Cheap No Down Payment Car Insurance

No down payment car insurance doesn't exist. But you can get a low first payment by using a cheap company such as Geico or State Farm.

Find Cheap Auto Insurance Quotes in Your Area

Get very cheap car insurance with no deposit

- You can't get car insurance without paying some money upfront. All reputable car insurance companies need you to pay something to start your car insurance coverage. There's no way to get car insurance for free at the start.

- The best way to get car insurance now and pay for it later is to put your bill on a credit card. This can buy you some time because you won't get the credit card bill for about a month. Remember to pay it off as soon as you can to avoid paying high interest on your credit card balance.

- You'll get the lowest down payment by shopping around for a cheap car insurance policy. You'll need to pay the first month's bill to start your coverage. So if you get a cheap policy, you'll have a low first payment.

What's the cheapest down payment you can get on auto insurance?

Most drivers will need to pay about $100 to $275 for their first payment on a full coverage car insurance policy.

If you don't have a car loan or lease, you can pay around $40 to $80 for a cheap liability-only car insurance policy. This will only pay for injuries or property damage you cause to others, not damage to your own car.

Car insurance companies with the lowest down payment

The best way to find low down payment car insurance is to compare quotes from the cheapest companies.

The lower your car insurance payment is, the cheaper your first bill or down payment will be.

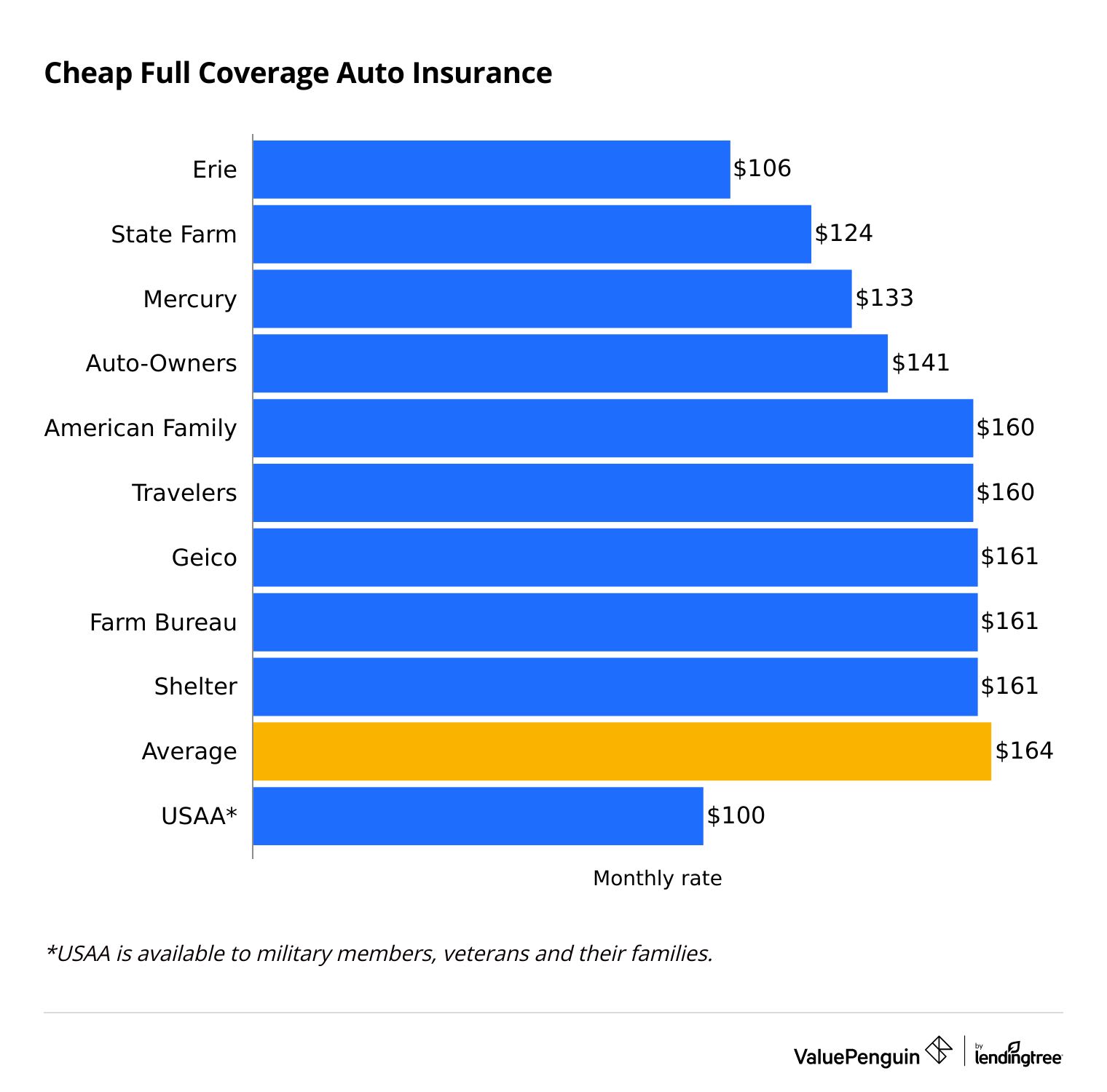

- If you have good credit and a clean driving record, State Farm usually has the cheapest low down payment insurance. You'll pay around $124 to start the full coverage policy and the same amount each month after.

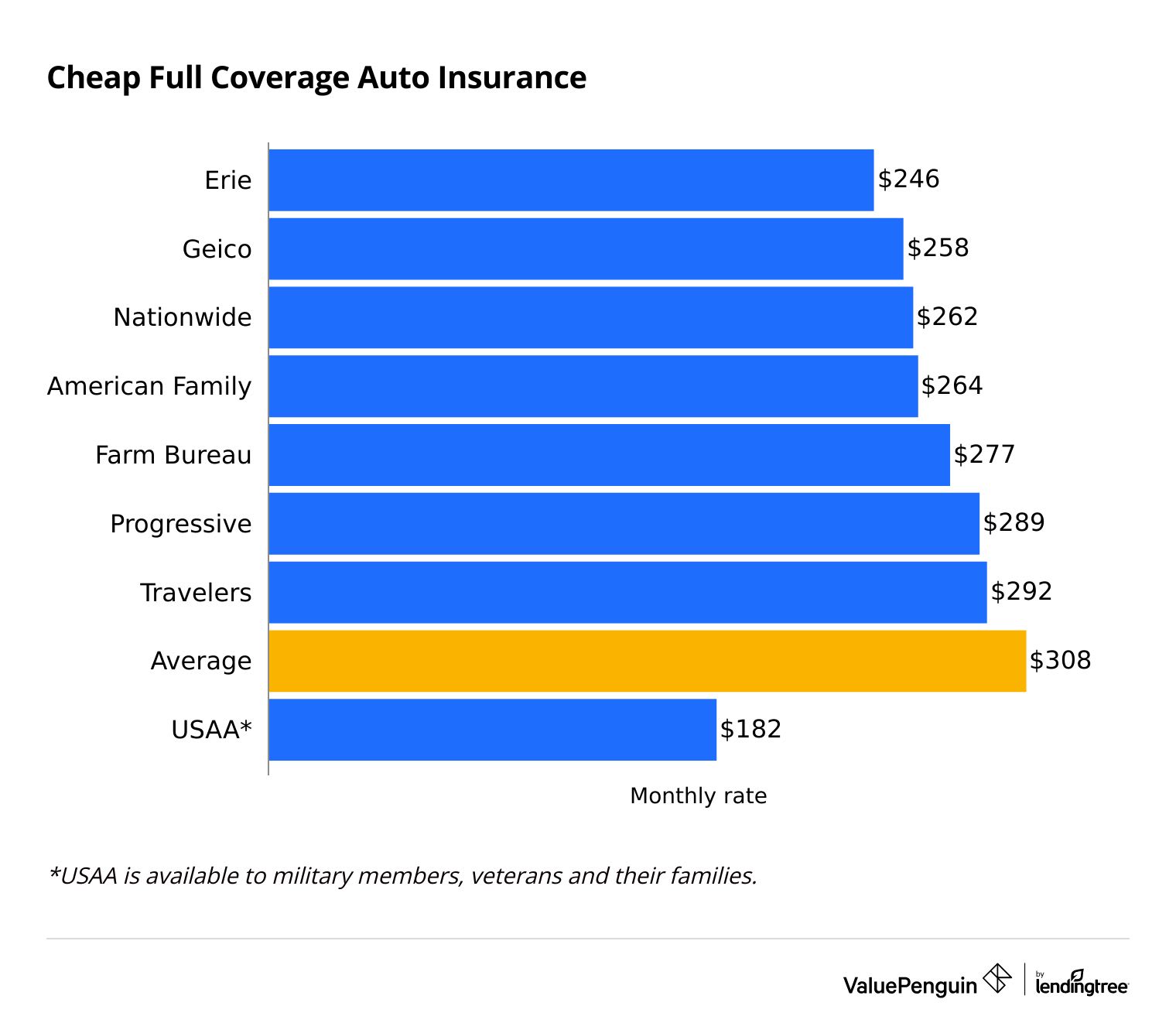

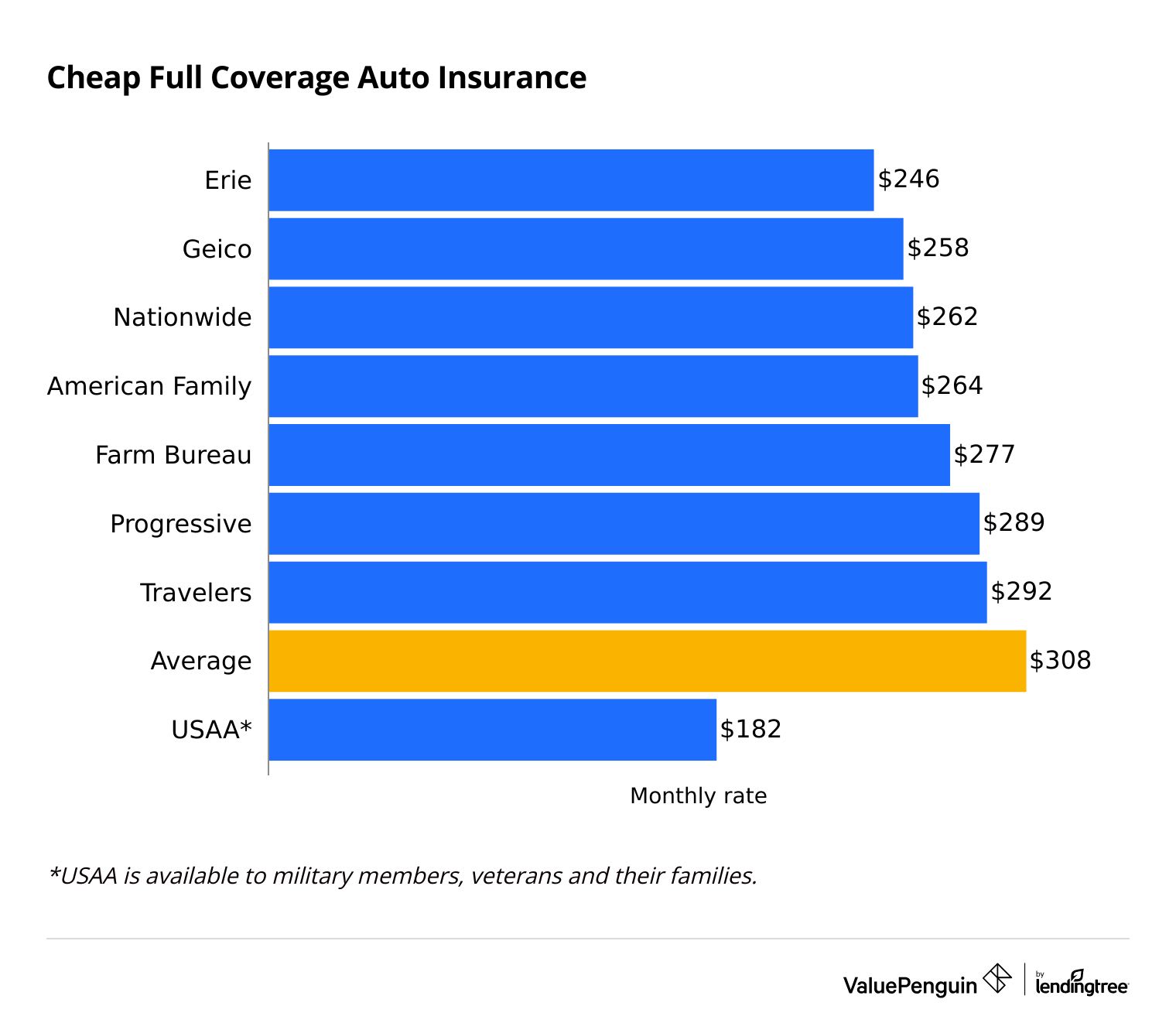

- If you have bad credit, Geico is the cheapest major car insurance company. For full coverage, you'll pay around $258 as the down payment to start the policy and the same amount each month to continue the policy.

Poor credit score

Good credit score

Find Low Down Payment Auto Insurance

Drivers with poor credit may be able to find even cheaper rates with Erie. However, it only sells car insurance in 12 states and Washington, D.C.

Cheapest full coverage quotes for drivers with poor credit

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $246 | ||

| Geico | $258 | ||

| Nationwide | $262 | ||

| American Family | $264 | ||

| Farm Bureau | $277 | ||

*USAA is only available to military members, veterans and their families.

Poor credit score

Find Low Down Payment Auto Insurance

Drivers with poor credit may be able to find even cheaper rates with Erie. However, it only sells car insurance in 12 states and Washington, D.C.

Cheapest full coverage quotes for drivers with poor credit

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $246 | ||

| Geico | $258 | ||

| Nationwide | $262 | ||

| American Family | $264 | ||

| Farm Bureau | $277 | ||

*USAA is only available to military members, veterans and their families.

Good credit score

Find Low Down Payment Auto Insurance

You may find more affordable quotes from mid-size companies like Erie, Mercury and Auto-Owners. However, these companies are only available in some states.

Best full coverage quotes with a low down payment

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $106 | ||

| State Farm | $124 | ||

| Mercury | $133 | ||

| Auto-Owners | $141 | ||

| American Family | $160 | ||

*USAA is only available to military members, veterans and their families.

How to get low down payment car insurance

In addition to comparing companies, you can lower your down payment on car insurance by changing your coverage options, changing the type of plan you have or asking for discounts.

You'll usually pay more than twice as much for a full coverage car insurance policy compared to a liability-only car insurance policy.

If you own your car outright and it's more than eight years old or worth less than $5,000, the cheaper minimum coverage policy is the best deal. You'll have to pay to fix your own car if you cause an accident, but you'll also get big savings on your car insurance deposit and monthly bill.

One of the easiest ways to lower your down payment is by qualifying for car insurance discounts. When you get a quote, make sure you ask the agent about all discounts the company offers.

Some discounts are very easy to get. For example, many companies offer a discount when you sign up for paperless billing or automatic payments. You may also be able to save if your car has certain features, your employer has a partnership with the insurance company or you're a full-time student with good grades.

If you're on a tight budget, you can decline car insurance extras and get a bare-bones policy. This could save you $5 to $20 on your deposit and on each monthly bill.

For example, extra coverage like rental car reimbursement will pay for a rental if your car is in the shop after an accident. You'll save about $4 per month if you don't get this on your policy.

Roadside assistance is another extra that costs a few dollars per month. You can save money by not getting this coverage, and you may even already have breakdown assistance from your credit card or car dealer.

Increasing your deductible can save you around $8 to $20 on your down payment and monthly car insurance bill.

Your collision and comprehensive deductible is the amount you must pay to fix or replace your car after an accident before insurance will start paying.

Insurance policies with a higher deductible typically cost less. That's because the insurance company won't pay as much money after an accident.

It's important to choose a deductible you can easily afford to pay after an accident. However, picking a higher deductible can save you money on your down payment.

If you live with family members, the best way for you to save money on your car insurance is by sharing a policy.

Households with multiple cars can save up to 25% on car insurance with a multi-car discount. And teen drivers can save an average of 62% by sharing a policy with their parents.

Usage-based insurance programs can save you about 30% on your car insurance bill if you practice safe driving habits. These programs track your driving habits via your cellphone or a small device you plug into your car.

Many companies give a participation discount just for signing up, which will lower your car insurance down payment. Just make sure to choose a program that won't raise your rates for poor driving habits. Otherwise, you could have higher bills in the future.

How to buy low down payment car insurance

If you want to pay for your car insurance monthly and find a low-deposit policy, start by getting free car insurance quotes and comparing costs from multiple companies.

Figure out how much you can afford to pay for car insurance each month. From there, you can estimate your car insurance costs to figure out how much coverage you can get.

Get online quotes from the cheapest companies. Fill out info about yourself, your car and your driving history for accurate quotes. Once you've gotten quotes, compare your first-month, monthly and total costs to find the best deal.

Set up payments to start your policy. Most companies will let you pay your car insurance bill by electronic funds transfer (EFT), credit card, debit card or check. Watch out for any extra fees attached to the payment type you choose.

Most insurance companies offer instant auto insurance after you get a quote and make a payment. That means you can get coverage on the same day.

How to switch car insurance

Switching car insurance companies can save you a lot of money. But it has an extra cost at the beginning because you have to pay for your new car insurance before your old policy ends.

You can request a refund from your old company, but it can take up to 30 days. However, there are some things you can do to make the process easier on your bank account:

How much does a car insurance down payment cost?

Depending on your insurance company, you may be able to pay for your car insurance with annual, semiannual, quarterly or monthly payments.

Generally, the smallest amount you'll be able to pay is the cost of one month of coverage.

One month of full coverage car insurance costs an average of $164 across the U.S. Minimum coverage costs an average of $64 per month.

Some companies may let you make a smaller payment for your first month's bill and pay the rest later. This depends on a lot of factors, including your credit score and driving history.

Can I buy car insurance with no money down?

You can't get car insurance with no money down, but most companies offer multiple payment options.

Paying for car insurance monthly is the lowest down payment option. If a company doesn't offer monthly payments online, you could call and talk to an agent.

However, not all drivers have the option to pay for car insurance monthly. Insurance companies take on the risk of protecting you and your car as soon as your policy begins. Because of this, they want to cover at least some of that risk with your initial payment.

Drivers with poor credit, those with a bad driving record or those who need an SR-22 typically have to pay more upfront.

Owners of newer, more expensive cars may have a hard time finding low down payment insurance. That's because new vehicles are more costly to repair or replace.

Some companies may advertise cheap car insurance with no down payment or "buy now, pay later" car insurance. However, you can't get insurance without paying any money upfront.

"No down payment" may mean you won't need to pay for more than the first month of coverage to start your policy. But you will still need to pay for a portion of your car insurance bill to get coverage.

Should I get no-down-payment car insurance?

You can't actually get car insurance without paying some money upfront to start the policy.

Low down payment car insurance is good if money is tight right now or if you want to pay the same amount each month. But if you put more money down when signing up, you could lower your total bill. You can usually save 5% to 10% on a one-year policy if you pay upfront.

For example, a driver in Chicago with a minimum coverage policy from Progressive could save $54 per year by paying upfront for a six-month policy.

Cost of a six-month car insurance policy

Monthly payment plan

- 1st month: $19

- Months 2-6: $50 per month

6-month total: $269

Paid in full

- 1st month: $242

- Months 2-5: $0

6-month total: $242

What should I do if I can't afford car insurance?

If you need to drive but can't afford car insurance, you can ask for a grace period, share a policy with other people, get a non-owner policy or consider a liability-only policy.

-

Check your policy's grace period. If you can't pay your car insurance bill right now but will have the money soon, ask your company about a payment grace period. You could have a few days or weeks to come up with the money to keep your coverage.

-

Share a car insurance policy. If you share a car with roommates or family members who live in the same home, you can share a policy and split the cost. Or you could ask them to add you to their policy as a named driver.

-

Try a non-owner policy. If you regularly drive someone else's car, a non-owner insurance policy could help you get affordable coverage. Non-owner car insurance is up to 15% cheaper than a standard policy.

-

Switch to liability only. Liability-only car insurance is the cheapest coverage you can get. It costs an average of $64 per month nationwide.

However, this may not be an option if you have a loan or lease. Lending companies typically require full coverage.

-

Check for low-income savings. Some states offer discounted car insurance policies for drivers with low incomes, including California and New Jersey.

Try not to let your coverage lapse, or you'll face higher costs in the future. If you have a lapse in coverage for 30 days or more, your rates could skyrocket when you restart coverage. And if you drive uninsured or cause an accident, you could face even more expensive penalties and fines.

Is no-deposit car insurance a scam?

No-deposit or no-down-payment car insurance is not language regularly used by legitimate car insurance companies. Usually, companies that use these terms are either trying to mislead you or they are a scam.

Be wary of companies that claim you can "buy now, pay later" or get your first month free.

First-month-free offers

You typically can't get car insurance coverage until you make your first payment.

Companies that promise "$0 down" car insurance could be scamming you to get your personal info. They may also be offering you a deal as a way to take your money without giving you insurance. These scammers are called ghost brokers and are common on social media. If something seems too good to be true, check with your state insurance department to make sure it's not a scam.

Paying for quotes

It's also a scam if you're asked to pay a deposit to get a car insurance quote. No major car insurance companies will ask for a deposit or charge a fee just for a quote.

Getting a quote is a free way to check what a policy would cost. You'll only have to pay when you actually sign up.

Temporary car insurance

If you can't find cheap car insurance with no down payment, you might consider a company claiming to offer temporary car insurance. However, reputable companies don't typically sell car insurance for less than six months.

The best way to get car insurance for a short period is to pay monthly since you can cancel or switch at any time. And you can get a refund for any money you've already paid in advance.

Frequently asked questions

Does Geico offer no-down-payment insurance?

No reputable company will ever let you get car insurance without some upfront payment. However, Geico may give you the option to pay less for your first month of insurance. The unpaid cost of your first month is spread out to your following payments. Geico may only offer this option to some drivers. It may not be an option for high-risk drivers and those with poor credit.

Can you get zero down car insurance?

Reputable insurance companies will only provide car insurance coverage after you pay to start your policy. However, many companies let you pay for car insurance monthly without an extra deposit for the first month. Some may even allow you to pay less for the first month.

Why is my car insurance down payment so high?

Your car insurance down payment might be very high if you have a low deductible or expensive insurance add-ons, like comprehensive and collision coverage. It may also be expensive due to your age, driving history or a poor credit score.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your quotes may be different.

Except where noted, all quotes are national averages for minimum coverage, corresponding to each state's legal minimum. Our sample driver is a 30-year-old with good credit.

ValuePenguin used quotes from Progressive to compare monthly versus annual payment plans. Quotes are for a liability-only policy in Chicago.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.