Who Has the Best Car Insurance Rates in Denver?

State Farm has the cheapest full-coverage car insurance in Denver, Colorado, at $113 per month. Auto-Owners is the cheapest for minimum coverage, at $45 per month.

Compare Car Insurance Rates in Denver

Best cheap car insurance companies in Denver, CO?

Cheapest car insurance in Denver: State Farm

Denver has the largest population of all the cities in Colorado, which translates to higher auto insurance rates. The average cost of car insurance in Denver is $189 per month for full coverage — 13% higher than the state overall.

State Farm has the cheapest rate for full coverage in Denver, at $113 per month.

That rate is 27% cheaper than the second-cheapest company, Geico, and 40% cheaper than the city average of $189 per month.

Auto-Owners and Progressive also offer full coverage that is cheaper than the citywide average. Auto-Owners charges $159 per month (18% cheaper than average), and Progressive charges $185 per month (2% cheaper than average).

Compare Car Insurance Rates in Denver

Cheapest full coverage car insurance in Denver

Company | Monthly rate | |

|---|---|---|

| State Farm | $113 | |

| Geico | $155 | |

| Auto-Owners | $159 | |

| Progressive | $185 | |

| American Family | $211 |

USAA is only available to current and former military members and their families.

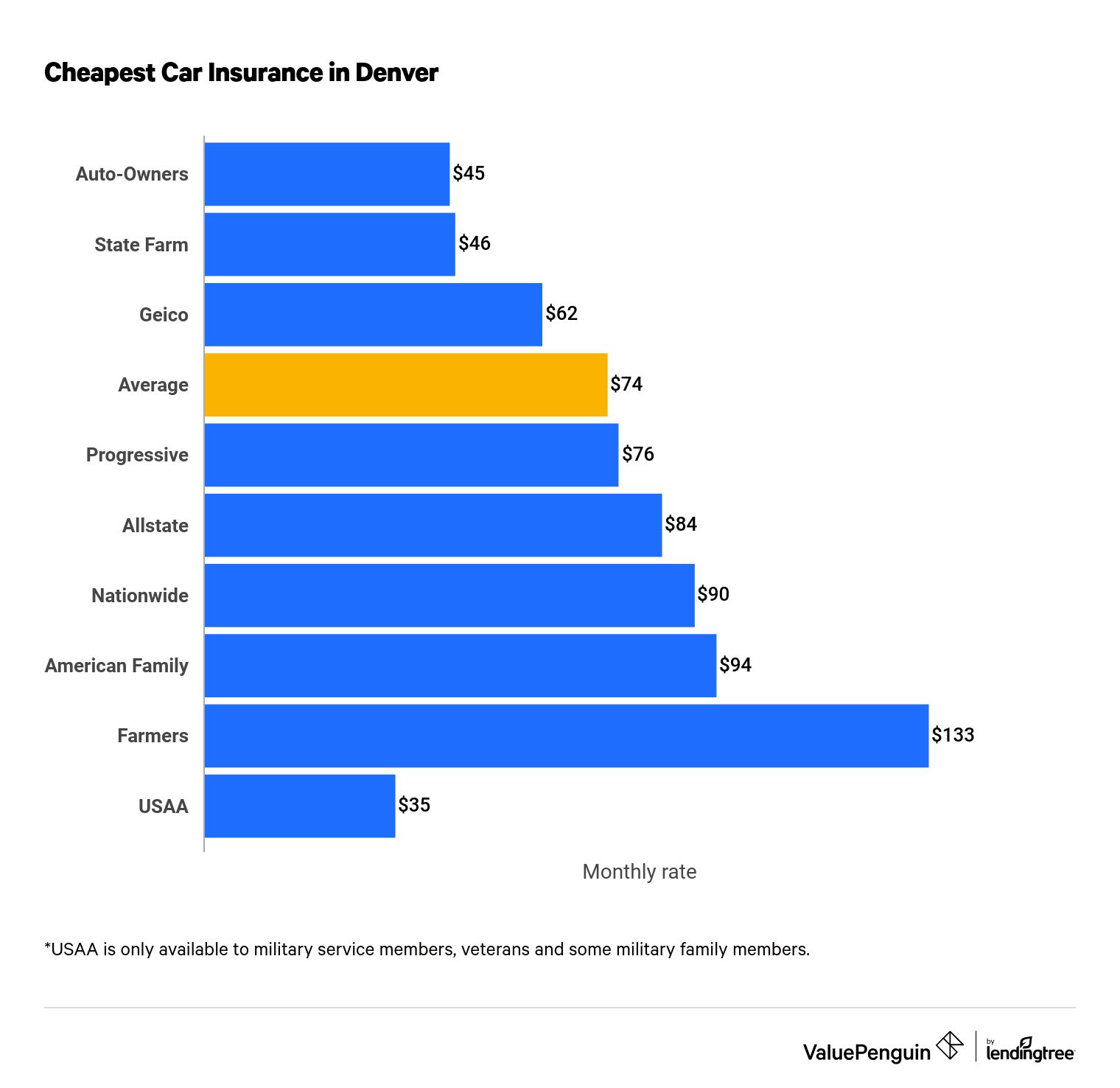

Cheapest liability insurance quotes in Denver: Auto-Owners

Auto-Owners has Denver's lowest car insurance rates, with prices just a bit cheaper than State Farm's.

Auto-Owners' average rate is $45 per month for minimum coverage, which is 40% cheaper than the city average. State Farm's average rate is $46 per month.

Compare Car Insurance Rates in Denver

Eligible drivers should get insurance quotes from USAA. At just $35 per month, the company — which only sells policies to current and former military members, as well as qualifying family members — charges rates that are half as expensive as the city average.

Best cheap liability car insurance in Denver

Company | Monthly rate | |

|---|---|---|

| Auto-Owners | $45 | |

| State Farm | $46 | |

| Geico | $62 | |

| Progressive | $76 | |

| Allstate | $84 |

USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers: State Farm

The cheapest rates for young drivers in Denver come from State Farm, both for minimum and full coverage. The company charges an average rate of $159 per month for liability-only coverage and $329 per month for full coverage.

American Family is the runner-up for lowest full-coverage rates, white Auto-Owners has the second-cheapest minimum coverage.

Cheapest car insurance for young Denver drivers

Company | Liability only | Full coverage |

|---|---|---|

| State Farm | $159 | $329 |

| American Family | $206 | $376 |

| Geico | $194 | $430 |

| Auto-Owners | $181 | $443 |

| Allstate | $298 | $564 |

USAA is only available to current and former military members and their families.

Rates for 18-year-old Denver drivers are three and a half times higher than rates for a 30-year-old driver. This steep increase is not unique to Denver, however; young drivers generally pay more than adult drivers do.

Try to stay on your parents' auto insurance policy if you're a teen driver. It's the best way to keep your rates affordable.

Other strategies for keeping your auto insurance rates low include taking a defensive driving course and getting good grades to score a good student discount.

Cheapest car insurance for people with a speeding ticket: State Farm

State Farm has the cheapest insurance for Denver drivers who have a speeding ticket. The citywide average for these drivers is $230 per month, but an annual policy from State Farm is just $122 per month. That's only an increase of $9 per month from the rate the company charges before a speeding ticket.

Cheapest car insurance after a speeding ticket in Denver

Company | Monthly rate |

|---|---|

| State Farm | $122 |

| Auto-Owners | $164 |

| Geico | $208 |

| Progressive | $234 |

| American Family | $240 |

USAA is only available to current and former military members and their families.

Speeding is one of the less expensive traffic tickets. Rates for full coverage increase by only 21% after a speeding ticket in Denver — far less than the 46% after an at-fault accident and 50% after a DUI citation.

Cheapest car insurance in Denver after an accident: State Farm

State Farm has the cheapest rates for Denver drivers after an at-fault accident, charging $131 per month — an increase of just $18 monthly. Auto-Owners and Progressive, the next-cheapest insurers, charge $233 and $263 per month, respectively.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $131 |

| Auto-Owners | $233 |

| Progressive | $263 |

| American Family | $274 |

| Geico | $296 |

USAA is only available to current and former military members and their families.

Insurance rates for full coverage in Denver jump by 46% after an at-fault accident, from $189 per month to $276, on average.

Cheapest car insurance for drivers with a DUI: State Farm

State Farm has the most affordable rates for Denver residents who have been caught driving under the influence (DUI). State Farm charges drivers who have a DUI citation an average of $122 per month. That makes State Farm's rates 57% cheaper than the city average for drivers with a DUI, which is $283 per month.

Cheapest car insurance after a DUI in Denver

Company | Monthly rate |

|---|---|

| State Farm | $122 |

| Progressive | $217 |

| American Family | $240 |

| Auto-Owners | $278 |

| Allstate | $285 |

USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with poor credit: State Farm

State Farm has the cheapest rates for drivers who have a low credit score, followed by Geico and Nationwide. State Farm's average rate is $220 per month, which is 34% cheaper than the city average.

Cheapest car insurance for Denver drivers with poor credit

Company | Monthly rate |

|---|---|

| State Farm | $220 |

| Geico | $227 |

| Nationwide | $311 |

| Progressive | $322 |

| Allstate | $358 |

USAA is only available to current and former military members and their families.

Having poor credit does not mean you're a bad driver, but insurance companies have found drivers with bad credit tend to file more claims. Drivers with poor credit in Denver pay 76% more than those with good credit.

Best auto insurance companies in Denver, Colorado

USAA is the best option for Denver drivers who can get coverage, based on ValuePenguin's multifactor rating formula.

USAA has a strong combination of low rates, good customer service and coverage options. The biggest downside is that only members of the U.S. military, veterans and some military family members can get policies.

Other top options in Denver and all of Colorado include Auto-Owners and State Farm.

Company |

Editor's rating

|

|---|---|

| Auto-Owners | |

| State Farm | |

| USAA | |

| Geico | |

| Nationwide | |

| American Family | |

| Farmers | |

| Allstate | |

| Progressive |

Average car insurance cost in Denver, by neighborhood

Denver's cheapest ZIP code is 80234, an area straight north of the city, while 80219, an area just southwest of downtown that includes the Mar Lee and Barnum neighborhoods, is the most expensive ZIP code for car insurance.

Certain ZIP codes experience higher traffic or crime rates, which can cause insurers to increase prices to account for risk. The difference between Denver's cheapest and most expensive ZIP codes is $44 per month.

ZIP code | Average monthly cost | % from average |

|---|---|---|

| 80014 | $201 | 6% |

| 80110 | $186 | -2% |

| 80123 | $175 | -7% |

| 80202 | $187 | -1% |

| 80203 | $192 | 1% |

What's the best car insurance coverage in Denver?

Many drivers choose minimum liability because it's the most affordable form of auto insurance. However, that affordability means forfeiting any protection of your own car. Minimum liability insurance in Colorado only helps you pay for the other driver's injuries and property damage; it doesn't help you pay for any injuries or damage you sustain.

While the average cost of full coverage car insurance in Colorado is $168 per month, the average cost in Denver is 13% higher.

Unlike minimum coverage, which only protects the other driver, full coverage includes collision and comprehensive coverages, which protect your own car.

-

Comprehensive coverage: Covers noncollision incidents, such as animal or weather damage, theft or vandalism.

- Collision coverage: Covers repairs to your own car resulting from collisions with stationary objects or other cars, regardless of who was at fault.

We recommend most people choose full coverage car insurance.

Methodology

ValuePenguin collected quotes from the largest insurers in Colorado. Unless otherwise noted, rates are for a 30-year-old man with a 2015 Honda Civic EX and a full coverage policy.

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

This ValuePenguin study used insurance rate data from Quadrant Information Services. Rates were publicly sourced from insurer filings. They should be used for comparative purposes only, as your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.