privileges to be suspended again, as your insurer would file an SR-26 form with the DMV notifying them of the lapse.

If you move out of California during your required filing period, you'll need to locate a company that does business in both states and is willing to file the form for you in the state. In addition, even if the state you've moved to has lower liability insurance requirements, you'll need to get auto insurance that meets California's minimum limits.

How to get car insurance after a DUI in California

SR-22 insurance is often referred to as DUI insurance because you'll likely be required to file an SR-22 to reinstate your driving privileges if you have a DUI conviction in California.

You don't need to notify your insurance company of a DUI charge, and it likely won't impact your auto insurance, but a DUI conviction will. Your insurance company will either learn of the conviction when you ask them to file an SR-22 or when you try to renew your policy. Insurance companies check your driving record when you renew or open a policy with a new company, and a DUI stays on your DMV record for 10 years.

After 10 years, the DUI will be removed from your driving record and you will be eligible for the safe driver discount again.

However, if there are no more incidents on your driving record, the DUI will have a decreasing impact on your car insurance rates over the course of five to 10 years.

You may be able to get the conviction removed from your record earlier. But if you stay with the same insurance company, the company will know about the DUI and continue to use it when determining your SR-22 insurance rates.

Non-owner SR-22 insurance in California

If you don't own a car but need proof of insurance, non-owner SR-22 insurance provides state-required liability insurance for you as the driver, no matter which car you use.

If you're convicted of a DUI or other violation and have your license suspended, you will need to have liability insurance and an SR-22 form for three to 10 years to keep your driving privileges. Even if you don't own a vehicle, this requirement is in place. The only other option is to give up your right to drive and, even then, you'll need to file an SR-22 in California if you want to begin driving later.

In California, there are three forms of financial responsibility: an owner's policy certificate, a broad coverage policy certificate and an operator's policy certificate, also called a non-owner SR-22 policy.

A non-owner SR-22 policy typically isn't available if there's a car you consistently drive but don't own, such as a parent's or roommate's vehicle. But it provides coverage if you occasionally drive other people's cars with their permission.

One of the benefits of non-owner SR-22 insurance is that quotes are typically cheaper than for an owner's policy, since you'll only have liability coverage and the insurer assumes you drive less often. Since your insurance rates will already be higher after the ticket that caused you to need the California SR-22, non-owner insurance is a simple way to reduce your costs but keep your license if you don't regularly drive.

Methodology

To determine the average price of SR-22 insurance in California, we gathered statewide average rates from eight insurers: Mercury, Allstate, AAA, Farmers, Geico, State Farm and United Automobile Insurance Company (UAIC).

All quotes are for minimum coverage policies for a 30-year-old man who is legally required to have his insurance company file an SR-22 on his behalf.

ValuePenguin's analysis used rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.