Can You Get Tiny Home Insurance?

Find Cheap Homeowners Insurance Quotes in Your Area

Tiny houses are popular partly because they don't fit the mold of a traditional home. But that also means regular homeowners insurance usually isn't the right fit. When it comes to insurance, tiny houses fall somewhere between mobile/manufactured homes and recreational vehicles (RVs). So, there isn't one type of insurance that's right for every tiny house.

Your insurance needs and cost will largely depend on whether you plan to regularly move your tiny house. And things get even more complicated if you build the house yourself: DIY houses may call for a specialty insurance company that offers coverage that matches your custom tiny home.

Do I need insurance for my tiny house?

The law doesn't generally require you to have insurance for your tiny house. But your lender might, if you finance your tiny house with a mortgage or other loan. Also, most states require you to have liability coverage for your home while it's on the road, like an RV does.

Even if it's not necessary, buying coverage for your tiny home is smart. Tiny houses can cost $10,000 to $100,000 to build, and insurance will help you protect your investment.

Tiny houses on wheels are especially vulnerable, because they can be stolen. They're also exposed to more wear and tear than a tiny house that stays in one place. Havingenough insurance coverage will give you peace of mind so you can enjoy your tiny house.

What kind of insurance should I get for my tiny home?

Tiny house insurance depends on your house's design and size. No matter what policy you buy, make sure you get coverage for the structure of the home and the property inside it. You'll also need liability insurance to protect yourself financially if someone is injured in the house.

Insurance for a tiny house that you want to move

If your tiny house is on a trailer frame, and you plan to move it more than a few times, look into RV insurance. This type of policy can cover homes designed to be regularly moved.

RV insurance is available from many national companies and covers your tiny home whether it's parked or moving. RV policies cover your tiny house and the property inside it.

However, there are some limitations to typical RV insurance policies. Crucially, they usually require the home or RV to be professionally constructed and certified by the RV Industry Association (RVIA). So if you build your tiny home yourself, you may not qualify for RV coverage.

Another issue with RV insurance is that it's sometimes designed to apply to a vacation home, not your primary residence. If you live in your tiny house full-time, you may need an endorsement or a policy that allows you to use it as your primary home.

Insurance for stationary tiny houses

If your tiny house is permanently installed in a single location, your best option is to cover your home with manufactured/mobile home insurance. You may be able to go this route even if your tiny house has wheels, as long as you understand how that will affect your insurance coverage.

If you buy mobile home insurance for your tiny house, the structure of your home and property inside will be covered from most hazards. You'll usually get liability coverage, which protects you financially if someone is injured in your tiny home. However, some mobile home insurance has limited fire coverage, given the compact size and high chance of a fire burning down the whole house before it can be contained.

Also, the coverage doesn't protect you while your tiny house is connected to your vehicle's trailer hitch or on the road. Anytime you move your tiny house, you'll need to buy a travel endorsement or separate temporary coverage. This is especially true if it's not covered by your car insurance — and tiny houses usually aren't. You'll also need to let your insurance company know every time you move your tiny house to a new location, so they can update your policy.

Insurance for a tiny house you build yourself

Many people go the DIY route when building a tiny house, but that can make it harder to insure. Companies often hesitate to provide coverage, especially if the DIY home is on wheels. So you may have to buy specialized insurance from an agency that sells coverage just for tiny homes. But make sure the policy is backed by a reputable insurance company, such as Lloyd's or Chubb.

Most specialty insurance agents require photos of the completed tiny house, along with pictures of wiring and plumbing. Taking these during your home's construction will save you work later. Some companies also require a walk-through inspection to make sure the house meets safety requirements.

How much does tiny home insurance cost?

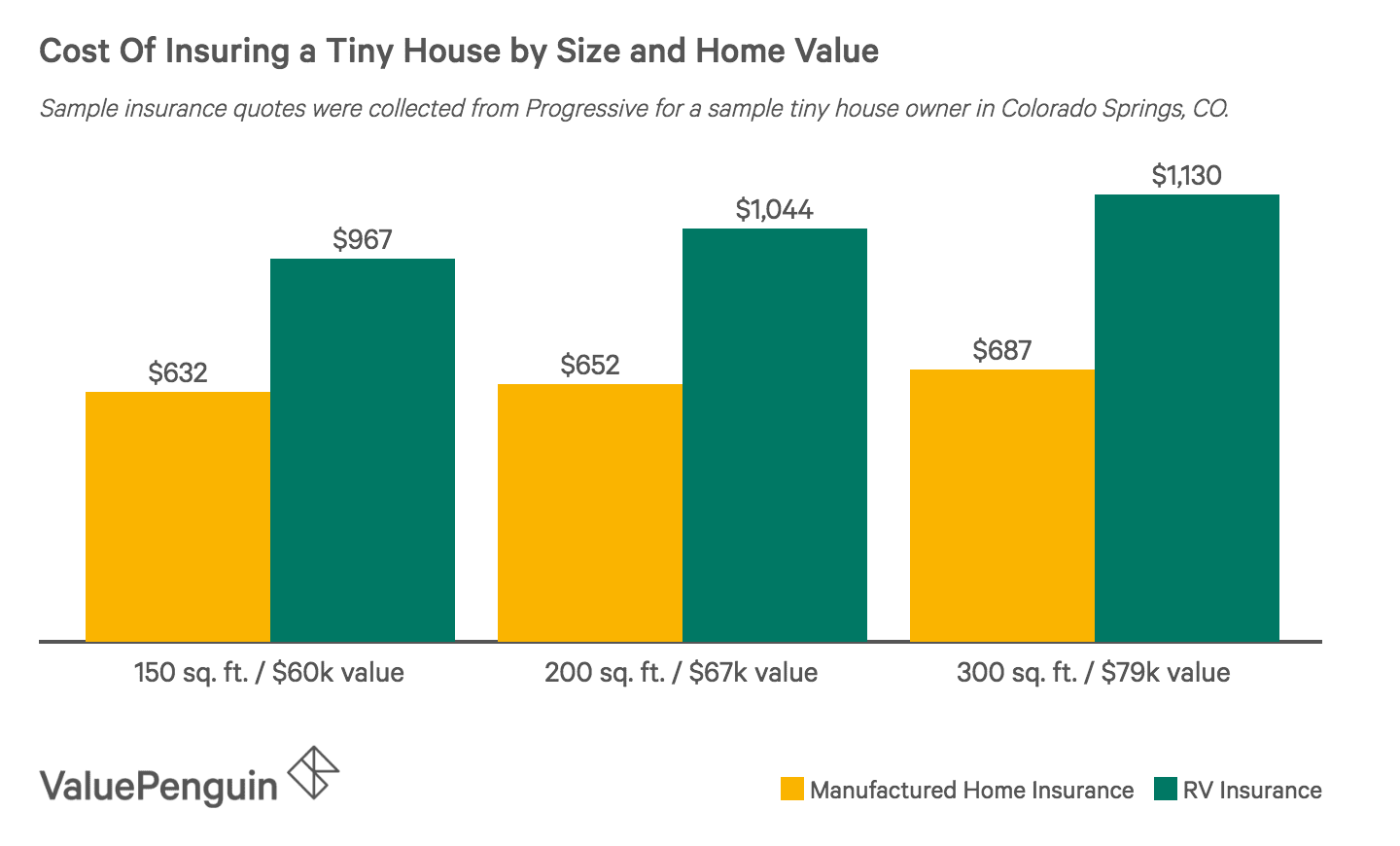

The cost to insure a tiny home can vary a lot by the type of insurance you choose and the house's size and value. The information in this article is based on quotes for three different houses, so you can see how the size and cost of a tiny home can affect insurance rates.

The average rate for tiny house insurance was $852 per year. Overall, the biggest price difference was between RV insurance and manufactured home insurance. RV insurance cost an average of 59% more.

The size and value don't have as much of an impact on your annual insurance premium. A tiny house that's twice as big only costs 14% more to insure.

The difference in price between RV and manufactured home coverage is due to RV insurance protecting the home even as you move it around the country. Your tiny home may be eligible for both manufactured/mobile home insurance and RV insurance. If so, consider whether the ability to move your home freely is worth the price increase.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.