Who Has the Cheapest Car Insurance in Flint, Michigan?

Progressive has the best rates for car insurance in Flint, MI with an average of $1,077 per year for basic coverage.

Find Cheap Auto Insurance Quotes in Flint, MI

Auto-Owners was often the second-best option for low prices, and had the best prices for younger drivers.

Both companies had much better rates than in Flint overall, where you can expect to pay $5,513 for full coverage or $3,133 for state-minimum protection.

Insurance companies charge different rates for every driver, so it's essential to gather quotes from several companies in order to be sure you find your best price.

Cheapest auto insurance in Flint: Progressive

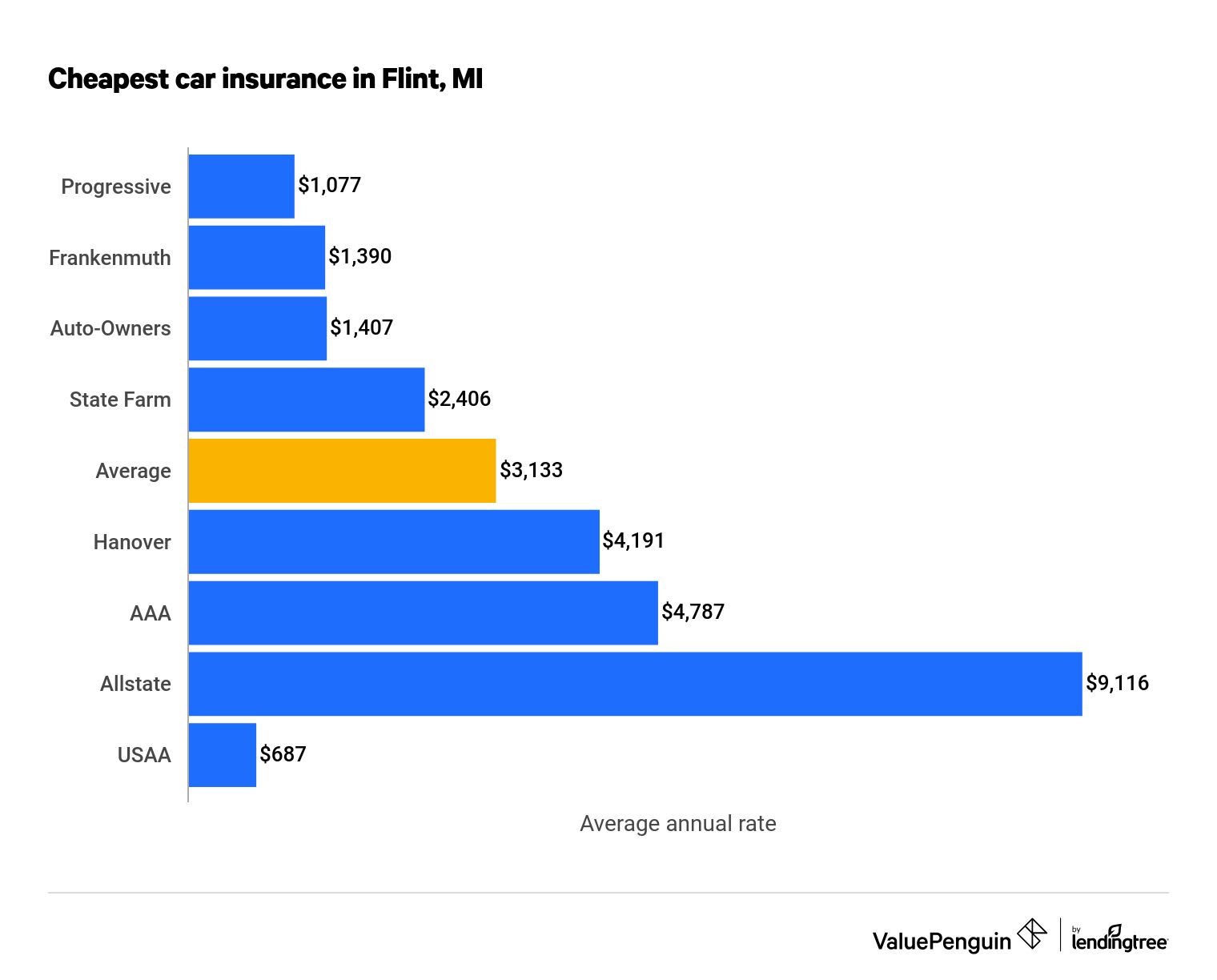

Progressive is the best minimum-coverage car insurance company in Flint, which has average rates of $1,077 per year. That's $2,056 cheaper than the average citywide. Drivers can also find affordable prices from Frankenmuth and Auto-Owners, which both charge around $1,400 for basic coverage.

Compare Car Insurance Rates in Flint, Michigan

Cheapest car insurance in Flint, MI

Company |

Rating

| Annual rate |

|---|---|---|

| Progressive | $1,077 | |

| Frankenmuth | $1,390 | |

| Auto-Owners | $1,407 | |

| State Farm | $2,406 | |

| Hanover | $4,191 | |

| AAA | $4,787 | |

| Allstate | $9,116 | |

| USAA | $687 |

*USAA is only available to current and former military members and their families.

Cheapest full-coverage car insurance in Flint: Progressive

Progressive has the best full-coverage car insurance for drivers in Flint. Its typical rate of $1,637 per year was 70% less expensive than the average rate citywide of $5,513. The second-most affordable option, Auto-Owners, was more than twice as costly, at $3,337 per year.

Full-coverage car insurance includes comprehensive and collision coverages in addition to all of the basic coverages required by law in Michigan, like liability protection and PIP.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Progressive | $1,637 |

| 2 | Auto-Owners | $3,337 |

| 3 | Frankenmuth | $3,626 |

| 4 | State Farm | $3,895 |

| 5 | AAA | $7,164 |

| 6 | Hanover | $8,594 |

| 7 | Allstate | $14,168 |

| N/A* | USAA | $1,682 |

*USAA is only available to current and former military members and their families.

- Comprehensive coverage: pays for damage to your car that is not due to a crash, such as vandalism or animal damage. Also covers theft.

- Collision coverage: pays for damage to your car that is due to a crash, regardless of who is at fault.

Cheapest car insurance for drivers with prior incidents

One of the main factors car companies use to set rates is your driving history. People with driving incidents on their records, like an at-fault accident or speeding ticket, are statistically more likely to make a claim than drivers with clean histories. The company passes this expected extra cost on to you by charging higher rates.

Cheapest car insurance for drivers with a speeding ticket: Progressive

Progressive is the cheapest company for Flint drivers with a speeding ticket, which offered us an average price of $2,067 per year for full coverage. That's much less than the price we found at the second-cheapest insurer, Auto-Owners.

Car insurance companies have found that drivers with a speeding ticket on their records are more likely to make another claim in the future, so you're likely to see your rates go up after you're caught speeding.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Progressive | $2,067 |

| 2 | Auto-Owners | $3,865 |

| 3 | Frankenmuth | $4,058 |

| 4 | State Farm | $5,070 |

| 5 | Hanover | $12,071 |

| 6 | Allstate | $15,478 |

| 7 | AAA | $15,585 |

| N/A* | USAA | $2,128 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance in Flint after an accident: Progressive

Progressive has the most affordable rates for drivers in Flint after an at-fault accident, which offered us a quote of $2,133 per year for full coverage. That's $1,732 per year cheaper than the second-cheapest option, Auto-Owners.

Car insurance companies have found that drivers who have been involved in one crash are more likely to be involved in another, so your rates tend to go up if you're at fault in an accident. We found a typical increase of 54% for Flint drivers.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Progressive | $2,133 |

| 2 | Auto-Owners | $3,865 |

| 3 | State Farm | $4,678 |

| 4 | Frankenmuth | $4,766 |

| 5 | Hanover | $14,132 |

| 6 | AAA | $15,585 |

| 7 | Allstate | $20,586 |

| N/A* | USAA | $2,356 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with a DUI: Progressive

A DUI is among the most serious driving infractions you can commit, and the consequences are similarly harsh. In addition to potentially losing your license and facing a steep fine, you'll likely see a big jump in your car insurance bills. We found a typical price of $18,735 per year for full coverage after a DUI.

We found the best price for car insurance after a DUI at Progressive, which gave a year of coverage for $1,934. That's 89% cheaper than the typical company in Flint.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Progressive | $1,934 |

| 2 | Auto-Owners | $7,809 |

| 3 | State Farm | $10,161 |

| 4 | Frankenmuth | $16,480 |

| 5 | Hanover | $16,701 |

| 6 | AAA | $26,340 |

| 7 | Allstate | $67,478 |

| N/A* | USAA | $2,978 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers: Auto-Owners

Auto-Owners offers the best price for teen drivers, which charged a typical price of $2,886 for one year of minimum coverage. That's more than $1,000 cheaper than the second-cheapest option, Frankenmuth.

18-year-old drivers can expect to pay the most for car insurance of any age group. Younger drivers have less experience behind the wheel and may not be as adept at assessing road risks as older people.

Rank | Company | Annual rate |

|---|---|---|

| 1 | Auto-Owners | $2,886 |

| 2 | Frankenmuth | $3,967 |

| 3 | Progressive | $4,000 |

| 4 | State Farm | $6,537 |

| 5 | AAA | $8,017 |

| 6 | Hanover | $9,913 |

| 7 | Allstate | $15,822 |

| N/A* | USAA | $1,204 |

*USAA is only available to current and former military members and their families.

Car insurance companies with the best customer service in Michigan

It's important to find car insurance that's affordable, but it's just as necessary to find an insurer that has great service, too.

For Michigan residents, we recommend Auto-Owners, USAA and State Farm as the companies with the best service. They performed the best among Michigan insurance companies in our national survey of car insurance claims service.

See our our page on Michigan car insurance for a full analysis of the best-rated Michigan auto insurers.

Average car insurance costs in Flint by neighborhood

The cost of car insurance varies based on where you live, even within a city. Residents of a neighborhood with a lot of car theft or narrow, poorly-maintained roads may have higher rates than someone living elsewhere.

Here's the full breakdown of car insurance costs in Flint by ZIP code.

ZIP code | Full coverage | Minimum coverage |

|---|---|---|

| 48502 | $5,873 | $3,396 |

| 48503 | $5,551 | $3,094 |

| 48504 | $5,625 | $3,178 |

| 48505 | $6,008 | $3,476 |

| 48506 | $5,150 | $2,916 |

Auto theft statistics in Flint

Car theft rates are moderately high in Flint compared to other major Michigan cities. The typical rate in Flint is 2.2 car thefts per 1,000 residents, slightly less than the state average of 2.3 thefts per thousand residents.

Rank | City | Population | Car thefts | Thefts per 1,000 residents |

|---|---|---|---|---|

| 1 | Detroit | 663,502 | 6,886 | 10.4 |

| 2 | Lansing | 118,953 | 367 | 3.1 |

| 3 | Dearborn | 93,902 | 266 | 2.8 |

| 4 | Warren | 134,653 | 356 | 2.6 |

| 5 | Grand Rapids | 201,799 | 501 | 2.5 |

Motor vehicle theft data was pulled from the FBI 2019 Michigan Crime Report.

Methodology

We collected data from eight of the largest companies in Michigan. We found quotes with a profile of a 30-year-old man who drove a 2015 Honda Civic EX. Unless otherwise stated, the driver received rates for a full-coverage policy.

We used the following limits for minimum and full-coverage policies:

Coverage | State minimum | Full coverage |

|---|---|---|

| Property protection | up to $1,000,000 | up to $1,000,000 |

| Residual bodily injury and property damage liability (BI/PD) | $50,000 per injury, $100,000 per accident | $50,000 per injury, $100,000 per accident |

| Personal injury protection (PIP) | $250,000 for people with qualified health coverage | $250,000 for people with qualified health coverage |

| Collision coverage | — | Included/$500 deductible |

| Comprehensive coverage | — | Included/$500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Source: