GAINSCO Car Insurance Review

Good rates for high-risk drivers, but more frequent complaints on customer service.

Find Cheap Auto Insurance Quotes in Your Area

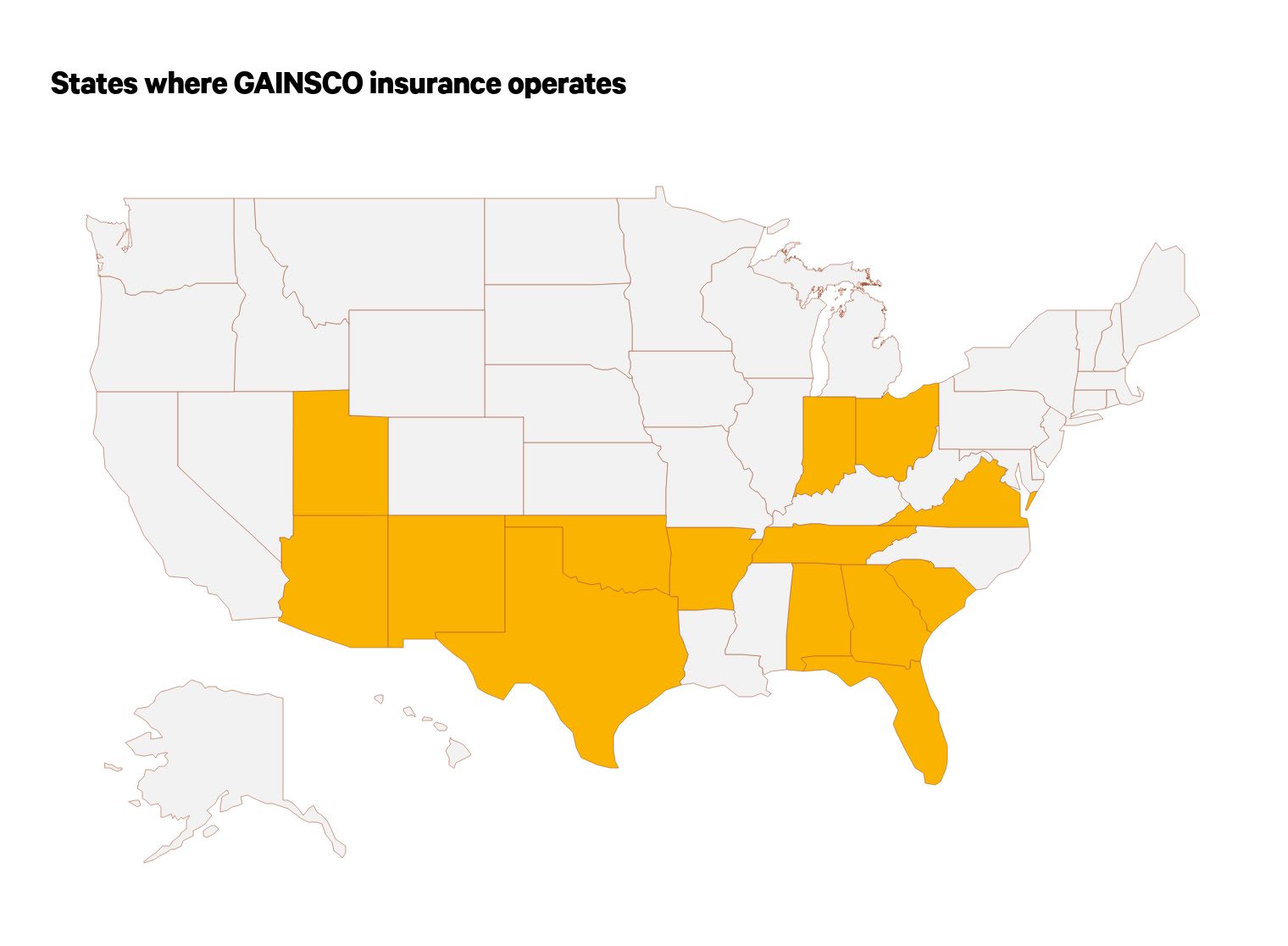

GAINSCO offers low-priced minimum liability coverage auto insurance policies in 14 states, but struggles when it comes to customer service. The company specializes in insuring high-risk drivers, such as those with accidents, DUIs or those who need SR-22 coverage.

GAINSCO delivers good rates for higher-risk drivers and offers a small range of discounts. However, it has little in the way of flexibility when it comes to coverage. Customer service responsiveness both online and by phone was below average.

Alternative options to GAINSCO

Drivers looking for similar features to GAINSCO car insurance policies can potentially get better deals from companies such as State Farm or Farm Bureau. Those auto insurers ranked highly among the best car insurance companies.

- For those looking for affordable car insurance: Farm Bureau is a highly-ranked insurer that operates in the same regions as GAINSCO, with State Farm also rating well.

- For those with an accident: State Farm is a well-rated alternative, with Farm Bureau also ranking highly.

- For those with a DUI: State Farm ranked as a top option nationally.

State Farm will not provide a quote for a driver with a DUI online, so you will have to speak to an agent. It is worth noting that GAINSCO, which is a subsidiary of MGA Insurance Company, was acquired by State Farm at the start of 2021 and will continue to operate as a separate company.

Pros and cons

Pros

Affordable minimum coverage insurance

Cheap rates after an accident or DUI

Cons

May not offer enough liability protection for a major crash

Limited coverage add-ons

Difficult customer service

GAINSCO car insurance rates compared to other companies

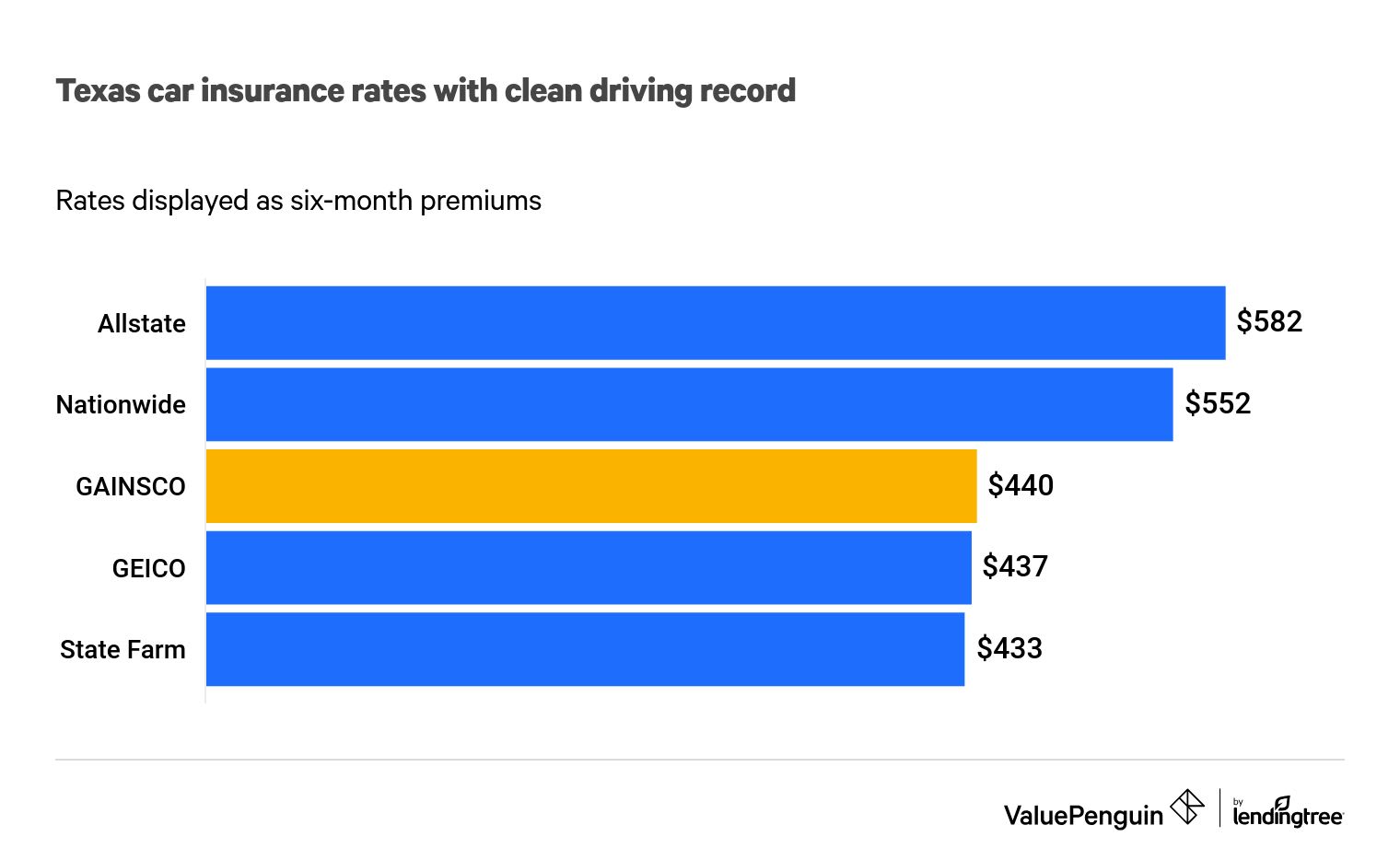

GAINSCO has cheaper car insurance rates than several national insurers, and was next to State Farm among the best-priced insurers for minimum liability coverage, based on our analysis. That was especially true when it came to drivers with DUIs and accidents.

Drivers with an accident paid 22% less for a GAINSCO car insurance policy as compared to the average. A GAINSCO policy for a driver with a DUI was more than $400 less than Geico and Allstate.

Find Cheap Auto Insurance Quotes in Your Area

GAINSCO delivered lower rates than several national insurers when it came to drivers with incidents on their records. Not every insurer provided information for complete quotes online.

Adding comprehensive and collision coverages with $500 deductibles nearly doubled the price of a six-month GAINSCO policy. The company also had a lower rate increase for starting a policy after an insurance lapse as compared to Allstate and Geico.

GAINSCO car insurance discounts

The list of discounts from GAINSCO is not as exhaustive as many larger insurers. The company does not offer discounts for telematics, safe driving or being a member of the military.

Most of the discounts are focused on prompt payment or staying with the company.

- Auto-pay discount: From a checking account, credit card or debit card

- Pay-in-full discount

- Prior coverage discount: Six months required proof with up to a 30-day lapse

- Prior GAINSCO coverage discount

- Advance purchase discount: Purchasing three days before the policy starts

- Loyalty discount

- Homeowner discount

- Renewal discount

- Multi-car discount

GAINSCO auto insurance coverages

GAINSCO does not offer liability coverage above state minimums. It does offer comprehensive and collision coverages with deductibles between $250 and $1,000.

The company will not provide quotes for many states and situations online. Instead, an agent will call potential customers with more information.

Coverage options available through GAINSCO

- Liability (state minimum only)

- Comprehensive

- Collision

- Underinsured motorist

- Personal injury protection

- Rental reimbursement (between $20 and $40 per day)

- Towing (between $50 and $100 per incident)

GAINSCO is active in 14 states but operates primarily in Texas. Online quotes are not available for some of those states.

Unlike most major national insurers, GAINSCO offers SR-22 insurance online.

GAINSCO customer service ratings and reviews

GAINSCO has a high rate of complaints. Negative reviews to the Better Business Bureau often focused on responsiveness to claims and other inquiries

The company's National Association of Insurance Commissioners (NAIC) Complaint Index rating was 2 1/2 times the national median. That shows GAINSCO has a disproportionate number of negative ratings relative to its premiums written.

Customer reviews centered on issues in getting responses to claims and basic questions. Long wait times on the phone were a consistent theme, as were issues with a website and app that do not provide a great depth of functionality.

How to file a claim with GAINSCO

GAINSCO customers can either file a claim online, via mobile app or by phone. Bilingual representatives are available.

- GAINSCO telephone number: (866) GAINSCO

- GAINSCO claims website: gainsco.com/customers/report-a-claim/

The claims call center only operates from 7a.m. CT to 7 p.m. CT, Monday through Friday. For weekends or after-hours claims reporting, drivers must leave a voicemail to receive a call back.

GAINSCO's cancellation policy allows the insured to cancel for a prorated refund. Policies can be canceled if a driver gets duplicate coverage.

Frequently asked questions

Is GAINSCO a good insurer?

GAINSCO is an average insurer. It has good rates for drivers after a speeding ticket or crash but lackluster customer service and coverage options.

Is GAINSCO good for drivers with tickets?

Yes. GAINSCO specializes in providing coverage to drivers with recent tickets or crashes. As a result, you may find affordable coverage there, even if you've struggled to get a policy from another company.

Where can I get GAINSCO insurance?

GAINSCO offers insurance in 14 states: Alabama, Arizona, Arkansas, Georgia, Indiana, Mississippi, New Mexico, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah and Virginia.

Methodology

Quotes were based on a sample driver from Texas, the state where GAINSCO primarily does business. The driver was a 30-year-old single man who drives a 2015 Honda Civic with minimum coverage. Rates should be used for comparison only. Your quotes might be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.