Homeowners of America Insurance Company Review: Good Rates, Troublesome Reviews

The lower your home insurance policy limits, the more competitive the rates tend to become.

Find Cheap Homeowners Insurance Quotes in Your Area

Homeowners of America Insurance Company (HOAIC) is an affordable home insurance company with limited availability, good endorsement options and restricted discounts. HOAIC may be a decent choice if you’re only interested in finding the cheapest rates and you live in one of the 20 states where it operates.

Pros and cons

Pros

Affordable rates for homes under $200,000

Offers pet coverage

Cons

Unproven customer service

Only available in 20 states

Homeowners of America: A young company offering affordable rates

Bottom line: HOAIC provides good rates and a good set of endorsement options for consumers who do not mind that it's an unproven insurance company. All other prospective policyholders should look for a more reputable company.

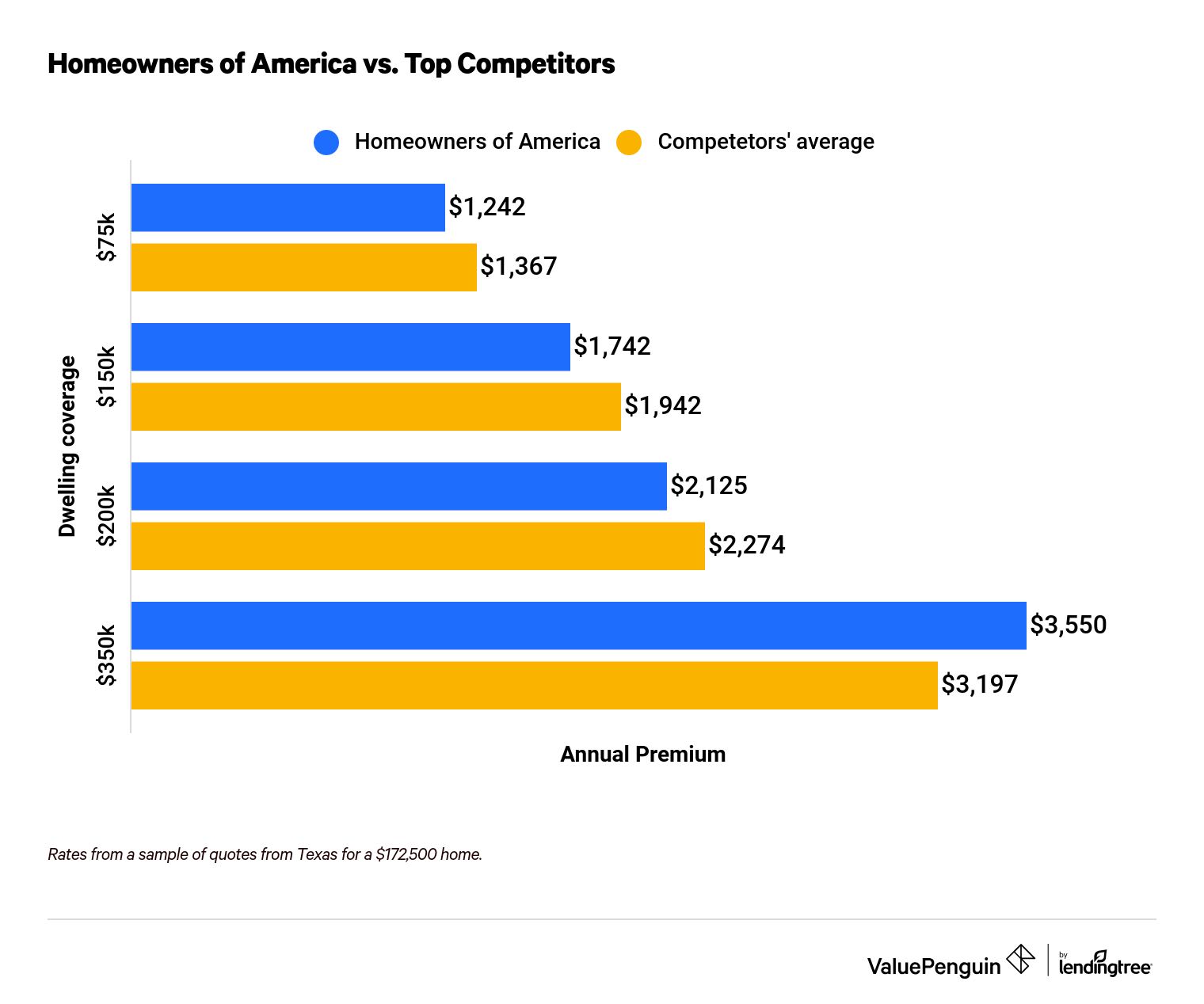

Homeowners of America Insurance Company’s best feature is its competitive pricing across a wide set of coverage limits. For those who live in one of the company’s covered states, HOAIC should be one of the cheaper insurance companies in the area. Compare annual home insurance rates between HOAIC and the average of three competitors: State Farm, Allstate and Texas Farm Bureau.

Find Cheap Homeowners Insurance Quotes in Your Area

Average home insurance rates by coverage amount

Company | $150k | $200k | $350k |

|---|---|---|---|

| Homeowners of America | $1,742 | $2,125 | $3,550 |

| Competitors' Average | $1,942 | $2,274 | $3,197 |

Home insurance is meant to protect you from losses and damages to your home, which is likely the largest purchase you’ll ever make. HOAIC was founded in 2005, meaning that it is a relatively new company. To put its age into perspective, both Farmers and State Farm are more than 100 years old.

Since policyholders complain about claims and suddenly canceled policies, the company’s reliability comes into question — which may not necessarily be due to its age. However, its relative youth combined with concerning customer reviews make it difficult to recommend the company to most people.

Consumers who prefer to work online should be aware that Homeowners of America Insurance Company doesn’t provide direct quotes to customers. But, if you prefer to work with an in-person agent, you can contact HOAIC directly to be referred to an independent agent in your area.

Homeowners of America Insurance quotes comparison

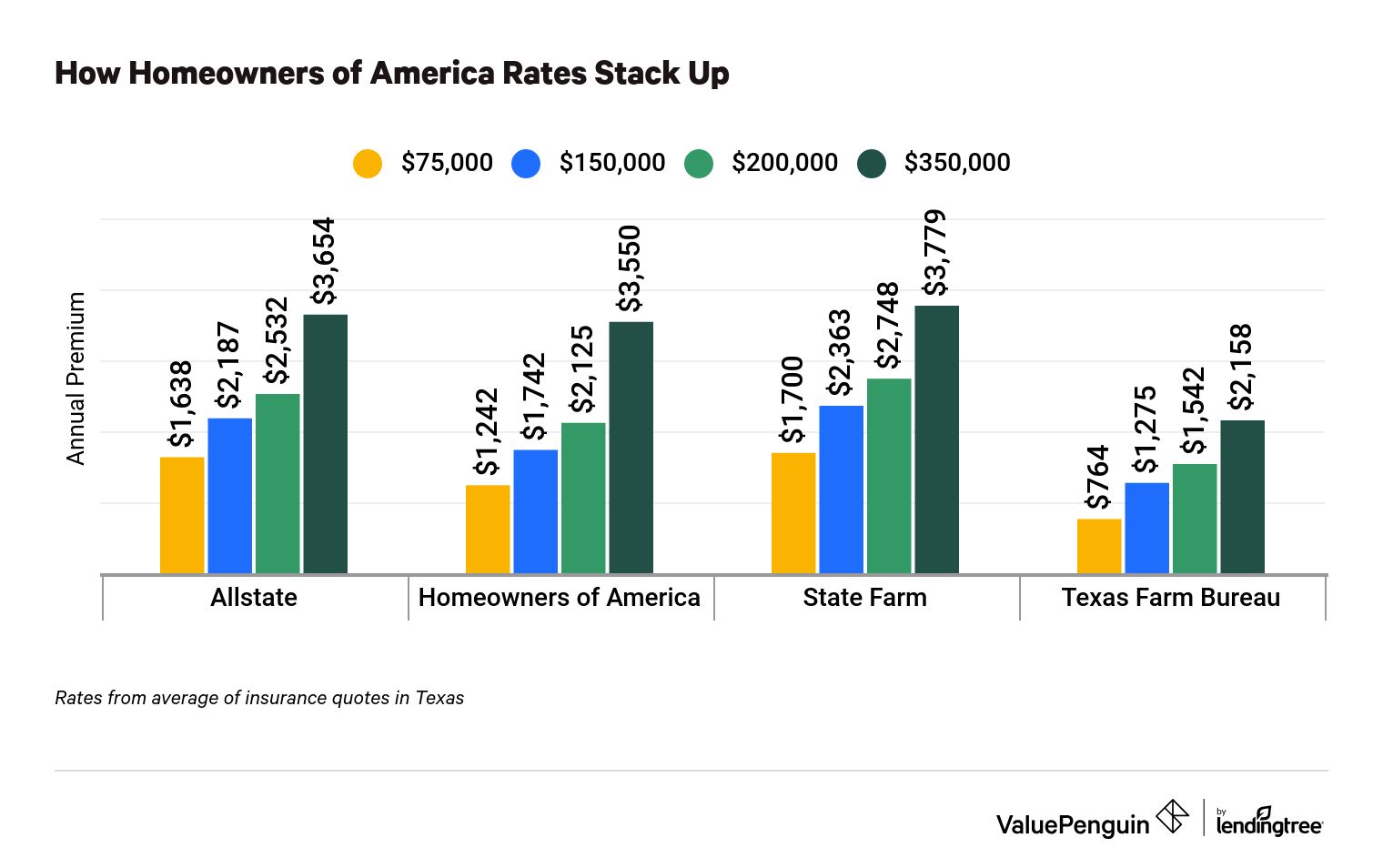

HOAIC’s home insurance rates are more competitive the lower the limit on the policy you’re looking for. At higher limits, it was still slightly less than Allstate or State Farm.

The company quoted an annual home insurance rate that was $200 per year less than the average of its competitors for a policy with a limit of $200,000. For a $350,000 coverage limit, the difference between Homeowners of America Insurance Company’s quote and the average of its competitors was $353, with Homeowners of America being the most expensive.

Although Homeowners of America is cheaper than Allstate and State Farm at every limit, Texas Farm Bureau has rates lower than HOAIC. We recommend gathering quotes from multiple companies since average rates for home insurance vary by state, among other factors.

Find Cheap Homeowners Insurance Quotes in Your Area

Homeowners of America Insurance rates vs. competitors

Company | $75,000 coverage | $150,000 coverage | $200,000 coverage | $350,000 coverage |

|---|---|---|---|---|

| Allstate | $1,638 | $2,187 | $2,532 | $3,654 |

| Homeowners of America | $1,242 | $1,742 | $2,125 | $3,550 |

| State Farm | $1,700 | $2,363 | $2,748 | $3,779 |

| Texas Farm Bureau | $764 | $1,275 | $1,542 | $2,158 |

Discounts offered by Homeowners of America

Homeowners of America Insurance Company offers a typical number of discounts to its policyholders. However, the availability of the discounts will depend on the state where you reside. For example, Texas homeowners have all but one discount available to them, while South Carolina homeowners are limited to five discounts.

Discount | How do you receive it? |

|---|---|

| Accredited builder | Added to your home policy if your home is less than five years old and was constructed by an accredited builder . |

| Advanced shopper | Receive a quote at least one day before the effective date of the policy you sign up for. |

| Claim-free renewal | Automatically receive a discount on insurance policy renewals if you’re claim free. |

| Companion product | Purchase another form of insurance from HOAIC. |

| New purchase | Automatically added to your policy when you purchase a new home. |

Homeowners of America Insurance coverage options

Homeowners of America Insurance Company offers more than the standard set of coverage options with its home insurance policies. HOAIC bolsters its standard coverage with various endorsements — such as equipment breakdown, inland flood coverage, cyber coverage, pet coverage, replacement cost for personal property, increased jewelry, watches and fur coverage and mortgage protection coverage.

Equipment breakdown

Equipment breakdown coverage will cover the costs of costly equipment breakdowns of kitchen appliances, pool equipment, water heaters and air conditioners. Coverage is for up to $100,000, with up to $10,000 in coverage for spoiled goods as a result of equipment breakdowns.

Cyber Home Advantage Privacy Insurance

Consider adding this endorsement to your home insurance policy if you’re concerned about identity theft or cyber attacks. The endorsement provides policyholders with up to $50,000 in reimbursements for applicable expenses, such as legal fees. A $100 deductible will apply before any reimbursements are made.

Mortgage protection coverage

If your home is destroyed and must be rebuilt, this will cover the increase in monthly mortgage costs associated with the loss of the home. The reimbursement is capped at $250 a month and $10,000 total. The endorsement also covers up to $2,000 in reimbursement for mortgage acquisition costs associated with rebuilding a home at the same location.

Pet coverage

If you’re worried about your pet, this will cover kenneling in the event that your family is temporarily displaced. It also covers vet charges or burial expenses if your pet is injured or killed because of damage to your home.

Replacement cost coverage

Replacement cost for personal property allows you to get the amount needed to replace items lost in an accident or incident. That means instead of getting the amount they would be worth at the time of loss, which factors in depreciation, you will be able to replace the items with up-to-date versions.

Valuable items coverage

This endorsement provides coverage for your valuables up to $5,000 on top of your basic coverage in the event of a covered loss. The increased jewelry, watches and furs endorsement is lackluster when evaluated among comparable offerings from other companies. Both State Farm and Farmers provide endorsements that reimburse policyholders for the entire value of the aforementioned items in the event of a covered loss. Depending on the value of your items, HOAIC’s endorsement might only cover one or two mid-range items.

Homeowners of America Insurance offers the following standard coverage limits:

Coverage | Limit |

|---|---|

| Dwelling coverage | $50,000 to $1,000,000 |

| Personal property | Up to 75% of your dwelling coverage |

| Loss of use | 20% of your dwelling coverage* |

| Medical payments | $500 to $5,000 |

| Personal liability | $25,000 to $500,000 |

| Other structures | Up to 20% of your dwelling coverage |

Limits are based on an HO-3 policy

Homeowners of America reviews and insurance ratings

Customer reviews of HOAIC trend toward being negative. Customers complain about a slow and unresponsive claims department. That said, customer complaints about the claims process are common among most insurance companies.

Filing a claim with Homeowners of America

If you need to file a claim with Homeowners of America, you can do so by calling 1-866-407-9896. You can also e-mail the claims department or submit an online form through the claims center. An HOAIC representative will follow up with you in regards to the claim.

Homeowners of America customer complaints and financial strength ratings

HOAIC has a low average number of customer complaints. The National Association of Insurance Commissioners (NAIC) gave HOAIC a complaint rating of 0.30, approximately 0.70 less than the national median, meaning that in the last year, HOAIC received substantially fewer complaints than the typical insurance company.

An insurance company's financial strength is important for prospective policyholders because it points to the company’s ability to pay out claims. HOAIC isn’t currently rated by A.M. Best Rating Services, the rating service used by most insurers. The company did receive an A rating (exceptional) for financial stability from Demotech, a different rating service.

Methodology

Sample rates were gathered from thousands of addresses in Texas for a home worth $172,500 and built in 1987. Policies also included $100,000 in liability coverage.

Rates were sourced from public insurance filings using Quadrant Information Services. Rates are for comparative purposes only. Your rates may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.