Best Cheap SR-22 Insurance Rates in Wisconsin

American Family and Progressive offer the cheapest SR-22 insurance in Wisconsin.

Find Cheap SR-22 Auto Insurance Quotes in Wisconsin

Wisconsin drivers that have had their driver’s license revoked or suspended — often due to serious tickets, such as a DUI or reckless driving — may be required to get SR-22 insurance coverage. Drivers under 18 without a sponsor also need SR-22 insurance.

An SR-22 form filing provides legal proof that your insurance meets Wisconsin's minimum personal liability insurance requirements. An insurance company must file the SR-22 form on your behalf and will often charge a fee of less than $50.

However, drivers who need an SR-22 insurance policy typically pay much more because people with past driving tickets are considered high-risk to insure.

Best SR-22 insurance in WI

Cheap SR-22 insurance in Wisconsin

American Family and Progressive offer the cheapest rates for Wisconsin drivers who need SR-22 insurance.

SR-22 insurance is usually more expensive than a standard car insurance policy for two reasons: a fee and the increased chances of a future claim.

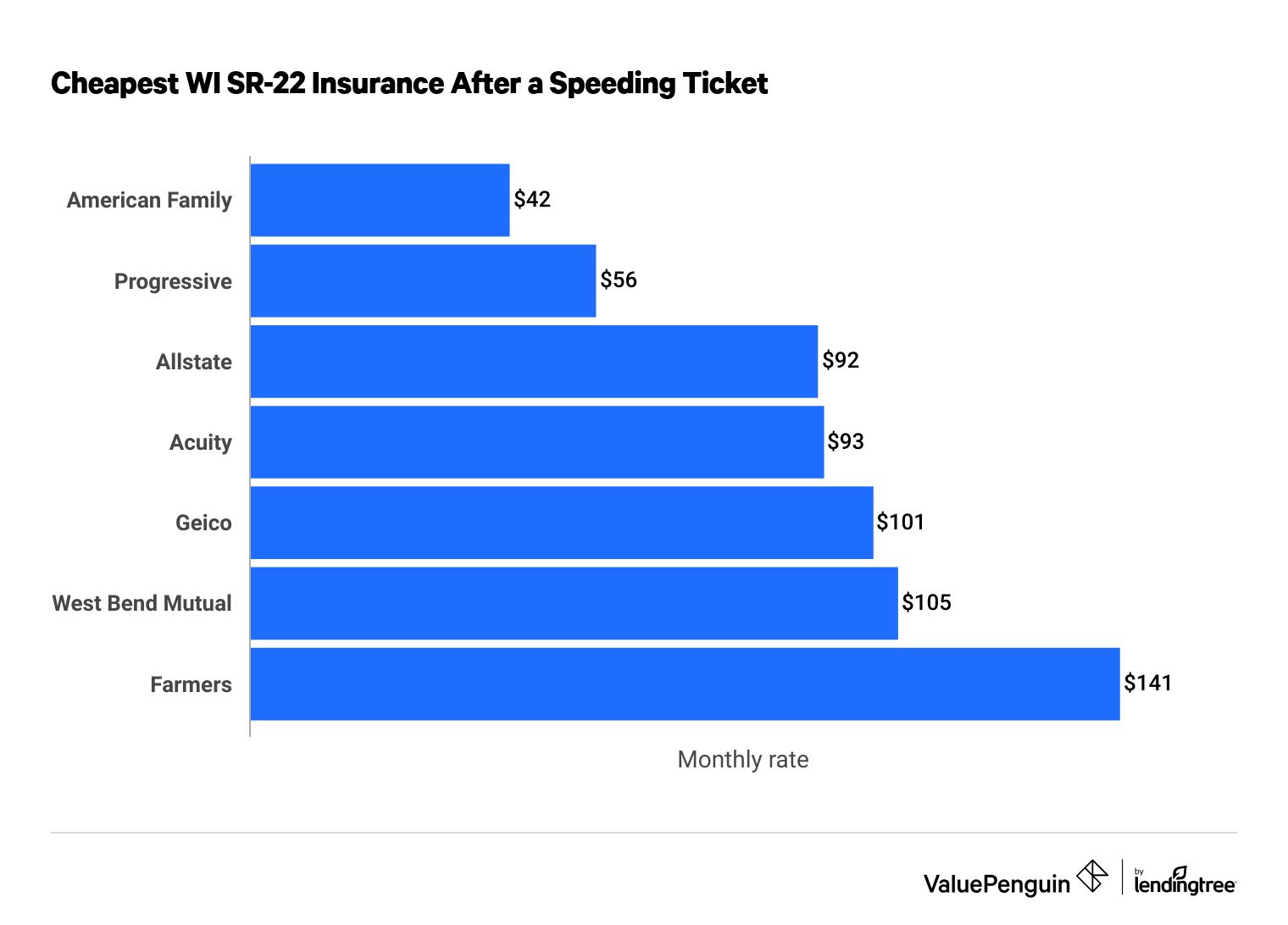

SR-22 for multiple speeding tickets

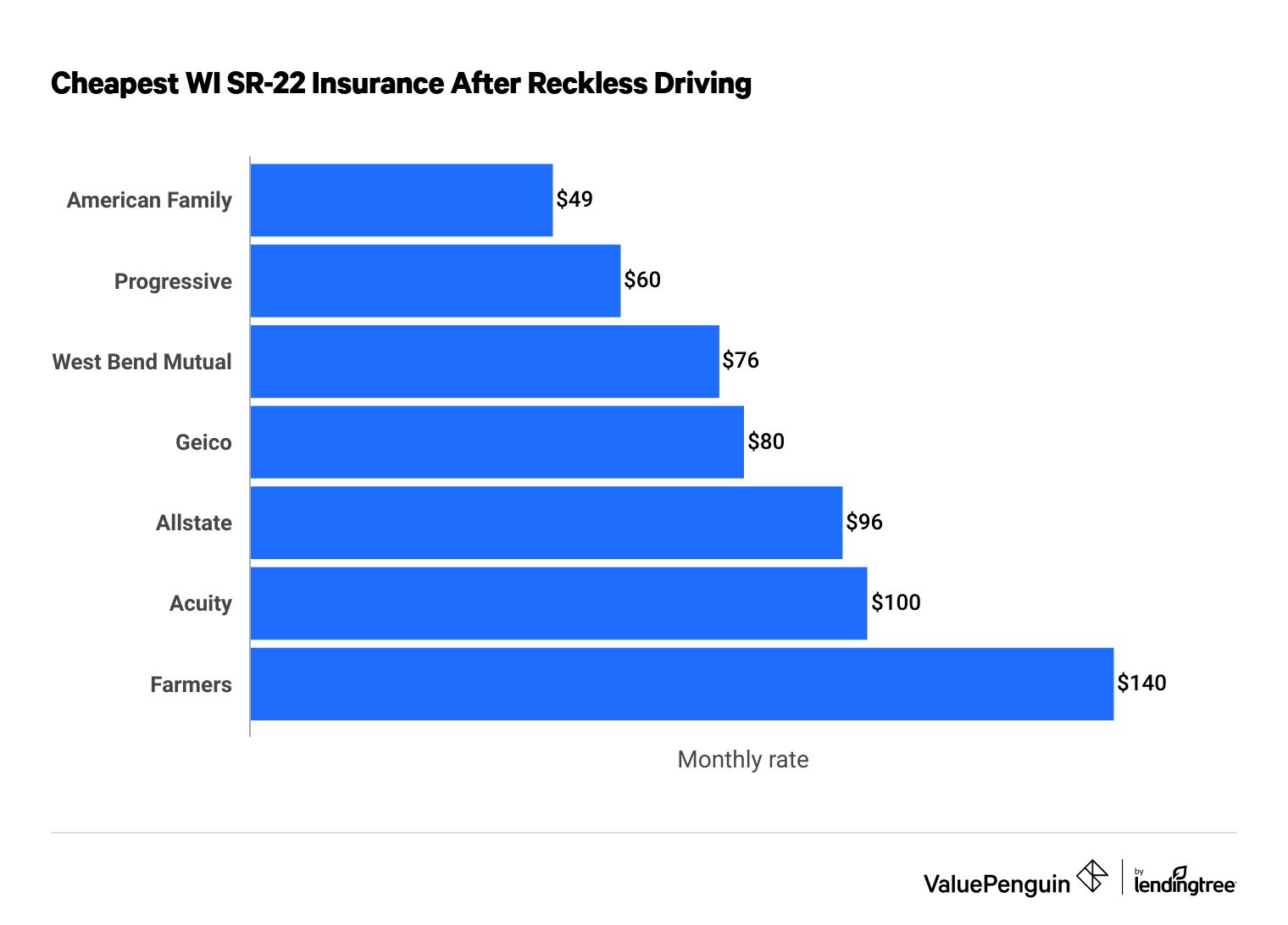

SR-22 for reckless driving

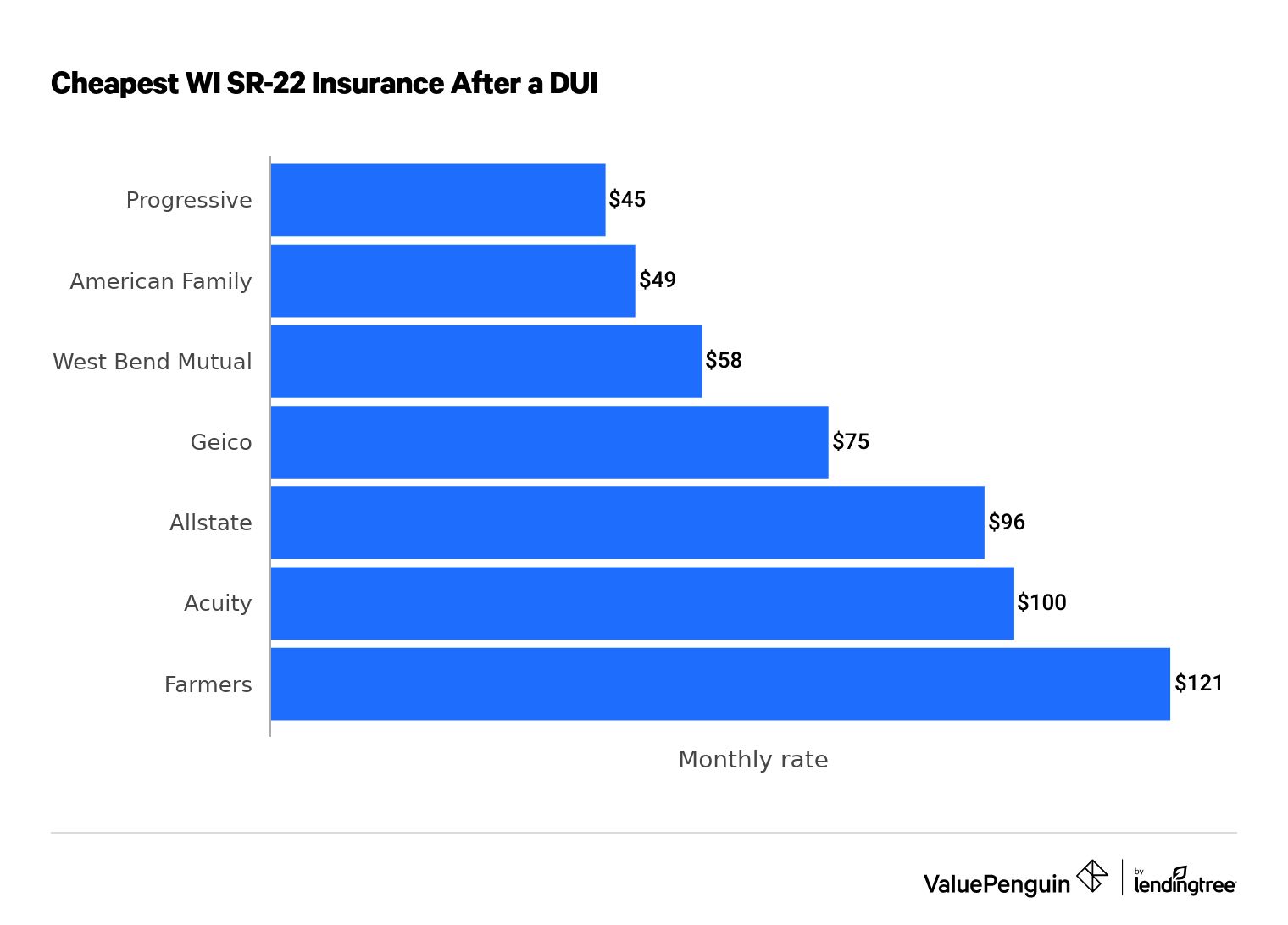

SR-22 for DUI

American Family has the cheapest SR-22 insurance in Wisconsin if you've been caught speeding multiple times, at $42 per month.

SR-22 insurance in Wisconsin after multiple speeding tickets

Company | Monthly rate | |

|---|---|---|

| American Family | $42 | |

| Progressive | $56 | |

| Allstate | $92 | |

| Acuity | $93 | |

| Geico | $101 |

SR-22 for multiple speeding tickets

American Family has the cheapest SR-22 insurance in Wisconsin if you've been caught speeding multiple times, at $42 per month.

SR-22 insurance in Wisconsin after multiple speeding tickets

Company | Monthly rate | |

|---|---|---|

| American Family | $42 | |

| Progressive | $56 | |

| Allstate | $92 | |

| Acuity | $93 | |

| Geico | $101 |

SR-22 for reckless driving

American Family is the cheapest insurer after a ticket for reckless driving. At $49 per month, it's 43% less expensive than the typical insurer in Wisconsin.

SR-22 insurance in Wisconsin after reckless driving

Company | Monthly rate | |

|---|---|---|

| American Family | $49 | |

| Progressive | $60 | |

| West Bend Mutual | $76 |

| Geico | $80 | |

| Allstate | $96 |

SR-22 for DUI

Progressive is the least expensive insurer for SR-22 insurance after a DUI. It offers basic coverage for $45 per month, or 42% less than the state average of $78 per month.

SR-22 insurance in Wisconsin after a DUI

Company | Monthly rate | |

|---|---|---|

| Progressive | $45 | |

| American Family | $49 | |

| West Bend Mutual | $58 |

| Geico | $75 | |

| Allstate | $96 |

Find Cheap SR-22 Auto Insurance Quotes in Wisconsin

The basic price of SR-22 insurance is the fee charged when your insurance company files the SR-22 form on your behalf. Insurers usually charge a nominal fee between $15 and $50. However, SR-22 insurance policies often end up costing more than typical auto insurance coverage if the SR-22 filing is required due to previous driving tickets, such as a DUI or repeated traffic offenses.

The average cost of car insurance in Wisconsin is $36 per month for liability-only coverage. A DUI alone can increase car insurance rates by about 61%, depending on your exact location and insurance provider.

To find the cheapest rate for SR-22 insurance in Wisconsin, you should shop around for SR-22 quotes from multiple insurers. Insurance companies assess risk differently and charge different prices accordingly, so searching for multiple quotes is often the best strategy to find cheap SR-22 insurance.

You should also ask about potential discounts, as drivers are often eligible for cost reductions based on their vehicle type, driving record, participation in a defensive driving course, being a good student and much more.

When is an SR-22 required in Wisconsin?

Generally, you need an SR-22 after repeated or serious driving violations, especially if your driver's license has been revoked.

You may be required to file an SR-22 if you're in one of the following situations:

- To reinstate a driver's license after driving privileges have been revoked or suspended, an accident with unpaid damages of $500 or more or violation of the uninsured motorists/safety responsibility law.

- To acquire an occupational license, or a restricted driver's license, that enables citizens to continue their employment and household duties after having their driving privileges revoked.

- To drive under the age of 18 without a sponsor. In Wisconsin, all drivers under 18 are required to have a sponsor to get a driver's license or instructor's permit — except in certain cases when an SR-22 can be filed instead.

What is SR-22 insurance in Wisconsin?

Filing an SR-22 form in Wisconsin provides proof of insurance coverage by demonstrating that you meet the minimum liability insurance coverage requirements in Wisconsin.

- $25,000 bodily injury (BI) coverage per person injured in an accident

- $50,000 BI coverage per accident

- $10,000 property damage coverage

Serious driving violations such as DUIs or DWIs, hit-and-runs or reckless driving can result in revocation or suspension of a driver's license, as well as the need for an occupational license.

How long is SR-22 insurance coverage required in Wisconsin?

In Wisconsin, drivers are usually required to hold SR-22 insurance filings for three years from the date their licenses are eligible to be reinstated. Insurance companies will notify the Wisconsin DMV if you cancel or don’t renew your SR-22 policy. Letting SR-22 coverage lapse can result in the loss of driving privileges, reinstatement fees and an increased cost of car insurance.

To avoid a lapse in coverage, we recommend renewing your policy early — usually at least 30 days in advance — during the three years you're required to carry SR-22 insurance.

Once you've carried SR-22 coverage for more than three years following the date of license reinstatement eligibility, contact the Wisconsin Department of Transportation (DOT) to verify that your requirement is complete. If it is, contact your insurance provider to inform the company that an SR-22 filing is no longer required.

How do I get SR-22 insurance coverage in Wisconsin?

To get SR-22 insurance coverage in Wisconsin, you’ll need to work with a car insurance company licensed to do business in the state.

Find an eligible insurer or contact your current carrier. Not all insurance companies provide SR-22 coverage, so confirm your current provider does or find a new provider that will file the SR-22 form on your behalf. If you're filing an SR-22 form as an under-18 driver, let the insurance company know that the filing is in lieu of sponsorship, meaning that you're applying for coverage to drive without a parent or guardian as a sponsor.

Pay the appropriate SR-22 fee. When your insurer files the SR-22 form on your behalf, it will typically charge a flat fee between $15 and $50 in addition to your standard rates.

Have an insurer file proof of insurance on your behalf. Your insurance company will file the SR-22 form directly, usually via mail or electronically with the Wisconsin Department of Transportation (DOT). Electronically filed SR-22 certificates should be reflected on your driving record within a few business days.

Get confirmation from the DMV. Upon processing the SR-22 form, the DMV should send you a letter confirming proof of insurance coverage and that you’re legally eligible to drive.

Frequently asked questions

How much does an SR-22 cost in Wisconsin?

An SR-22 filing usually costs between $15 and $50 in Wisconsin. However, your car insurance rates will likely go up because of the violation that caused you to need SR-22 insurance.

For example, minimum coverage SR-22 insurance costs an average of $90 per month if you've been caught speeding multiple times. That's a little more than double what a driver with a clean record pays.

How long is an SR-22 required in Wisconsin?

SR-22 insurance is usually required for three years in Wisconsin. The length can vary depending on the reason you need to file proof of insurance, so you should check with the DMV to confirm how long you need to keep your SR-22 in place.

How much is SR-22 insurance in Wisconsin?

Minimum coverage SR-22 insurance costs $78 per month for Wisconsin drivers with a DUI, on average. Progressive offers the cheapest SR-22 rate, at $45 per month.

Methodology

To find the best cheap SR-22 car insurance rates in Wisconsin, ValuePenguin gathered quotes from seven of the top companies in the state. Rates are for a 30-year-old single man with good credit who drives a 2015 Honda Civic EX.

SR-22 rates include the minimum liability limits required in Wisconsin.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.