How Much Is Used Car Insurance & How to Get the Best Deal

Find Cheap Auto Insurance Quotes in Your Area

Getting car insurance is an essential part of buying a used car: You need insurance to drive a car in almost every state, even if it's not new. You usually don't have to get coverage until after you buy the vehicle, but it's smart to get quotes beforehand.

Unfortunately, used cars are not universally cheaper to insure than new cars. Some insurance companies charge less for older vehicles than new ones, but others charge more. The only way to make sure you're getting the lowest premium for your used vehicle is to get quotes from several companies.

How much does used car insurance cost?

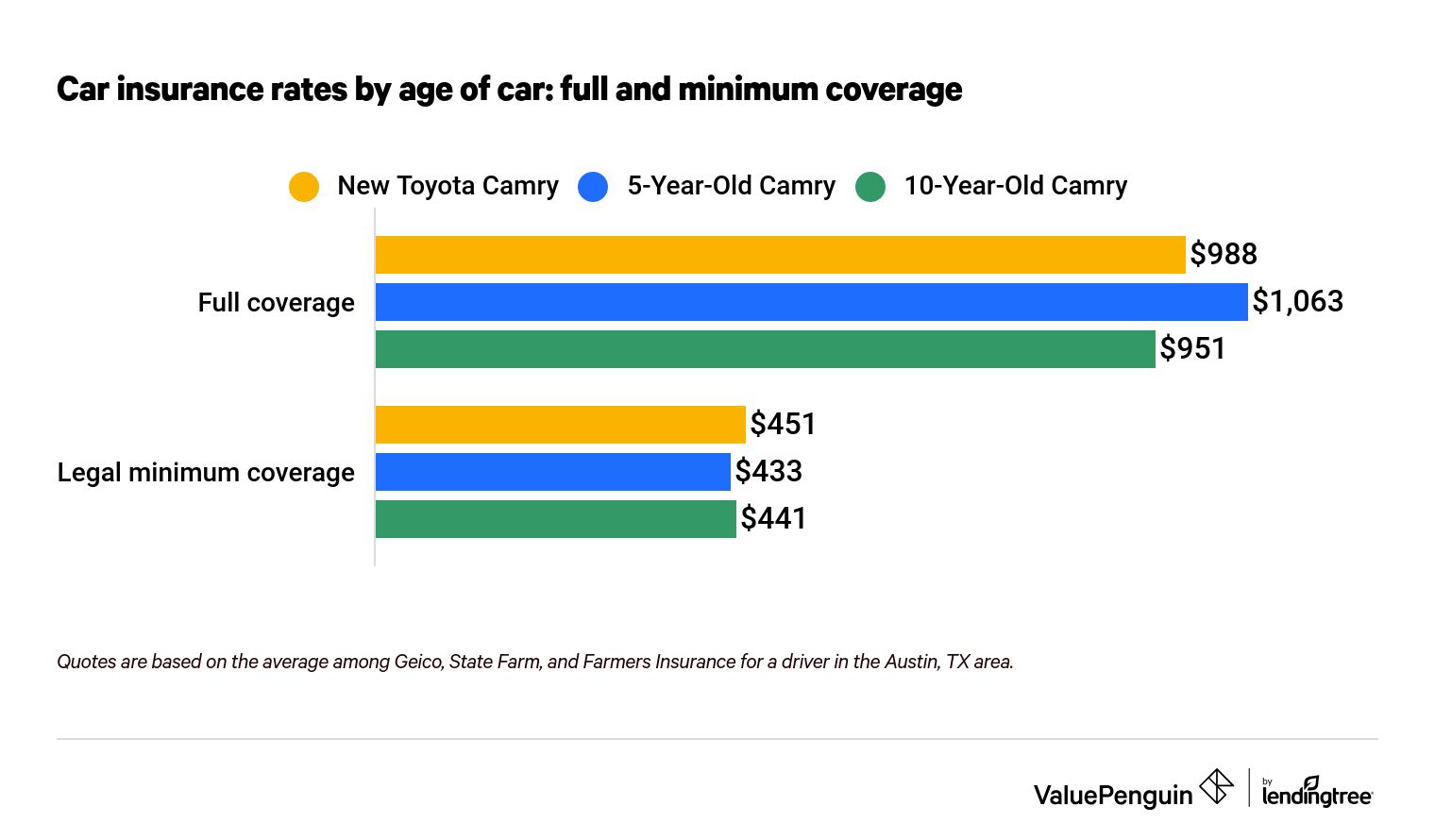

People with older cars typically pay less for car insurance, but the main reason isn't that they're cheaper to insure. Rather, as older vehicles lose their value, drivers often decrease the level of insurance. If you were to keep equivalent levels of coverage, a 10-year-old car is typically only 3% cheaper to insure than a brand-new model.

Find Cheap Auto Insurance Quotes in Your Area

People with older cars commonly remove comprehensive and collision coverages from their policies. For example, the owner of a new Camry might buy a full-coverage policy for $988 over six months. Meanwhile, someone with a 10-year-old Camry may select minimum coverage for just $441.

It can be a sound financial decision to remove comprehensive and collision on an older car and choose liability-only car insurance. This is because the maximum payout you stand to receive from comprehensive and collision coverages goes down as the car loses value.

People buying new cars are also more likely to finance it with a loan or lease, which often requires full coverage. After the car is paid off, the owner may choose to lower coverage to save money.

Why older cars aren't always cheaper to insure

Although insurance for older cars tends to be cheaper, that's not always how it works. An older car may be more expensive to insure than an equivalent new car if it's less reliable or lacks certain safety features.

Full coverage policies

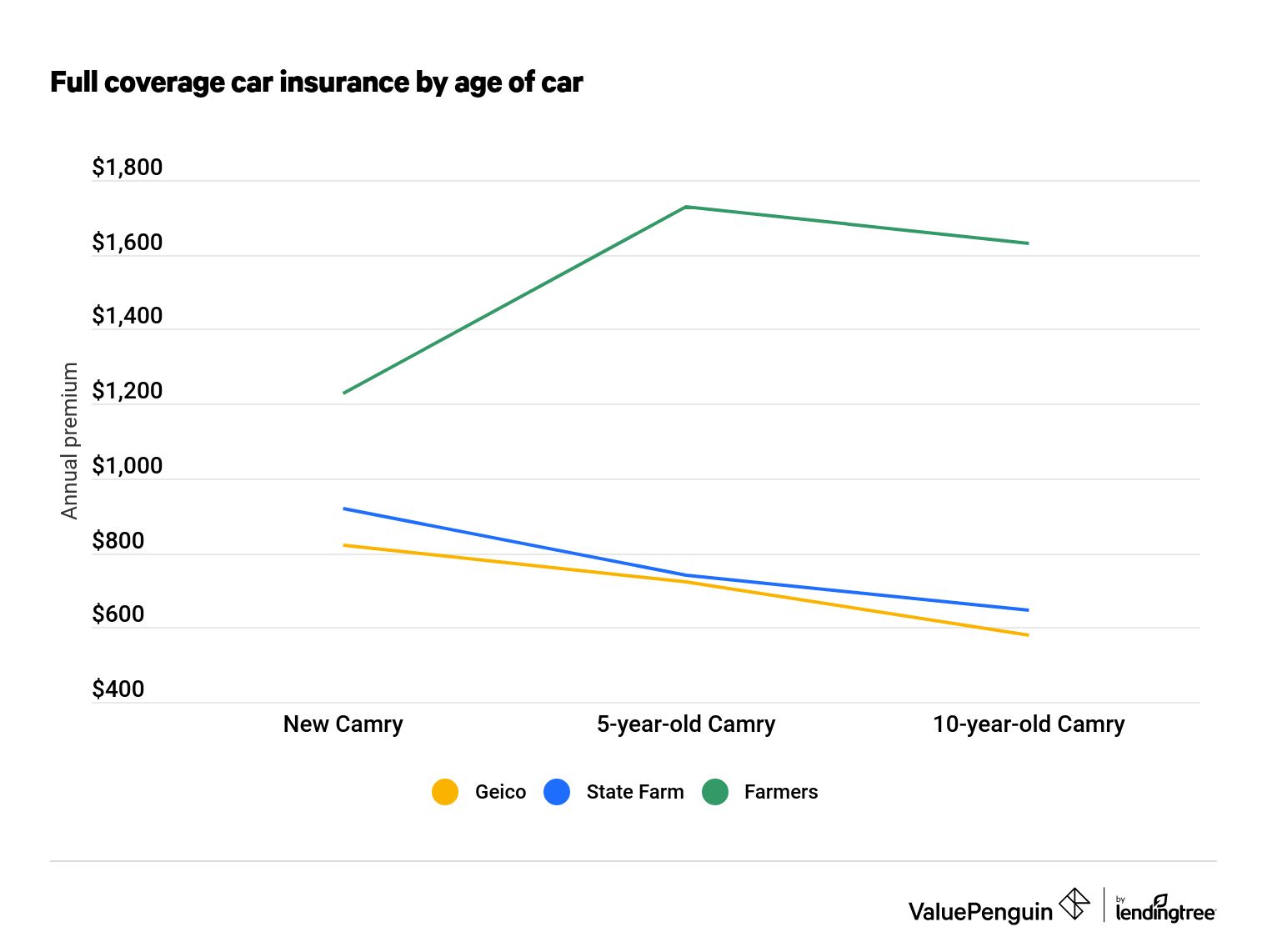

Full coverage insurance typically means having comprehensive and collision coverages — which pay for repairs to your car after an accident — plus whatever liability coverage you pick. When you have full coverage, the rates will likely differ between a new car and a used one. But whether a car becomes cheaper to insure can vary by car model and insurance company.

For example, car insurance for a common inexpensive car, such as a Toyota Camry, is likely to decrease with age: Two-thirds of insurance companies surveyed reduced their rates for older vehicles. Part of this is because as cars age, replacement parts are cheaper and easier to get. But the decreased repair cost could be offset by the lack of safety features in newer cars, such as backup cameras and lane detection, which reduce the likelihood of serious collisions.

Every insurance company calculates rates differently. In this sample, Geico and State Farm both offered quotes that were about 30% cheaper for an older model, while Farmers charged 33% more for an older car. This is why getting multiple quotes can save you a lot of money.

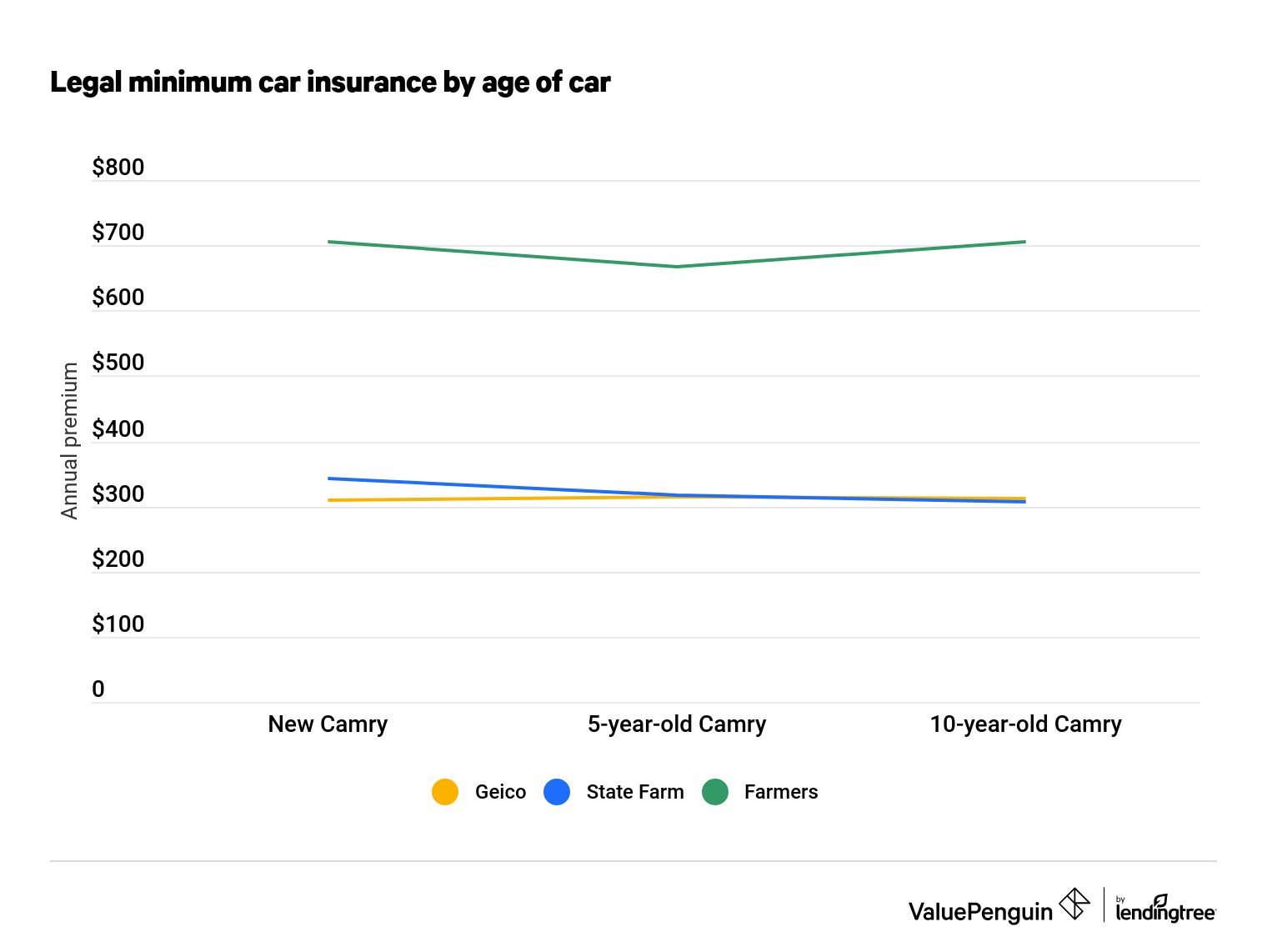

Minimum car insurance rates stay the same over time

For minimum coverage, prices stay nearly the same as your car gets older, since liability-only protection (plus PIP or uninsured motorist coverage in some states) doesn't pay for car repair. So the age of the car doesn't have much to do with the likelihood of an insurance claim, nor the size of a claim.

Insuring a classic or specialty car

Classic and antique cars are insured completely differently from used cars. You may be able to get a regular policy for your classic car, but owners often buy specialty classic car coverage instead. It's designed specifically for collectibles. For example, your car might be insured for a much higher value than its list price, but the policy could have very strict mileage limits. You also might want to consider specialty coverage if your vehicle has been heavily modified beyond the stock configuration, such as for racing.

The best car insurance for used cars

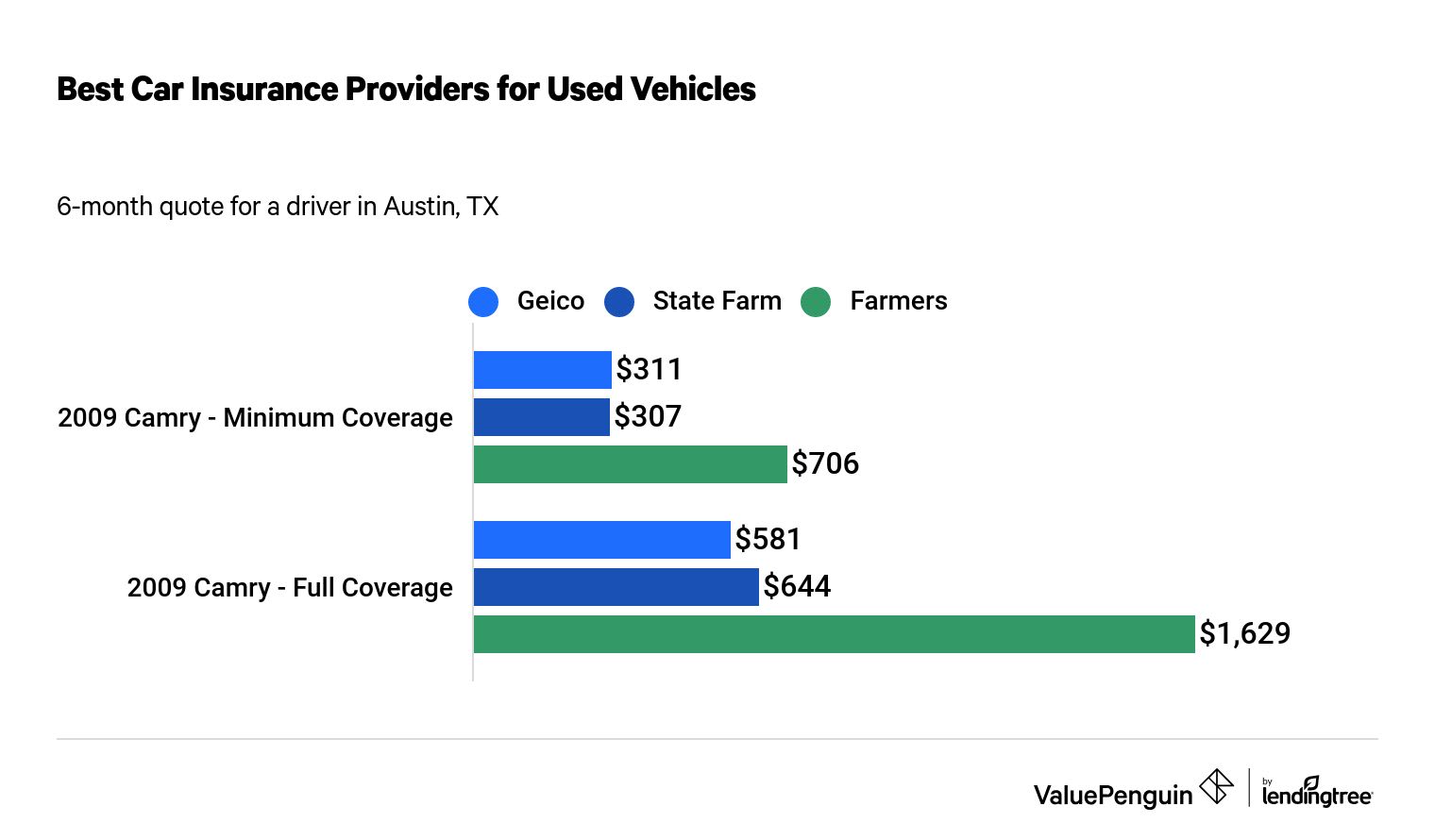

Quotes for a 10-year-old vehicle were collected from three leading companies for both legal minimum and full coverage. Geico had the best prices.

Geico also offers mechanical breakdown insurance for more recent used cars — under 15 months old with 15,000 miles or less on the odometer — which can help pay for repairs. But if your used car is on the older side, it won't qualify.

State Farm deserves an honorable mention for the best discount for an older car: A driver with a 10-year-old Camry will save 25%, compared with someone insuring a new Camry. This may be especially beneficial for drivers who had already gotten a good price from State Farm when their vehicle was new. Compare quotes from multiple companies to find the cheapest rates.

How to get insurance when buying a used car

When applying for car insurance for a used car, you can get a quote online or work with an agent, just as with a new car. Many companies also allow you to buy car insurance online.

You don't need car insurance before you buy a used car. Typically, you'll buy your policy after the old owner has signed over the title and before you register it with your state's DMV. Almost every state requires insurance coverage to register or drive a vehicle.

Remember, car insurance is one of the biggest ongoing expenses of owning a vehicle, alongside gas, maintenance and repairs, so make sure you compare quotes.

When selecting a policy, you'll choose different coverages and limits than you would for a new car. For example, you might select a higher deductible on your comprehensive or collision coverages or skip them entirely, since the possible payout will be lower for an older, lower-value car.

One thing you might want to add is roadside assistance or emergency breakdown coverage, as older cars are more likely to break down.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.