Uninsured Motorist Statistics: Changes by State and Over Time

About 13% of people on the road are uninsured drivers.

Car insurance is required in nearly every state. However, there are around 29 million uninsured drivers in the U.S. That means about one out of every eight drivers doesn't have car insurance.

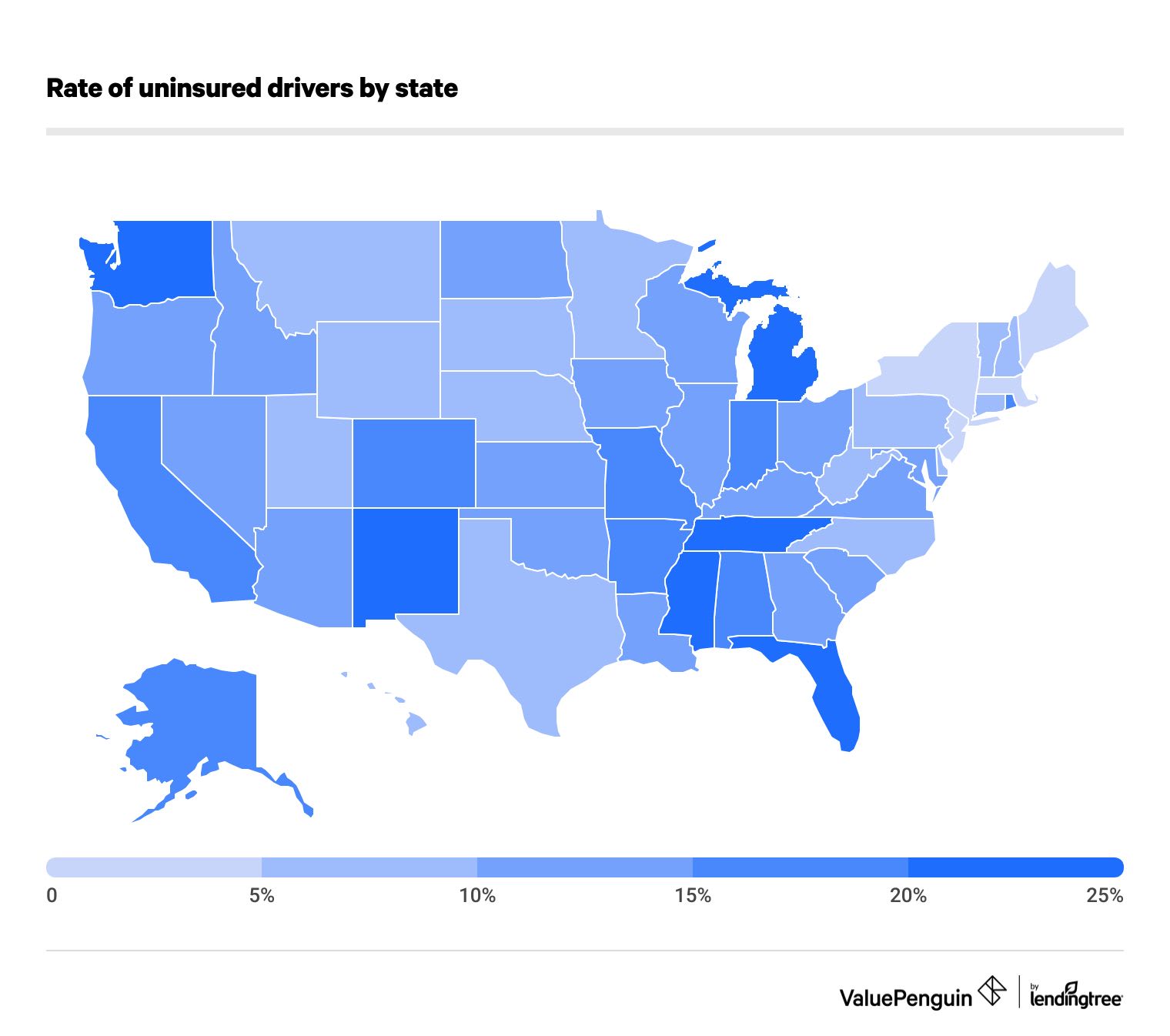

The percentage of uninsured motorists varies by state. In Mississippi, 29% of drivers don't have insurance. In New Jersey, only 3% of drivers are uninsured.

Uninsured motorist rates by state

Mississippi has a higher percentage of uninsured drivers than any other state, with about 29% of people driving without insurance.

Mississippi is one of the cheapest states for car insurance, but it's also the state with the lowest household income. So cost may cause many drivers not to buy insurance.

If you live in a state with a high rate of uninsured drivers, it's a good idea to add uninsured motorist coverage to your auto policy. This means your car insurance will cover you after an accident with a driver who doesn't have insurance.

Uninsured motorists by state

State | Rate of uninsured drivers | 10-year change, in percentage points |

|---|---|---|

| Alabama | 19.5% | -2.5 |

| Alaska | 16.1% | 3.1 |

| Arizona | 11.8% | -0.2 |

| Arkansas | 19.3% | 3.3 |

| California | 16.6% | 1.6 |

The state with the fewest uninsured drivers per capita is New Jersey. Only 3% of drivers in the state are uninsured. That's about a quarter of the national average.

- New Jersey has very low bodily injury liability insurance requirements: just $15,000 per person and $30,000 per accident.

- It is one of the 24 states (including the District of Columbia) that requires drivers to have uninsured motorist insurance.

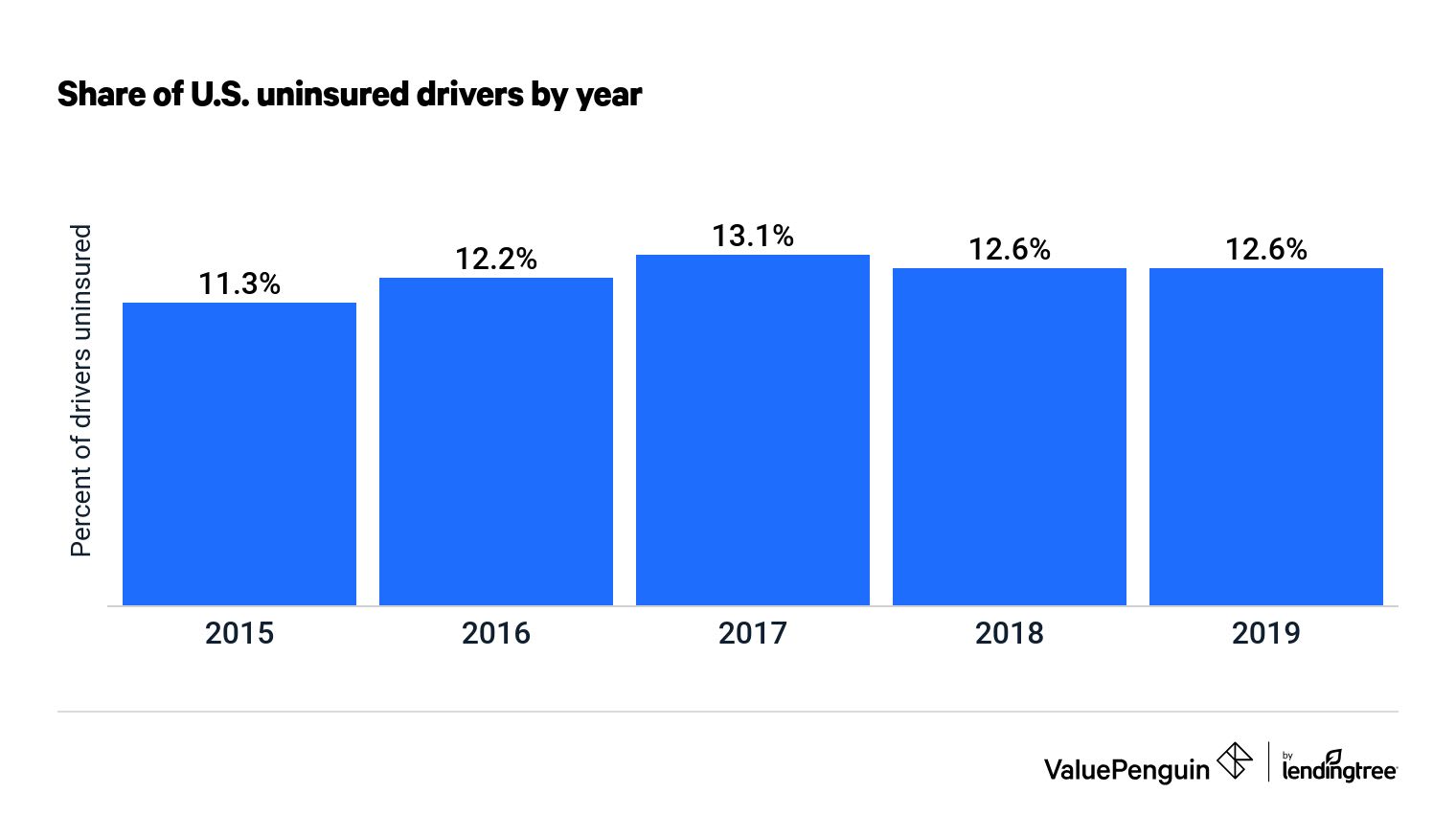

National uninsured motorist rates by year

The rate of uninsured motorists on the road hasn't changed much in recent years. Uninsured driver rates went from 12.3% in 2010 to 12.6% in 2019 — the most recent year data is available. This rate is estimated based on the ratio of uninsured motorist (UM) insurance claims to bodily injury insurance claims.

Penalties for driving without insurance

Being caught driving without insurance can result in extra fees, license suspension, getting your vehicle impounded and even potential jail time. Additionally, if you are in an accident while you are driving without insurance, you can be sued for damage to the other driver's vehicle or their medical bills.

Though penalties vary across all states, you can expect a fine of a few hundred to a thousand dollars for driving uninsured.

State | Fine | Driving privileges | Additional penalties |

|---|---|---|---|

| Florida | $150-$500 | Suspended license and registration for up to three years unless proof of insurance is provided within five days | |

| Michigan | $1,000 ($500 per year for two years) | Driver's license suspended for up to 30 days | Up to one year of jail time |

| Mississippi | $500 | License suspension for one year or until proof of insurance is provided | |

| New Mexico | $300 | Possible vehicle registration suspension | Up to 90 days of jail time |

|

Tennessee | $300 | Driver's license suspension until you provide proof of financial responsibility |

Being an uninsured motorist is different from not having proof of insurance, such as if you left your insurance card at home. Generally, if you have insurance but don't have the proper proof, you are able to avoid a penalty (or at least lessen your penalty) by submitting proof within a certain time period.

State policies to lower the rate of uninsured motorists

States are taking steps to try to reduce the number of uninsured motorists on the road. This includes "no pay, no play" insurance laws, insurance verification systems and random selection programs.

"No pay, no play" laws

In "no pay, no play" states, there is a limit on how much uninsured drivers can collect if another driver crashes into them. States with "no pay, no pay" laws include:

- Alaska

- California

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Missouri

- New Jersey

- North Dakota

- Oregon

"No pay, no play" laws often limit uninsured drivers from suing for pain and suffering, also called noneconomic damages. In other words, only drivers who pay for insurance can get this compensation.

These laws don't limit the ability of uninsured drivers to sue for economic damages, such as medical bills or vehicle repairs.

These laws are meant to encourage uninsured drivers to get a policy. However, states with "no pay, no play" laws actually have slightly higher rates of uninsured drivers — 13.7% compared to 12.2%.

Insurance verification systems

In some states, insurance companies must notify the DMV or state transportation office when a car insurance policy lapses or is canceled. This helps law enforcement identify uninsured motorists who are on the road.

States that have implemented online insurance verification systems include:

- Alabama

- Connecticut

- Georgia

- Louisiana

- Idaho

- Ohio

- Mississippi

- Montana

- Nevada

- Oklahoma

- South Carolina

- Tennessee

- Rhode Island

- Texas

- West Virginia

- Wyoming

- Utah

States that require uninsured motorist coverage

Nearly half of U.S. states require drivers to have uninsured and underinsured motorist coverage. With this coverage, the insurance company pays for your car repairs and medical bills if you're hit by a driver who doesn't have insurance.

There are two forms of uninsured motorist coverage:

- Uninsured motorist bodily injury (UMBI)

- Uninsured motorist property damage (UMPD)

States typically only require UMBI to cover injuries and medical bills. But some, such as the District of Columbia, also require UMPD coverage to cover car repairs.

States where uninsured/underinsured motorist coverage is required

Frequently asked questions

Which states have the highest rates of uninsured drivers?

Mississippi has the highest rate of uninsured drivers, at almost 30%. In Michigan, New Mexico, Tennessee, Washington and Florida, more than 20% of drivers don't have car insurance.

Are there more uninsured drivers on the road?

Nationally, the rate of uninsured drivers has not changed over the past decade. However, the largest increases in uninsured motorists have occurred in Idaho, Michigan, Washington and the District of Columbia. States that have had the biggest decrease in uninsured motorists are New Jersey, North Carolina, Oklahoma and Texas.

How much does uninsured motorist coverage cost?

The cost of uninsured motorist coverage is between $3 and $6 per month for a policy that covers injuries up to $25,000 per person and up to $50,000 per accident.

Methodology and sources

Uninsured driver rates were calculated by the Insurance Research Group by comparing rates of liability insurance claims and uninsured motorist claims in the U.S.