Car Insurance Costs for 50-Year-Olds (and Those Over 50)

Bundle & Save

Auto

Home

1-800-772-1213

The average cost of a full coverage car insurance policy for a 50-year-old is $2,698 per year, or $225 per month. On average, the cheapest widely available insurer for 50-year-olds is Geico.

Our analysis of thousands of quotes across nine of the most populated U.S. states found that Geico offers the best car insurance rates for 50-year-olds. To ensure you get the best rate, compare several quotes, since rates for 50-year-olds can vary by as much as $3,170 per year.

How much is car insurance for a 50-year-old?

The average yearly cost of car insurance for 50-year-olds is $2,698, but rates vary widely from one company to the next. Amongst the 23 insurance companies included in our study, rates varied by more than $3,000 per year.

Bundle & Save

Auto

Home

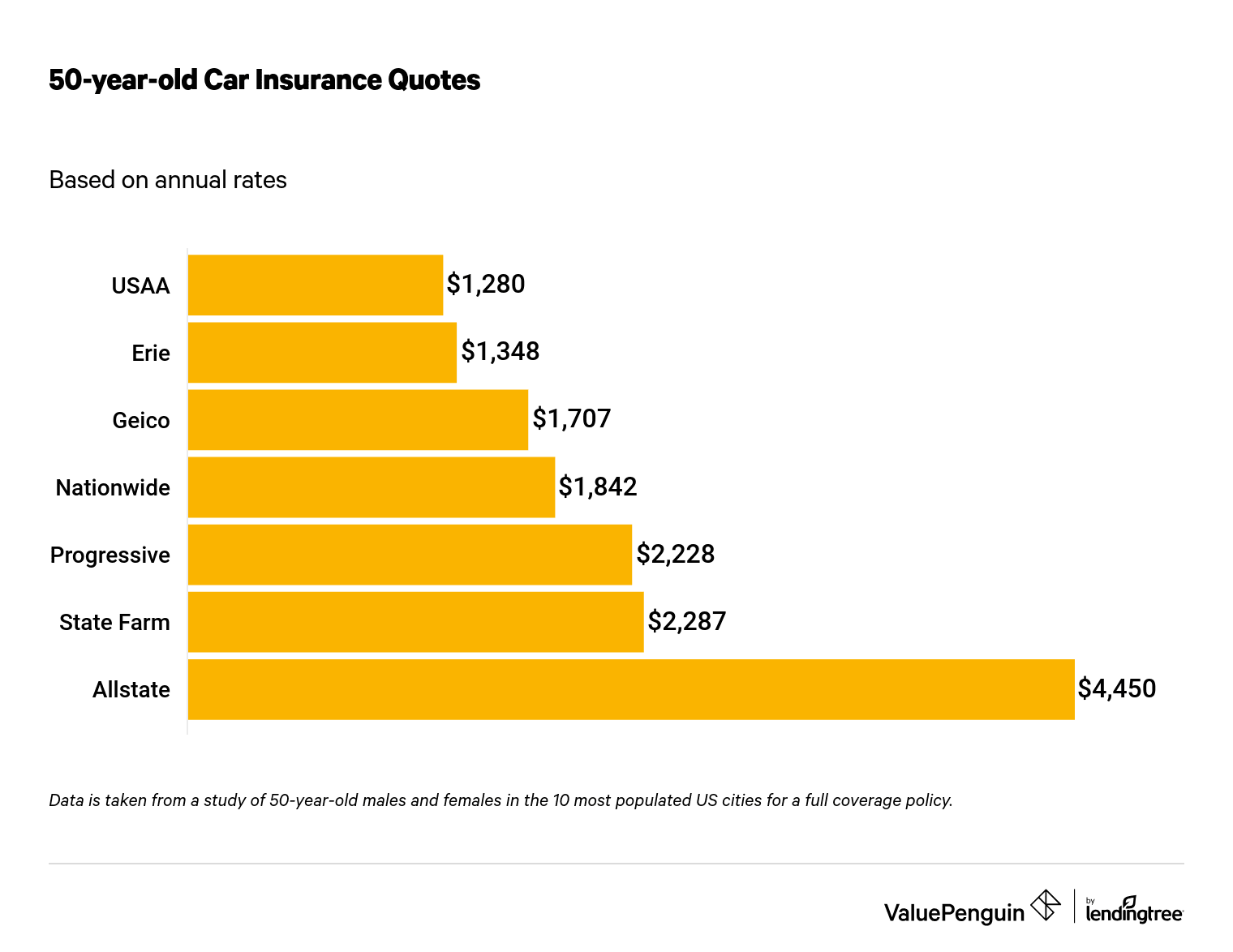

These are the cheapest companies we found for 50-year-olds:

- USAA: Fifty-year-old drivers pay $1,280 on average. However, this rate is only available to current and former military members and their families.

- Erie Insurance: The second-cheapest option is Erie, at $1,348 per year, but coverage is only available in 13 states.

- Geico: Although it costs more than USAA and Erie, Geico is the cheapest insurer that is widely available for 50-year-olds, at $1,707 per year on average.

Cheapest annual 50-year-old car insurance by company

Insurer | Average cost per year | |

|---|---|---|

| USAA | $1,280 | |

| Erie | $1,348 | |

| Geico | $1,707 | |

| Nationwide | $1,842 | |

| Progressive | $2,228 | |

| State Farm | $2,287 | |

| Allstate | $4,450 |

The cost of coverage varies greatly across insurers. Often, two companies even offer the same coverage and very similar services at vastly different prices. For that reason, drivers looking for the cheapest rates should always compare multiple quotes.

How do car insurance prices differ for 50-year-old men and women?

Regardless of gender, car insurance prices are similar for drivers at this age. However, women pay 0.7% more than men at age 50, or about $18 per year.

Annual cost - 50-year-old male | $2,689 |

|---|---|

| Annual cost - 50-year-old female | $2,707 |

The gap in car insurance prices between men and women tends to narrow as they age. We've found that 20-year-old men pay an average of about 10% more for car insurance than women. This is because young male drivers are more likely to get into car accidents than young female drivers.

In some states, the practice of gender-based insurance pricing is prohibited. Residents of California, Hawaii, Massachusetts, parts of Michigan, Montana, North Carolina or Pennsylvania, you won't see any difference in car insurance rates for men and women, assuming all other factors that determine their rates are equal.

Car insurance rates by age

Auto insurance generally gets more affordable as drivers get older and gain more driving experience. The average 50-year-old pays $2,698 per year, or $225 per month, for car insurance. That's $509 less than the average cost for a 25-year-old, and $4,481 less than the average for an 18-year-old.

The biggest drop in prices happens as a driver approaches the age of 30. In other words, you won't notice a large difference between insurance prices for 30-year-olds and older drivers, as long as all other factors affecting rates are equal.

Cheapest car insurance company for 50-year-olds by state

Overall, USAA is the cheapest insurer, offering the lowest rates in six of the 10 most populated U.S. states. However, USAA is only available to current and former military members and their families. Geico, which is much more widely available, offers the cheapest rates in three of the 10 states.

Cheapest 50-year-old annual insurance rates by state

State | Company | Average cost |

|---|---|---|

| California | Geico | $1,339 |

| Florida | Geico | $1,723 |

| Georgia | USAA | $1,210 |

| Illinois | USAA | $1,004 |

| Michigan | USAA | $2,324 |

| New York | USAA | $1,327 |

| North Carolina | Geico | $1,112 |

| Ohio | State Farm | $1,065 |

| Pennsylvania | USAA | $740 |

| Texas | USAA | $1,078 |

Fifty-year-olds in Ohio get the lowest rates available, at an average of $1,505. That's $6,501 lower than auto insurance rates in the most expensive state, Michigan.

Average car insurance rates for 50-year-old drivers by state

State | Average rate |

|---|---|

| Ohio | $1,505 |

| North Carolina | $1,543 |

| Pennsylvania | $1,710 |

| California | $1,767 |

| Illinois | $1,960 |

| Texas | $2,125 |

| Georgia | $2,479 |

| New York | $2,585 |

| Average cost of car insurance | $2,698 |

| Florida | $3,300 |

| Michigan | $8,006 |

How to find the cheapest insurance for 50-year-olds

If you're a 50-year-old driver looking for the lowest price, we recommend comparing rates from multiple insurance companies. Our analysis provides a good starting point, but your prices will differ based on your driving record and other personal details.

When comparing insurance quotes, select the same coverage with each insurer so you can make a fair comparison.

You should also check to see what discounts are available from the insurer, as that could affect your final rate, too. For instance, a 50-year-old with a long and safe driving record will likely qualify for a safe driver discount, but the rate reduction may differ between companies.

How to find the best company for customer service

While rates are important, you'll also want to find an insurance company with good customer service, since you could have to rely on your insurer during a crisis.

One way to start your search is to read our reviews of the best car insurance companies, which rate insurers on their customer service, as well as coverage options and price. You should also consider how a company scores with the following industry experts:

- J.D. Power's Insurance Satisfaction Study See how customers rate their overall satisfaction with their insurer.

- National Association of Insurance Commissioners (NAIC) Complaint Index. This number indicates how often customers complain about a given company and whether or not the volume of complaints is proportional to the company's size.

Methodology

This analysis used insurance quotes for thousands of ZIP codes in the 10 most populated states in the U.S. Our sample drivers were 50-year-old men and women driving a 2015 Honda Civic EX, and the drivers were single and had clean driving records.

The policy used was a full coverage policy, including liability, comprehensive and collision insurance. Limits and deductibles are listed below.

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection (PIP) | Minimum when required by state |

This study included 23 insurance companies, but we only included a company in our rate tables if its policies were available to drivers in at least three of the 10 states.

ValuePenguin's analysis collected insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your quotes might vary from the averages in this study.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.